Quick Value #255 - Havas NV (HAVAS)

Ad agency spin from Vivendi trading at 4x EBIT and 7x FCF

Today’s idea:

Recently completed spin-off (December 2024)

Consistently profitable and cash flowing ad agency

Shares trading at 4x EBIT and 6-7x FCF with net cash balance sheet

For newer subscribers, check out the VDL “home base” for background info, links to key resources, articles, trackers, etc.

As always, leave a comment with thoughts or stocks you want to see covered and check out past posts here to get a flavor for recent write-ups.

Quick Value

Havas NV (HAVAS)

Making my way through the 4-way breakup at Vivendi and fortunately, I haven’t missed much as the pieces appear to be trading at steeper discounts than under the conglomerate.

What they do…

Havas is one of the Big 6 global advertising agencies. Of that group, they rank 6th in total revenue.

According to Dentsu, advertising is a $755bn industry split between digital ads ($450bn) and traditional ads ($305bn). Digital is growing 6% annually and retail (includes e-commerce) is a subsegment of digital which is expected to grow at a much higher rate of 20% per year from 2024-2026:

Havas operates under 3 segments:

Havas Creative (39% of sales) — delivers a wide range of creative services, from advertising, brand strategy and business transformation to digital and social media solutions as well as public relations and events

Havas Media (36% of sales) — dedicated to delivering comprehensive media experiences, through media planning and buying, fan engagement, retail media and e-commerce, as well as data analytics services to optimize client advertising investments

Havas Health (24% of sales) — focuses on healthcare and wellness communications, providing specialized marketing services to pharmaceutical companies, healthcare providers and wellness brands.

Fees range from fixed retainers, to hourly rates, to commission-based. The top 10 clients were 21.7% of 2023 net revenue (€585m). These are typically large multinational customers with recurring ad budgets. Industries served:

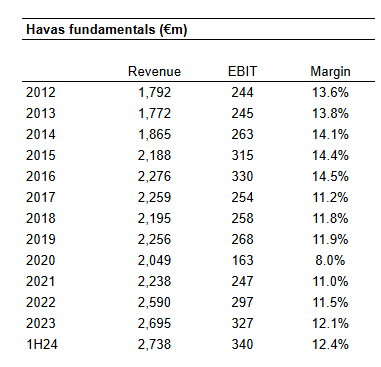

Long-term net revenue, EBIT, and margin trends:

Why it’s interesting…

Ad agencies are traditionally stable and profitable businesses with longstanding client relationships (translation: excellent revenue visibility). As of 2023, 43 of the top 50 clients by revenue have relationships of 10 years or longer.

Revenue is growing and margins expanding coming out of COVID — 4% revenue CAGR and 50bps margin expansion from 2019-1H24:

At €1.52/share and 992m shares = €1.5bn market cap with a net cash balance sheet. The most recent trading update calls for 2024 revenue to decline around -1%, adjusted EBIT at €335-340m and net cash at €180-220m. That would make Havas a €1.3bn EV trading at ~4x EV/EBIT. This is a very cheap stock with a clean balance sheet.

Why are shares so cheap?

There are 3 challenges I see:

Growth — pre-pandemic, Havas was a mostly negative organic grower… coming out of COVID and into 2024, organic growth was very strong, but now that’s turning negative into yearend. Full year 2024 guidance is negative 1% top-line growth but 2025 is expected to grow 2%. Hmm…

Margins — EBIT margins were 13-15% from 2012-2016, 11-12% from 2017-2024, and expected to recover up to 14-15% long-term — trends are positive but is the >1.5% increase achievable?

Guidance — Based on recent performance, both 2025 guidance and the 2028 outlook seem like stretch goals.

What could shares be worth?

Despite the lack of organic growth and margin compression, Havas is trading way below peers:

WPP and Dentsu are on the lower end of the valuation spectrum at ~7x EBITDA while OMC, IPG, PUB are trading at >8x EBITDA. At 7x €335m EBIT = €2.55/share or 67% upside from here. I’m ignoring lease liabilities and buy-out / earn-out obligations from acquisitions; buy-out obligations totaled €250m at 6/30/24.

I haven’t compared business model differences between these firms but the valuation gap seems like an anomaly unless Havas is structurally disadvantaged to peers. Margins are comparable to bigger peers in the mid-teens, balance sheet is no worse (arguably best in the industry), and FCF generation is plentiful. Hmm…

Cash flow and capital allocation

It took some effort to compile cash flows and convert to FCF as I’m used to with GAAP-reporting companies. I get €0.16/share trailing FCF which leaves the stock trading at ~9.5x FCF. Here are my estimates from 2021-1H24:

Cumulative FCF from 2021-2023 was €644m (43% of the current €1.5bn market cap). From that, €151m was spent on acquisitions, €195m on dividends, and €117m went to non-controlling interests.

Management is targeting a 40% dividend payout ratio based on net income. They paid €85m in 2023 or €0.085/share for a >5% dividend yield.

Acquisitions were €151m from 2021-2023 and management intends to spend €400m from 2024-2027

Agency acquisitions often leave minority ownership stakes to key personnel. Dividends to those minority owners are €20m per year and Havas periodically buys out those ownership stakes

Go-forward, call it €190-210m FCF per year — uses include: €85m or so earmarked for dividends, €100m per year for acquisitions, and €60m for non-controlling interests. Buybacks would be very accretive here, but I doubt they’re being considered. This policy feels a bit constrained.

Summing it up…

Ad agencies are stable and profitable businesses but entry barriers are low, especially on smaller clients/engagements. Bigger accounts are competitive too with larger players jockeying for market share; and that might increase with the pending merger of OMC/IPG.

Havas looks like it would make a good takeout candidate at this size and valuation but Bollore has a significant ownership stake at 30%, so that path is unclear.

This bet is 2-fold in my view: 1) closing the valuation gap with peers, even if by a small amount; and 2) accretive capital allocation over the next few years; will M&A lead to EBIT growth each year.

Some back-of-the-napkin math… using €400m acquisition spend at 6-7x EBIT would add €60-70m to the current €340m guidance by 2027. With zero growth in the core business, that would be €400-410m EBIT by 2027. At a 7x EBIT multiple and no change in net cash, that works out to €3/share. Plenty of upside if things go right.

Resources: