Quick Value #257 - Terex Corp (TEX)

Cyclical capital goods business with a recent "bet the farm" acquisition from Dover (probably a good business but did they overpay?)

Today’s idea:

Capital goods manufacturer

Share price flat from 2021-2024

Shares trading at 9.4x earnings / 8x EBITDA on trough(?) numbers

For newer subscribers, check out the VDL “home base” for background info, links to key resources, articles, trackers, etc. As always, leave a comment with thoughts or stocks you want to see covered and check out past posts here to get a flavor for recent write-ups.

If you’re not a premium member, consider signing up below — there are 2 active recommendations I’m pretty excited about right now, both should have a nice 2025.

Quick Value

Terex Corp (TEX)

Terex came from a screen for a combination of cheap valuation plus a flattish share price over 3-4 years (i.e. not a falling knife). At first glance, it has potential as a COVID over-earner looking for a normal year of operations.

What they do…

Terex is an industrial equipment manufacturer for electric utility, mining, construction, and waste management industries (among some others). It’s a heavy machinery / capital goods business not dissimilar to CAT, DE, etc.

They operate under 3 segments:

Materials processing (MP) — materials processing equipment including crushers, screens, conveyors, washing systems, wood and biomass processors, material handlers, cranes, concrete mixers, and pavers; serving industries like mining, construction, recycling, and infrastructure.

Aerial work platforms (AWP) — aerial work platforms, utility equipment, and telehandlers… alongside services including inspections, maintenance, repairs, and training.

Environmental solutions group (ESG) — refuse collection bodies, compaction and recycling equipment, and digital solutions for waste management, advanced camera and software technology for fleet optimization, services including maintenance, repairs, and training.

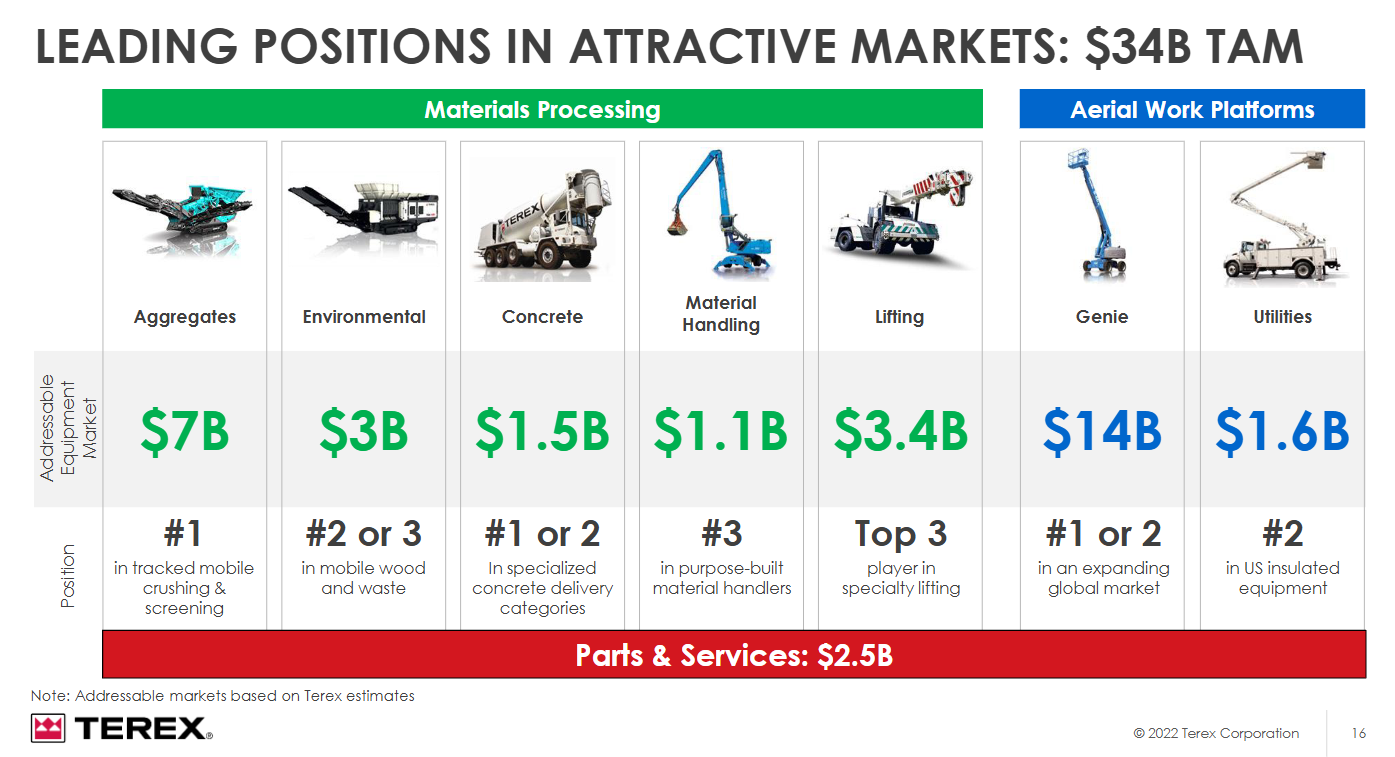

Terex has a top 1-3 position in most markets served by the MP and AWP segments:

The ESG segment was acquired in September 2024 from Dover (DOV) for $2bn at an 11.5x EBITDA multiple (pre-synergy). ESG is the #1 player in manufacturing garbage trucks and compactors. Dover wanted out of this business (and a few others) to reduce their exposure to “capital goods” (i.e. machinery and heavy equipment) and focus on component businesses with less cyclicality.

Why it’s interesting…

It looks like a simple thesis… MP and AWP segments are correcting after a period of supernormal earnings, the ESG acquisition looks like a major uplift in quality (although they paid a premium for it), and overall valuation is well below historic median.

1) MP and AWP segments

These are cyclical businesses tied to customer capex spending (capital goods). Regardless whether 2021-2023 performance was caused by COVID, it’s clearly an abnormal period of high demand.

Backlogs are starting to look more like 2019 and 2025 guidance calls for DD revenue decline at AWP and HSD decline at MP… so maybe these are nearing a cyclical trough.

In 2018-2019, AWP earned $196-300m segment income and MP did $211-228m segment income… those spiked to $371m and $359m in 2023, then $342m and $252m in 2024:

2024 finished the year at $642m EBITDA and the 2025 guide is $660m which includes a full year of ESG. Implies a ~25-30% drop in MP/AWG EBITDA. That would be pretty consistent with 2018-2019 levels.

2) High(er) quality ESG business

Terex paid $2bn for $174m TTM EBITDA and funded the deal entirely with debt. For a $3bn market cap company, it’s not quite a “bet the farm” acquisition, but it’s definitely a significant bet. How this acquisition plays out will meaningfully determine whether TEX stock is a dud 2-3 years from now…

ESG has been a solid organic grower for 10+ years and expected to grow MSD in 2025. They’ve also been an active acquirer of other brands while inside Dover.

Segment EBITDA margins are much higher than MP/AWP at >20% too. Close to 30% of revenue comes from aftermarket parts and “digital” offerings (i.e. software). It’s less capital intensive than MP/AWP at ~1.5% of sales vs. ~2.5%.

Surface level fundamentals look good — organic growth, high margins, low capex — which isn’t too surprising as Dover is one of those high ROIC industrials. But EBITDA jumped from $110m to $149m to $174m at which point Terex is levering up to pay a full multiple… hmm…

3) Valuation

Guidance for 2025:

$5.3-5.5bn sales

$660m EBITDA

$4.70-5.10 EPS

$300-350m FCF ($4.50-5.20/share)

That leaves shares trading at 9.4x earnings and FCF with DD/HSD revenue declines at AWP/MP embedded in there. It’s a decent amount below the 11.2x median multiple over the past 10 years and that’s with earnings well off the $7/share high point from 2023. You’re basically paying a low multiple on potentially trough earnings.

Part of that valuation disconnect is due to leverage. Net debt at $2.2bn is ~3.3x leverage on a cyclical business. My guess is most/all of capital allocation will go toward repaying debt for the foreseeable future.

Terex trades at $46/share with 67m shares outstanding = $3.08bn market cap. Net debt at $2.2bn makes this is $5.3bn enterprise value. Currently trading at 9.4x earnings and 8x EBITDA.

Let’s say that 2025 is indeed a trough year financially and give them credit for 2026 results… analyst estimates call for $740m EBITDA and $5.76 EPS. Assume midpoint FCF guide for 2025 ($325m) and 100% FCF conversion in 2026 ($385m) = ~$700m cumulative FCF through 2026.

At 8x 2026 EBITDA and $700m less net debt = $66/share. At 11x 2026 EPS = $63/share. So maybe this is worth $63-66 vs. $46 today. Not a ton of upside but when these cyclicals recover, they can oftentimes overshoot estimates.

Summing it up…

I’d probably be interested in this one if I better understood the recovery prospects and cycle timing (share notes if you do). Or if shares were trading at a wider discount to 2025 guidance; it feels like a recovery is already expected.

Lastly, I’ve seen a few of these big cyclical acquisitions blow up lately (take a look at CE) so it probably makes sense to wait a few quarters and see how ESG progresses. Granted, if it was sitting inside Dover, it’s probably a good business and already well-run.

This one is sitting on the watchlist for now.

Resources: