Quick Value #271 - CMCSA/WBD Cable Spins

A "way too early" look at the CMCSA/WBD cable network spins

Today’s post:

Comcast spinning off cable networks by yearend 2025

Warner spinning off cable networks by mid-2026

A way too early look at each spin and valuation

Welcome to a free edition of Quick Value. For new subscribers, check out the VDL “home base” for background info, links to key resources, articles, trackers, etc. As always, leave a comment with thoughts or stocks you want to see covered.

Quick Value

Cable Network Spins (CMCSA & WBD)

Both Comcast (CMCSA) and Warner Bros (WBD) are planning to spin-off their cable networks by yearend 2025 and mid-2026, respectively.

Most investors will probably lump these businesses into the “melting ice cube” bucket and call it a day, but that’s missing the real story here. It’s just another episode in the media “content vs. distribution” saga.

1) The cable landscape

Cable network is a fancy word for channel. In the past, cable companies would package these channels into bundles and sell them as a monthly subscription to consumers. Along came the internet and DTC streaming apps like Netflix, Roku, YouTube TV, Sling, Apple TV, Amazon Prime, etc. These led consumers to cut the cord and pay only for the channels/offerings they wanted.

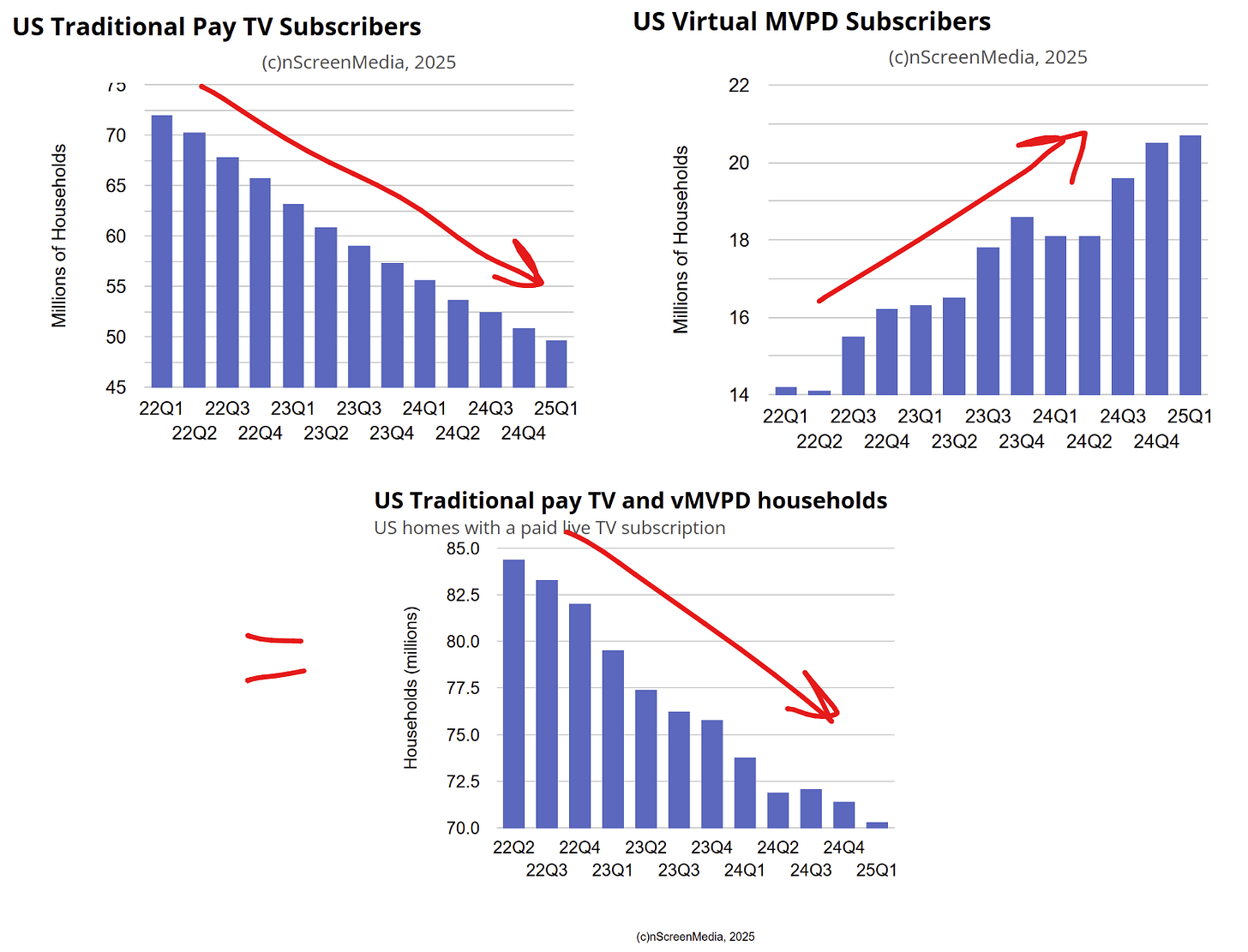

Think of cable (“linear”) and streaming (“OTT” or “vMVPD”) simply as 2 different forms of distribution for paid video content. Cord cutting gets all the attention with ~4-5m cable customers canceling each year, but the bigger picture is that Pay TV as a category is declining even with robust growth from vMVPDs.

I’ve seen subscriber estimates ranging from 50-60m cable TV subs and 20m vMVPD subs with YouTube TV leading the way at 9.4m subs. That’s 70m total Pay TV subscribers today vs. 100m+ from ~2006-2015.

Note that direct-to-consumer streaming services like Netflix are not vMVPDs. They sell their programming direct and while they may license other content, they don’t act as a distributor.

So Pay TV as a whole isn’t growing, but maybe it’s 3-5 years away from that point? If vMVPD grows 20% per year and cable loses 5m subs per year, that would put Pay TV at a 35m / 35m split within 3 years. Hmm…

2) Comcast (VERSANT)

From the 10-K, we have a summary view of 11 networks inside NBCUniversal. Subscriber counts range from 16m to 66m and include channels like USA Networks, E!, Syfy, and CNBC. Not included in SpinCo are Bravo (65m subs), the NBC broadcast network, Telemundo and regional sports networks.

Each of these networks are declining at a pretty good pace. USA Networks for example is down from 86m households in 2020 to 66m households in 2024 (8.5% annual decline).

Cable networks were reported as their own segment from 2011-2020 and then started consolidating inside the “Content & Experiences” segment (couldn’t hurt to hide weakening results).

Management was asked about the rationale for the spin and it’s clear the growth drag + large revenue base were bringing down consolidated Comcast results:

We have been very clear, we're really focused on 6 growth drivers, where we have a right to play. They are massive addressable markets. We have really strong moats in a couple really sort of attacker positions in a couple of the others, and it's a really nice portfolio.

That's 60% of what we do, and that 60% is growing mid- to high-single digits, which is terrific. But overall, as a company, we're not growing revenue, right? That's sort of what you saw in the first quarter, what you saw late last year. And it's because the other 40%, there's parts of that, that are not growing revenue.

So the question becomes, we've been very clear on the 60%, how do you think about the 40%? And so this was a part of the 40% that was separable. And when we say separable it's, is it feeding into Peacock in a way that you would say, you can't separate this because you need to keep it? Only 2% of Peacock's content is coming from the channels that were separable. So that's what sort of created the opportunity.

But for VERSANT, their opportunity is going to be well-capitalized company, very strong management team, a lot of free cash flow, the ability to go do some things maybe in digital that we weren't necessarily thinking of and maybe the opportunity to look at things over time, exactly as you mentioned.

We won’t have pro-forma financials or an outlook for a while longer so take this with a grain of salt.

Here are the standalone cable network results form 2011-2020:

Extrapolate the 2020 results to 2024 and you likely have $8-9.2bn revenue and $2.4-3bn operating income before any corporate allocations or standalone public company costs.

Call it $2-2.5bn operating income after standalone costs.

At 5-7x EBITDA = $10-18bn enterprise value. Assuming 2-3x leverage ($5-6bn net debt) = $5-13bn equity value or $1.30 to $3.50 per CMCSA share based on 3.733bn shares outstanding.

This is a much smaller piece of the overall company on an EV basis, but it still represents close to 10% of sales. With a leverage-neutral spin, the goal here is to lift organic growth at RemainCo.

Details are slim so far, but we’re told the balance sheet will be “well capitalized” and M&A will be a priority.

3) Warner Bros Discovery Global Networks

WBD was formed via the 2022 merger between Time Warner (AT&T) and Discovery. Warner doesn’t own a broadcast network and their “Networks” segment includes all cable networks and the sports portfolio (which is included in the spin).

SpinCo will also own the discovery+ DTC streaming app which has 24m subscribers. It sounds like management intends to find a mix of distributor revenue (cable + OTT) and DTC revenue via one or more streaming apps (CNN launching soon).

the perimeter for this company is going to be broader than what's in our Network segment today. We will have discovery+ in there. You mentioned the strong start that Mark Thompson has had with CNN's digitization, the sports portfolio in the U.S. being under control of this company. So there are a lot of things that are not in scope today. And if you combine that with what's already there, the strong positions in free-to-air internationally, I think there is a very, very strong starting position with a lot of assets that we can build on and build around.

Network segment revenue fell 6% per year from 2021-2024 and operating income fell 9.5% per year. At 1Q25, they were $19.2bn and $7.8bn apiece.

Corporate costs at consolidated Warner are running $1.2bn per year and SpinCo likely gets half of that ($600m). Add that in and EBITDA is probably closer to $7bn.

At 4-6x EBITDA = $28-42bn enterprise value. Net debt is $33.6bn today and with the spin nearly a year out, it’ll probably be closer to $30bn at time of spin. CFO Gunnar Wiedenfels referenced the pro forma balance sheet during the announcement:

…it's safe to assume that the majority of the debt is going to live with Global Networks and a smaller portion but not insignificant portion on Streaming and Studios as well

EBITDA could be lower by mid-2026, but let’s keep it at $7bn and assume 3.5-3.75x leverage = $24-26bn net debt. That’d leave $4-6bn for RemainCo which has trailing EBITDA of $2bn.

My “way too early look” would leave SpinCo at a $10-18bn equity value or $4-7 per share on 2.474bn shares outstanding.

What about future capital allocation?

When asked about the possibility of a larger merger (hint: a CMCSA + WBD cable network tie up), David Zaslav explicitly called out the potential for an RMT transaction:

Q: And then the second question is about that the structural flexibility. So because this is a tax-free structure, I would assume there is some limitation in terms of the amount of time before you could do something on a larger scale. Is that accurate? Would it apply both to Streaming and Studio and to Global Networks? Or could there be differences between one or the other businesses?

A: …when it comes to looking at options during this period of time, if it's option -- if there's an option for less than 50%, that's something that we can look at with an RMT or a similar structure.

Summing it up…

There will be a few key variables for these stocks:

When will they fully (mostly) transition from linear to OTT?

What will the economics look like in a fully-OTT world?

What will the M&A landscape look like?

The first will determine future revenue trajectory and the second future profit potential (i.e. can they make the same amount of money selling through YouTube vs. cable).

There’s a real possibility that these 2 businesses work out a merger/RMT structure before either spin takes place. This could also turn smaller players like AMCX/STRZ into takeout candidates.

Peers have widely varying business models (studio, theme parks, broadcast networks, DTC, cable networks, etc.). A quick look at the post-split players:

DIS — studio, DTC streaming, cable network, broadcast network, sports, theme parks

PARA — studio, DTC streaming, cable network, broadcast network

FOX — cable network, broadcast network, TV stations, sports

CMCSA RemainCo — studio, DTC streaming, broadcast network, sports, theme parks

CMCSA SpinCo — cable network

WBD RemainCo — studio, DTC streaming (HBO)

WBD SpinCo — cable network, DTC streaming (discovery+)

AMCX — cable network, DTC streaming

STRZ — cable network, DTC streaming

LION — studio

If the low end of peer valuations are 5-7x, then I’d imagine the slower growth less attractive cable networks would trade at a discount. Comcast RemainCo probably looks more like FOX/DIS combo post-split and Warner RemainCo more like LION studio business. Both likely to see a nice re-rate.

Going to keep an eye on these and do some work as spin docs get filed, maybe there’s an opportunity to get involved pre-spin.

If they combine in a mega-merger deal, it will almost certainly be a deleveraging story until (or if) growth resumes.

Resources:

I think Zaslav is overrated. When he ran Discovery there were great expectations, which never happened. Then everyone became excited with the Warner Brothers combo. Investors got burned again.

Personally, I think both companies want to disassociate themselves from their news channels more than anything because they have tarnished their image, but they had to chuck in some other channels with the hopes that it will make the spin cos investable.

Comcast is more interesting because they are starting to give Disney a run for their money with Universal. Plus, their Wi-Fi is booming and make no mistake the broadband assets make a big difference between the two companies.

Warner has good content but can’t seem to monetize it, at least with Zaslav at the helm.

Disney is frittering away their content too. They haven’t made a good movie in years. They have probably had more success with Beatle documentaries than with anything else on their streaming platform as well.

Just my two cents.