Quick Value 9.26.23 ($VSTS)

Vestis - Uniform rental spin-off; what's it worth?

Yet another spin-off this week as the upcoming schedule is packed with them… Here were the last few covered:

Subscribe below for access to all weekly and monthly posts! Thanks for your support.

Market Performance

Quick Value

Vestis Corp ($VSTS)

Aramark (ARMK) is set to spin off Vestis (VSTS) at the end of September so this is quite timely… let’s take a look at what they do and what the pieces might be worth.

What they do…

Vestis provides uniform rentals and workplace supplies like towels, floor mats, bathroom supplies and some safety items. Total sales were $2.7bn in 2022 with $1.2bn from uniforms and $1.5bn from workplace supplies. It’s a pretty straightforward business model… usually weekly, Vestis will visit their customers to pick up dirty uniforms, mats, towels, etc. and drop off clean uniforms or consumable supplies like restroom towels, soap, etc. At its core, this is a route-based business with some scale and density effect.

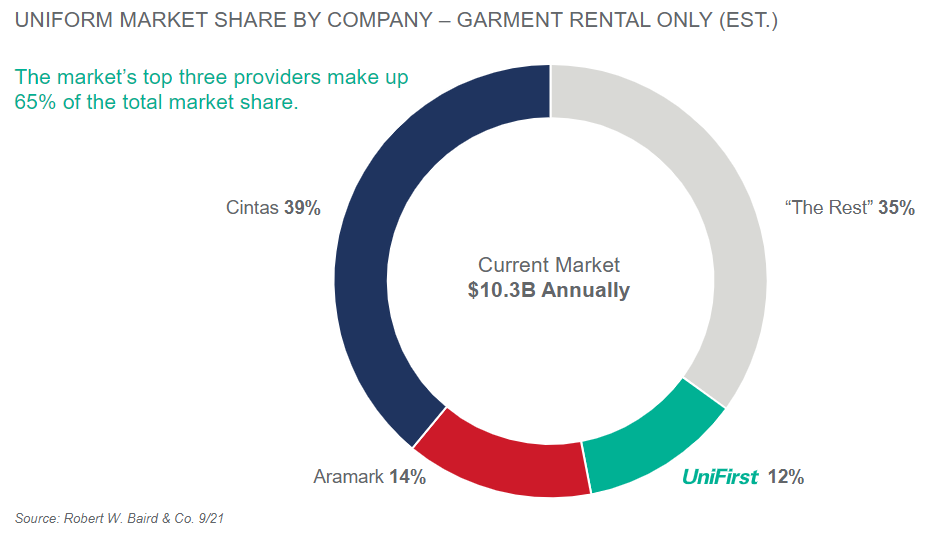

There are a few differing definitions of the “industry size” depending on what ancillary services you’re including but generally it’s a $40-50bn market with Cintas (CTAS), Vestis (VSTS), and UniFirst (UNF) as the top 3 players with <30% market share combined.

Looking at the $10.3bn uniform rental market only; Cintas is a the clear leader with Vestis/UniFirst roughly even in size:

Customers typically enter into multi-year contracts with recurring payment terms (usually weekly). These are mostly small businesses (84% as defined by Vestis) with the remainder being “national accounts” that generate sales of $25,000+ per week. Concentration isn’t an issue here with the 10 largest customers chipping in less than 10% of total revenue. Industries they service are pretty diverse too: manufacturing, hospitality, healthcare, retail, auto, government, etc.

Why it’s interesting…

I’m going to take a different approach with this post since we already know the spin-off is what makes this interesting… instead I’ll attempt to value the 2 pieces of the spin — SpinCo (uniforms) and RemainCo (facilities management).

Starting with comparable companies across each piece — both industries generally trade at high multiples with some clear industry leaders:

Starting with SpinCo…

Cintas is far and away the largest competitor in the industry and they’ve experienced runaway multiple expansion over the past 10 years with EV/EBITDA jumping from ~10x in 2014 to >20x since 2020.

A big driver for Cintas’ outperformance are likely: 1) consistent revenue growth every year since 2015 (COVID included); and 2) industry-leading EBITDA margins >20%.

Vestis struggled with revenue during COVID; and operating income under Aramark grew at a meager 1.9% annual rate during the 7-year period from FY16-22. New management hopes to turn that around as a standalone company. Management is targeting 5-7% sales growth from FY23-28 and 18-20% EBITDA margins by FY28.

However, the pressure for performance will be high with a loaded 4x levered balance sheet at time of spin ($1.5bn gross debt). Management is targeting 1.5-2.5x net leverage but expect that to happen in 2026 so it sounds like: 1) an entirely organic revenue growth story; and 2) capital allocation will go entirely to paying down debt.

No guidance was given for the first post-spin year but naturally they’ll be digesting some standalone public company costs that will set them back from 2023 results. Here’s a quick look at sales/EBITDA for standalone UniformCo — these include TTM results for 9M23 and some placeholder estimates for FY24:

It’s possible we see a dip back to FY22 levels in FY24 before growth starts benefitting margins. Let’s say the spin should see a discount to peers based on the high leverage, call it 9-10x EBITDA or $3.4-3.7bn. Backing out $1.5bn net debt gets an equity value of $7-8.50/share on 261m (pre-spin) outstanding. [It’s a 1:2 spin ratio so that works out to ~130m outstanding post-spin.]

Under a few different EBITDA scenarios, I get to ~$130-160m in FCF for SpinCo:

RemainCo…

Stub Aramark operates in the food and facilities management industry which is a huge $540bn market ($215bn food / $245bn facilities). It’s highly fragmented with the biggest competitor being self-operation by facility owners. It’s a relatively low margin business since the capital requirements are low (lower barriers to entry). Sodexo and Compass Group are 2 large players.

I’d describe this situation as a levered COVID recovery play… Lots of office buildings, healthcare facilities, and sports/entertainment venues took big hits in traffic and likely still haven’t fully recovered to pre-pandemic levels.

The balance sheet is 4.7x levered (net) as of 6/30/23 with $7.6bn+ in gross debt on ~$1.5bn EBITDA:

Pre-pandemic, operating cash flow was consistently >$1bn per year. That fell in 2020 and rebounded to $650-700m in 2021-2022 but still well below “normal.”

Remember that these include SpinCo numbers as well…

With their fiscal year ending in a few days, I’m going to use FY2024 (ending 9/30/24) as a starting point… and I can’t confidently say what is or isn’t included in estimates for the uniform SpinCo so I’ll take the $1.73bn EBITDA estimate and back out TTM SpinCo EBITDA of $390m = $1.34bn RemainCo EBITDA in 2024.

Net debt should come down to ~$5.6bn with SpinCo taking $1.5bn of it; but that still works out to ~4.2x leverage on $1.34bn forward EBITDA.

If Aramark continues to trade at 9-10x EBITDA (on FY24 estimates) = $25-30/share.

Side note on RemainCo… they seasonally generate cash in Q4 so I may not be giving them full credit for leverage; plus they sold some non-core assets for >$600m gross proceeds. These could add another $2-3/share to RemainCo value.

Summing it up…

Aramark went private in a 2007 leveraged buyout and came public again in 2013 with a still highly levered balance sheet. Since 2013 they’ve increased total debt levels while revenue is up >50% and cash flow/earnings are flat.

These are good businesses with growth trends and good economics but definitely constrained by past capital allocation. Both SpinCo and RemainCo will start with ~4x leverage and plans to get that under control over the next few years.

SpinCo looks like the better cash flowing business… combined capex was $364m in 2022 and SpinCo was 20% of that while generating >33% of operating cash flow…

We’ll need to see where these start trading…

Part of the reason why Aramark hasn't recovered as much is because of pricing increase lags. Their costs rose and they couldn't pass along those costs until recently. You finally saw good margins last quarter and their management says should continue improving.