Quick Value #292 - Dole plc (DOLE)

Technical sell-off + improving fundamentals + attractive valuation

Today’s post:

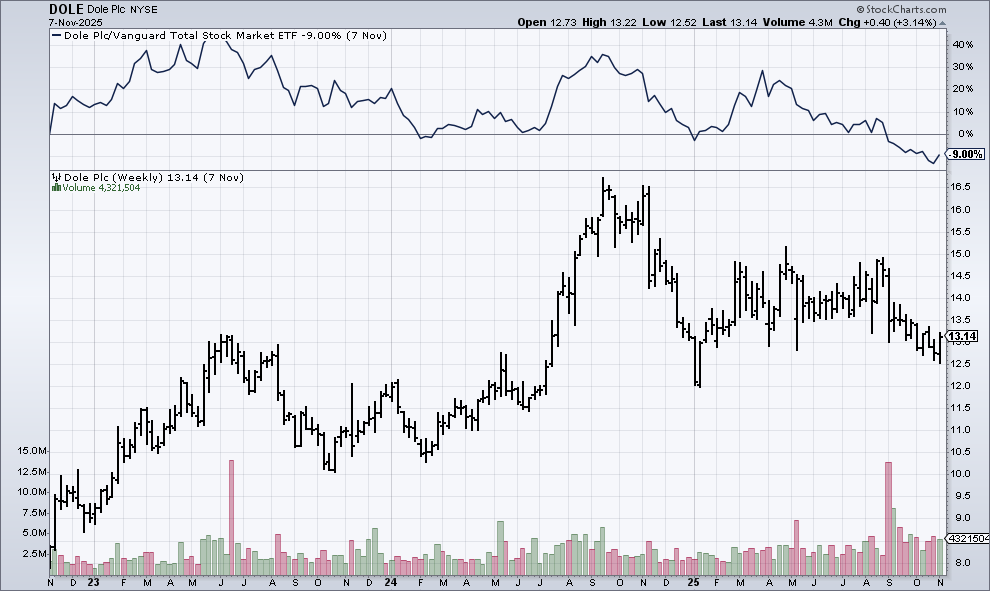

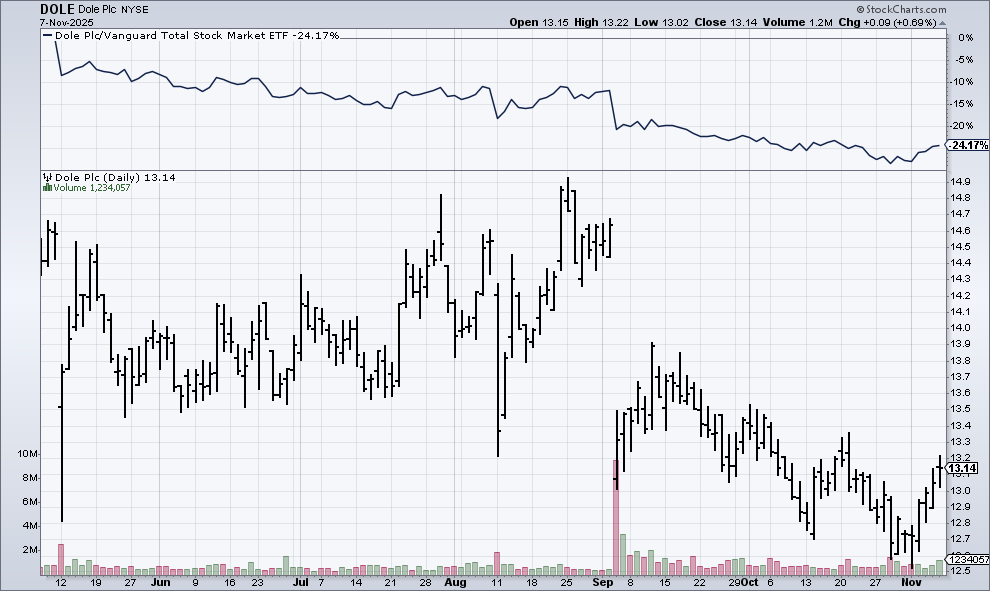

Shares down 8% since 2021 merger + IPO

Non-fundamental selling in 2025 after passing of large shareholder

Historically stable fundamentals with improved leverage (~5x to <2x)

Attractive valuation based on historic multiples and peer valuations

Quick reminder — For newer subscribers, my write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Check out past write-ups here and my home base page here.

Recent write-ups include:

10/27/25 — ONEOK is a cheap midstream energy co

10/20/25 — Net-net in oilfield services ($)

10/13/25 — Solstice spin off from Honeywell

10/06/25 — Divestitures and delevering at Leggett & Platt ($)

09/29/25 — A look at Portillo’s recent struggles

09/15/25 — Axalta Coatings = quality mid-cap chemical business

Quick Value

Dole plc (DOLE)

Ticker: DOLE

Shares: 95m

Market cap: $1.24bn

Valuation: 7-8x FCF, 5-6x EBITDA

Theme: CheapBackground

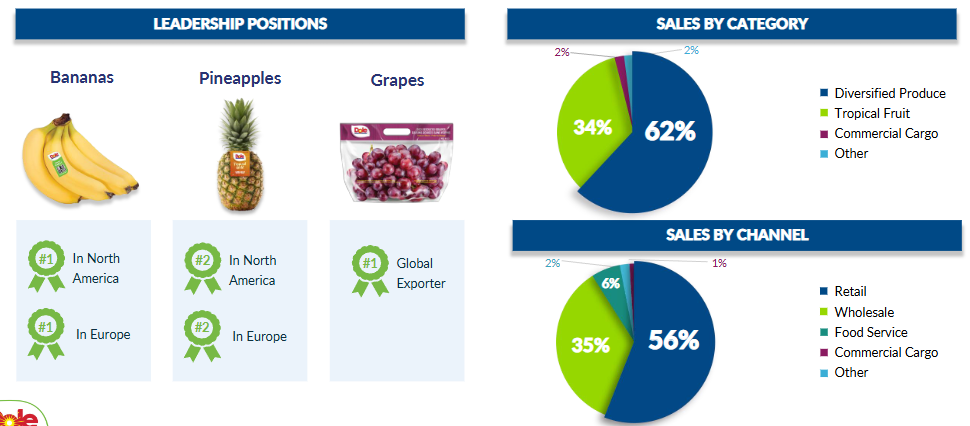

Dole plc is a vertically integrated fresh produce supplier with leading positions in bananas, pineapples, grapes, and a variety of other fruits.

A quick timeline of key events:

Pre-2021 — Dole predecessor purchased by David Murdock in 1985 and went through a series of acquisitions, divestitures, take-private transactions (2003, 2013), and public offerings (2009, 2021).

2018-2021 — IPO at $16. Irish-based Total Produce plc bought 45% of Dole in 2018 and completed merger in 2021 at time of IPO.

2022-2024 — Debt was elevated from the merger (~5x leverage in 2021). Dole spent 4 years repaying debt down to 2.6x leverage at yearend 2024. Shares went from $13 to $16.

2025 — Longtime owner and former CEO passes; his estate liquidates ~13% position causing moderate sell-off. Fundamentals still improving and leverage <2x at 3Q25. Shares from $16 to $13.

Dole has #1-2 positions in bananas, pineapples, and grapes in North American and Europe. Virtually all revenue is sold to grocery retailers directly or indirectly through wholesalers (concentrated customer base).

It’s a vertically integrated business with significant assets and infrastructure: 110,000 acres of land, 75 packhouses, 85 farms, 20 ripening facilities, 13 container ships, etc. Translation: it’s a capital intensive business model..

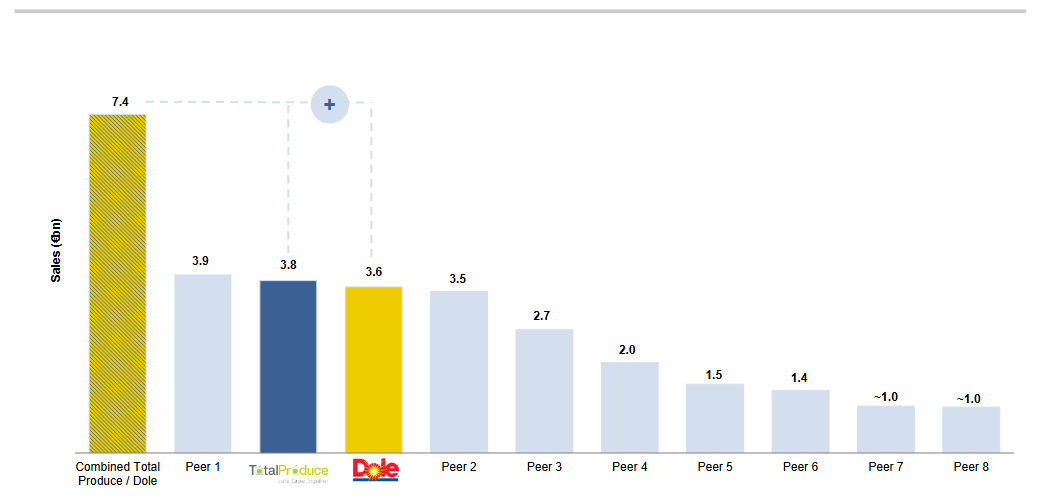

The 2021 merger created a highly scaled player in the fruit & produce industry:

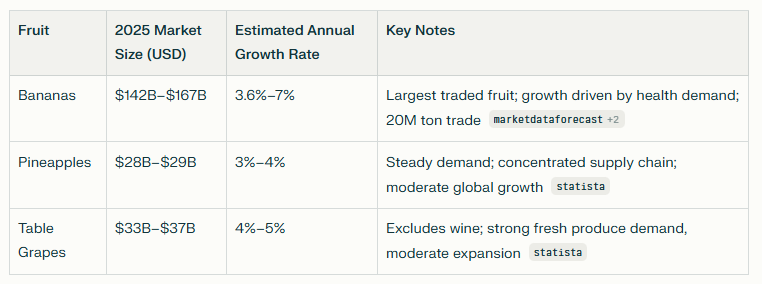

These are large and growing markets (specifically focused on banana, pineapple, and grapes here):

Growers and producers don’t have a ton of bargaining power, especially with an increasingly concentrated grocery retail industry. There’s also ag risks like weather and crop yields which can impact results. And then there’s capital investment required to maintain the asset base. Produce has the makings of a highly competitive, low return industry.

Why it’s interesting…

Non-fundamental sell-off

Improving fundamentals

Attractive valuation

1) Technical sell-off

Longtime owner and former CEO David Murdock passed away in June 2025 at 102. At the time of his death, Murdock had a 13% stake in Dole. His stake was liquidated in September 2025 as a secondary offering at $13.25 per share, a 10% discount to the previous day’s share price.

Murdock retired as CEO during the 2013 take-private transaction and then stepped down entirely around the 2021 merger with Total Produce; so his operational involvement was nil.

For a company with improving fundamentals, this creates a nice opportunity to pick up shares of a good company on an unwarranted sell-off.

2) Fundamentals

Industry dynamics are highly competitive even though these are recognizable brand names; brands don’t translate to consumer preferences here (if I’m eating a banana, do I care if it’s Dole or Chiquita?). That said, fundamentals for Dole and Total Produce are stable and growing.

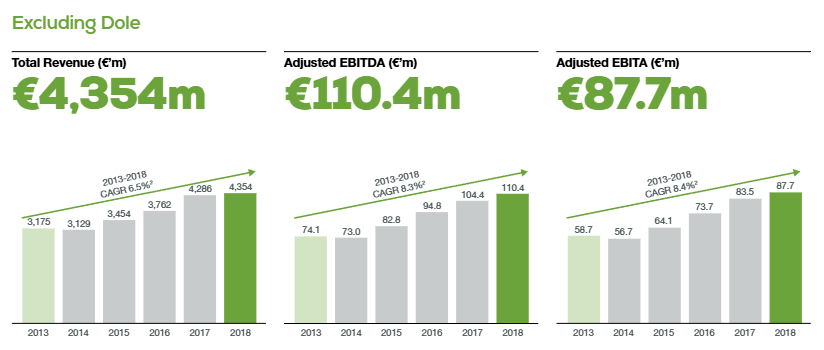

Here’s a picture of the 2013-2018 period for Total Produce where EBITA grew 8.4% annually:

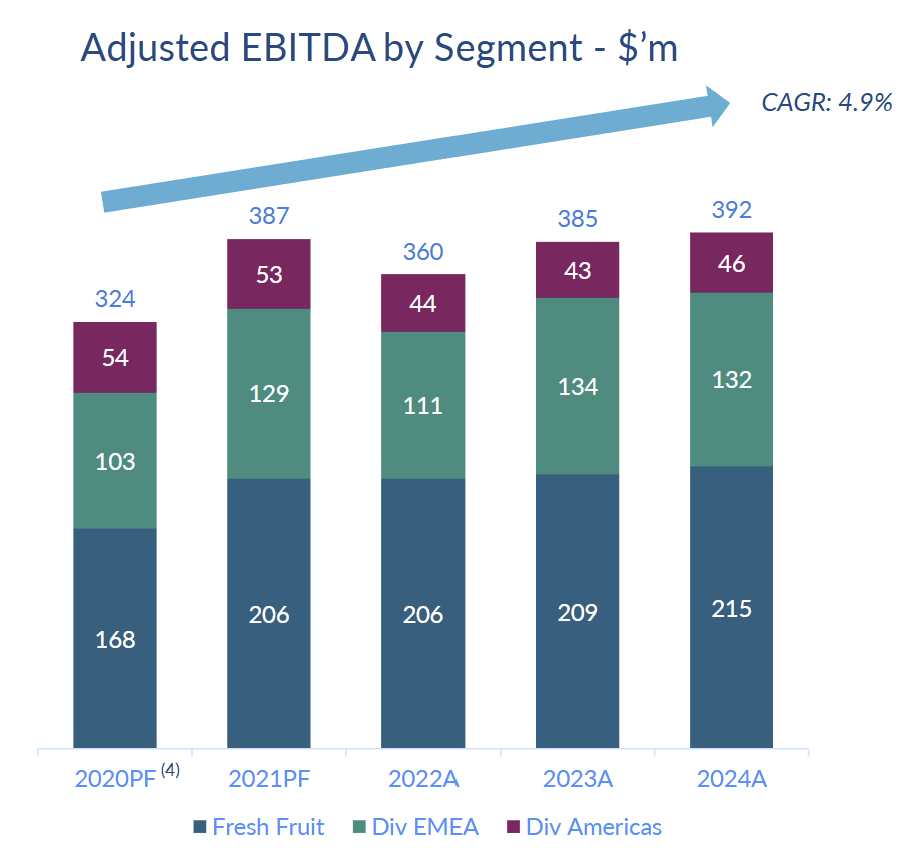

And here are post-merger results from 2020-2024 with 4.9% annual EBITDA growth:

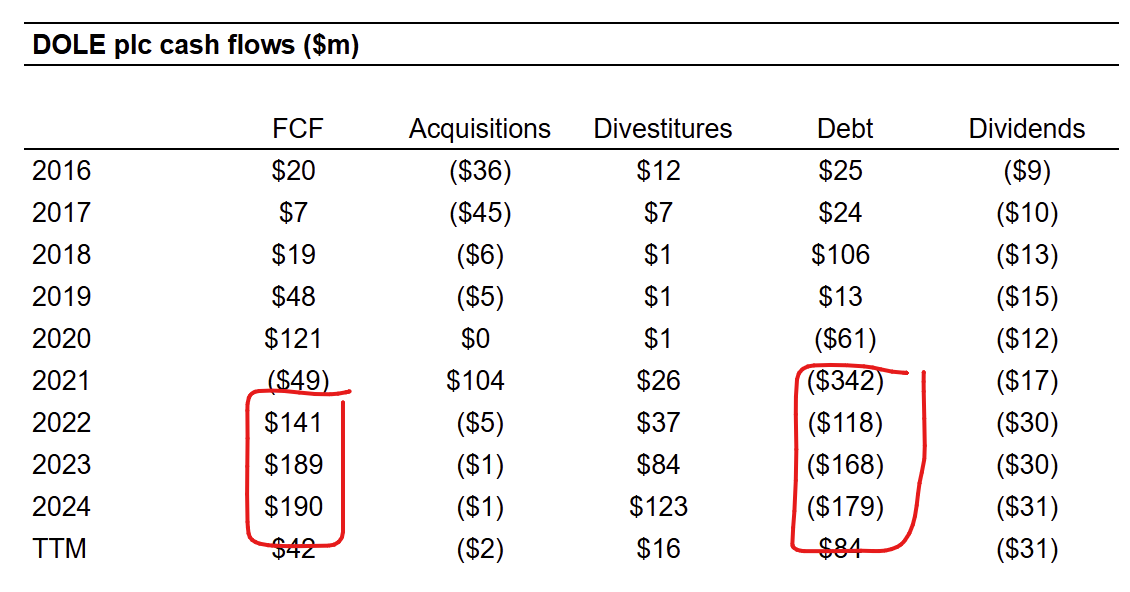

Cash flow is highly stable since the merger, averaging $173m per year or ~$1.80 per share (~7.2x P/FCF).

Virtually all FCF went toward debt repayment along with a small dividend (~2.5% yield). Several assets and divisions (vegetables) were divested during this period too. In 3Q25, the board authorized a $100m buyback plan (~8% of current market cap).

Last comment on fundamentals…

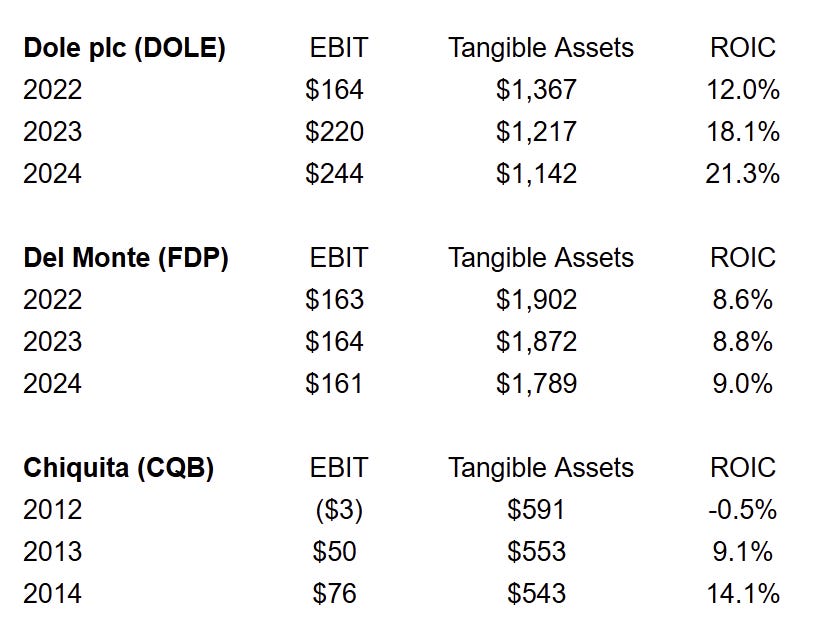

If you compare return on invested capital across Dole, Fresh Del Monte (FDP), and Chiquita (CQB) during their public tenure; you’ll find Dole generates significantly higher returns on invested capital (net working capital + net fixed assets in this case):

3) Valuation

We’ve already established that fundamentals are stable and returns on capital are higher than peers. This business looks more like consumer staples than a commodity/ag producer.

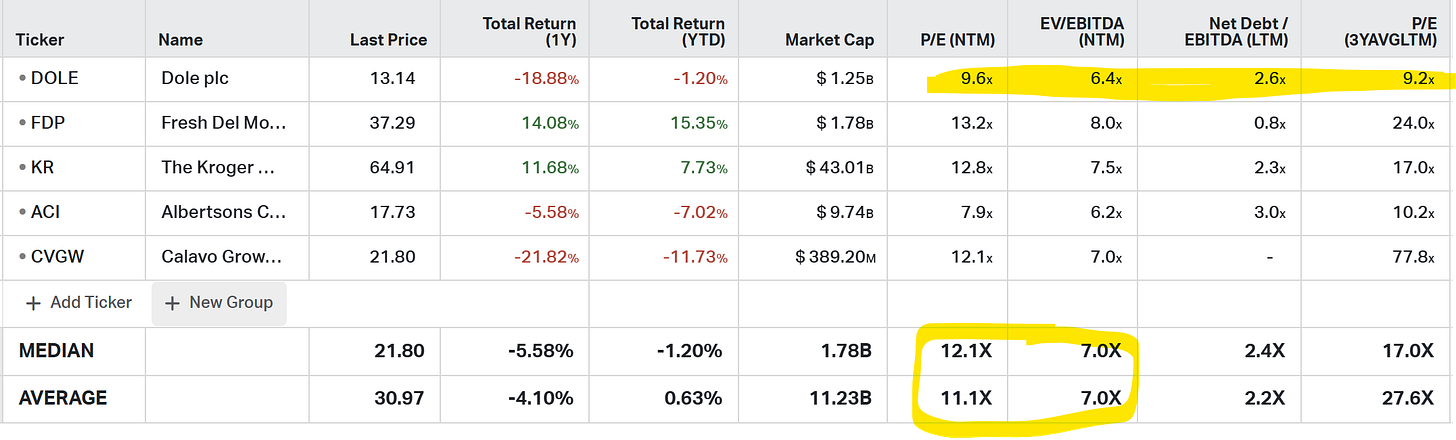

Peers (produce + groceries) are trading at 6-8x EBITDA and 8-13x earnings. As another reference, Chiquita was acquired in early 2015 at a ~7x EBITDA multiple.

FY25 guidance calls for $380-390m EBITDA. There are ~95m shares outstanding x $13 per share = $1.24bn market cap. Net debt is $665m at 3Q25 (1.7x leverage at guidance mid-point). This equates to a 4.9x EBITDA multiple (excluding operating leases in my EV calculation).

Using a 7x EBITDA multiple on $385m = $2.7bn EV. Less $665m net debt = ~$2bn market cap or $21 per share (on 95m s/o). In addition, EBITDA should convert to FCF at a higher rate with less debt and capital allocation is starting to shift (recent buyback authorization).

Summing it up…

Not a bad setup.

I’d like to better understand what sets Dole apart from Fresh Del Monte (i.e. how do they generate superior returns on tangible assets?). At a minimum, this looks like a decent trade back to the pre-Murdock-liquidation price of ~$15, but even then shares would be cheap.

Does this deserve a staples-like multiple? If so, how will it get there (what’s the catalyst)?

Disclosure: I own a small position and may add to my stake

Resources: