Quick Value #284 - Axalta Coating (AXTA)

Market leading chemical business at 12x earnings; management change leading to operational improvements + capital allocation changes

Today’s post:

Shares basically flat since 2014 IPO

Quality chemicals business with market leading position in several product lines

New management (external) took over late 2023 and leading significant operational and capital allocation changes

Leverage within targeted range, earnings growing, and capital allocation opening up

Quick reminder — For newer subscribers, my write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Check out past write-ups here and my home base page here.

Recent write-ups include:

09/09/25 — Deleveraging catalyst at Synchronoss ($)

09/02/25 — Special situation in Pitney Bowes (PBI)

08/25/25 — A look at Greenlight’s stake in Fluor (negative EV?) ($)

08/18/25 — Atleos a 20% EPS grower at 10x earnings

08/11/25 — Sangoma Technologies turnaround-to-growth transition ($)

08/04/25 — My sourcing list and watchlist process

07/21/25 — ATN International high-quality small-cap telco ($)

07/14/25 — Babcock & Wilcox (BW) option-like upside

06/02/25 — Mid-year review of recommended ideas ($)

05/24/25 — Guide to reviewing a 10-K

Quick Value

Axalta Coatings (AXTA)

Ticker: AXTA

Price: $31

Shares: 218m

Market cap: $6.8bn

Valuation: 12.4x FY25 EPS

Theme: Management changeI get excited when I find a stock with decent fundamentals and a flatlining price chart over multiple years (the longer the better).

What they do…

Axalta is a specialty chemical business producing coatings mainly for passenger vehicles. They operate a network of 44 manufacturing facilities and distribute via direct salesforce and ~5,000 independent distributors.

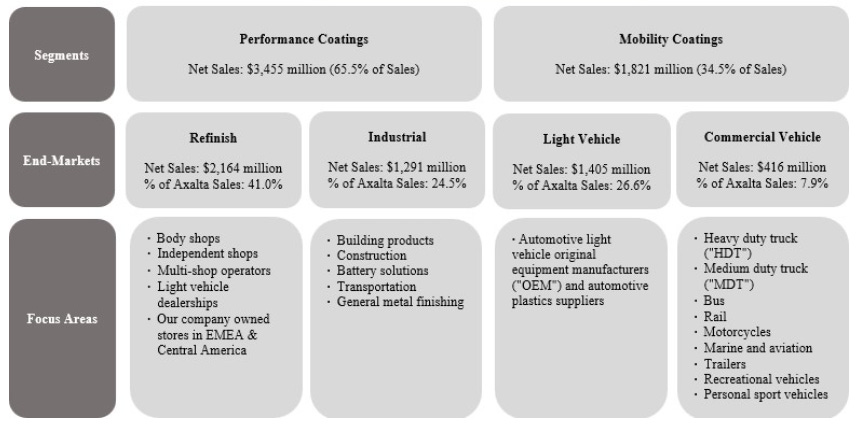

There are 2 segments with 2 sales channels each:

Performance coatings — 1) refinish coatings (i.e. body shops); and 2) industrial coatings

Mobility coatings — OEM business for: 1) passenger vehicles; and 2) commercial vehicles

The refinish channel is the largest piece of the business at 41% of 2024 revenue. Sales are primarily to body shops and driven largely by volume of vehicle collisions and miles driven. Axalta is the market leader in this $6.8bn industry. Industrial coatings is a large market ($69bn annually) covering a variety of applications: building, construction, metals, battery, etc. They’re a small player in each product line served.

The Mobility segment essentially houses the OEM business for passenger and commercial vehicles. This is a very different business with a direct/technical salesforce and customer concentration. As you’d expect, this segment carries way lower margins than the refinish/industrial lines.

Axalta was previously the “Performance Coatings” business within DuPont before it was acquired by Carlyle Group in 2013 for $4.9bn. Carlyle renamed the business Axalta and took it public in 2014.

Why it’s interesting…

Share price underperformance since 2014 IPO

New management creating change

Reasonable valuation

1) Share price performance

Shares of AXTA have underperformed the S&P massively since coming public, but I wouldn’t classify the business as a “shitco” and shares are not a falling knife, just flatlining. The stock is more of a “coiled spring” trading in a tight range between $25 and $35 for more than 10 years now.

Why the underperformance?

This strikes me as a decent business with a decent amount of mismanagement over several years. Axalta churned through 5 CEO’s since coming public in 2014 and takeover rumors from 2 competitors fell apart in 2017 which deflated a premium valuation. Since then, the company has been lacking a concrete strategy to drive value…

2) Management change

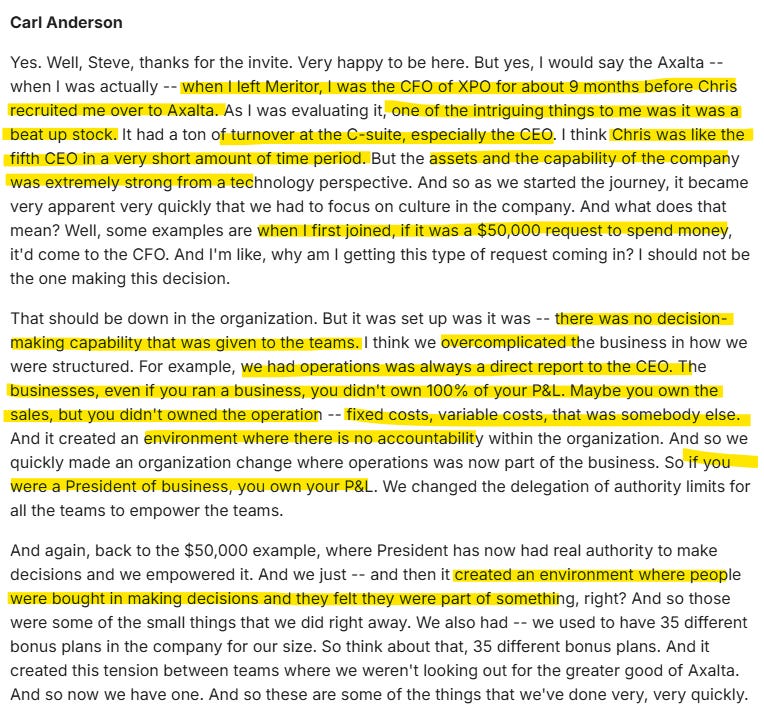

New management took over in 2023. CEO Chris Villavarayan came from Meritor (which sold to Cummins) and CFO Carl Anderson from XPO/Meritor. This CEO/CFO combo are making real changes…

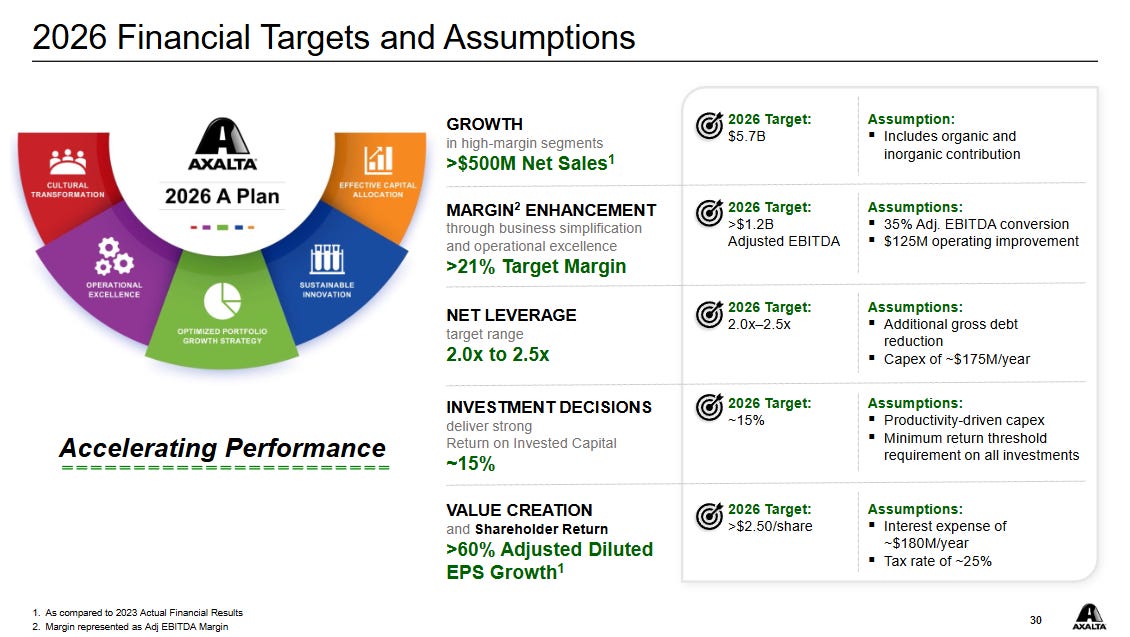

In mid-2024, they laid out a 3-year plan covering 2024-2026 — targeting $5.7bn revenue, $2.50 EPS, and leverage down to 2-2.5x.

By mid-2025, most of these targets have already been accomplished.

Leverage is ~2.5x at 2Q25, EPS guidance for 2025 is $2.50, and revenue guidance is $5.2bn. So it looks like they’ll achieve virtually all targets except for revenue. This is a much needed credibly boost for the company.

It sounds like the operational mismanagement during Axalta’s public tenure goes much deeper... Here are some revealing comments from CFO Carl Anderson in a Feb 2025 presentation around P&L ownership and pushing decisions down to lower levels in the org:

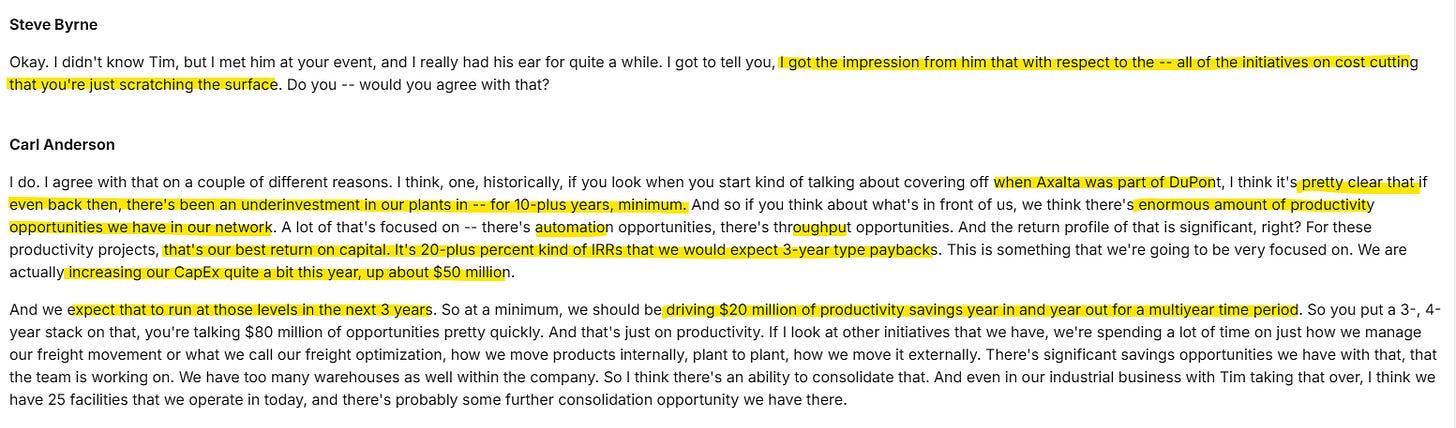

Behind that, Axalta was underinvesting in their plants. In response, management is increasing capex spending from a 2015-2024 average of $130m up to $180m for the next 3 years. They expect 20% IRRs from these investments.

3) Fundamentals, capital allocation, valuation

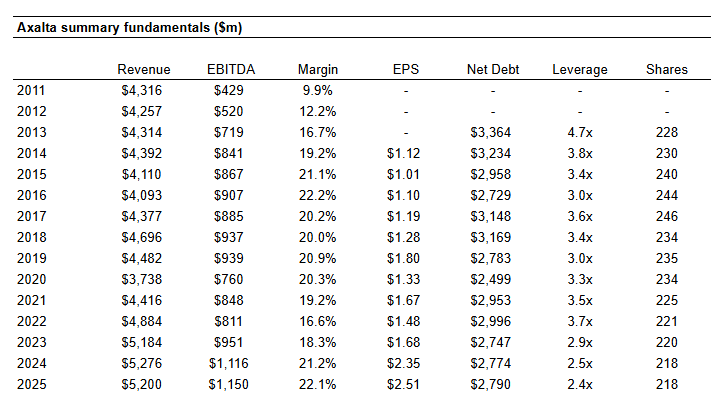

A quick look at the fundamentals reveals several “eras” of management. Reminder: 1) AXTA came public in late 2014; and 2) new management came in 2H23.

Modest revenue growth boosted by $1.86bn of acquisitions from 2015-2025

EBITDA margins consistently 20-22% (excluding post-COVID period)

Leverage consistently 3-3.7x from IPO to 2022 — consistently and meaningfully stepped down under new management (now 2.5x)

Inconsistent buyback pacing

Inconsistent earnings (EPS) and EBITDA generation (flat from 2014-2022) — EPS growth accelerating under new management

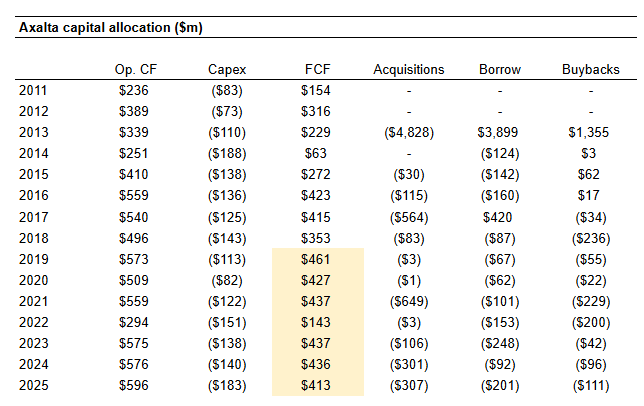

What about capital allocation?

Free cash flow is essentially flat for ~7 years now (though 2025 guidance calls for $475-500m which is a step up).

Prior management teams opted for larger acquisitions and minimal allocation to repaying debt. Buybacks were sporadic too. Since 2023, things look a bit more balanced with acquisition spend less than annual FCF generation, consistent and moderate buybacks, and heavy debt repayment.

It sounds as though the balance sheet is “fully reset” and within the targeted 2-2.5x leverage range which means more cash available for M&A and shareholder returns (no dividend currently).

Valuation

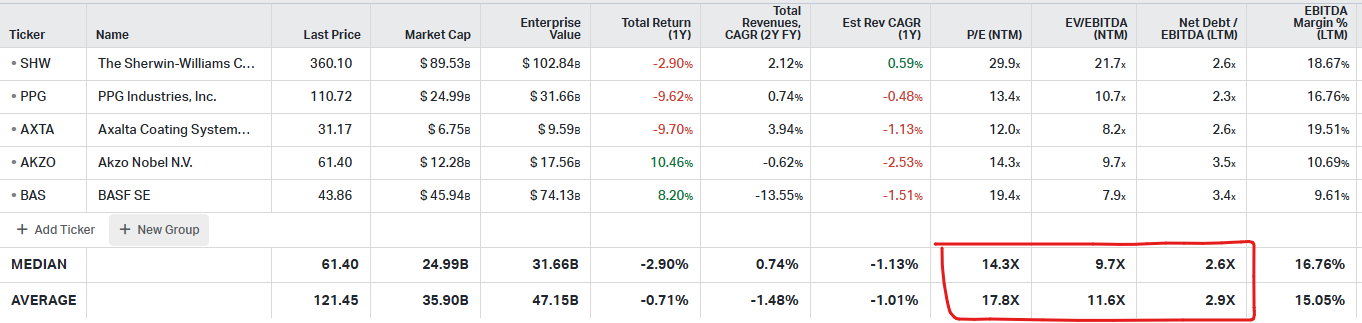

Shares of AXTA are trading at $31 and EPS guide for 2025 is $2.50 = 12.4x P/E. If FCF finishes at $500m = $2.30 FCF per share, so they’re converting 90-100% of earnings into FCF too.

Peers have varying business models and product lines, but generally trade at 14-15x earnings. AXTA 2026 EPS estimates are $2.73 currently. Productivity gains from capex are expected to add $20m next year (~$0.10/share pre-tax) and $200m buybacks could add another $0.05/share so estimates look very achievable.

At 14-15x earnings on $2.73 EPS = $38-41 per share. Not incredibly cheap, but solid for a good business with a much improved balance sheet and earnings upside.

Summing it up…

I glossed over some of the risks here, the refinish market is struggling lately with auto insurance claims down across the board. Self-help operational improvements could carry them through the market downturn though.

This looks like one of the better “management change” stories I’ve seen lately.

Disclosure: no position

Resources: