Quick Value #282 LIVE - Pitney Bowes (PBI)

This "special sit" has it all - activism, management change, GoodCo/BadCo, divestiture, and an early innings capital allocation inflection

Today’s post:

Combination management change + capital allocation inflection

Shares trading at 9x earnings with <3x net leverage

Buybacks initiated in 1H25 and ramping

Heavy insider ownership + alignment

Quick reminder — For newer subscribers, my write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Check out past write-ups here and my home base page here.

Recent write-ups include:

08/25/25 — A look at Greenlight’s stake in Fluor (negative EV?) ($)

08/18/25 — Atleos a 20% EPS grower at 10x earnings

08/11/25 — Sangoma Technologies turnaround-to-growth transition ($)

08/04/25 — My sourcing list and watchlist process

07/21/25 — ATN International high-quality small-cap telco ($)

07/14/25 — Babcock & Wilcox (BW) option-like upside

06/23/25 — Reviewing RAL spin-off and FTV RemainCo

06/02/25 — Mid-year review of recommended ideas ($)

05/24/25 — Guide to reviewing a 10-K

Quick Value

Pitney Bowes (PBI)

Ticker: PBI

Price: $12

Shares: 172m

Market cap: $2.1bn

Valuation: 7.7x FCF

Theme: Management change / inflectionThese are my expanded notes following a LIVE review of Pitney Bowes (video below). It’s a “first look” at the company so ease up if you’ve been following the situation for a while now!

Company overview

First, some history:

2010-2015 — After a GFC drop-off, revenue was mostly stable at $3.6-3.8bn from 2011-2014. Earnings were consistent and shares hung around $24-25 during this stretch.

2015-2020 — Melting ice cube phase… PBI spent ~$900m on acquisitions within their Global Ecommerce segment (more on that later). Revenue was (surprisingly) flat at $3.6bn while EBIT fell from $640m to $150m. Share price fell each year from ~$25 to ~$3.

2020-2023 — Survival mode… Shares hung around $3-4 (mostly) as revenue declines accelerated and losses piled up in the Global Ecommerce segment.

2024 — Announced sale/bankruptcy process for struggling Global Ecommerce segment, a huge milestone for the story (discontinued ops lost ~$740m from 2022-2024). Shares went from $4 to $7.

2025 — Core earnings (ex disc ops) and FCF expected to grow substantially in 2025. New CEO from activist investor group. Capital allocation inflecting. Shares went from $7 to $12 (as of August).

That’s quite a bit going on here…

Segment overview

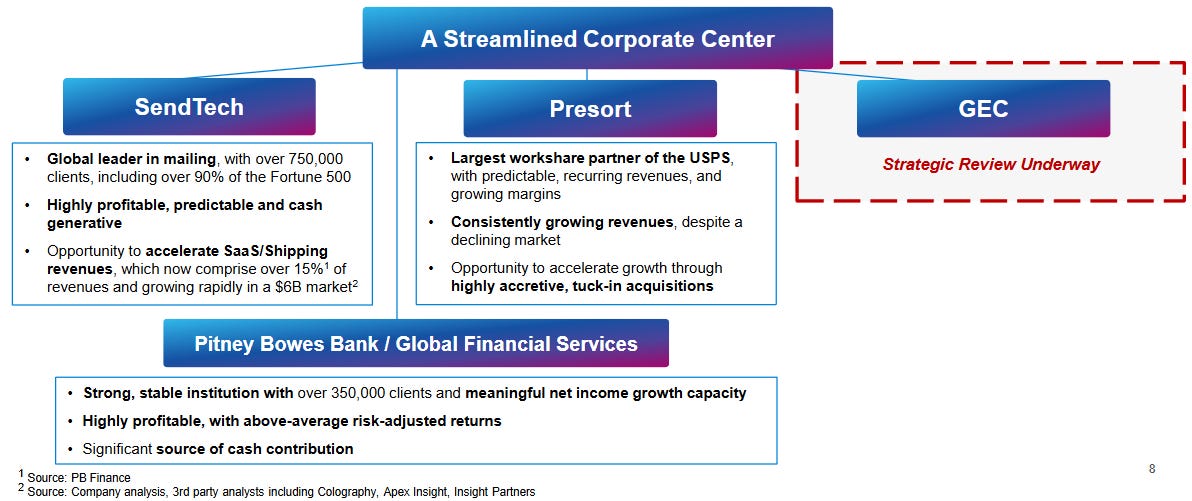

After the GEC segment exit in 2024, Pitney Bowes operates 2 segments: 1) SendTech; and 2) Presort.

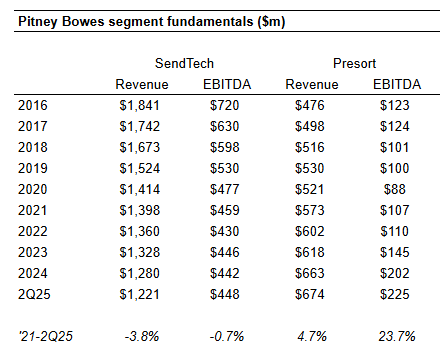

SendTech is larger and more profitable, but declining fairly rapidly (accelerating from 2-3% per year to 8%). Presort looks like the crown jewel segment with consistent revenue and earnings growth.

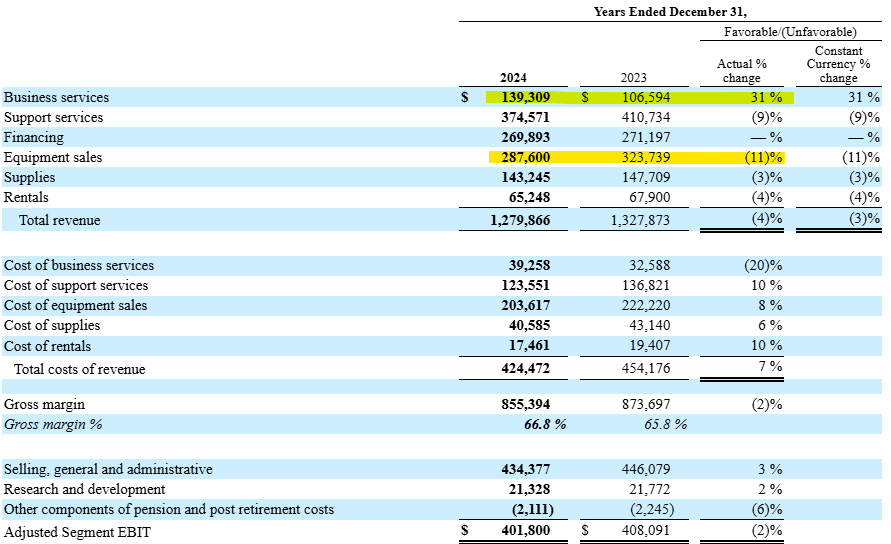

SendTech itself is an amalgamation of several products and services ranging from equipment sales (postage meters), software subscriptions, rentals, consumables, and financing revenue. Equipment sales are likely the most challenged here with postal volumes falling 3-4% per year. Business services, which contains their shipping software product, is a bright spot.

Presort is a “workshare partner” for the USPS… instead of businesses sending mail directly through the post office, Pitney Bowes sorts it in large sorting centers, then delivers it to the postal branch closer to where it needs to go. In return for easier and faster handling, business customers get discounts on postage from USPS.

Revenue is growing 4-5% annually since 2021 and EBITDA grew 23-24% annually since 2021 (though slowing in 2025).

This segment is fascinating since fundamentals look strong despite overall industry challenges (i.e. mail volume declining 3-4% per year)… but USPS revenue is increasing around 2% per year which allows PBI to pick up higher revenue-per-piece. (Maybe this segment isn’t as challenged as I originally thought.)

Some financial stats

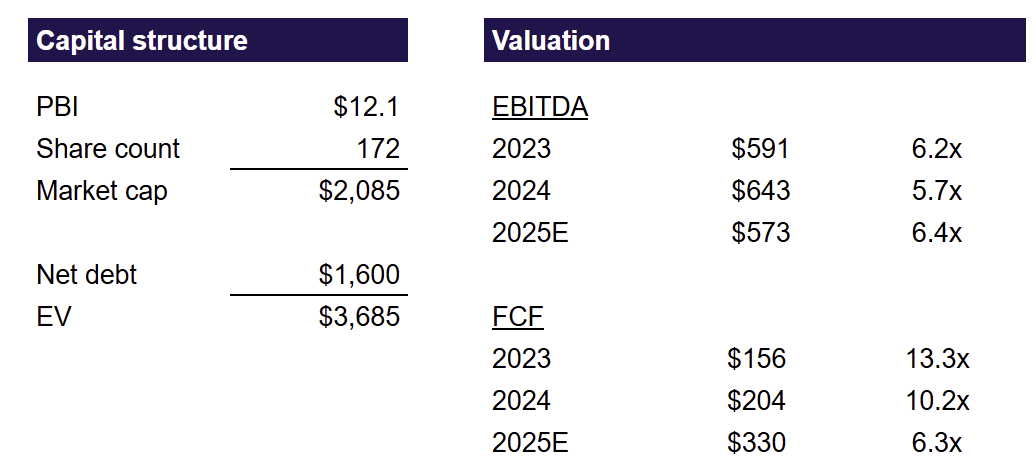

There are 172m shares outstanding at 2Q25 x $12 share price = ~$2.1bn market cap. The balance sheet has $1.9bn gross debt and $300m cash (~$1.6bn net) for a $3.7bn enterprise value.

FY25 guide:

$1.9bn revenue (down 3-4% from FY24) — but Presort still growing

$1.20-1.40 EPS (~9x P/E) — unclear what share count this assumes

$450-465m EBIT (~8x EV/EBIT) — works out to $565-580m EBITDA if D&A holds around $115m

$330-370m FCF (~6x P/FCF) — likely excludes bank activity (loan receivables / customer deposits)

On the surface, this is a cheap stock with fairly low leverage… if EBITDA works out to $565-580m, then leverage should finish the year well below management’s 3x target.

The inflection

Now that we’re caught up on the history/business, what’s currently going on here?

A few things of importance:

1) New management

Hestia Capital ran a successful proxy battle in 2023 which culminated in founder Kurt Wolf joining the board and playing a role in PBI’s strategic actions. Hestia currently has a ~7% stake with ~90% of their portfolio invested in PBI alone.

Although the story was progressing nicely, Kurt stepped in as CEO in May 2025. His comp is very shareholder-aligned with a modest salary ($40k) and a large options package vesting over 3 years at $12, $14, and $16 per share. “Skin in the game” might be an understatement here.

Here’s an inaugural shareholder letter he wrote for 2Q25 earnings.

2) Capital allocation inflection

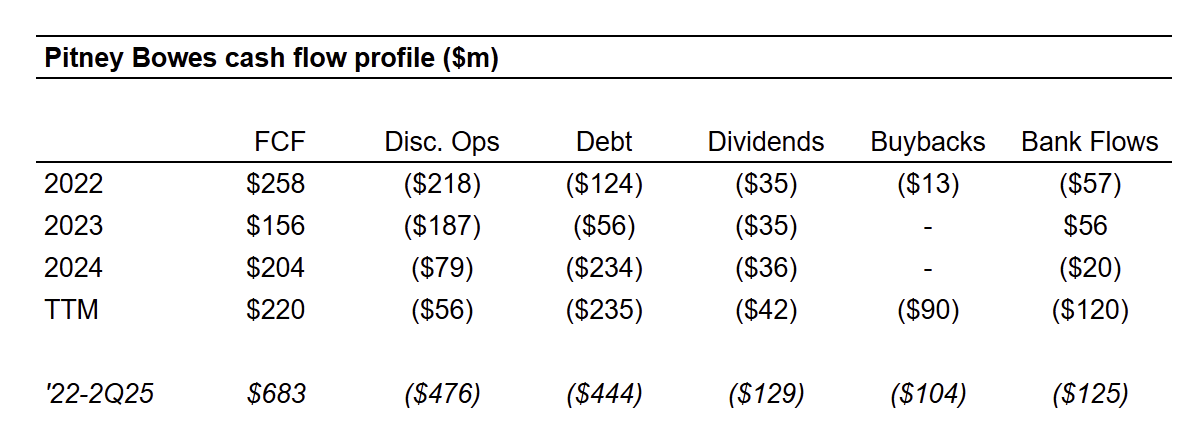

With GEC and its history of operating losses out of the picture, cash flow is beginning to ramp, a lot. Discontinued ops had total cash outflows of $484m from 2022-2024 which consumed most of the ~$620m FCF generated during that period.

Those outflows are now zero as of 2025 which has management turning up the dial elsewhere…

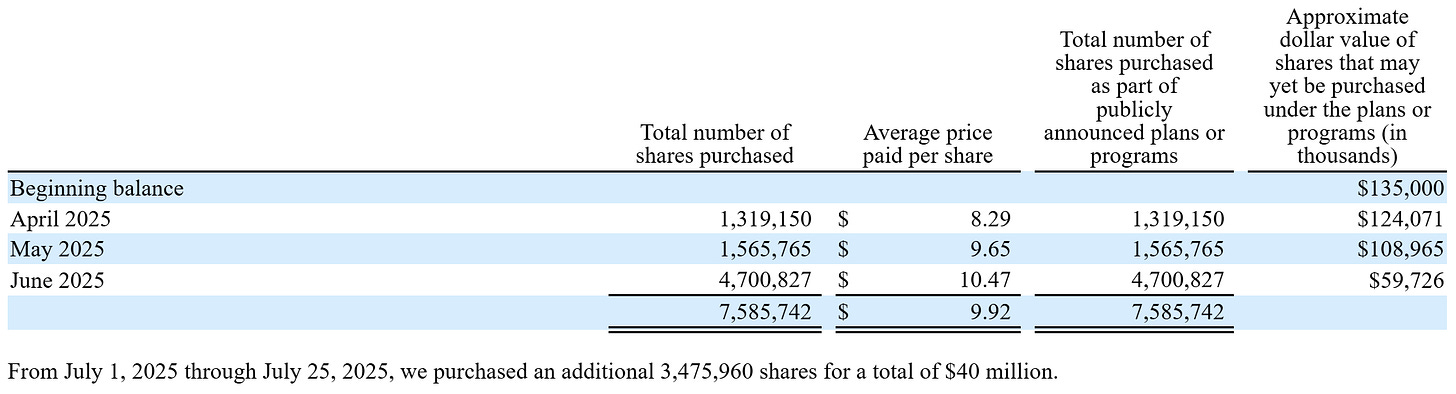

Buybacks went from $0 to $90m in the first half of 2025 and the board increased the repurchase authorization from $150m to $400m (!!). With the $40m repurchased in July, that leaves $270m remaining (~13% of current market cap).

I don’t imagine FCF will continue at the same $330-370m pace into 2026. Take $565m EBITDA and back out $140m interest expense, $72-75m capex, and $80m or so in taxes = ~$270m run-rate FCF or $1.57 per share (on 172m s/o).

Still quite a bit higher than EPS and a healthy 13% FCF yield…

Other odds and ends

These are some other notes gathered from filings and transcripts.

PB Bank — Within the SendTech segment sits a literal bank. It takes “customer deposits” in the form of prepaid postage and makes secured and unsecured loans for equipment, shipping expenses, and working capital. The bank is certainly valuable, but it’s consuming cash in recent years ($125m outflows since 2022). As was pointed out on the Q2 call, a transaction similar to the Harley deal would be very interesting here to both unlock cash and minimize future cash outflows. “…it's an incredibly undervalued asset and the opportunity we have to bring value to our shareholders. Yes, I mean, that's a template that you have out there, and I'm sure folks will be calling us on that. So we're aware of it. We're studying it. And I would just say, just stay tuned.”

Cost cuts — Management touched on several cost initiatives under review during the Q2 call. Could be some upside here, but for now I’d conservatively view these as offsetting future declines in SendTech. “During the quarter, we initiated the first phase of our strategic review, which is focused on internal improvements. This has yielded numerous opportunities for value creation, and I look forward to speaking about them on future calls.”

Acquisitions — When asked about acquisitions: “I mean it's unbelievably attractive. And we're constantly scanning the horizon for opportunities.” PBI has not been active in M&A recently (~$7m spent since 2022), so maybe this is a future growth avenue for the Presort business?

Summing it up…

There’s a lot to unpack here and clearly I should have done some work on the name earlier.

At first glance, it looks like the plan is to run SendTech for cash flow (slow decline) while Presort is growing revenue & earnings and deploy capital around that.

But the parallels to a true GoodCo/BadCo setup aren’t here. Compare this with Thryv which is struggling with declining overall cash flow and managing debt (despite a very fast growing software business)…. in this case, PBI is seeing increasing cash flow and stable “BadCo” earnings.

Hmm…

Management is hitting the accelerator on capital allocation here with massive buybacks, restarting M&A, and perhaps pausing on debt paydown altogether. If SendTech remains stable for another 5-6 years, this could play out extremely well. Although if SendTech starts to decline like Thryv’s yellow pages business, then things could look quite bad in a hurry.

Disclosure: No position as of this writing… though I’ll likely buy at least a starter position to keep watching this one.

P.S. this was only a “quick” review of the name… I’m likely missing several key facets so leave me a comment if I need to review anything vital to the thesis!

Resources:

Notes from live review:

How to evaluate the bank inside PBI — receivables + deposits — what are deposit trends over last few Q’s and last few years

Check long-term (~10 year) trends for loan receivable balances & customer deposit balances

Bank has positive equity balance

Re-calc FCF with loan/deposit flows

Recent revenue growth trends? Is this business growing?

Presort = yes

SendTech = no

Capital allocation = reduce leverage to 3x over ~24 months, and/then return capital via buybacks

As of 1H25, almost exhausted $150m authorization… increased to $400m (~$270m left)

Aggressive buybacks are primary focus here? Maybe M&A maybe deleverage but much less so

Segment review = why have margins increased so much (2022-2024) in presort segment?

Presort = growing (crown jewel?) and asset light / minimal capex

SendTech = declining (highest margin segment) but seems well managed for now

Disc ops

2017 acquisition ~$480m — Global Ecommerce (GEC)

Significant losses past few years, now exited

FCF was ~$200m in 2024… guiding $330-370m in 2025… but, lots of other investing/financing cash flows, what are sources/uses there?

How much working capital flux in that guide?

Loan receivables flow through investing cash flows

Customer deposits flow through financing cash flows

Looking at ways to unlock value within PB Bank (analogy to Harley)

Management

CEO took over in May 2025 (management change)

"SendTech is larger and more profitable, but declining fairly rapidly (accelerating from 2-3% per year to 8%)"

Context on the sendtech decline, from the last earnings release, and why the decline could moderate.

SendTech Results: During the quarter, SendTech revenue was down 8% primarily due to the IMI

migration having bolstered sales in the first half of 2024. We expect materially lower year-over-year revenue declines in the second half of 2025 based on easier comparisons (the number of trade-up transactions declined 40% from the first half of 2024 to the second half of 2024).

It is important to note that we began consciously prioritizing postage meter lease renewals roughly a year ago. We made this change because, despite generating lower upfront revenue, lease renewals are more profitable over their life due to the absence of associated cost of goods sold for the new device. As a result, lease renewal revenue was up more than 20% year over year in the second

quarter. We expect lease renewals to continue to build as a top- and bottom-line tailwind for SendTech.

Also - the company announced an increase in their revolver today. Between the untapped revolver and proceeds from the recent convert sale, they have $530m plus in available liquidity.