Quick Value #277 - United Natural Foods (UNFI)

Middle innings turnaround + deleveraging story. Multi-year EBITDA & FCF growth at <7x EBITDA.

Today’s post:

Management set lofty 3-year targets in October 2024

Current performance outpacing those lofty targets

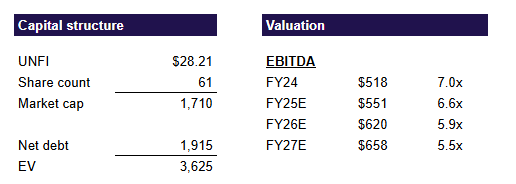

Shares cheap at existing levels (6.6x EBITDA)

Simple execution thesis

Quick reminder — For newer subscribers, my write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Check out past write-ups here and my home base page here.

Recent write-ups include:

07/21/25 — ATN International high-quality small-cap telco ($)

07/14/25 — Babcock & Wilcox (BW) option-like upside

06/23/25 — Reviewing RAL spin-off and FTV RemainCo

06/16/25 — Deep dive into AIRT public HoldCo model ($)

06/10/25 — A “way too early” look at CMCSA and WBD cable spins

06/02/25 — Mid-year review of recommended ideas ($)

05/24/25 — Guide to reviewing a 10-K

Quick Value

United Natural Foods Inc (UNFI)

Ticker: UNFI

Price: $28

Shares: 61m

Market cap: $1.7bn

Valuation: 6.6x EBITDA (FY25E)UNFI is a middle innings turnaround and deleveraging story.

It’s well covered (links to others’ research below), so my goal is to summarize the thesis and log some financial estimates for future reference.

Company overview

UNFI is a foodservice distributor with 2 segments: 1) wholesale; and 2) retail.

The wholesale segment is a typical many-to-many distributor of food and non-food products carrying 250,000 SKUs from 11,000 suppliers and selling to 30,000 customer locations. UNFI’s wholesale segment distributes mainly to grocery store chains (vs. other distributors serving convenience stores, restaurants, etc.) with a focus on faster growing natural and organic product lines. Virtually all EBITDA comes from this segment.

Inherited from the 2018 SuperValu acquisition are 75 regional grocery stores (Cub Foods and Shoppers) which make up the retail segment. These are full size grocery stores doing $2.4bn revenue annually at essentially breakeven EBITDA.

Competitors like SYY, USFD, PFGC, and SPTN serve different parts of the market, but each have: 1) higher margins than UNFI; and 2) trade at higher multiples (SPTN an exception).

Some history

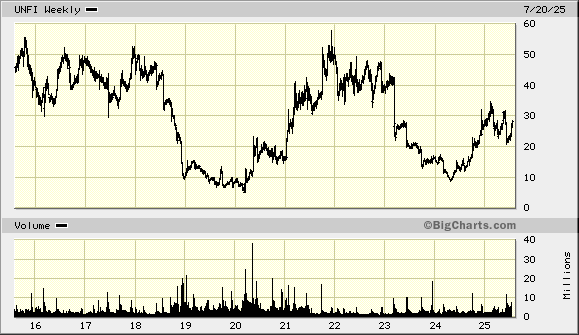

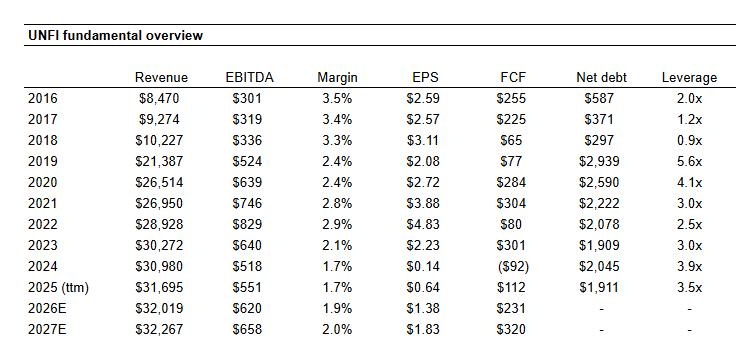

Pre-2018 — UNFI was growing revenue and EBITDA at a 10%+ annual clip: revenue grew from $3.5bn in FY09 to $10bn in FY18 and EBITDA from $137m to $336m.

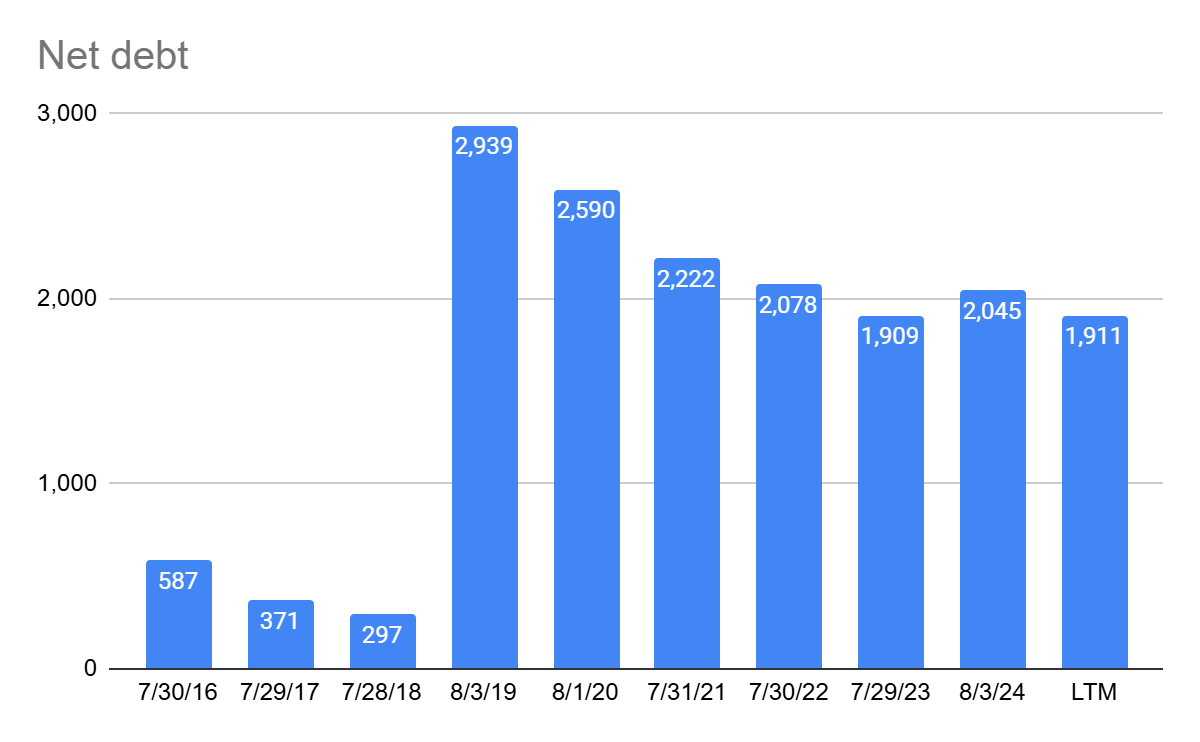

2018-2019 — Levered acquisition of SuperValu for $2.9bn. Stock cratered from $50 to $10 with the added leverage and subscale grocery store chains.

2020-2022 — Pandemic recovery in earnings and margins; stock recovers from $10 to $50.

2023-2024 — Stock back to $10 as earnings collapse (EBITDA down from $830m in FY22 to $518m in FY24).

2024-present — Management outlines 3-year plan for margin and earnings recovery during FY25-27 period. After 1 year of progress (FY25), stock recovers from $10 to $30.

These time periods are fairly evident when looking at historic financials:

The turnaround

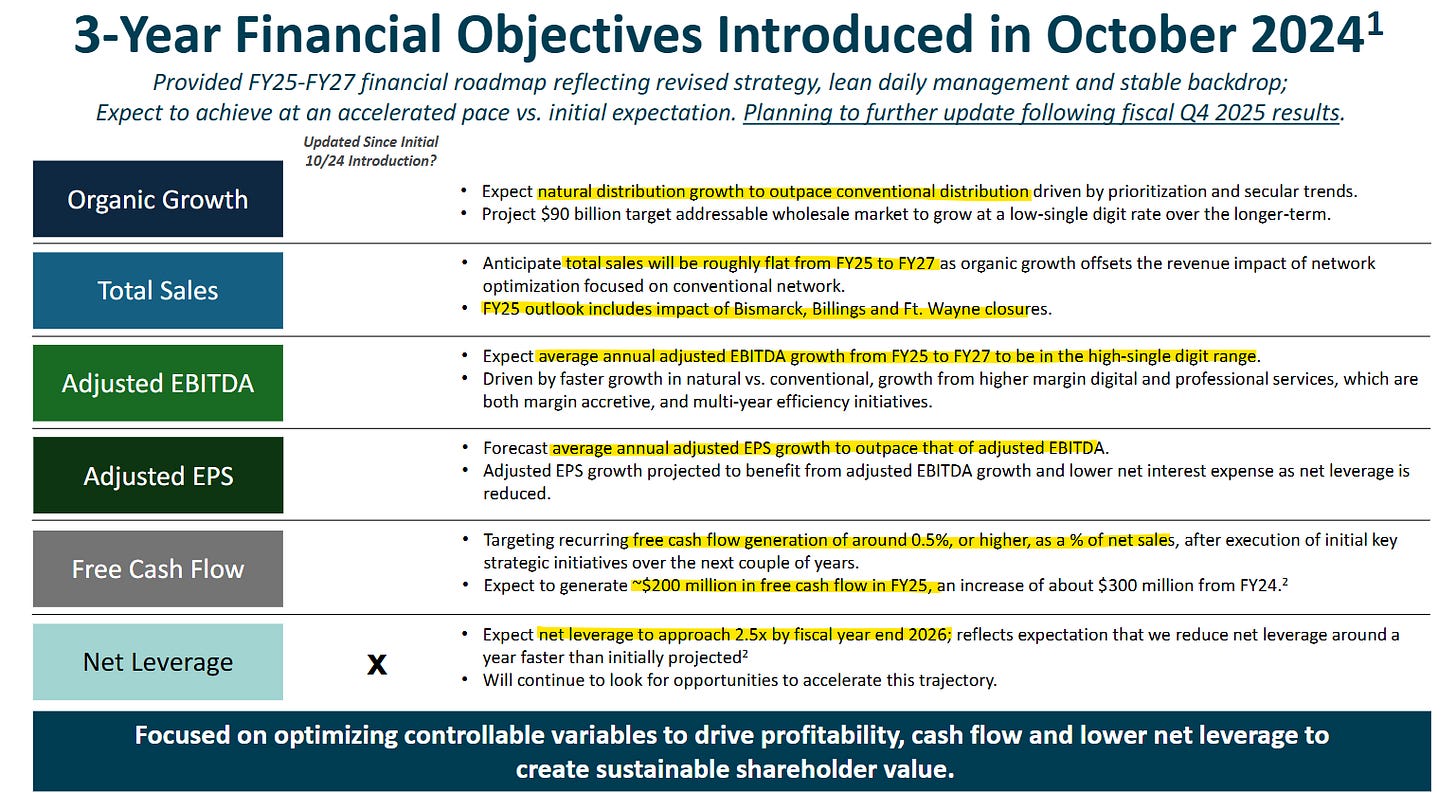

In October 2024, management set 3-year financial objectives covering FY25-27. Summing things up: it called for flat revenue, margin expansion, lower debt, and higher FCF generation.

Let’s focus on 4 specific areas of improvement:

Flat revenue (i.e. no growth from FY25-27)

Annual EBITDA growth at “high single digits” (from a base of $550m)

FCF margin of 0.5% or better (by FY27)

Net leverage at 2.5x by FY27 (now expecting to achieve this a full year early)

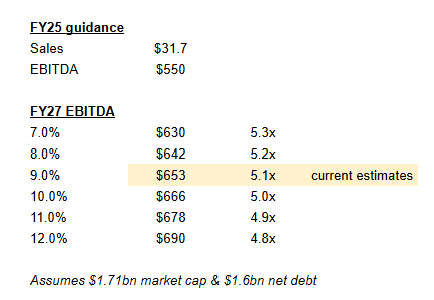

If you pencil out those targets, it works out to $30.5bn revenue, $630-650m EBITDA, and ~$150m ($2.50 per share) FCF by FY27 (assumes 7-9% annual EBITDA growth and 0.5% FCF margin). Not bad for a $1.7bn market cap / $3.6bn enterprise value business.

It hasn’t even been a full year since these objectives were set, but how are things going so far?

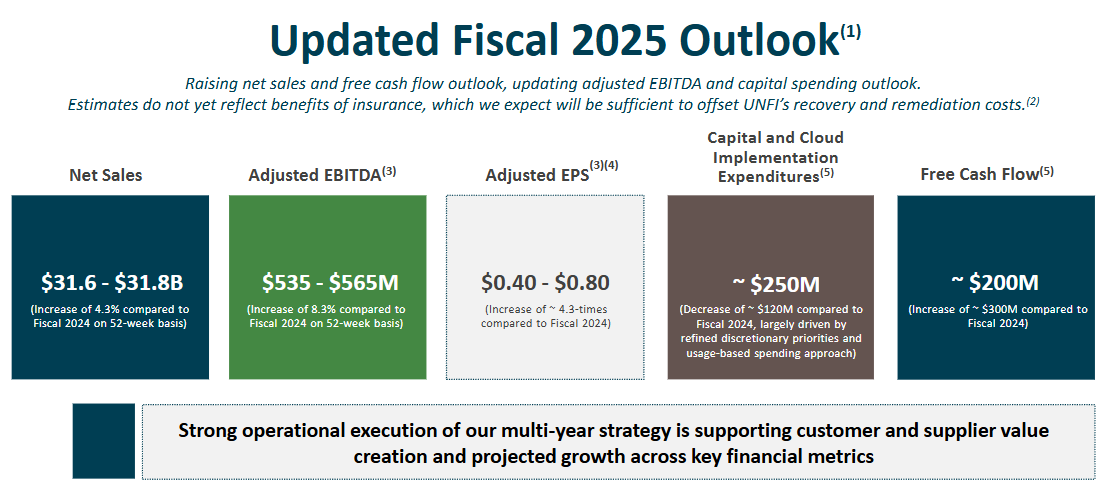

Revenue is not flat at $30.5bn, it’s growing… FY25 guidance is $31.7bn which includes a $350-400m revenue loss from a cybersecurity incident.

EBITDA was pacing ahead of plan at $575-615m for FY25 before the cybersecurity impact.

FCF is ramping faster than expected… FY25 guide was $100m at October 2024 and now expected to be $200m. Also, revenue growth = higher FCF by FY27.

Net leverage expected to hit 2.5x target by FY26, a full year early.

So what could this business look like by FY27?

Well it depends on your starting EBITDA for FY25. At $550m and 7-12% annual growth, I get $630-690m by FY27. Analyst estimates are near the middle at $650m or so. Assuming leverage of $1.6bn, that puts the stock around 5x EBITDA. If shares trade at 7x $650m, that works out to $48 per share… a nice 30% IRR from here.

If UNFI is making progress, why are shares so cheap?

1) Leverage / balance sheet

The balance sheet is still a work in progress with $1.9bn net debt or 3.5x net leverage on FY25 estimates. Management guided to $200m FCF in FY25 and they’ve achieved $153m through 3 quarters. In order to hit the 2.5x net leverage guide by FY26, they’ll need both higher FCF and strong EBITDA growth next year.

Example: $625m EBITDA at 2.5x = $1.56bn which would require $350m cash flow or asset sale proceeds. Is this doable? Hmm…

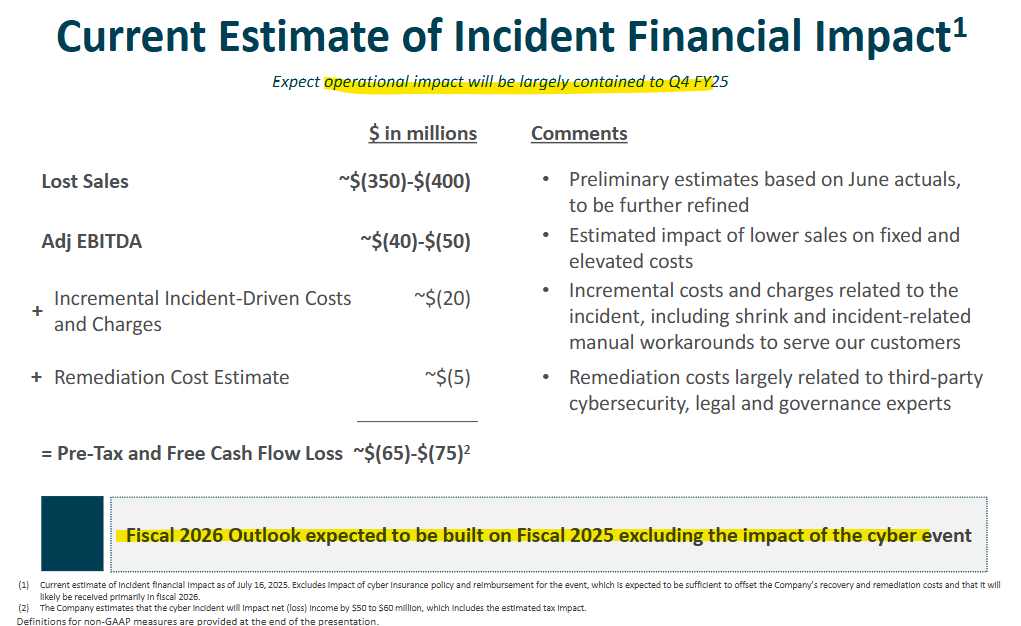

2) Cybersecurity incident

In June 2025, UNFI identified unauthorized activity in their systems. Shares fell from $30 to $20.

Since then, an “update call” was held to assure investors that financial and operational impacts were controlled. Specifically, management said operational impacts “will be largely contained to Q4 FY25” and quantified the financial impact as a $350-400m sales hit and $40-50m EBITDA hit.

Most important, they held onto their FY25 guidance including $31.7bn sales, $550m EBITDA, and improved FCF at $200m. It was also mentioned that FY26 was expected to grow from the unimpacted base (i.e. $32bn sales, $590m EBITDA).

Summing it up…

Shares are basically flat in 2025, but they’re up 85% over the past year. Granted, there was a pretty big selloff in June 2025 after the cyber incident. Most of that selloff erased after management gave an “update” in July.

This feels like a simple execution story. FY25 is shaping up to be an excellent start to the 3-year program and it seems management is banking some “ahead of plan” progress to hit those 3-year targets. (Note: I haven’t looked at management incentives, but that would be interesting to tie into the multi-year plan.)

It looks like you can get a solid return if they do nothing but hit their initial targets. I’d actually prefer estimates not creep too high and reduce management’s margin for error.

Let’s assume $650m FY27 EBITDA (inline with consensus estimates)… at 6-7x = $3.9-4.6bn EV. Assume net debt falls to $1.6bn and stays there = $2.3-3bn market cap or $38-49 per share. That’s a 16-30% IRR from today’s $28 per share. Perhaps my scratch math is a bit conservative too?

Let me know what you think!

Resources:

Biggest problem I found when I've looked over the years... Their vendors couldn't hate them more...bull and bear case can be made from that comment