Quick Value #280 - NCR Atleos (NATL)

ATMaaS offering gaining traction = 20%+ EPS grower for the next few years. At $39/share, it's trading at 10x 2025 earnings guide and 6.5x 2027 consensus estimates. It's another "3-year plan" story...

Today’s post:

October 2023 spin-off from NCR

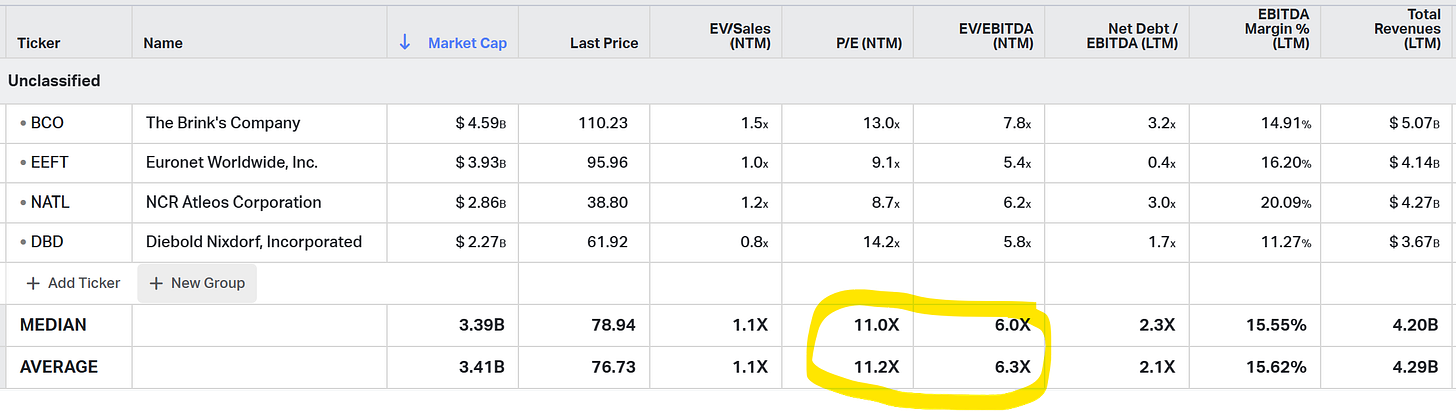

Shares trading at 6.3x EBITDA and 10x earnings with 3x leverage

20% EPS grower thanks to ATMaaS offering which is gaining momentum

2027 targets: 6% revenue growth, 15% EBITDA growth, and 35% FCF growth

Quick reminder — For newer subscribers, my write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Check out past write-ups here and my home base page here.

Recent write-ups include:

08/11/25 — Sangoma Technologies turnaround-to-growth transition ($)

08/04/25 — My sourcing list and watchlist process

07/21/25 — ATN International high-quality small-cap telco ($)

07/14/25 — Babcock & Wilcox (BW) option-like upside

06/23/25 — Reviewing RAL spin-off and FTV RemainCo

06/16/25 — Deep dive into AIRT public HoldCo model ($)

06/10/25 — A “way too early” look at CMCSA and WBD cable spins

06/02/25 — Mid-year review of recommended ideas ($)

05/24/25 — Guide to reviewing a 10-K

Quick Value

NCR Atleos Corp (NATL)

Ticker: NATL

Price: $39

Shares: 73.6m

Market cap: $2.87bn

Valuation: 6.3x EBITDA (FY25E)It’s been 2+ years since I first looked at the NCR spin-off. At the time, I pegged Atleos (SpinCo) shares at a $36/share valuation.

After combing through a list of cheap stocks, it came back on my radar for 2 key reasons: 1) management expects to generate ~$700m FCF over the next 6 quarters (24% of current market cap); and 2) consensus estimates call for EPS of $6 by 2027.

Company overview

Atleos (NATL) is the ATM piece of the October 2023 NCR spin-off (NCR Voyix kept the retail/hospitality businesses consisting of POS, self-checkout, and software/services).

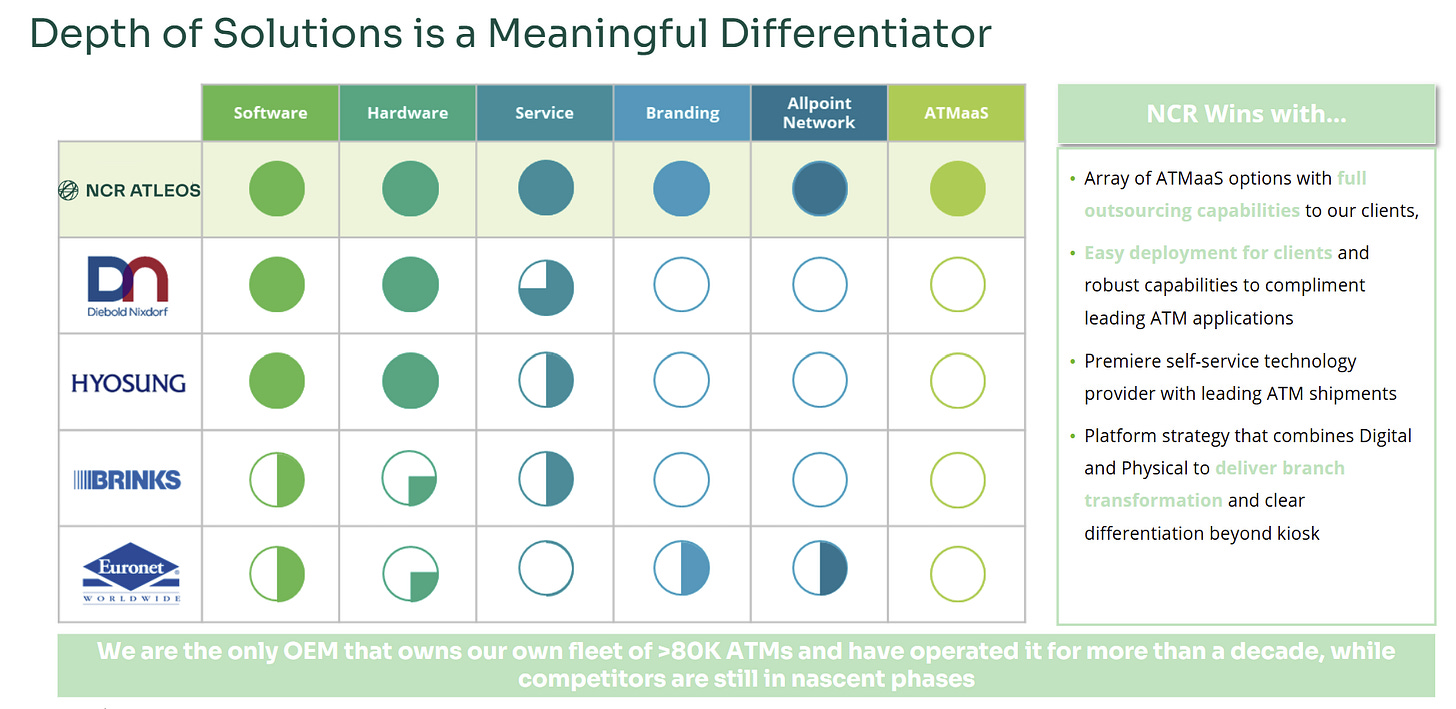

They make money 4 ways — hardware (primarily ATMs), software, services, and network transactions. Historically, it was a very hardware-centric business model; but the revenue mix shifted to mostly recurring revenue over the past few years. The $2.5bn acquisition of Cardtronics in 2022 was a big contributor to this mix shift.

Here’s how NATL described the ATM market at the 2023 spin-off:

So what’s “going on” at NATL to make it special?

Consensus view is that ATMs are a secularly declining industry with decreasing global cash usage. (Technically, cash usage is pretty flat and global ATM count is slowly declining at 1-2% per year off a ~3m base.)

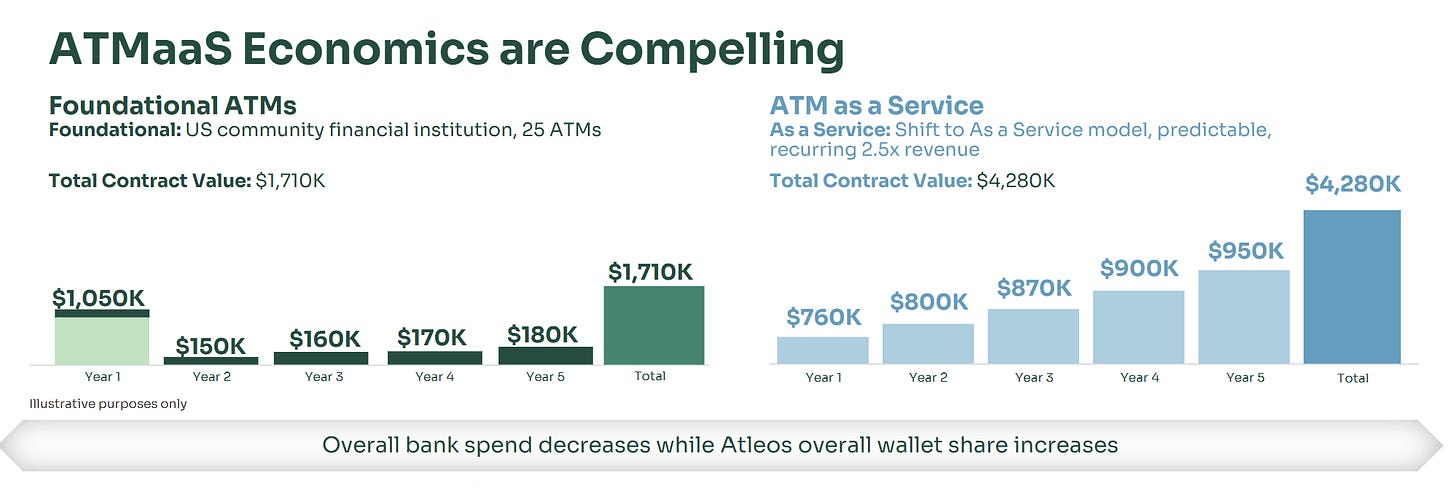

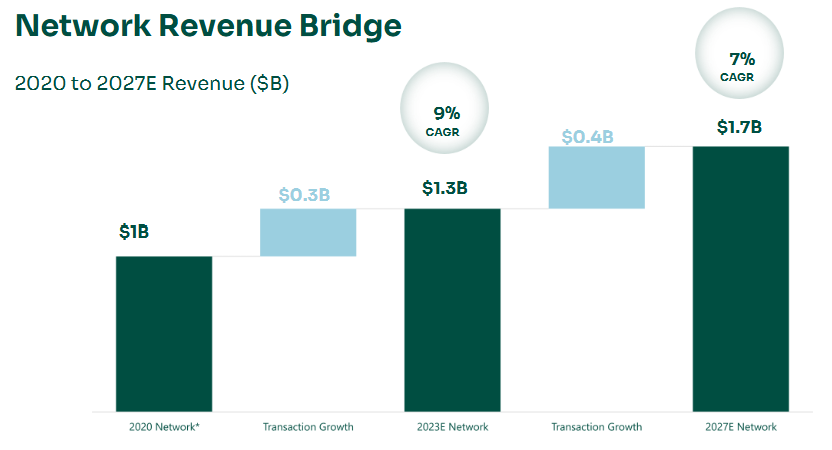

To counter those secular challenges, NATL (and peers) are pushing ATMaaS (ATM as a service) offerings. What’s that? ATMaaS = bank outsourcing all ATM operations (hardware, software, back office, etc.) as opposed to buying the hardware from Atleos and then managing it themselves. Under this model, NATL can pitch cost reductions of 20-30% to banks and capture 2.5x more revenue over the life of a contract.

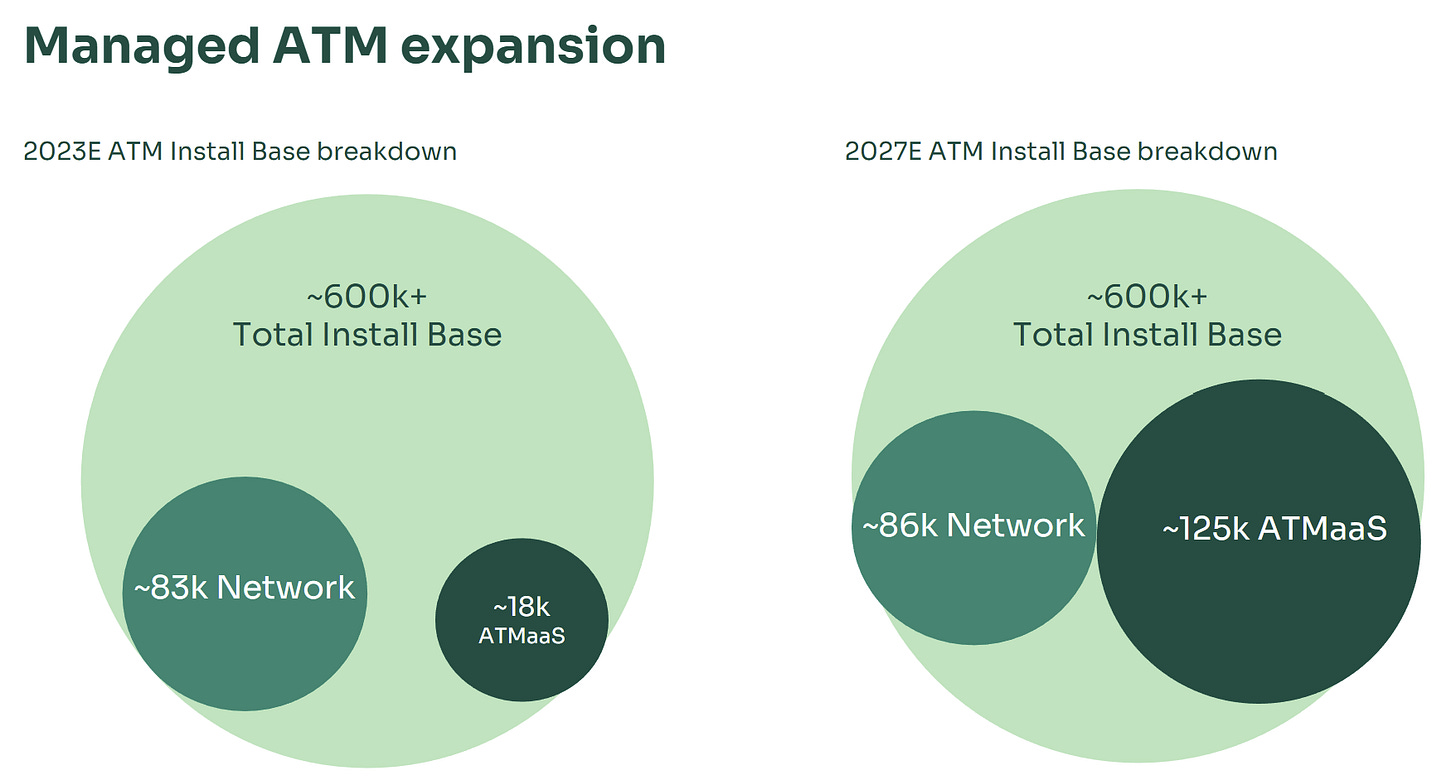

So without installed base growth (i.e. market share), NATL can significantly grow revenue and margins, pretty cool. In their 2023 investor day presentation, management targeted 0 change in their overall installed base, but a ~10x increase in ATMaaS units (i.e. mix shift):

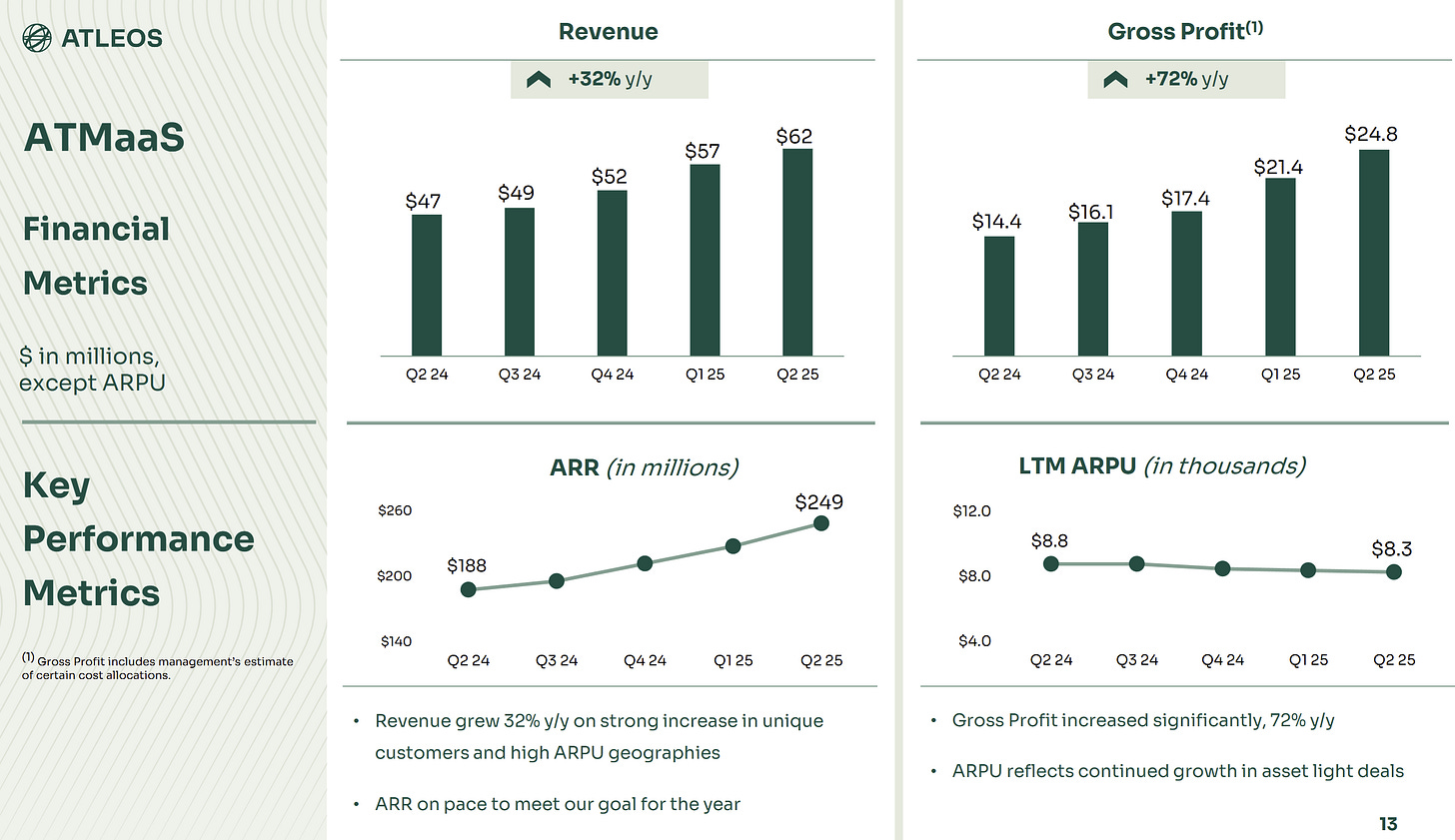

Fast forward to mid-2025 and the ATMaaS offering is gaining momentum: 24% Q1 revenue growth, 32% Q2 revenue growth, and ARR hitting ~$250m. It’s a small base at less than 6% of total sales (on a run-rate basis), but still very early innings.

Why is this such a big deal? Aside from the growth/momentum, the ATMaaS economics are more compelling with revenue >2.5x legacy contract models.

What about the rest of the business?

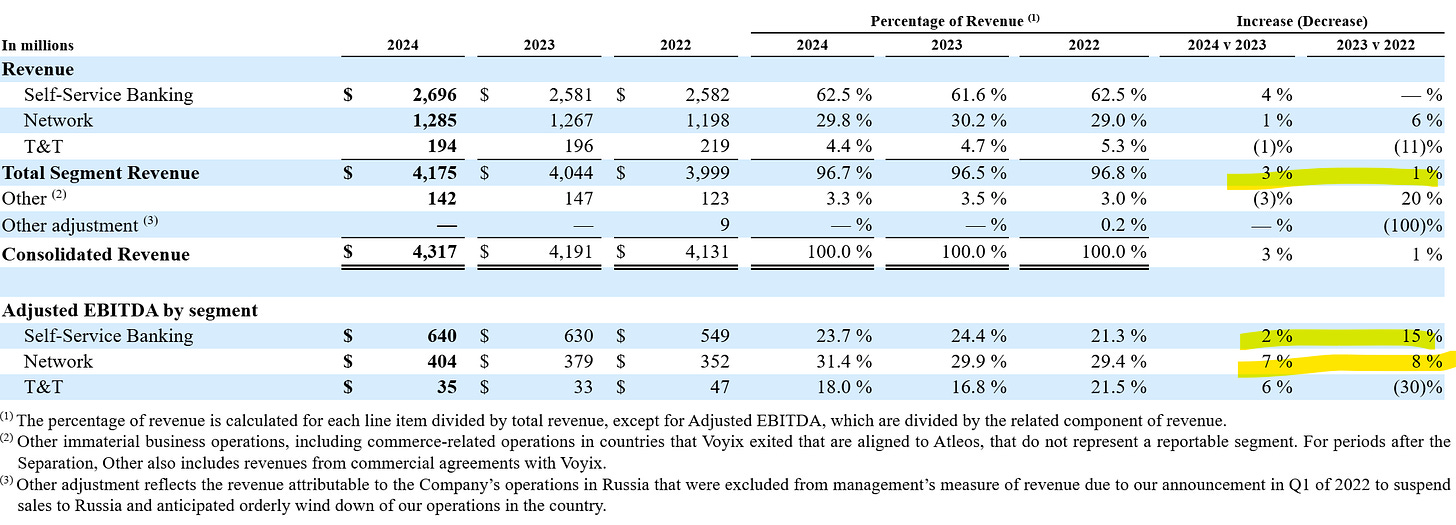

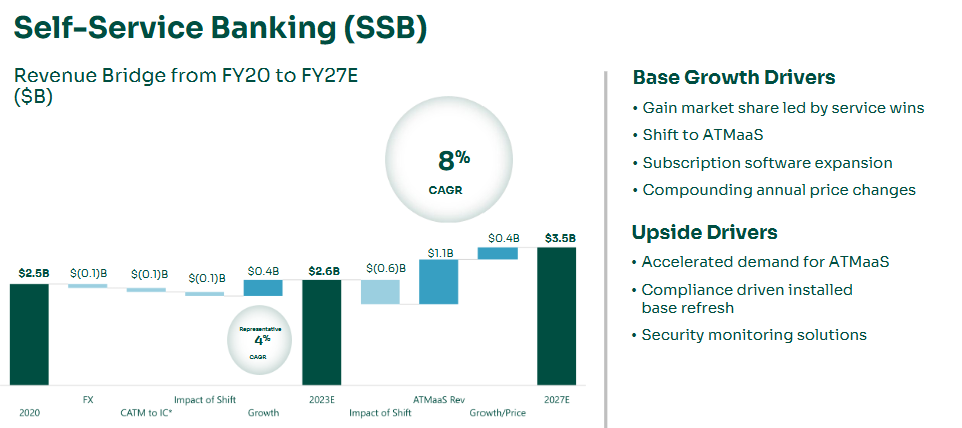

ATMaaS gets the headlines, but it still represents less than 10% of overall business. The self-service banking (SSB) and network segments are each growing modestly since 2022 and expected to continue…

In SSB, most of the growth is coming from ATMaaS. The network segment is down modestly this year, but expected to grow from transaction volume over time. Here are the key drivers for each of the 2 segments from the 2023 investor day:

What’s the peer group look like?

There are 3 main publicly traded peers, each with slightly different business models and focus areas:

Diebold (DBD) — Large retail mix (26% of sales) and more hardware centric (43% of sales)

Brink’s (BCO) — Most revenue comes from cash management. They do have an “ATM Managed Services (AMS)” business which competes with NATL’s ATMaaS offering.

Euronet Worldwide (EEFT) — Mostly a money transfer business, but they do have a ~60k ATM network.

Valuations for the group have changed quite a bit recently… BCO is +20% YTD, DBD is +44% YTD, and NATL is +14% YTD, so multiples have jumped a bit.

Notably, the group ranges from 6-8x EBITDA and 9-14x earnings with BCO/DBD on the high end of those ranges. Both BCO and DBD are targeting substantial EBITDA/earnings growth over the next 3 years (much like NATL).

What are shares worth?

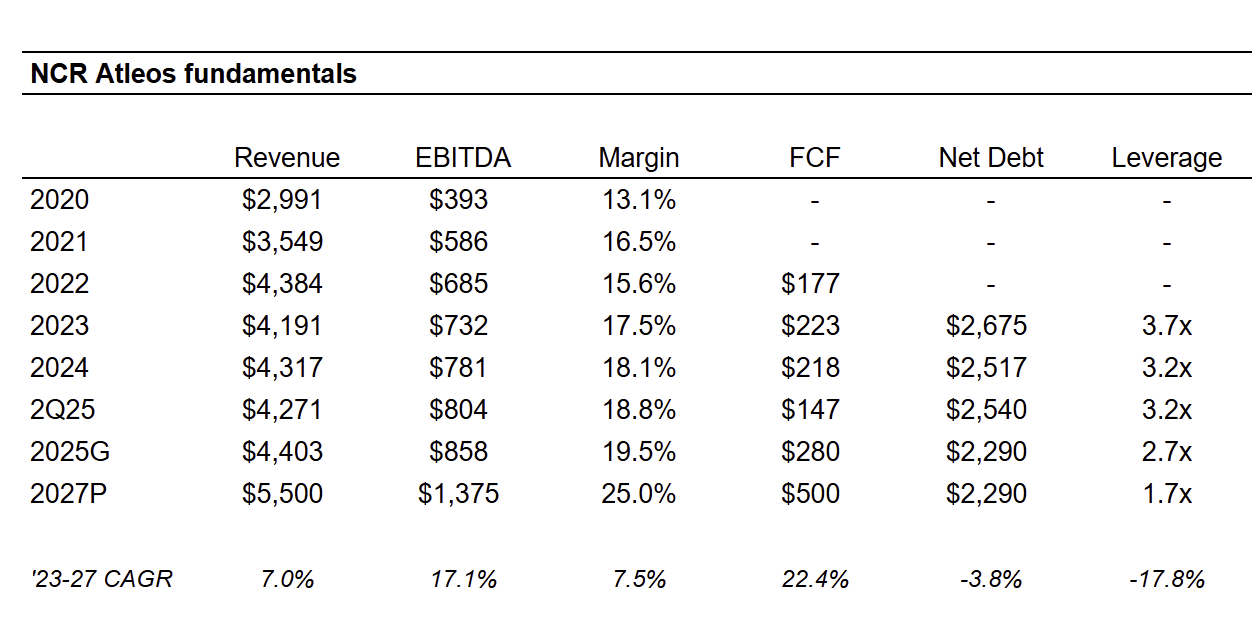

First, here’s the fundamental picture dating back to 2020 (spin-off completed in October 2023):

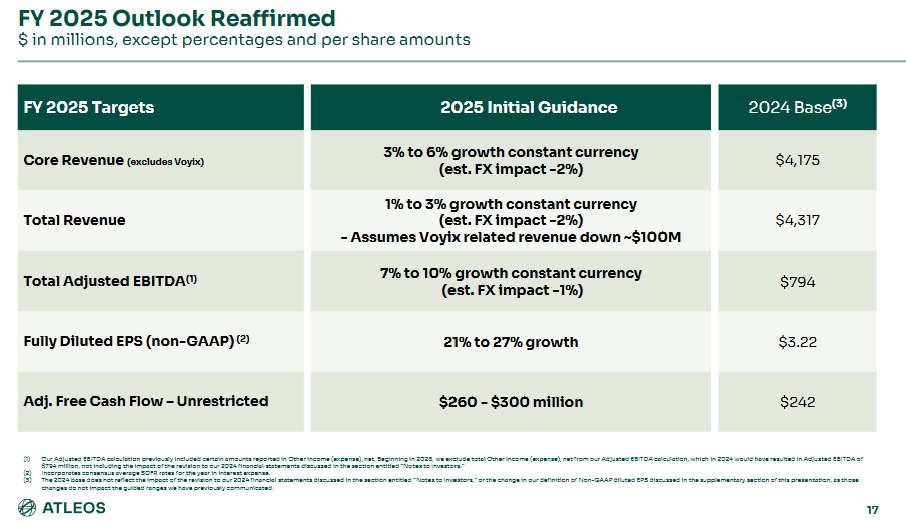

Next, 2025 guidance calls for 1-3% revenue growth (ex currency), 7-10% EBITDA growth, 21-27% EPS growth, and $260-300m FCF.

Let’s keep this simple… at 24% EPS growth for FY25 = $4 per share by yearend. That puts the stock around 10x earnings at today’s price. Using the 13-14x multiple from BCO/DBD = $52-56 per share.

Or if EPS continues growing at a 20% rate = $4.80 per share by 2026 (consensus is $4.90 right now). Using the same 13-14x multiple = $62-67 per share.

Leverage will cross below 3x by 3Q25 which is opening up capital allocation flexibility too. The company just announced a $200m buyback authorization (~7% of market cap).

Hitting $2/share in additional EPS doesn’t sound that challenging… it works out to $150m assuming no change in share count… they’ve added $22m annual gross profit from ATMaaS over the past 4 quarters and interest expense is $33m lower on an annual basis since 2024. Sprinkle in some share count reduction and $6 in 2027 doesn’t sound far off…

Summing it up…

Atleos is early innings of serious growth and priced reasonably at 10x earnings. Consensus estimates are close to $6 per share by 2027 which works out to a 23% CAGR from 2024. I’d imagine most investors are skeptical about the industry and the “melting ice cube” potential.

Some open questions I’d like to resolve here:

What makes Atleos’ ATMaaS offering more compelling than peers (which are also ATM experts)? What’s the competitive advantage within ATMaaS

Does bank consolidation help or hurt this business model long-term?

Shares jumped from $27 to $39 in early August on the back of an Alta Fox presentation (link below) which has me sitting on my hands at the moment. It’s probably a “top of pile” idea right now…

Disclosure: no position (yet).

Resources: