Quick Value #283 - Synchronoss (SNCR)

Microcap software provider undergoing balance sheet transformation; trading at <4x EBITDA with high visibility FCF growth over next 2-3 years.

Today’s post:

Shares down 40% YTD and 60% over past year

Received tax refund post-Q2 totaling 50% of market cap

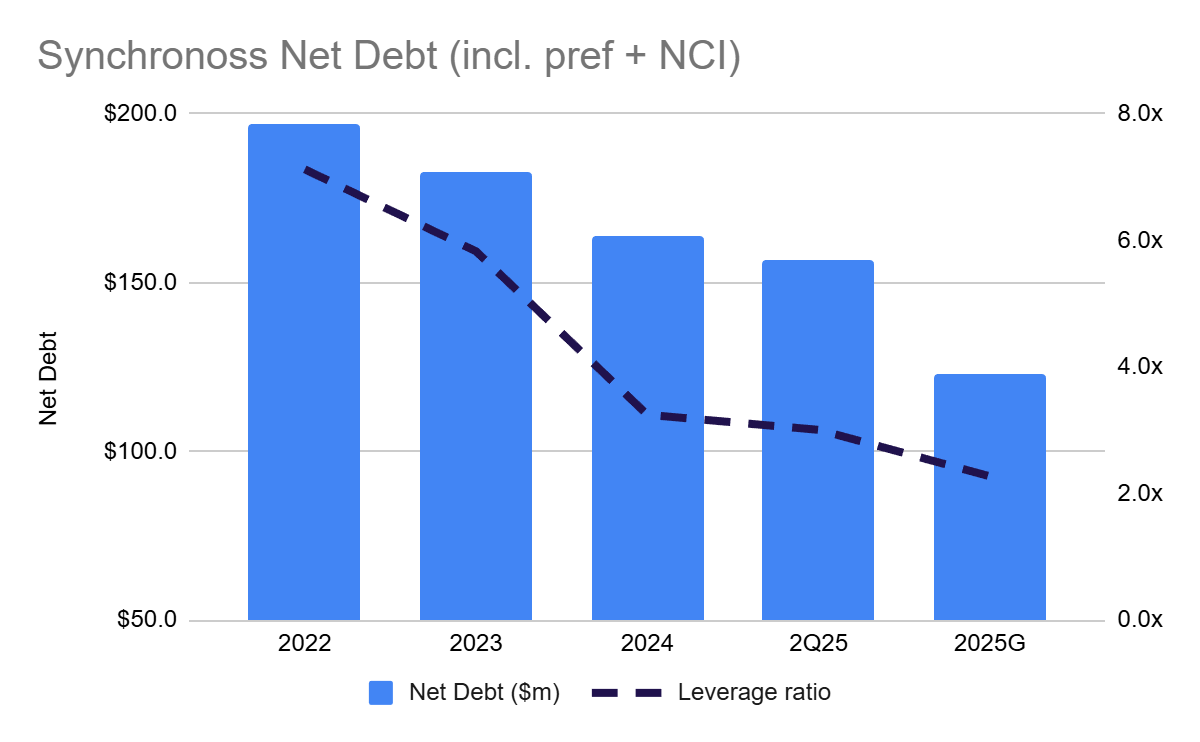

Delevered from >7x in 2022 to 2.7x after receipt of tax refund

Non-cyclical + 90% contracted revenue through 2027-2030 = high visibility

I don’t often share the name of the company in write-ups for paid subscribers, but I recently tweeted I’ve been actively buying shares of this one; so these are my notes accompanying that idea.

Quick reminder — For newer subscribers, my write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Check out past write-ups here and my home base page here.

Recent write-ups include:

09/02/25 — Special situation in Pitney Bowes (PBI)

08/25/25 — A look at Greenlight’s stake in Fluor (negative EV?) ($)

08/18/25 — Atleos a 20% EPS grower at 10x earnings

08/11/25 — Sangoma Technologies turnaround-to-growth transition ($)

08/04/25 — My sourcing list and watchlist process

07/21/25 — ATN International high-quality small-cap telco ($)

07/14/25 — Babcock & Wilcox (BW) option-like upside

06/23/25 — Reviewing RAL spin-off and FTV RemainCo

06/02/25 — Mid-year review of recommended ideas ($)

05/24/25 — Guide to reviewing a 10-K

Quick Value

Synchronoss (SNCR)

Ticker: SNCR

Price: $5.7

Shares: 11.5m

Market cap: $66m

Valuation: 3.8x EBITDA (post tax refund)

Theme: Balance sheet transformationOverview

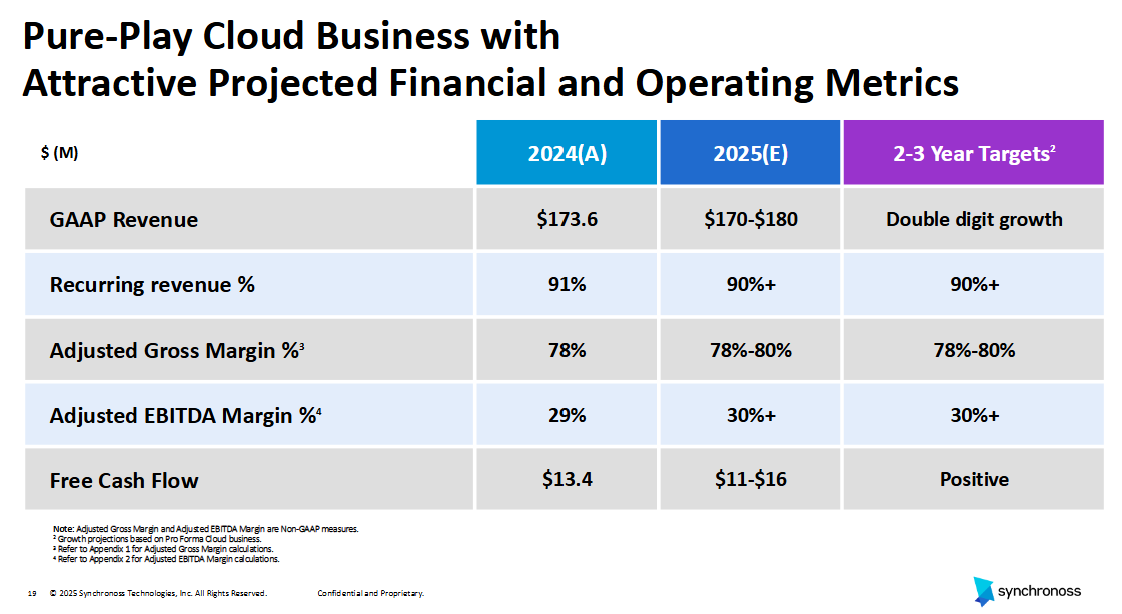

Synchronoss is a microcap software provider. Most of the large mobile carriers white label their “personal cloud” product to SNCR (think: Apple’s cloud storage or Dropbox, but offered with your cell phone plan). Software economics are excellent and SNCR is no different (90% recurring revenue, 75% gross margins, 30% EBITDA margins, and plenty of cash flow).

AT&T, Verizon, and Softbank are major customers and the top 5 customers are nearly 100% of revenue (that’s the bad news). Those top customers are each on multi-year contracts expiring between 2027-2030, so medium-term visibility is very high (that’s the good news).

Thesis

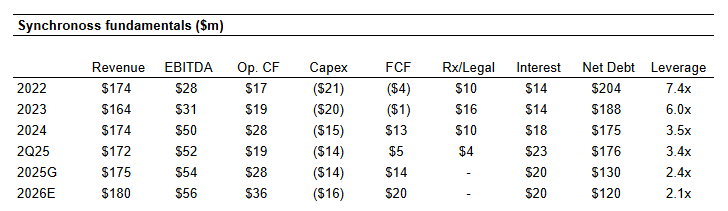

SNCR has a strange corporate history which left them burdened by debt, preferred stock and non-controlling interests. Through divestitures, solid cash flow, and a recent tax refund; they’ve taken leverage from 7x in 2022 to ~2.5x by yearend 2025 (my estimates).

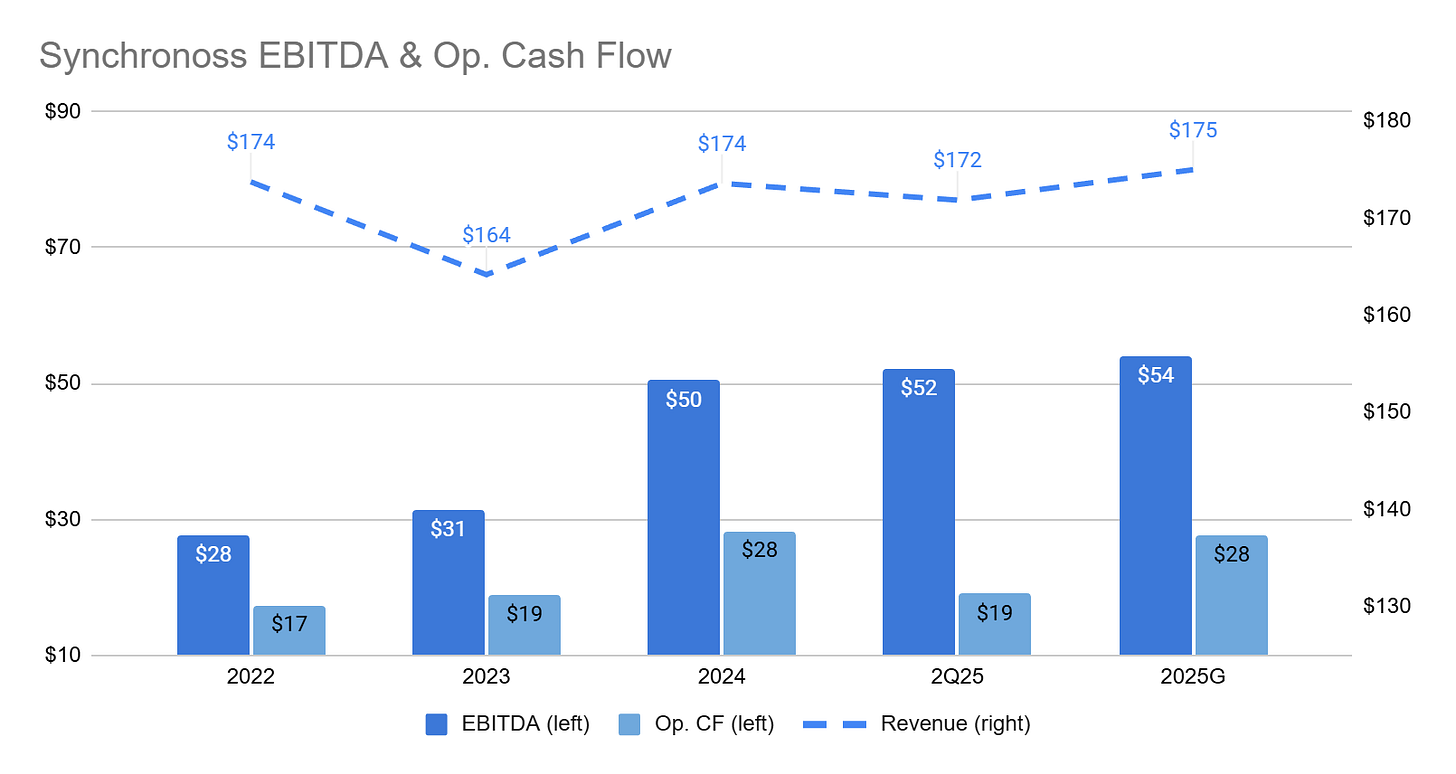

At the same time, revenue, EBITDA, and cash generation all remain solid (stable-to-improving)…

And management is targeting double digit revenue growth with stable margins over the next few years:

I’m a skeptic on 10% revenue growth, but a quick look at historic financials and the bet becomes quite obvious. Revenue growth is the only major detractor here. Otherwise, trends across virtually all metrics are improving. This is an incredibly stable business with good visibility into the next few years.

So if fundamentals are stable and leverage is down, why are shares falling?

The charts above paint a positive picture and yet the stock is down 40% YTD and 60% over the past year. What gives?

A few non-fundamental optics are at play right now:

B. Riley was at one point a major shareholder (~1.3m shares back in 2023), they’ve been consistently selling down their stake for 2 years now and own ~500k or 4.3% of outstanding shares. That’s a lot considering average volume of 80-100k shares per day.

1H25 results include 2 optically horrible non-cash expenses — debt recap costs of $6.4m and currency losses of $18m — those total $24m on a $66m market cap! The debt modification expenses are truly non-recurring while the FX losses are purely optical; they represent intercompany receivable/payables between subsidiaries (revenue is 95% domestic, but staffing is international).

The $34m tax refund is still sitting in “other assets” as of 2Q25 with a significant portion unrecognized (interest income).

What makes it work from here?

A few things should make this work in 2025 and into 2026:

Next quarterly results will show a significantly improved balance sheet with net debt below $140m (~2.6x leverage). As a bonus, they’ll also recognize a few million from unrecognized interest income on the tax refund.

Management is confident they’ll land another major client in 2025 (yet to be announced) — “We remain confident in our ability to sign at least one new customer in 2025, as we previously indicated. The conversations that we're having with prospects are progressing well, and we are deep in the process with several potential new clients.”

2026 FCF should grow 20-30% solely from lower interest expenses — 2025 FCF guide is $11-16m (vs. $13.4m in 2024) and a $25m term loan repayment saves $2.9m per year. So at the midpoint we have $13.5m in 2025 and $16.5m in 2026. Call it $1.40 per share in 2026 FCF on a $5.70 stock (4.1x). Very cheap.

Even with the tax refund and debt repayment, it’s extremely expensive debt at SOFR + 7% (~11.5%). This is in part from recent very high leverage (>7x in 2022) and part from major contracts expiring “soon” (AT&T up for renewal in 2027). If SNCR could refinance and save 3%, it would add $5.3m or $0.45/share to pre-tax earnings.

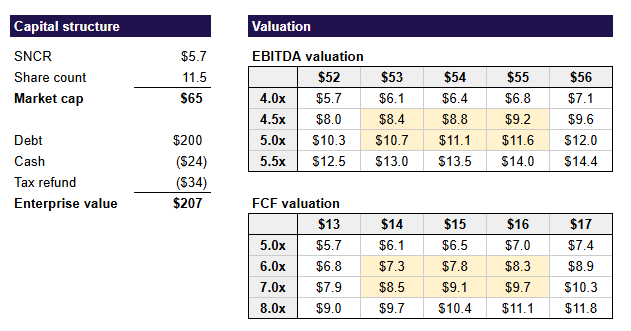

Valuation

I’ll use FCF as a proxy for earnings here and take the guidance midpoint ($13.5m) as a baseline for 2025. That’s $1.17 FCF per share. Going into 2026, I’m estimating they’ll grow EBITDA to $56m, get the term loan down to $165m ($19m interest), and capex jumps to $15m to support a new customer. Blend those together and you get $22m FCF. Knock that down $2m for working capital and it works out to $20m FCF or $1.74 per share in 2026.

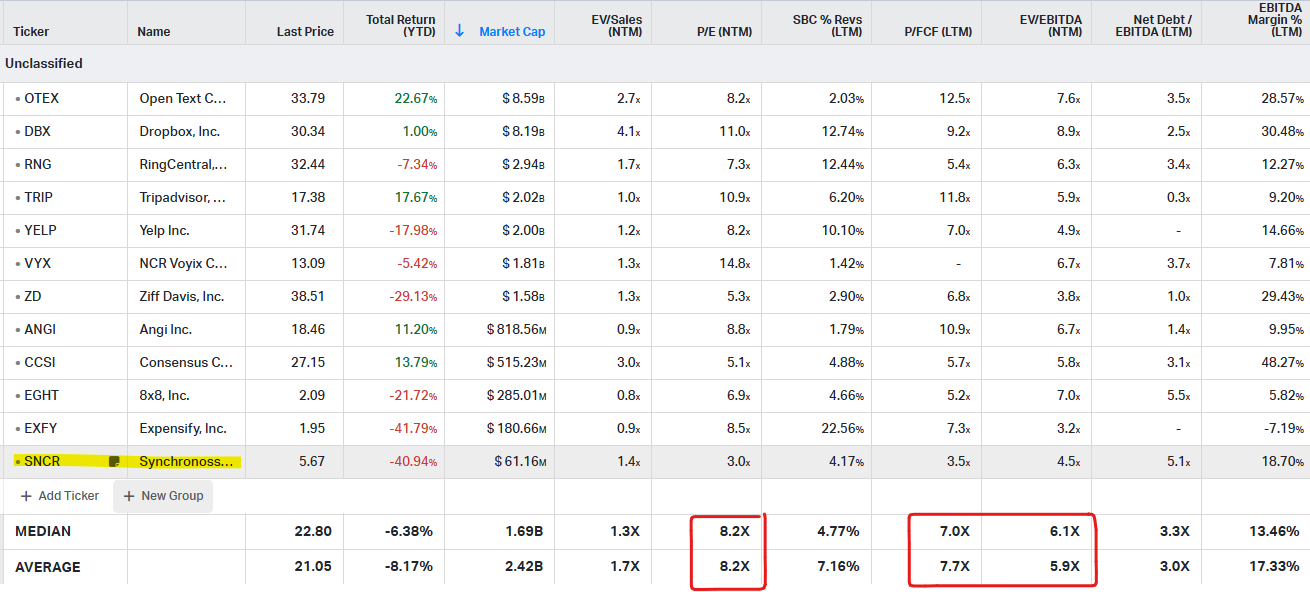

These heavy customer concentration situations can be scary even with multi-year contracts; so I’ll use the lower end of my “cheap software” peer group (5-7x earnings and 4-6x EBITDA).

Those multiples work out to a fair value of $8.50-10 per share (50-75% upside) with virtually no consideration for growth or additional balance sheet improvement.

Summing it up

It’s a similar backdrop to Babcock & Wilcox (BW) a few months ago where meaningful deleveraging took place after quarter-end, but went unrecognized for a while. It’s an incredibly simple bet, the question (for me) is how large to size it…

The business seems OK but not bad. There’s always a risk that Verizon and AT&T abandon SNCR and white label Apple cloud storage, but in a sense they’re getting some outsourced R&D and product development via SNCR.

This feels like a great trade over the next 12-18 months.

Disclosure: Long SNCR.

Resources: