Quick Value #288 - Solstice Advanced Materials (SOLS)

Honeywell set to spin off specialty chemical business, Solstice; a closer look at the business and valuation

Today’s post:

Honeywell spin-off set for trading late October 2025

Specialty chemical business with 25-26% EBITDA margins

Clean balance sheet (1.6x leverage) = room for capital returns or M&A

Quick reminder — For newer subscribers, my write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Check out past write-ups here and my home base page here.

Recent write-ups include:

10/06/25 — Divestitures and delevering at Leggett & Platt ($)

09/29/25 — A look at Portillo’s recent struggles

09/15/25 — Axalta Coatings = quality mid-cap chemical business

09/09/25 — Deleveraging catalyst at Synchronoss ($)

09/02/25 — Special situation in Pitney Bowes (PBI)

08/25/25 — A look at Greenlight’s stake in Fluor (negative EV?) ($)

08/18/25 — Atleos a 20% EPS grower at 10x earnings

08/04/25 — My sourcing list and watchlist process

05/24/25 — Guide to reviewing a 10-K

Quick Value

Solstice Materials (SOLS)

Ticker: SOLS

Shares: 158.7m

Theme: Spin-offAnother spin-off with the Form 10 filed, investor day held, and distribution date set! Honeywell (HON) will spin-off their “advanced materials” business, Solstice, on 10/30/25 with a 1:4 spin ratio.

Background

Solstice is a $3.8bn revenue specialty chemical business with 2 segments:

Refrigerants & Applied Solutions (RAS) — HVAC/R, automotive, energy, building and appliance insulation, and healthcare

Electronics & Specialty Materials (ESM) — Chemicals for semiconductor, defense, pharmaceutical and construction end markets

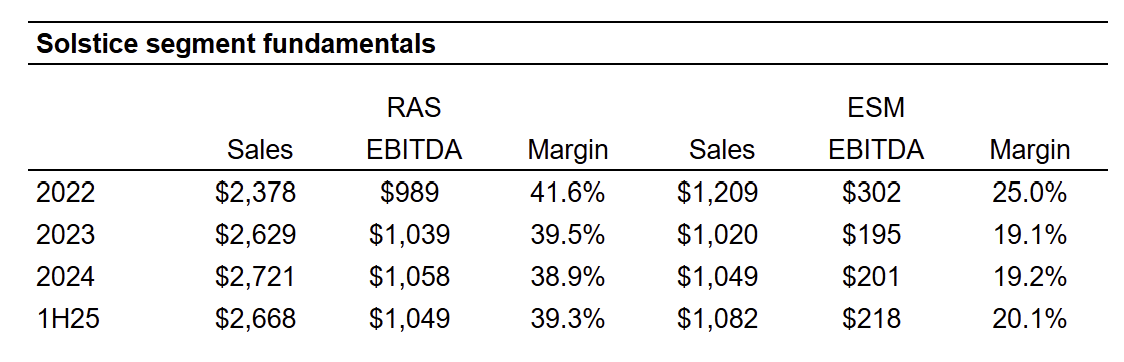

RAS is the larger segment at $2.7bn sales and nearly 40% EBITDA margins (pretty incredible, makes me think of Ingevity’s emissions chemicals business) while ESM likely has better growth potential via semiconductors and data centers.

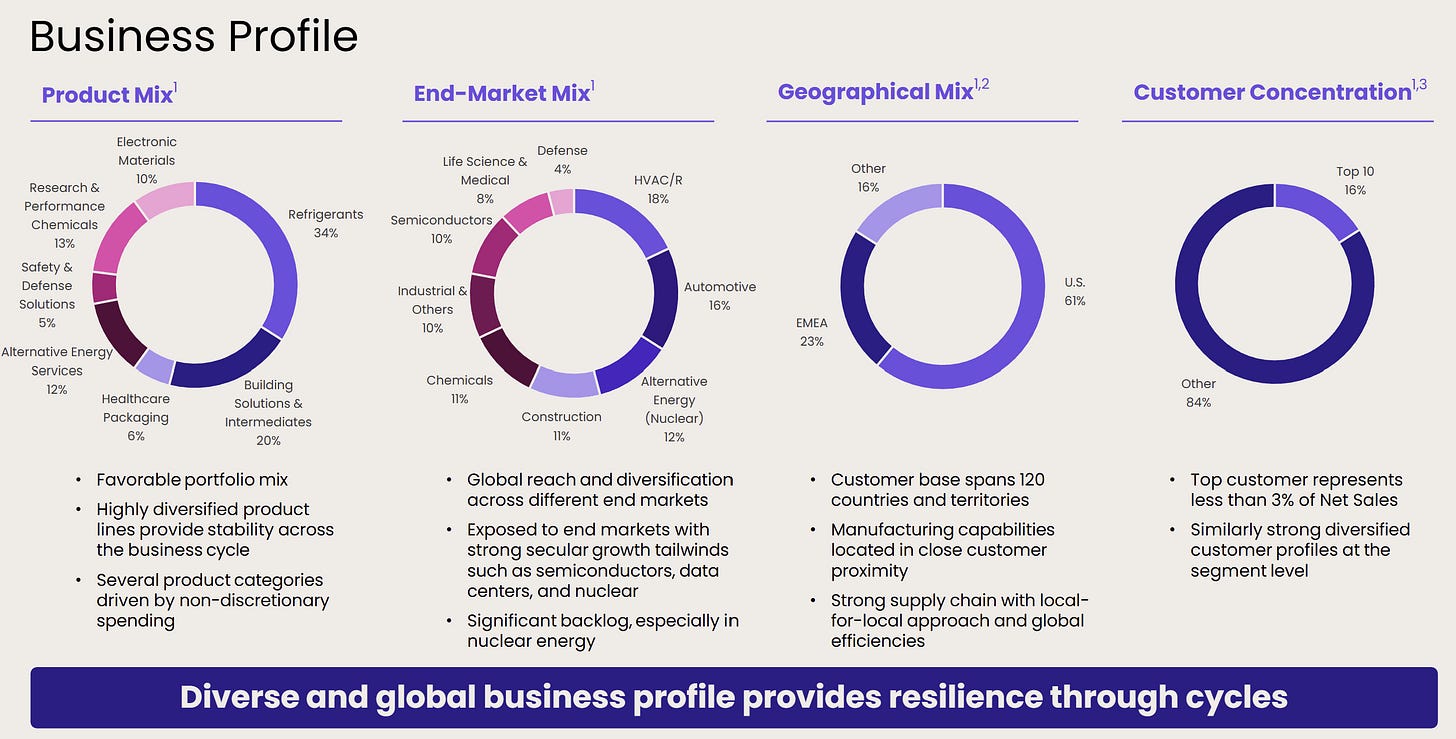

It’s a well-diversified business with no end market larger than 18% of sales, minimal customer concentration (largest customer is 3% of sales), and only 2 product lines greater than 20% of sales (refrigerants and insulation spray foam).

Most of their 3,000 customers are on long-term contracts too. Translation? High revenue visibility and low volatility / cyclicality in results.

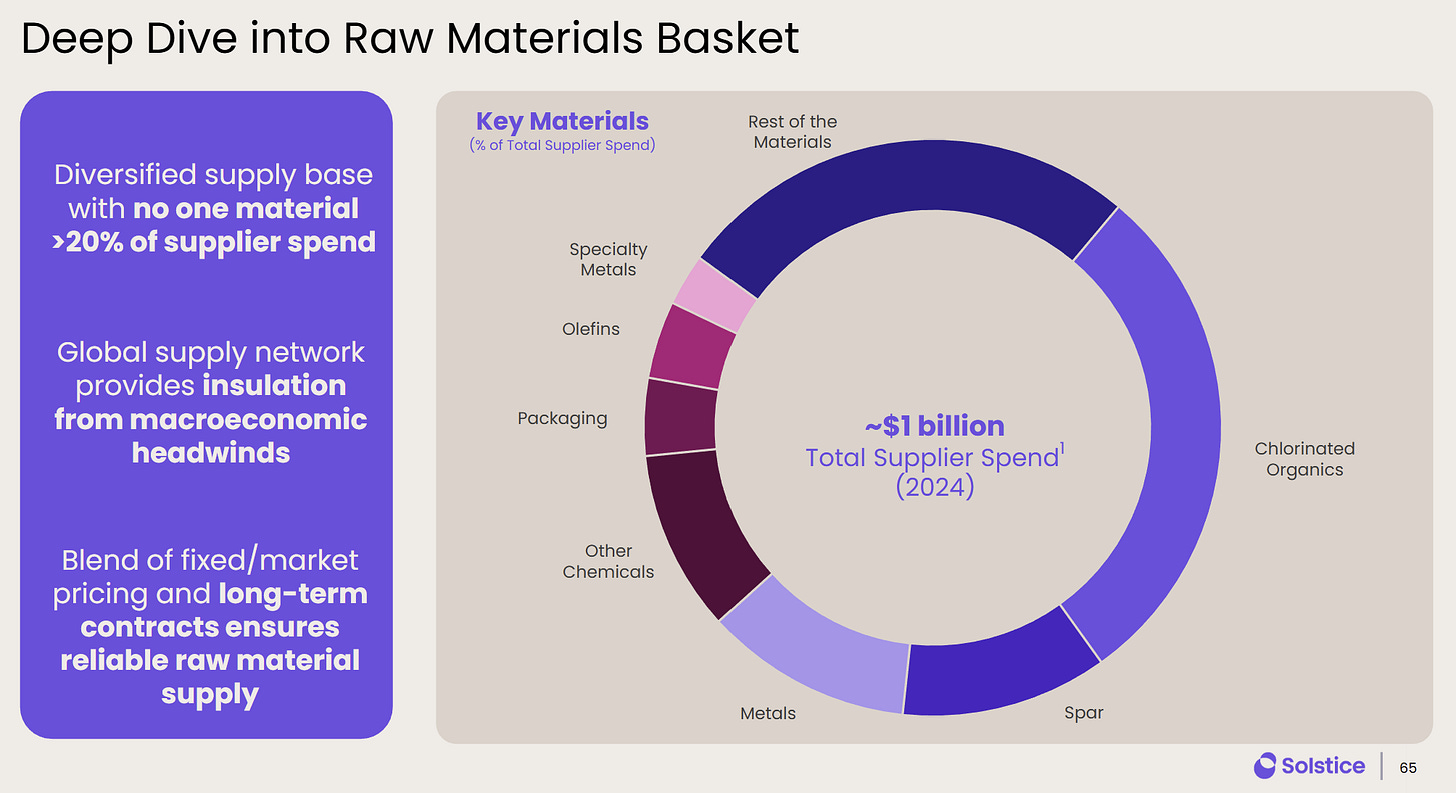

Raw materials are diversified and likely more tailwind than headwind from here (big exposure to ethylene/polyethylene which is in oversupply right now).

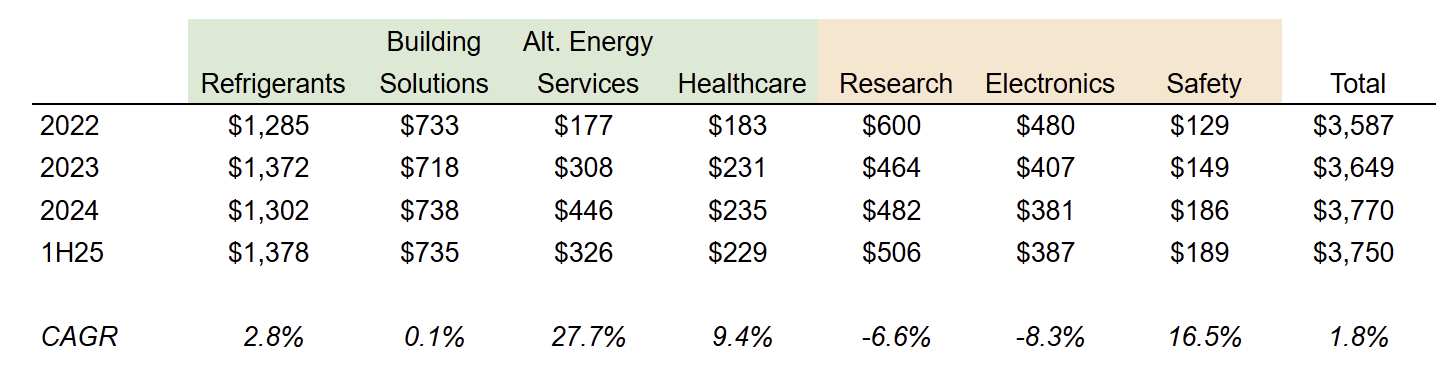

There are some very interesting niches within these sub-segments… Here’s a revenue breakdown of the RAS/ESM segments (green = RAS, orange = ESM):

If ESM has growth potential via semis, AI, data centers, then it isn’t showing through in revenue yet…

Group president David Sewell will lead SpinCo as CEO. Sewell was previously CEO at packaging business WestRock which was sold during his tenure (here’s an interview he did on that subject). Before that he had executive positions at Sherwin-Williams. Seems like the business will be in capable hands.

Honeywell is a “high performance conglomerate” trading at 19x forward earnings and 14.3x EV/EBITDA with 4-7% annual revenue growth. Two things to take from this: 1) those HPC “best practices” will likely carry over to Solstice; and 2) the spin-off will likely command a high multiple as a result.

Let’s take a closer look at the details…

1) Fundamentals

Consolidated results fit the picture of a best-in-class specialty chemical business with >25% EBITDA margins, leading positions in niche markets, low(ish) volatility & cyclicality (mostly through diversification), and consistent revenue growth.

It’s interesting that sales were flat at $2.8bn from 2017-2019 and are “stalling out” a bit from 2022-2025 ($3.6-3.8bn), the chart above doesn’t exactly paint a picture of “consistent” revenue growth. In the first half of 2025, RAS is down 4% while ESM is up 6%.

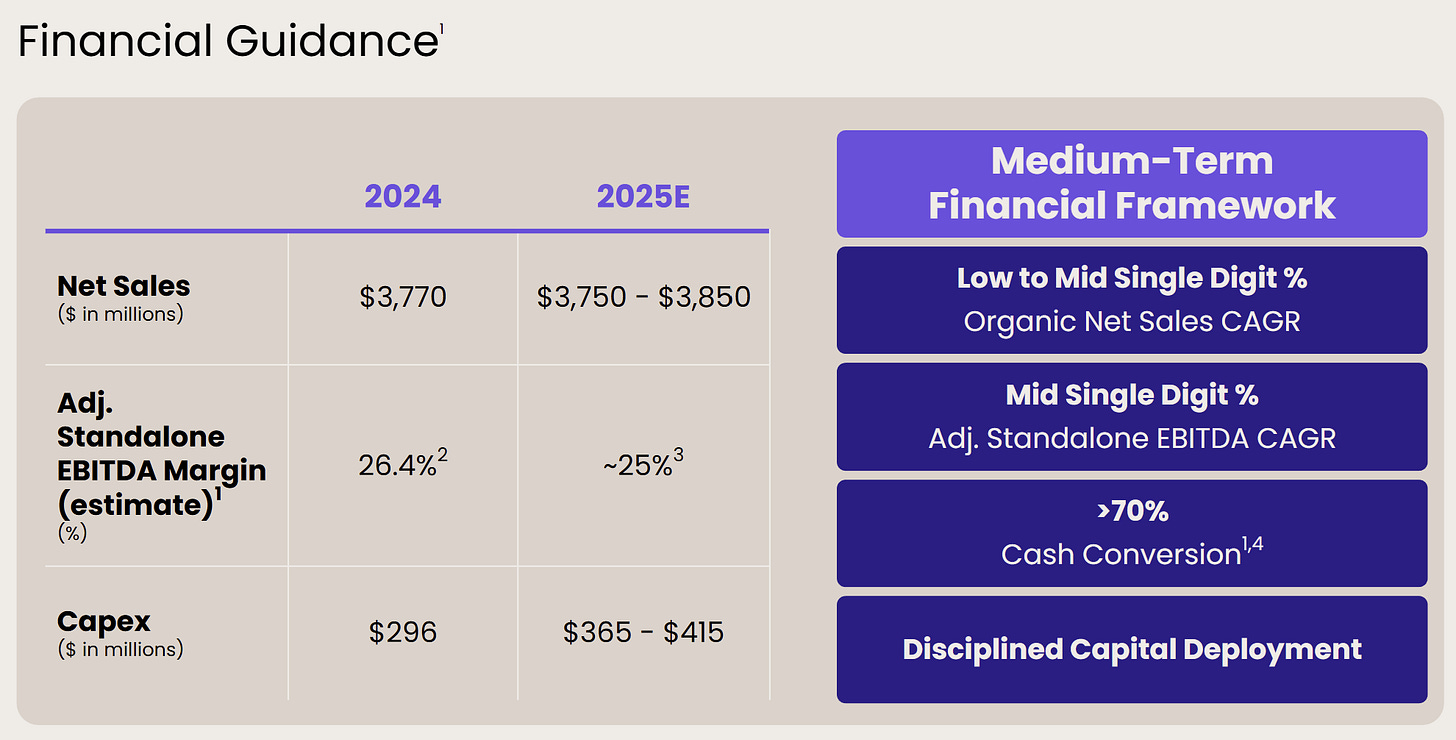

Guidance for 2025 is essentially flat compared to 2024 ($3.8bn sales) and management was vague on long-term targets. Here is the outlook given:

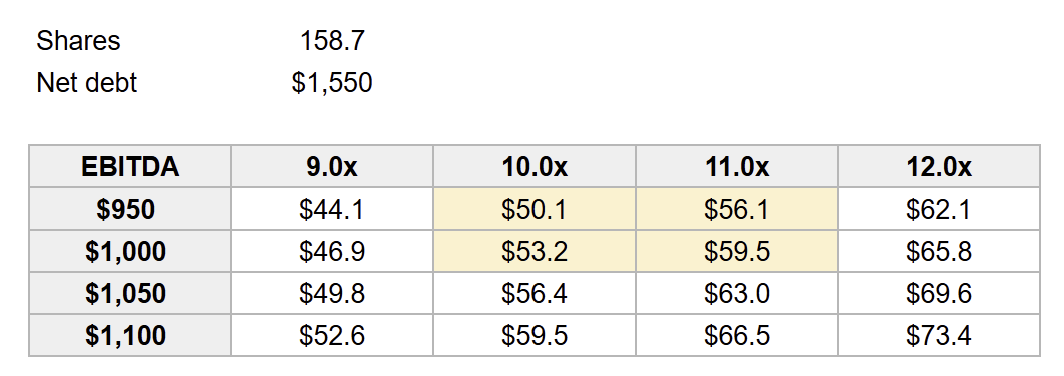

2025 = $3.8bn revenue with $950m standalone EBITDA and $390m capex.

Medium-term = LSD-MSD revenue growth (organic), MSD EBITDA growth, and 70% cash conversion (EBITDA minus capex divided by EBITDA, not my favorite version of this metric)

At ~3% annual revenue growth, this is a $4.2bn revenue business by 2028 with $1.1bn EBITDA at a 26% margin.

2) Balance sheet

After the spin, Solistice will have $2bn debt (at a 5.8% average interest rate) and $450m cash ($1.55bn net debt) which works out to 1.6x net leverage (on $950m EBITDA guide).

Honeywell is running at 2.6x leverage but FCF conversion is much higher there. Solstice gave no formal leverage targets during the investor day, but I’d expect them to keep things at 2x or better while capex is elevated the next few years.

We’ll see how hard they’re willing to push M&A (more on that in a minute).

3) Cash flow and capex

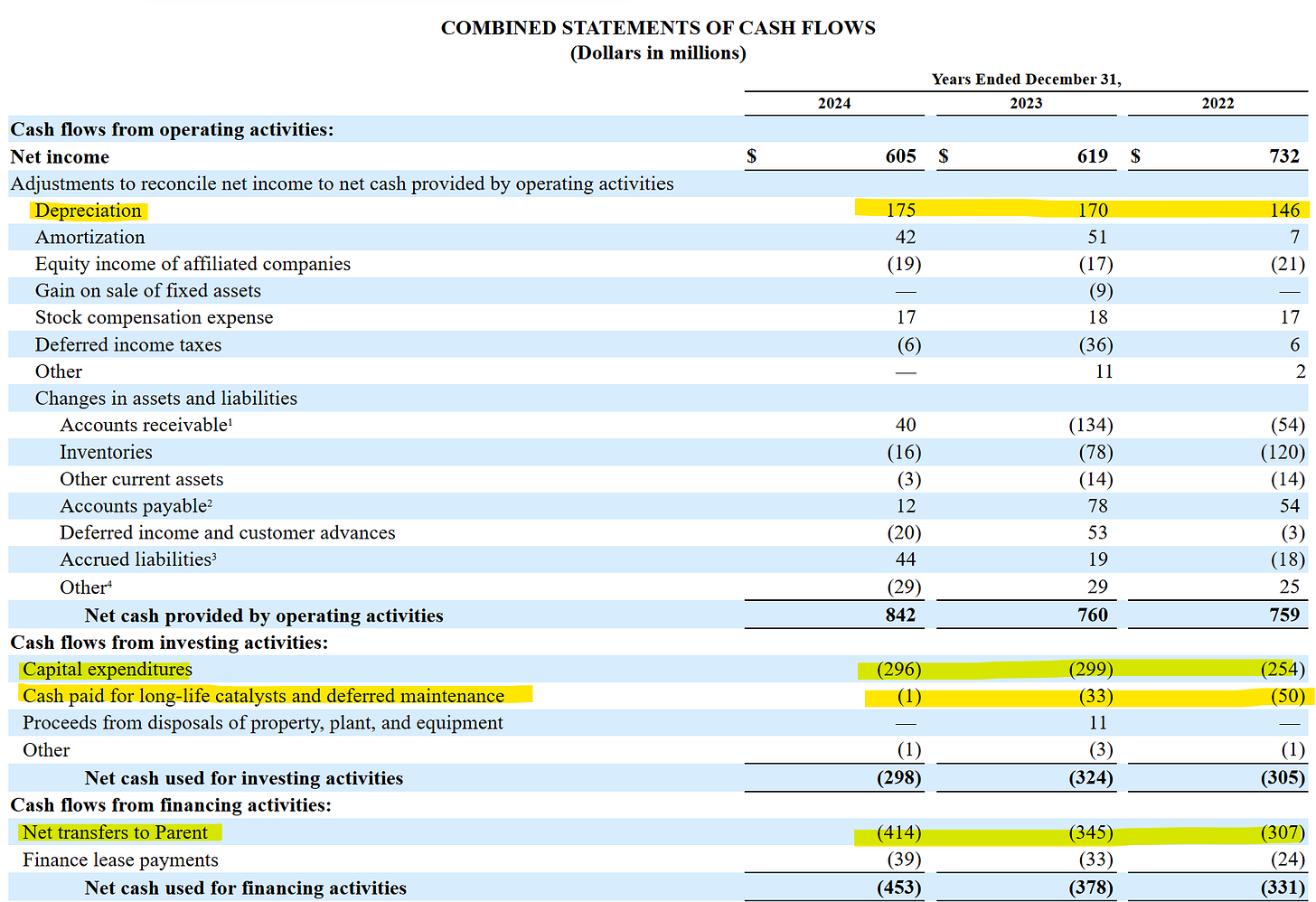

Large EBITDA margins generally translate into large cash flows. Total operating cash flows from 2022-2024 were $2.36bn or $790m per year (these exclude pro-forma interest expense on new debt issued).

This business was a dividend vehicle within Honeywell’s portfolio, sending >$1bn dividends back to the parent (out of ~$1.4bn total FCF) from 2022-2024.

Going forward, capital allocation will focus on: 1) organic growth / capex; and 2) bolt-on acquisitions, essentially a first for this business unit:

…since we’ve been a company within Honeywell since 2016, we have not really invested in M&A, and this opportunity as a stand-alone gives us the opportunity with some bolt-on acquisitions in adjacency markets and technologies

So we have a business with no M&A experience or track record for nearly a decade now turning their attention to it… this could be viewed both positively and negatively I suppose.

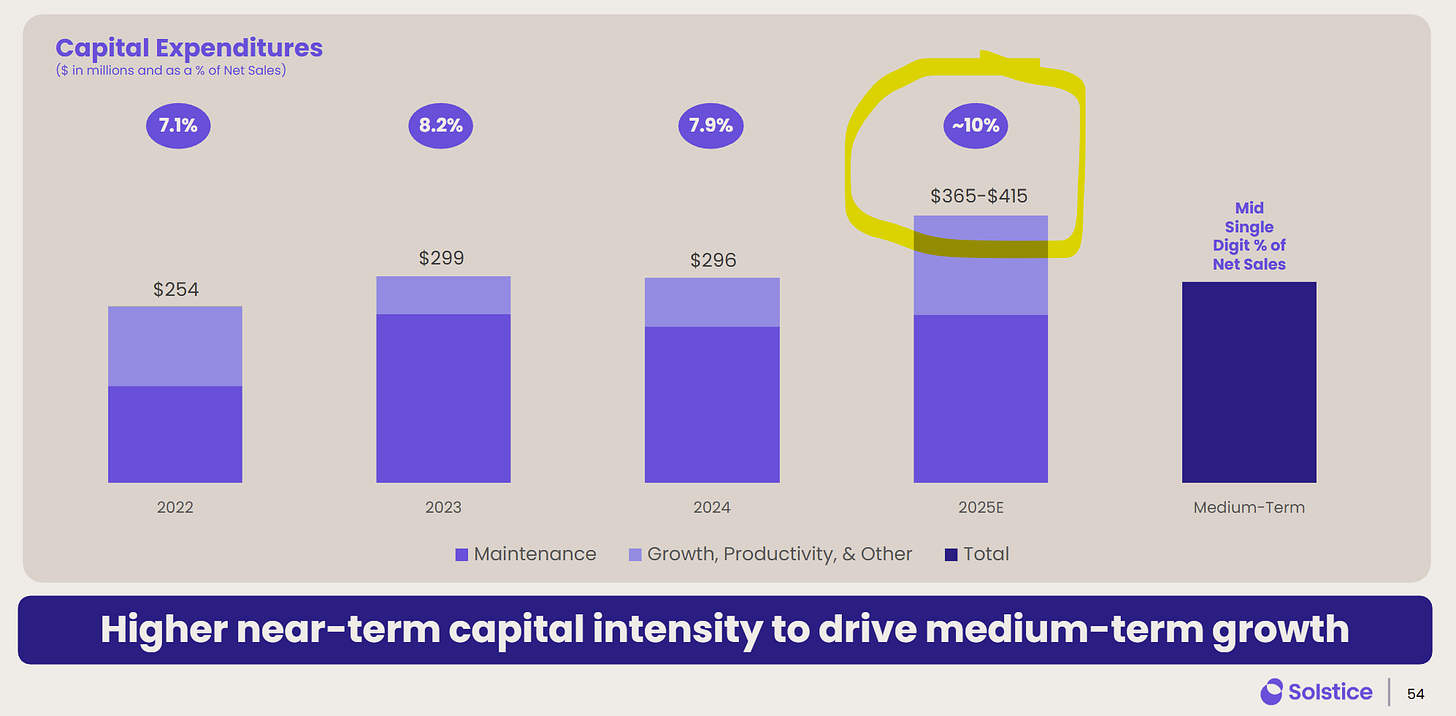

One negative aspect of this business is its capital intensive nature.

For the past 3.5 years, Solstice was spending 8-9% of revenue on capex (note: the chart below excludes cash payments for “long-life catalysts and deferred maintenance” which sure sound like capex to me).

In 2025, capex will ramp from $296m (2024) to $390m (mid-point guide), totaling >10% of revenue.

We expect in the near term that we will have -- as we approach, we see all these growth opportunities that we will have kind of the similar level of CapEx as what we’ve seen in ‘25. By the end of the medium term, we’re expecting that to normalize back to mid-single digit, which is what we had prior to 2025.

After a few years of elevated capex, management is guiding to 70% cash conversion (defined as: EBITDA minus capex divided by EBITDA; which excludes taxes, interest, and working capital) over the medium term.

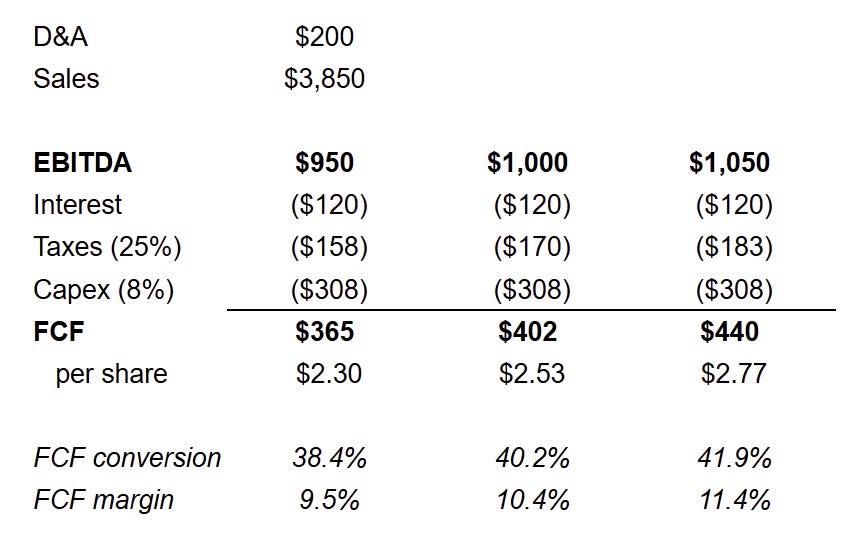

Solstice won’t have much excess cash flow to deploy in the first 1-2 years post-spin. A quick EBITDA-to-FCF bridge (below) shows $360-400m FCF at normalized levels of capex (8% of sales).

Subtract another $100m from these FCF figures for elevated capex in 2025-2026 and that leaves maybe $200-300m for buybacks, dividend, and M&A? If they take leverage up to 2x EBITDA, then perhaps they have a combined $900m to $1bn capital available to deploy over the next 2 years.

If I can belabor the “capital intensive” point one more time: SpinCo represents ~14% of consolidated Honeywell operating cash flows from 2022-2024 but 29% of consolidated capex. RemainCo is getting more asset light.

4) Valuation + spin dynamics

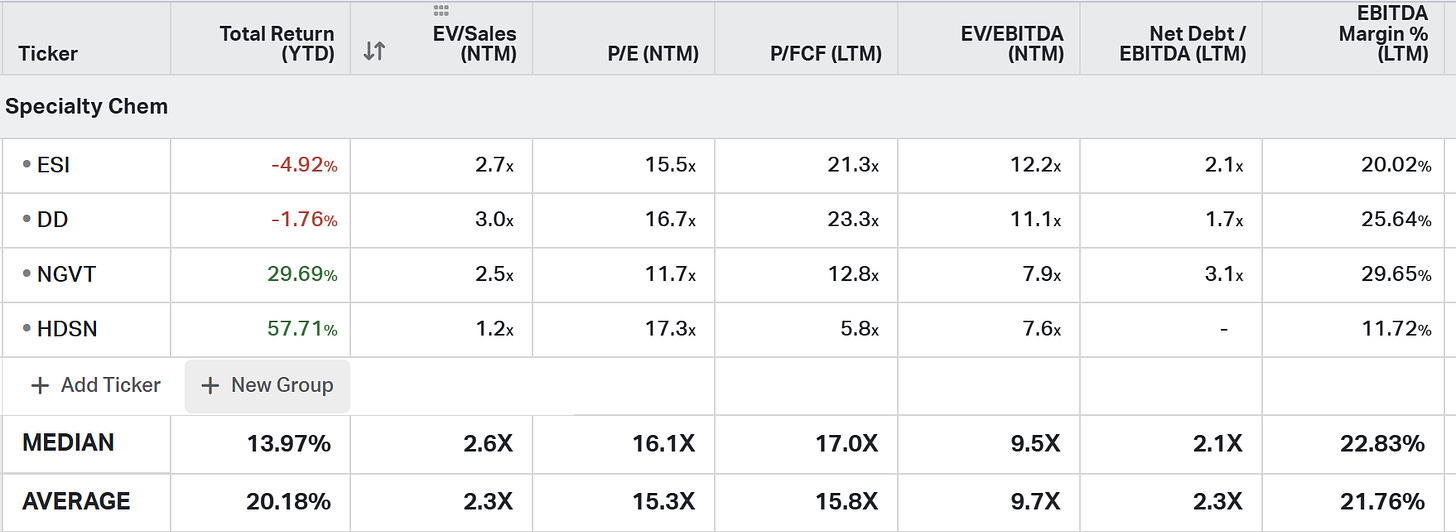

Chemours has a competing refrigerant business, but other segments and high debt make it less comparable overall. DuPont, Element Solutions, and Ingevity have similar financial profiles and they trade at 8-12x EBITDA.

I expect this business will trade at 10-12x EBITDA (or higher) which makes this somewhat uninteresting…. but, it’s relatively small compared to pre-spin Honeywell. Assuming 10-12x EBITDA ($950m) = $9.5-11.4bn enterprise value, which is 6-7% of Honeywell’s $155bn enterprise value. Perhaps larger holders will sell?

At 10-12x EBITDA = $9.5-11.4bn enterprise value. Subtract $1.55bn net debt = $8-9.9bn equity value. On 158.7m shares outstanding (634.9m pre-spin Honeywell share count), that would be $50-60 per share for Solstice.

For what it’s worth, Elliott Management valued this segment at 13.5x EBITDA minus capex when calling for change at Honeywell in late 2024, that works out to ~$50 per share.

Summing it up…

This looks like a nice business with plenty of favorable attributes (pricing power, diversified customers, products, and end-markets, high margins, strong balance sheet, etc.), but I’m skeptical it will trade at an attractive price.

At 10x EBITDA, you’re paying 20x FCF for this business which is slower growth and more capital intensive than RemainCo.

I could be wildly estimating the growth impact from semiconductor and data center exposure, but it’s not yet showing through in the results or outlook.

I’ll start getting interested at $40 or lower on this one…

Resources:

Will you be looking at the Dupont spinoff? I think the RemainCo might be more interesting than this one.

They also have 12% of revenues from Uranium conversion. With current market craziness could be a potential multiple upside here