Quick Value #294 - Cyprium SpinCo

A look at the upcoming electrical systems spin-off from Aptiv (APTV)

Today’s post:

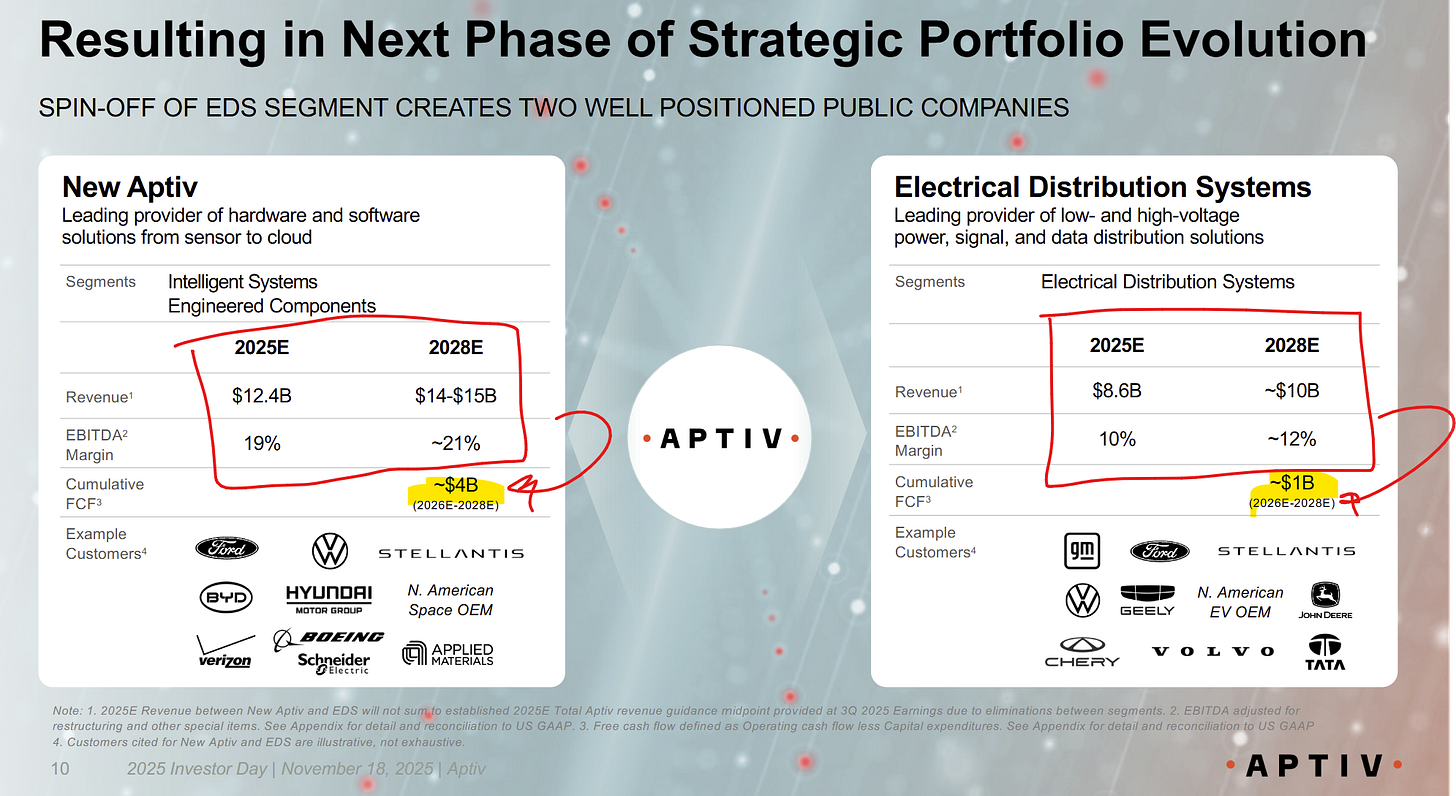

$16bn market cap auto supplier spinning off lower margin & lower growth electrical business (EDS)

EDS is a best-in-class operator in a tough segment of auto suppliers

RemainCo expected to generate >4x SpinCo FCF over next 3 years = potential mispricing opportunity

An initial look at the business, estimates, and valuation

Quick reminder — For newer subscribers, my write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Check out past write-ups here and my home base page here.

Recent write-ups include:

11/17/25 — Turnaround + management change at SWK ($)

11/10/25 — Dole fully deleveraged, cheap, kickstarting buybacks

10/27/25 — ONEOK is a cheap midstream energy co

10/20/25 — Net-net in oilfield services ($)

10/13/25 — Solstice spin off from Honeywell

10/06/25 — Divestitures and delevering at Leggett & Platt ($)

Quick Value

Aptiv (APTV)

Ticker: APTV

Shares: 216m

Market cap: $16bn

Valuation: 9.6x pre-split 2025 EPS ($7.70)

Theme: spin-offAnother spin-off investor day presentation in the books. Here’s what caught my eye on this situation and why we could get a good look at SpinCo…

New Aptiv (RemainCo) has the juicier margins, growth potential, and free cash flow profile. In fact, RemainCo is expected to generate $4bn cumulative FCF from 2026-2028 vs. on $1bn for SpinCo. It’s not just size and margin differential, RemainCo is substantially more cash generative.

Pre-spin Aptiv has 216m shares outstanding x $74 = ~$16bn market cap. Debt is $7.6bn and cash is $1.6bn = $22bn enterprise value. Pre-split 2025 EPS is guided at $7.70 for a 9.6x P/E.

I’m going to focus on the spin-off for now and perhaps revisit RemainCo later this week.

SpinCo = Cyprium Holdings (no ticker yet)

Background

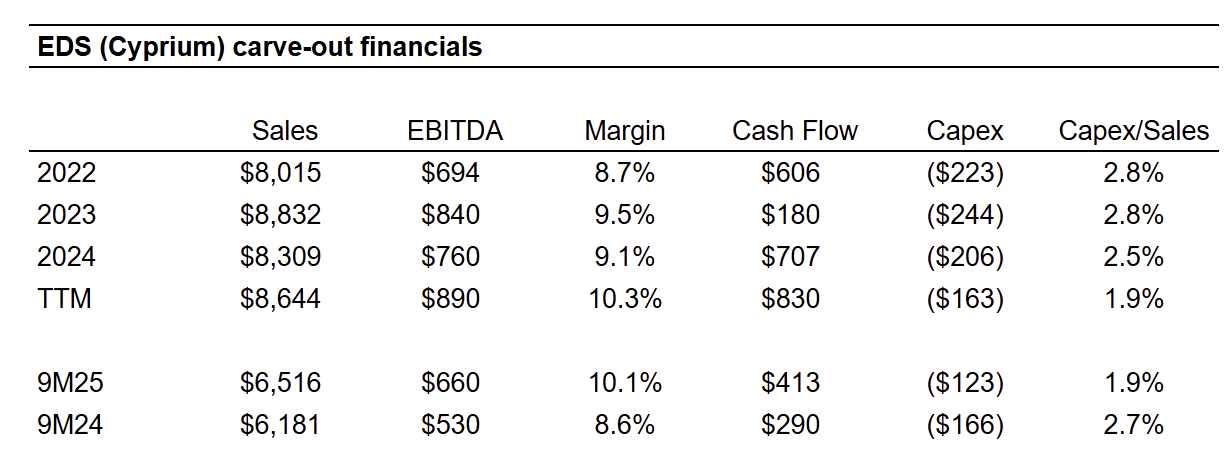

Cyprium is the Electrical Distribution Systems (EDS) carve-out within Aptiv’s “Signal and Power Solutions” segment, so unfortunately we can’t go back in time to gauge performance like we could if this were a standalone segment.

The EDS business makes electrical cables that are wired throughout a car (known as wire harnesses). These cables connect things like dashboard electronics, car batteries, lights, fuses, etc. It’s the automotive equivalent to plumbing.

Wire harness manufacturing is manual and labor intensive (some processes like cutting and stripping are automated, but assembly is mostly done by hand) which makes it low value and low barrier. For reference, EDS has ~138k headcount (including PT employees) = ~$60-66k revenue per employee (very low). Wage inflation will be a key variable for future margins here.

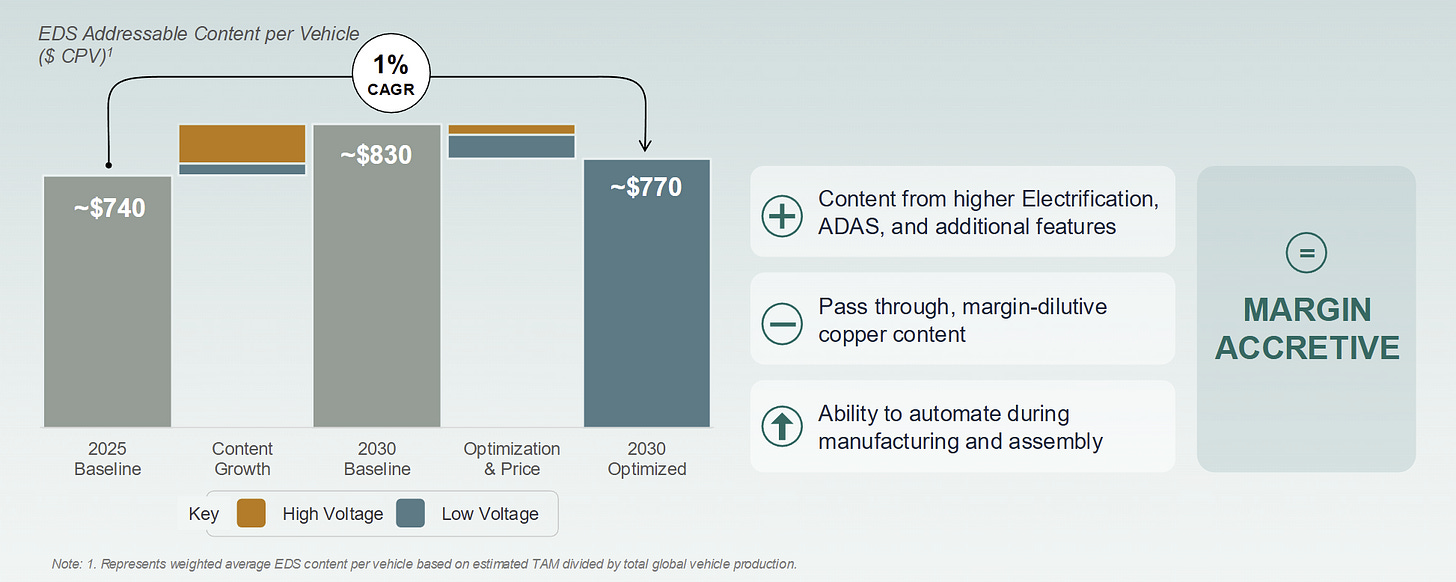

Content per vehicle is around $740 today. At an average $50k new car price this is ~1.6% of total value in a car. EDS sells 2 types of cable: low voltage and high voltage. Electric vehicles use more high voltage cable which has higher margins.

One positive note, this is a fairly concentrated industry with the top 5 players likely accounting for ~70% share of this $60-70bn market.

Why SpinCo is interesting…

“Interesting” is subjective here… Cyprium is much less attractive and much smaller than New Aptiv; and for those reasons, it may become available at a great price.

Why is it less attractive?

It’s a low margin business with limited (if any) pricing power

Capital intensive — planning for 3-4% capex vs. historic 2-3%

Labor intensive — wage inflation will be a detractor over time

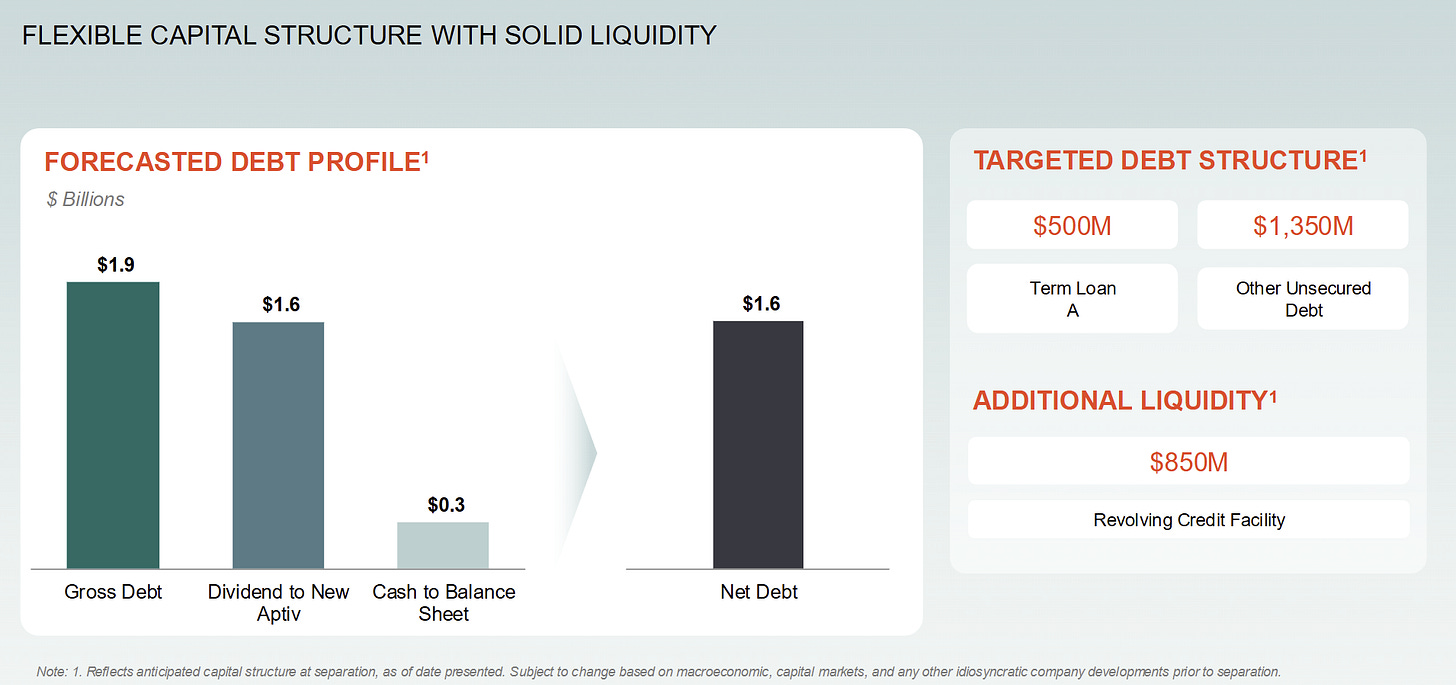

Balance sheet with 1.9x leverage at spin and targeting 2-2.5x is not best-in-class (median peer leverage = 1.4x)

Cash restructuring costs of $75-90m per year — sounds like this will be ongoing indefinitely

Greater ICE exposure + minimal non-auto sales (passenger vehicles = 90% of revenue)

For all of these reasons, I expect Cyprium to trade at the lower end of auto supplier peer valuations.

Let’s take a closer look at the targeted financial profile and thesis from here… starting with a summary view of carve-out financials (i.e. these do not include standalone costs, interest expense, etc.).

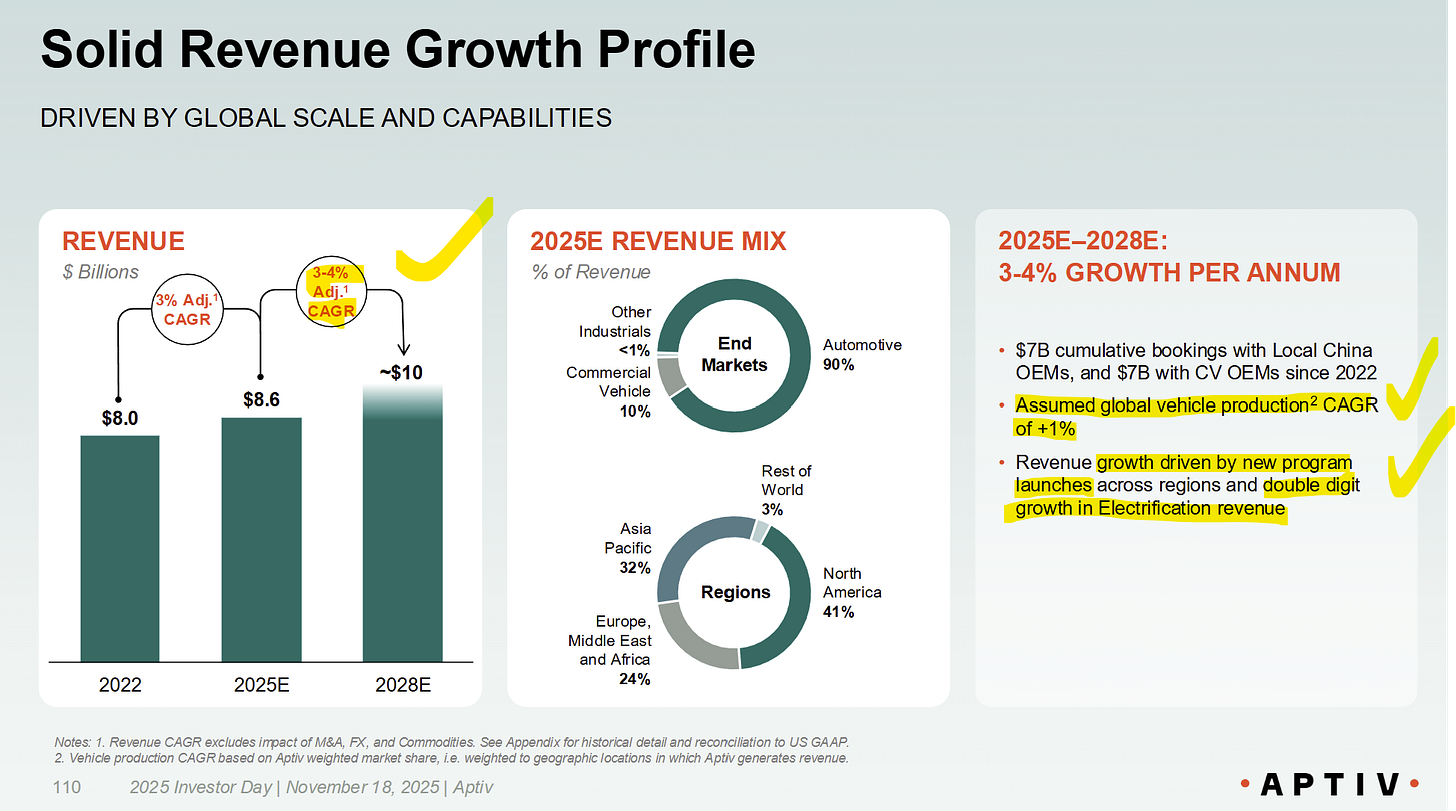

Management is targeting 3-4% annual revenue growth following 2.5% growth from 2022-2025E. I’m a skeptic on this growth profile ($8bn to $8.8bn to $8.3bn to $8.6bn over 4 years is not a steady 2.5% grower).

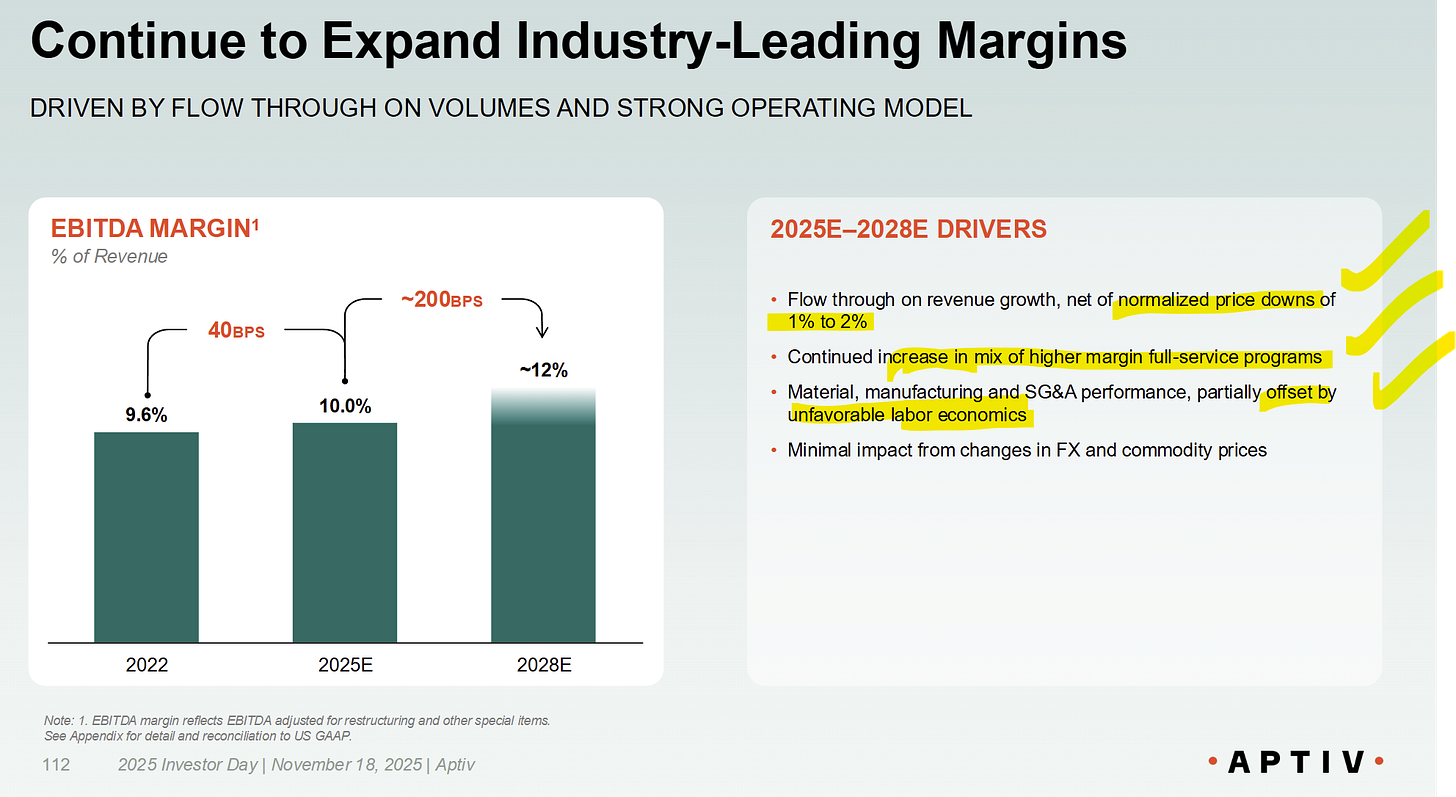

Embedded in their 3-4% future growth profile are 4 things: 1) global auto production at a 1% CAGR; 2) new program wins; 3) double-digit growth in high voltage revenue (which carries higher margins); and 4) price declines of 1-2% per year.

Margins have a few puts and takes… labor + pricing will be detractors while volume (operating leverage) and mix shift are expected to add to margins.

Capital allocation is pretty vanilla…

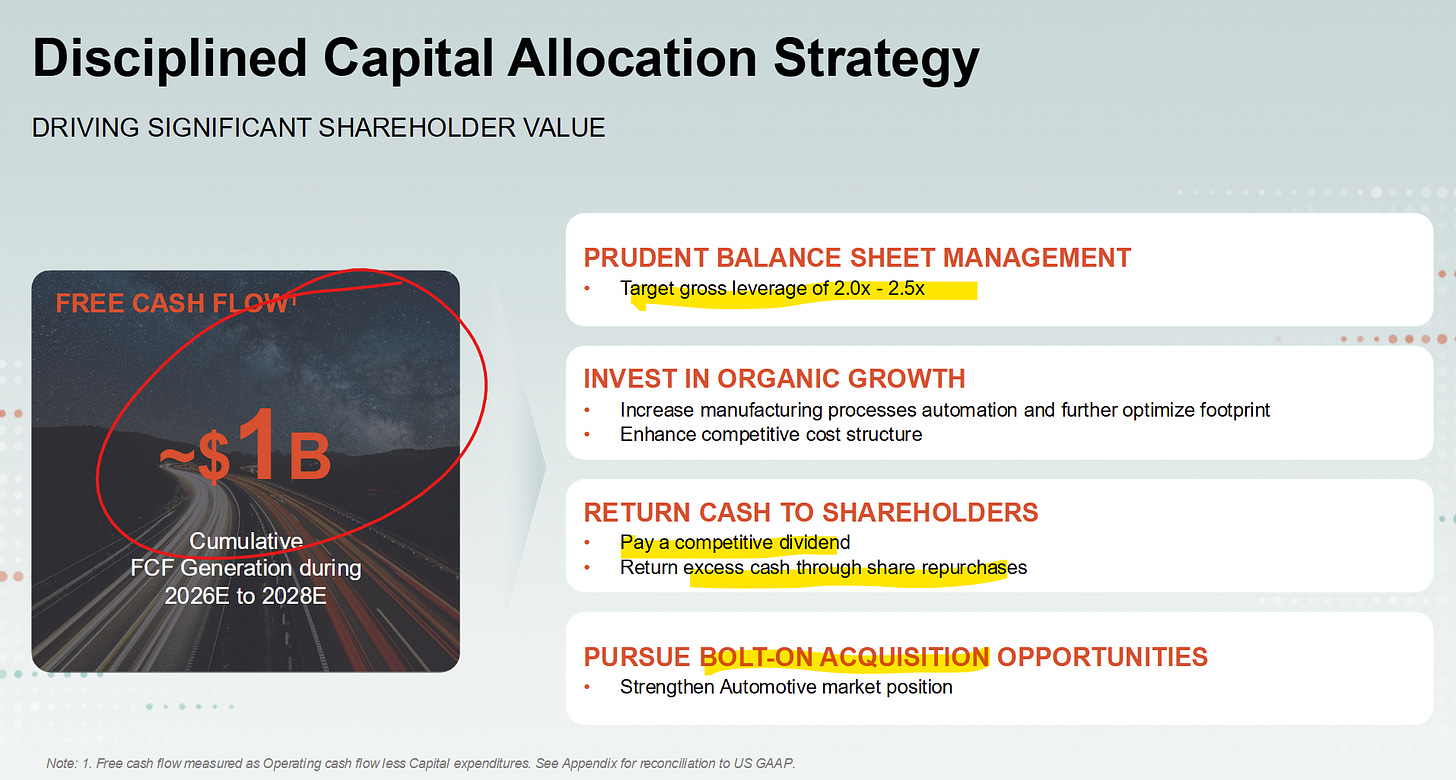

Management is targeting $1bn cumulative FCF over the 3-year period 2026-2028. On 216m shares, $1bn cumulative FCF = $4.60 per share. From that FCF: expect a modest dividend, maybe some buybacks, and perhaps a bolt-on acquisition. Capital allocation is not baked into their 2028 targets.

The balance sheet will have ~$1.6bn net debt at time of spin. On $860m EBITDA = 1.9x leverage. That leaves maybe $100-500m excess capital if they chose to lever up to the 2-2.5x targeted range.

It’s not all ugly, there are some positive attributes here…

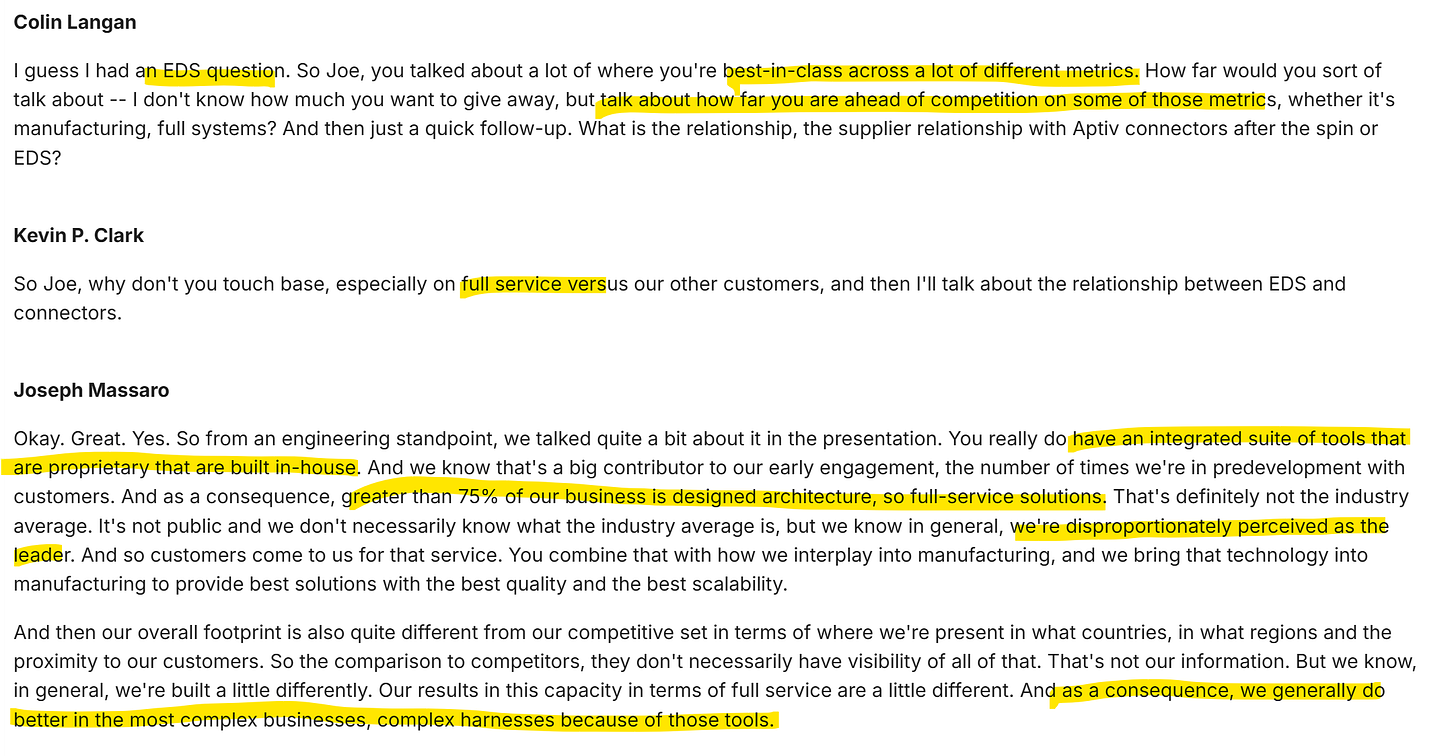

Cyprium has engineering & design capabilities unlike many of their competitors and margins (9-10%) are higher than competitor Lear’s at 6-7%. Here’s how they described the higher margin “full service” nature of their business:

Returns on capital are quite high… from 2022-2024, EBIT averaged $575m on $1.5bn average invested capital = 38% ROIC.

And it’s possible the high voltage / electrification business is a secular grower with increasing EV sales over time.

What are shares worth?

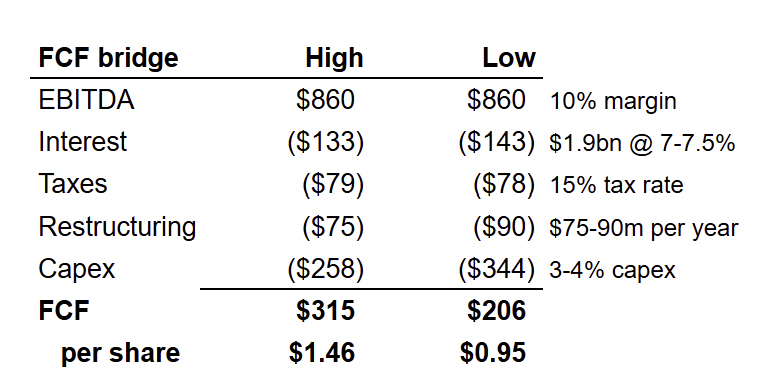

First, I’m estimating $1-1.46 in FCF per share = $1.20 at mid-point. This would put the company below their $1bn cumulative FCF target so it would need to include EBITDA/FCF growth in 2027-2028.

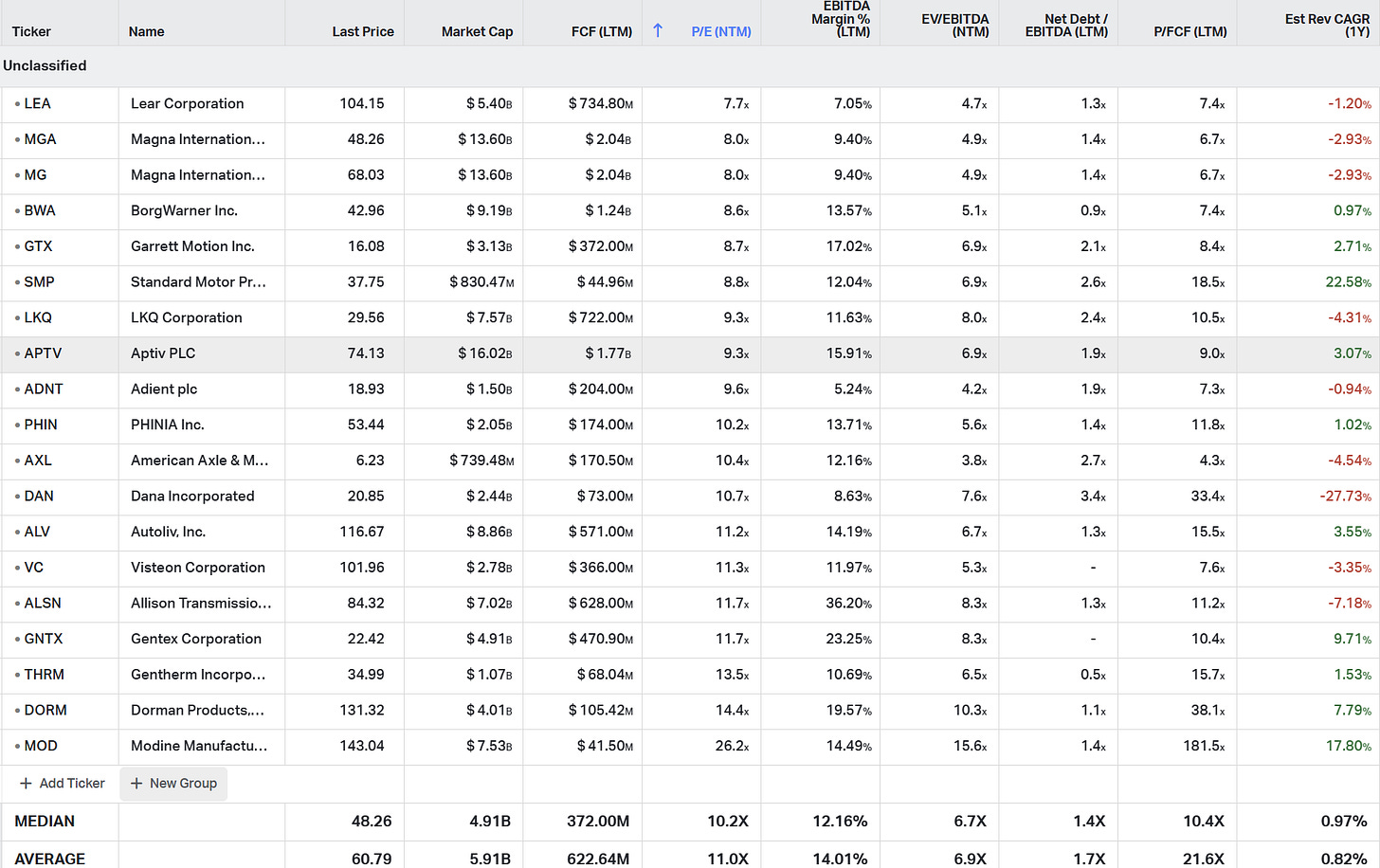

Next, there are 2 sets of peer groups: those trading at 7-9x earnings and another group trading at 10-12x or higher. Lear (LEA) is most comparable given their E-Systems wire harness division and it trades at ~8x earnings & 4.7x EBITDA with 1.3x leverage.

At 8-10x earnings, Cyprium should trade at $10-12 per share (using a 216m share count). Note: my earnings figure includes $75-90m cash restructuring expenses which management hinted at continuing for the foreseeable future; if you exclude these costs, that would add another $3-4 per share.

Summing it up…

Cyprium looks like a best-in-class operator in a tough industry. Plenty of unattractive factors might lead to a sell-off post-spin which could make this interesting. I’d certainly be a buyer at the right price. Ideally, I’d like to pick up shares at a low multiple to the $1bn cumulative FCF guide from 2026-2028.

Disclosure: no position in Aptiv

Resources: