A Guide to Deleveraging Stories

Investment themes Pt. 7 of 15 = public LBO / deleveraging situations

I’m still on a multi-part series covering my favorite investment themes (as an ode to Peter Lynch’s six “story types”). Today, I’m looking at the public LBO / deleveraging situation.

This is part 7 covering the 15 investment themes I look for. As a recap, we’ve already covered:

Part 1 — beaten down shares (my favorite source of idea gen)

Part 2 — spin-offs (my favorite source for actionable investments)

Part 3 — post-reorg equities (infrequent but actionable)

Part 4 — management changes (good ones are uncommon but actionable)

Part 5 — insider buying (a checklist of what to watch for)

Part 6 — activist investing (highly actionable source of investments)

7) Public LBO / Deleveraging Stories

Picture this: a business with remarkably stable cash flows (non-cyclical) levers up to 5x EBITDA for an acquisition. They subsequently repay 2x of the leverage over 2-3 years.

What happens to the equity? Is it now 2x more valuable with a 3x levered balance sheet instead of 5x?

This is a deleveraging story in a nutshell.

It doesn’t always pan out this way (and you probably don’t want to build an entire portfolio around these sorts of bets), but it can be fertile hunting ground for new investment ideas.

The general setup I’m looking for — a business is levered at 3-5x EBITDA, trades at maybe 7-8x EBITDA or less, has reasonably stable cash flows and is committed to deleveraging to 2x or less. Consistent and noncyclical free cash flow is hugely important to making these work. In these situations, I also prefer to gauge leverage as debt-to-FCF over debt-to-EBITDA with 6x as a comfortable coverage level.

My checklist for public LBO / deleveraging situations:

Extreme cash flow stability — Minimal cyclicality, minimal working capital intensity, and modest capex requirements = highly predictable cash flow streams. Cannot stress this rule enough; I’ve been roped into cyclical delever stories which adds a variable in timing industry cycles.

Reasonable delever path — If buying at 5x leverage, the equity is going to be highly prone to sell-offs… I want assurances that the path to lower leverage is not reliant on “blue sky” scenarios only.

Bonus points for divestitures — Say the market is heavily discounting a business with 4-5x leverage, but cash flow is stable and the company has plans to divest assets or non-core businesses. I’m much more inclined to like a deleveraging situation with asset sale “optionality.”

Prepare for volatility — Need to be highly confident in valuation math and/or industry multiples… small changes in trading multiples will cause big drops in the share price with this much debt. Recognize that these holdings will be volatile; if you’re confident in your thesis + valuation, then sell-offs can create opportunities to add to your position.

How did they get there — What’s the back story? I like to know if high leverage was the result of a past acquisition, industry downturn, or bad decisions by management. This context affects my confidence in management to navigate the situation go-forward (or I might be looking for a potential management change scenario).

Capital allocation inflection — My favorite aspect of the deleveraging story: once debt goes from 5x to 2x, the company moves from capital constrained (repaying debt) to “all options on the table” for capital allocation. Buybacks start back up, M&A is back on the table, dividends are initiated, etc. And oftentimes management takes a more conservative approach to M&A given the scars from years of repaying debt.

Some case studies:

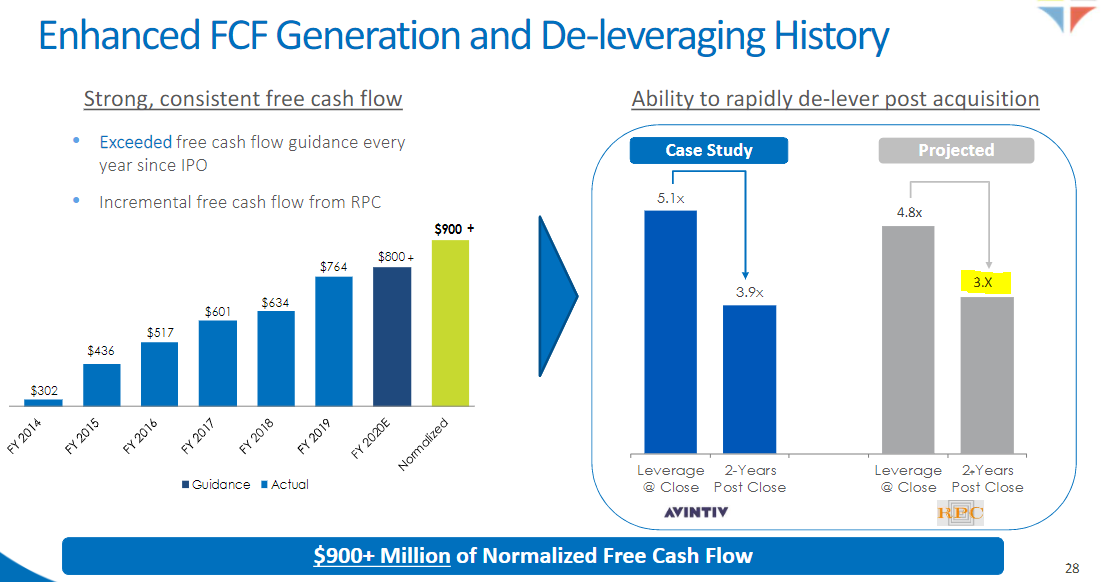

Berry Global (formerly: BERY) levered up to 4-5x on several occasions for large acquisitions and subsequently repaid to ~3-3.5x

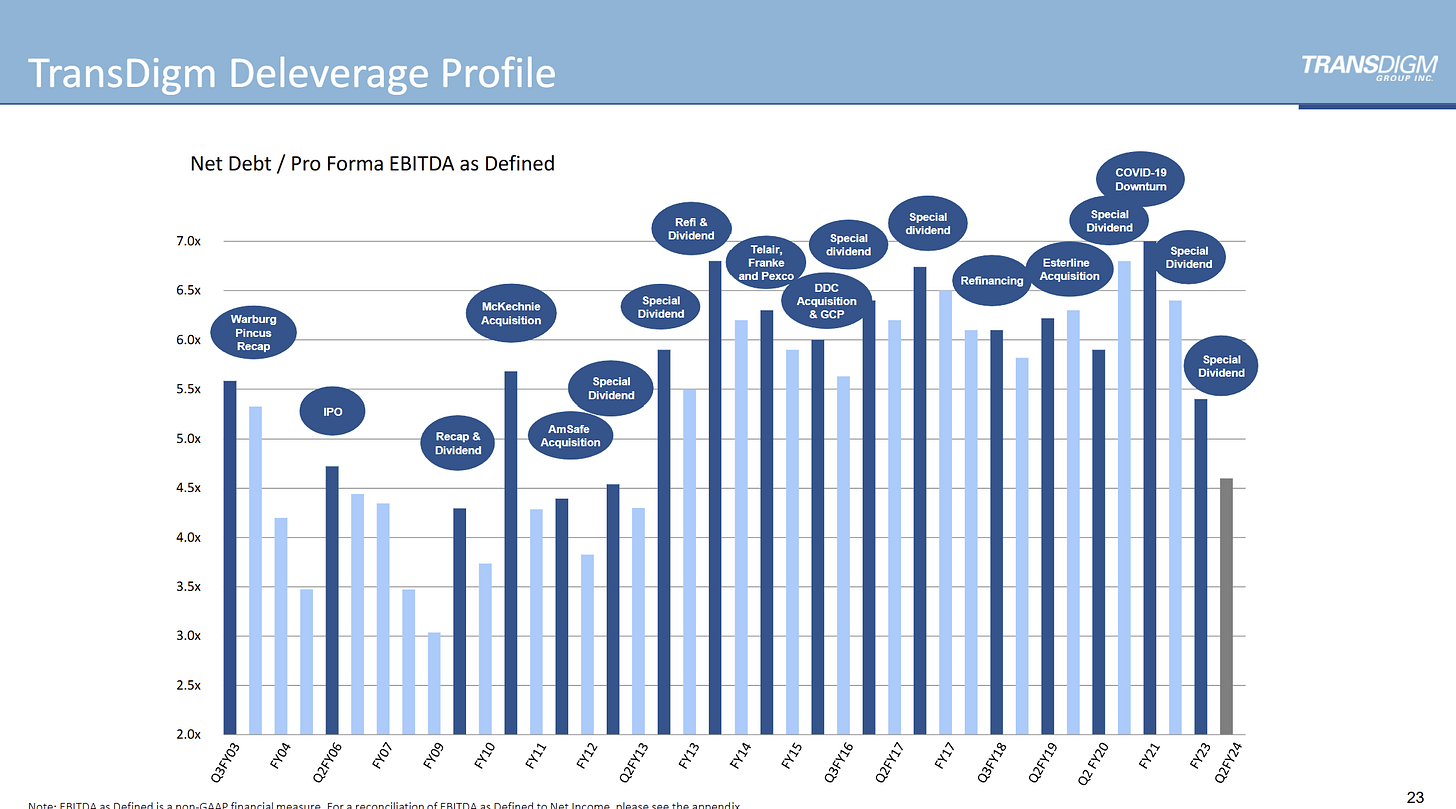

Transdigm (TDG) is an aftermarket aerospace parts roll-up with highly stable cash flows and low capex needs… management runs the company between 5-7x leverage and as cash flow grows they deploy into acquisitions or special dividends

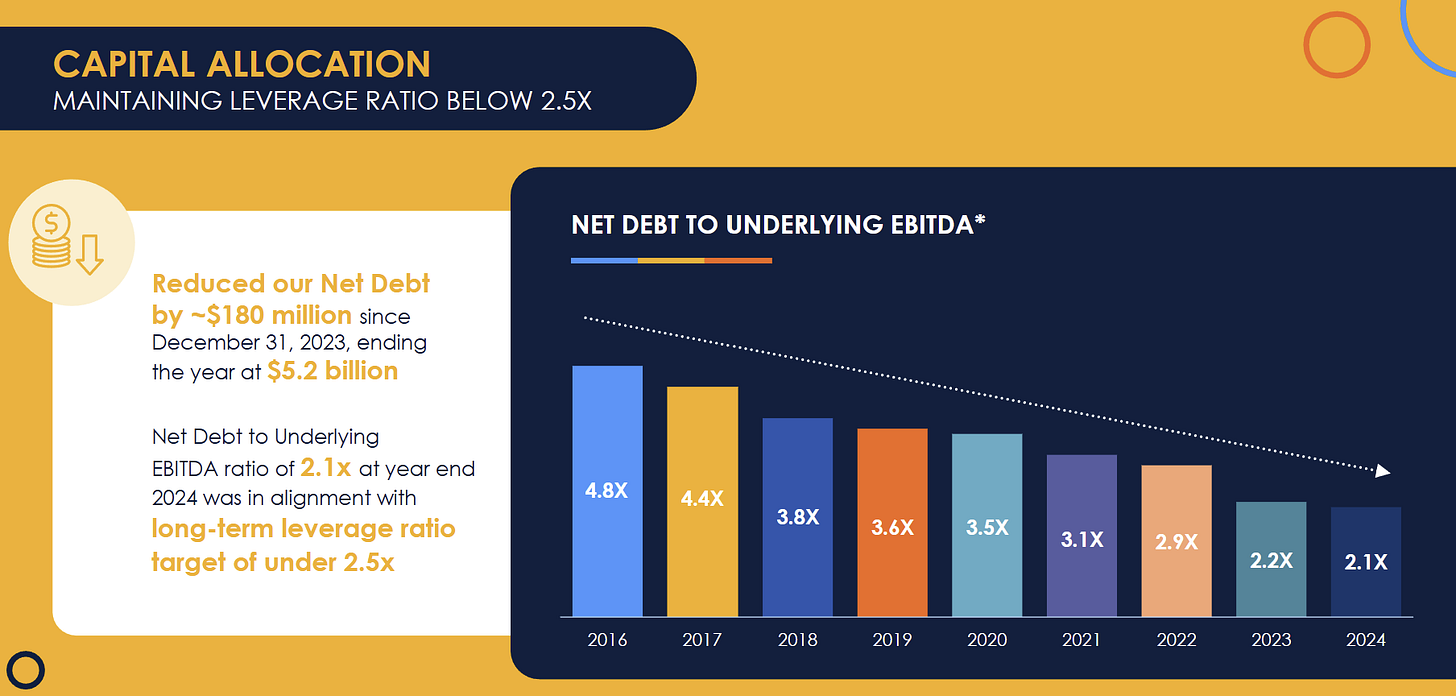

Molson Coors (TAP) levered up to 5x debt/EBITDA in 2016 for an overpriced acquisition of their MillerCoors joint venture… it took ~9 years to move from ~5x leverage to 2x leverage. Interestingly, shares are lower today than prior to the acquisition while free cash flow is unchanged!

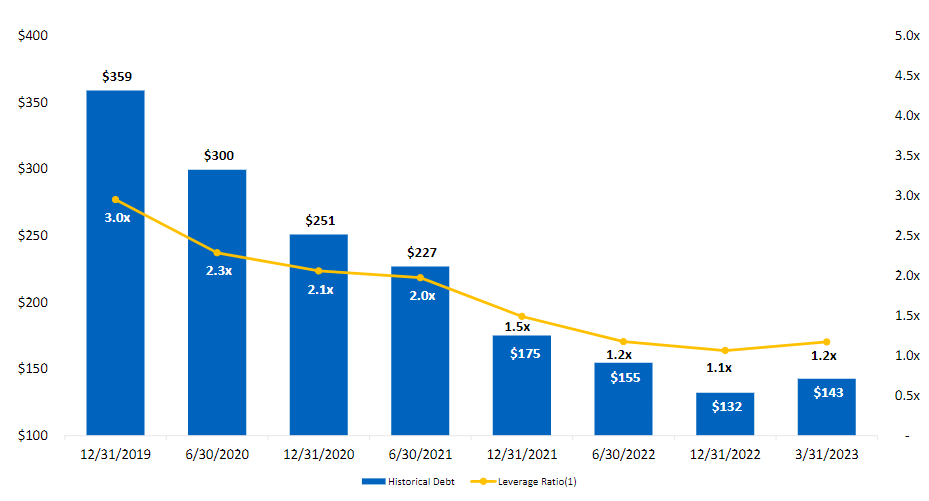

Civeo (CVEO) was spun off as a real energy-based real estate play in 2014, right before oil prices collapsed from $100+ to $30-40 per barrel. Leverage was >5x, the REIT plans were scrapped, and Civeo spent the next 10 years repaying debt. Today, the company is virtually unlevered and redirect capital into buybacks (see my article on activist investing too).

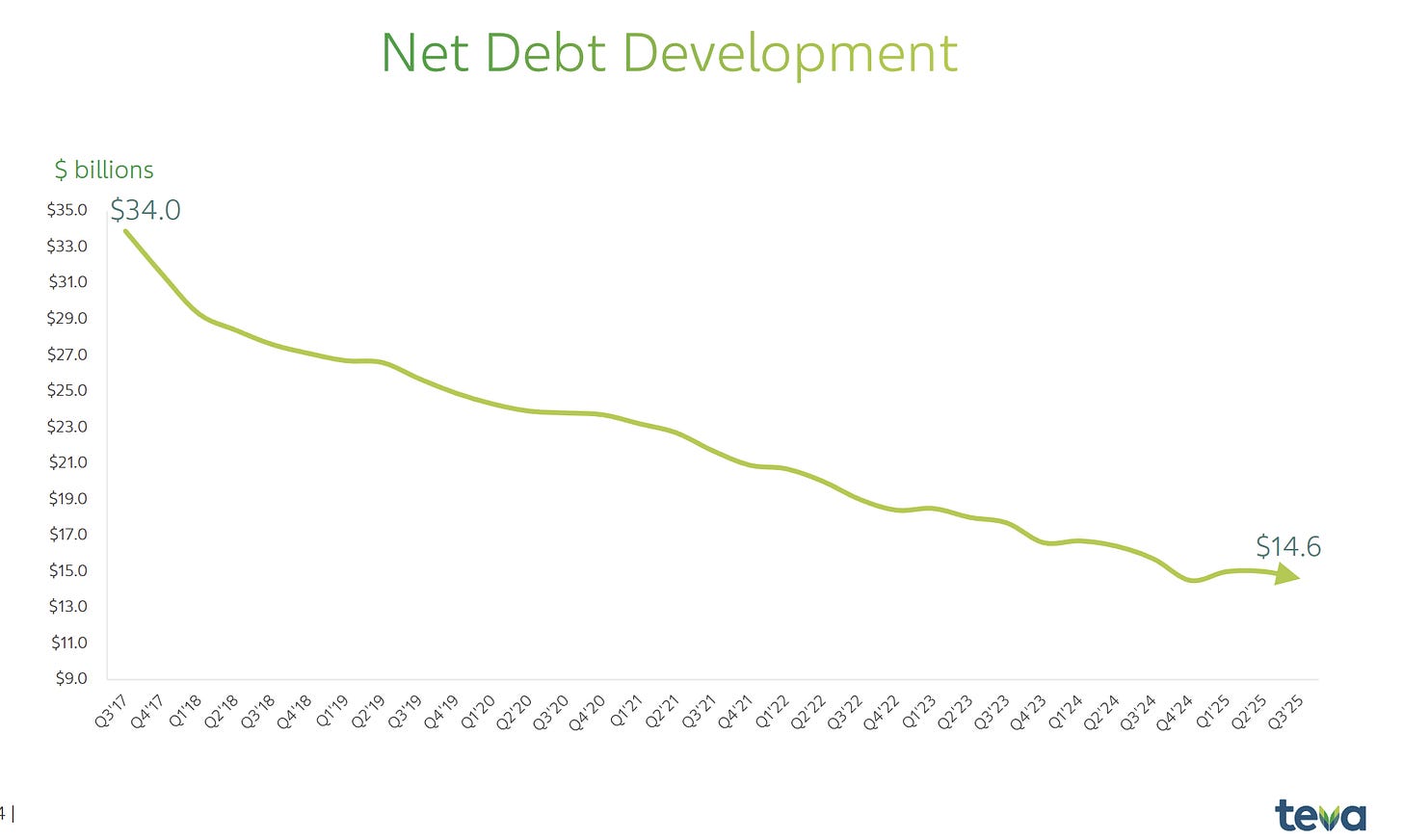

Teva Pharmaceuticals (TEVA) piled up massive debts after a $40bn acquisition of Actavis in 2016 at near peak valuations. Again, it took the company close to 10 years to get leverage under control. Shares have responded nicely in 2025.

Gibraltar Industries (ROCK) is an “active” idea in this bucket (here’s a link to my Dec 2025 write-up). The company announced an acquisition which will take this net cash balance sheet up to 4x+ leverage. Management has a clear path to repaying debt plus some divestitures on the horizon. Shares quickly re-rated down to 11-12x earnings to compensate for the debt profile.

Leave a comment with other public LBO case studies are active ideas in this bucket. This is a good category to monitor for periodic sell-offs.

Good stuff, thanks for the writeup.

Sonoco, SON, one I recently added. They very much reshuffled their portfolio in the last 2 years, adding more metal/can manufacturing, just closed a disposition 11/3/25, so they're close to their target leverage ratio now. The reshuffling also created a lot of purchased intangibles, so cash EPS is a lot higher than GAAP, and they're under 8x cash EPS.

Loved the case studies! Do you think Diageo could fit this theme now?