Quick Value #297 - Versant Media (VSNT)

A look at the upcoming cable network SpinCo from Comcast - set for trading on 1/5/26

Today’s post:

Spin-off set to begin trading on 1/5/2026 (when-issued trading implies $47 share price, $6.8bn market cap)

Shares trade at 4.7x EBITDA and 6.2x FCF with ~1.2x net leverage

Capital allocation likely a mix of M&A and buybacks — $1bn buyback authorization implies ~14% of market cap

SpinCo represents 6-7% of pre-split CMSCA shares ($30) — chance for a major sell-off?

For new subscribers — these write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Each write-up includes: 1) company background; 2) why the idea is interesting; and 3) fair value estimate.

Check out past write-ups here and my home base page here.

Recent write-ups include:

11/27/25 — New Aptiv (RemainCo) and Cyprium (SpinCo)

11/17/25 — Turnaround + management change at SWK ($)

11/10/25 — Dole fully deleveraged, cheap, kickstarting buybacks

10/27/25 — ONEOK is a cheap midstream energy co

10/20/25 — Net-net in oilfield services ($)

10/13/25 — Solstice spin off from Honeywell

10/06/25 — Divestitures and delevering at Leggett & Platt ($)

Quick Value

Versant Media Group (VSNT)

Ticker: VSNT

Price: $47 (when-issued)

Shares: 145m

Market cap: $6.8bn

Valuation: 4.7x EBITDA / 6.2x FCF

Theme: spin-offOn January 2nd, 2026, Comcast shareholders will receive 1 share of Versant for every 25 shares of Comcast (~3.6bn CMCSA shares outstanding = ~145m VSNT shares outstanding).

Background

Versant is a collection of linear cable networks and other assets.

Their networks are grouped into 4 core markets:

Political news and opinion — MSNBC (MS NOW)

Business news and personal finance — CNBC

Golf and athletics participation — Golf Channel

Sports and genre entertainment — USA Network, Oxygen, SYFY, E!, etc.

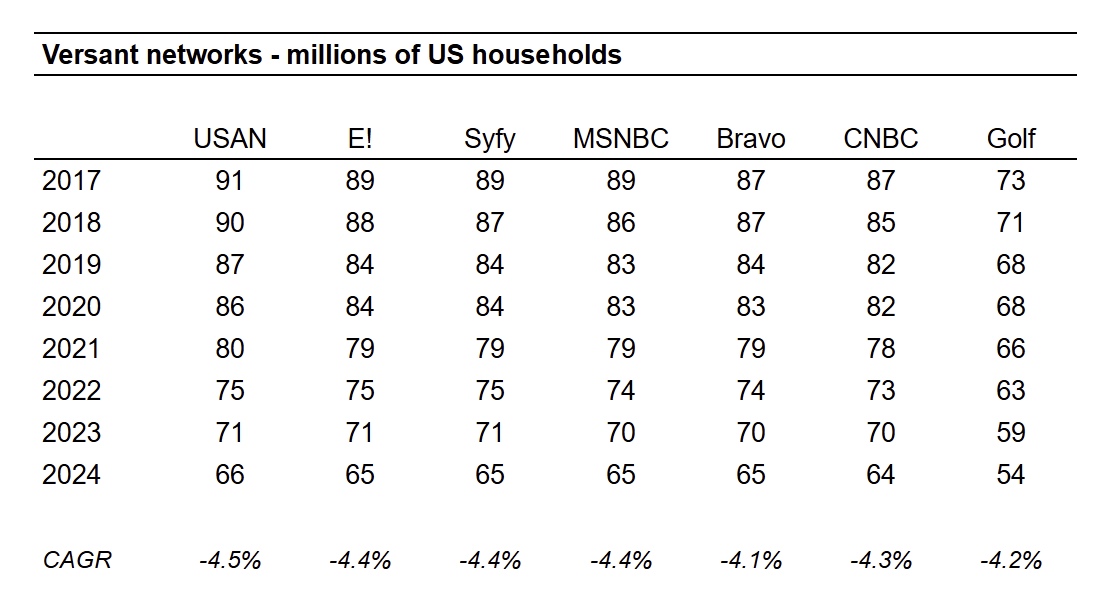

Here’s an overview of key channels and audience trends since 2017:

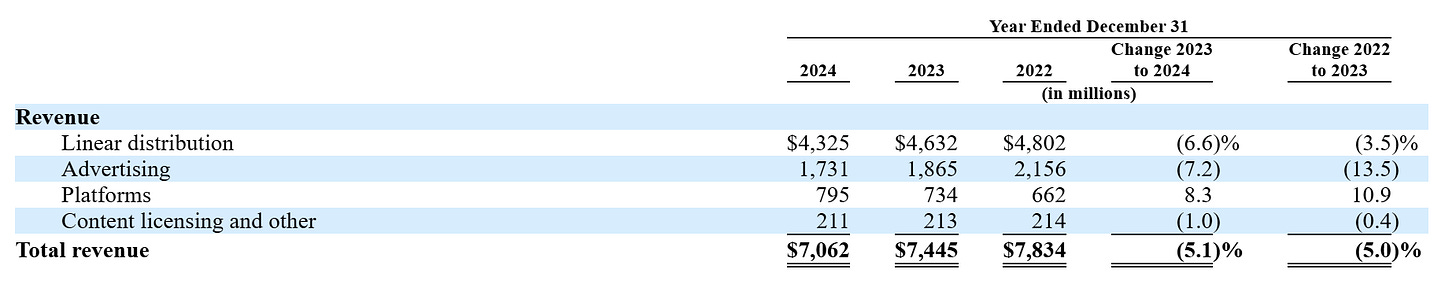

Revenue comes from 4 sources:

Linear distribution — sales to MVPDs (i.e. cable providers) usually on a per subscriber basis

Advertising — sales of advertising on cable networks and digital platforms based on ratings, subscribers, brand/quality, etc.

Platforms — sales from digital sites… this bucket is a mix of subscription and transaction revenue

Licensing — sales of Versant created content to other networks or digital platforms

Versant generated 83% of 2024 from pay-TV related sources. Except for platforms, each of these revenue streams are in decline.

Most of the news programming is created in-house, sports rights are purchased via multiyear contracts, and general entertainment is purchased via film/TV studios.

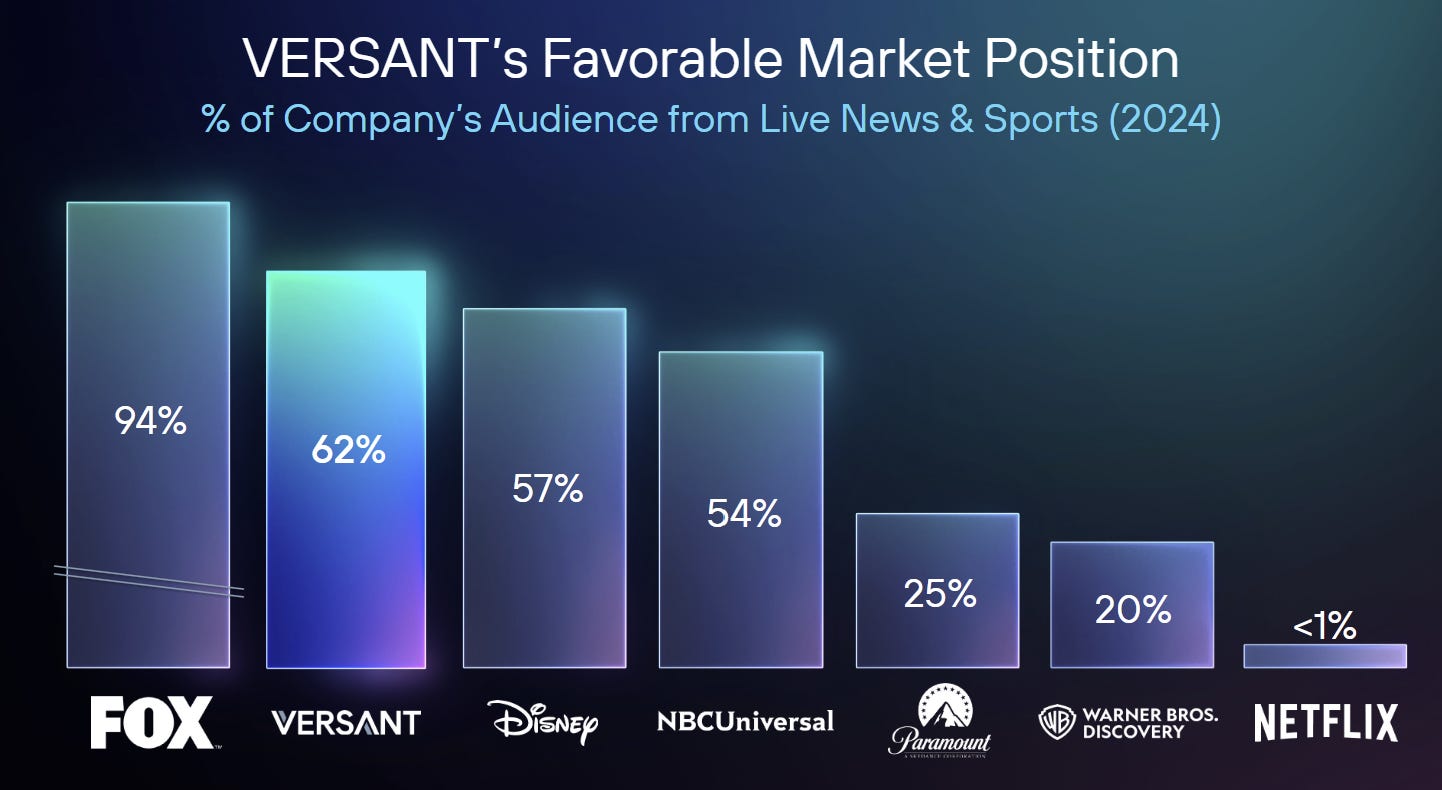

Versant gets the majority of viewers (62%) from live news & sports which, in theory, is better insulated from cord cutting. The remaining 38% is in the general “entertainment” category of scripted/unscripted content. Here’s how that mix of live programming stacks up against peers:

Why it’s interesting…

The perceived view of Versant is a secularly declining “melting ice cube.” Recent results support that description, but there’s a good chance for estimates + valuation to become draconian.

1) Fundamentals

Sales and earnings are in decline (as is the case for all linear cable networks) primarily due to declining cable subs.

How bad are results?

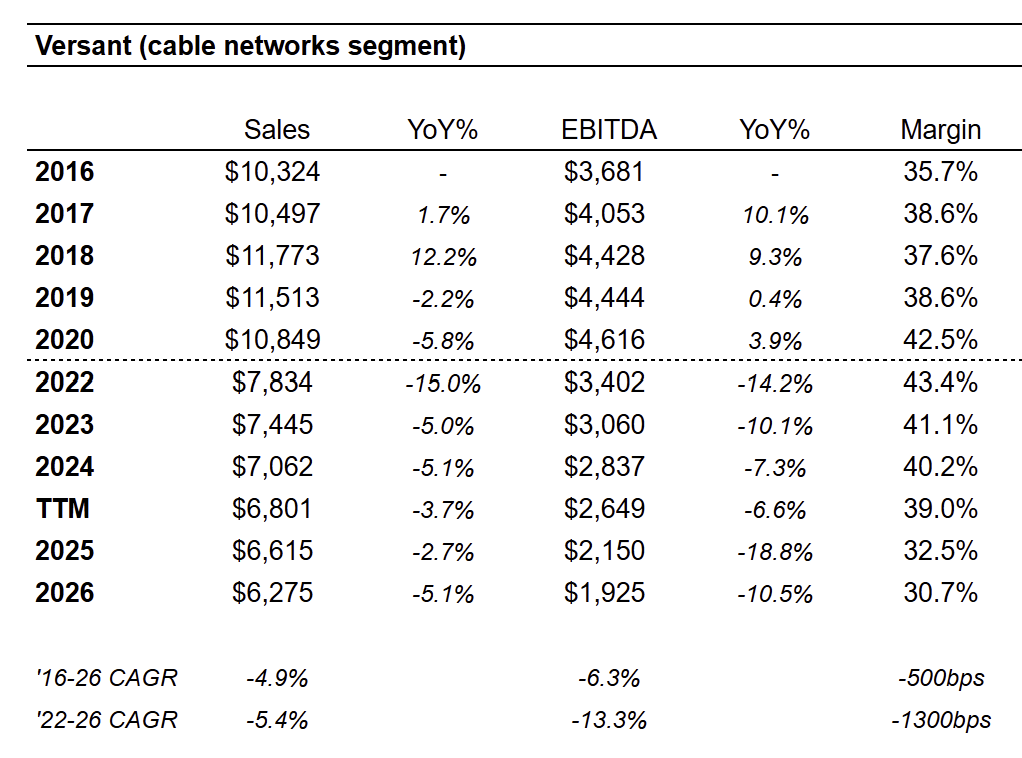

Sales and EBITDA are declining at a 5% and 6% CAGR from 2016-2026 (based on guidance). Those rates of decline accelerated post-COVID. (Note: Comcast discontinued “cable networks” segment reporting in 2021; and 2025-2026 figures include standalone public company costs.)

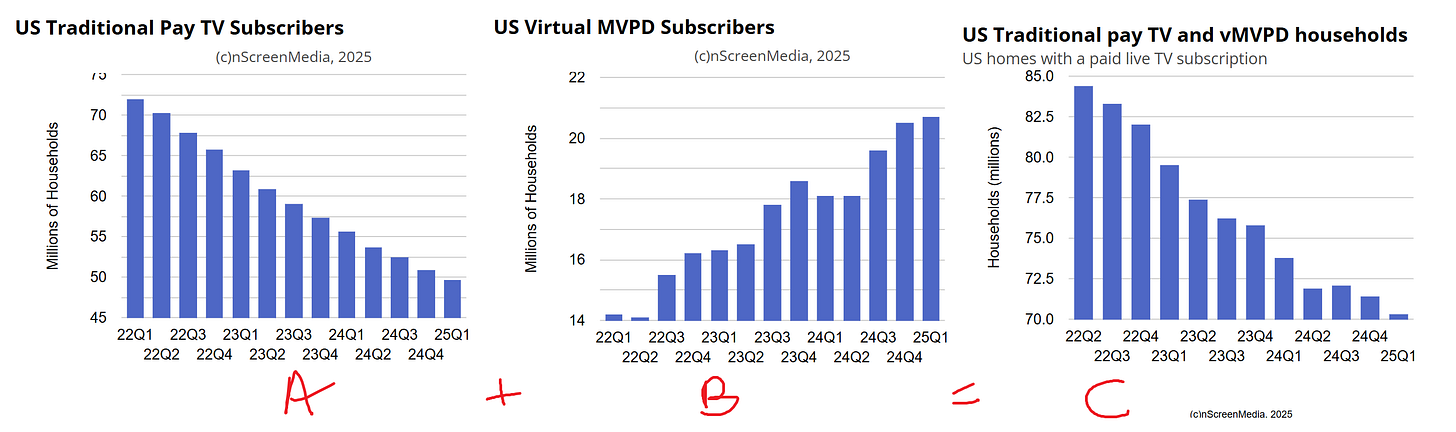

“Traditional” cable subscribers were >100m in 2014 vs. ~50m at yearend 2024, a 6-7% annual decline. Traditional meaning Comcast, Charter, Cox, etc. vs. vMVPD providers like YouTube TV, Sling TV, Fubo, etc. The latter group is growing (mostly YouTube TV), but not yet at a pace to offset traditional cable sub losses.

Where is the cable distribution market headed?

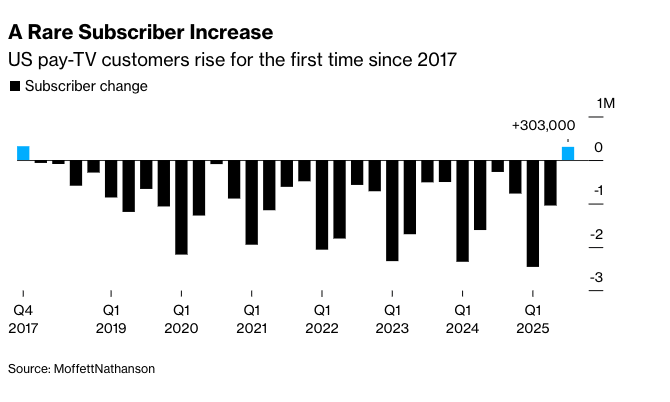

It appears that pay-TV subs may finally be turning a corner? Total subs increased for the first time since 2017 according to MoffettNathanson. (This is a combination of traditional and virtual providers.)

At some point 5-10 years from now, it would seem the virtual providers like YouTube TV will overtake traditional providers and the overall pay-TV market will stabilize. The big questions are: 1) when will that happen; and 2) will the economics for networks be similar under a virtual pay-TV model.

Along the way, I expect cable networks will consolidate for scaled programming costs (in-house production, purchased content, sports rights, etc.) plus add other revenue streams (digital, OTT apps, etc.).

2) Outlook

With that overview of fundamentals + cable distribution, let’s look at where Versant is headed.

Historically within Comcast, cable networks saw little, if any, reinvestment. It was used for distributions and reinvestment elsewhere within Comcast (i.e. theme parks and broadband).

This will change as management invests outside of pay-TV via organic product launches (CNBC retail investor subscriptions, Fandango, MS NOW subscriptions, etc.) and acquisitions.

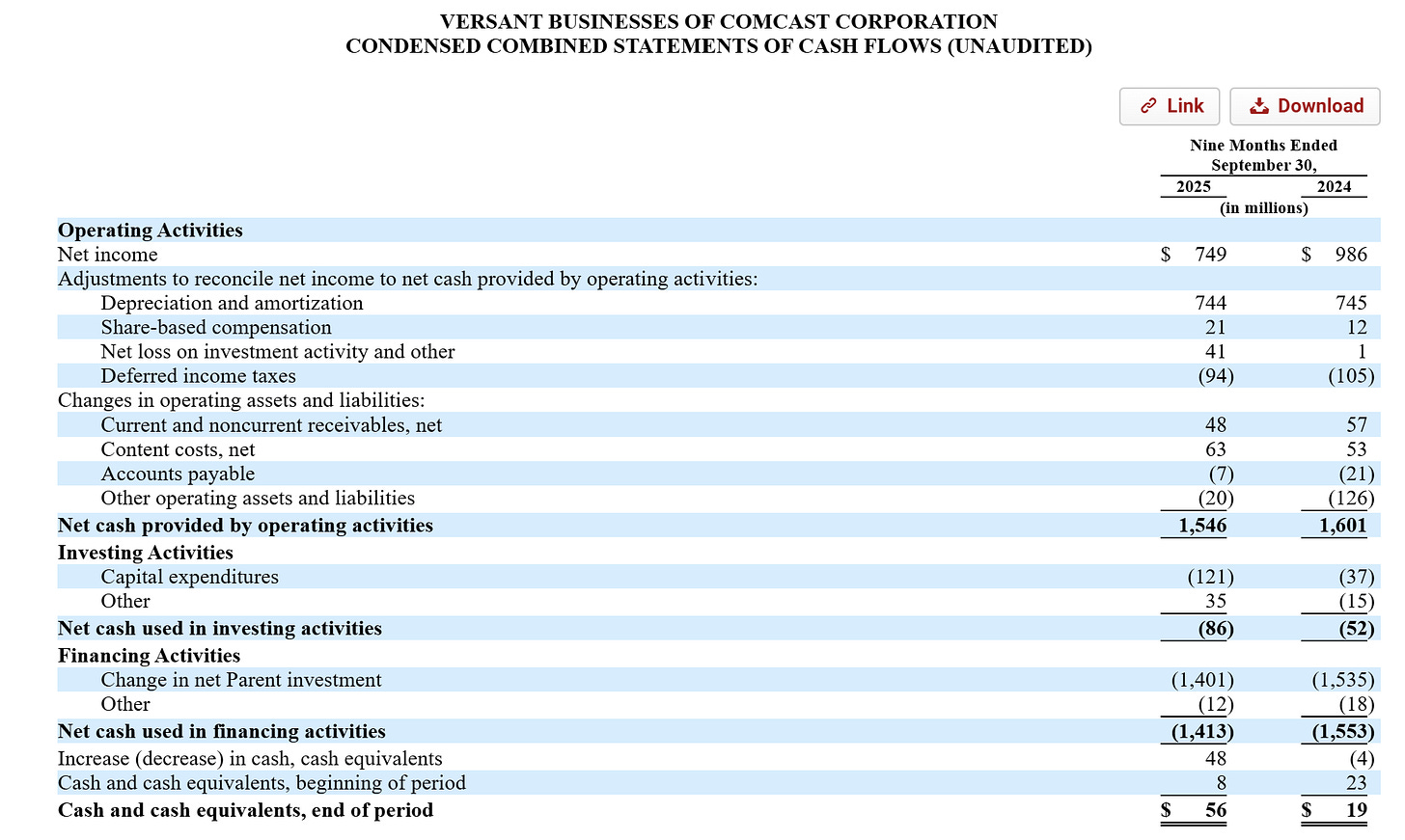

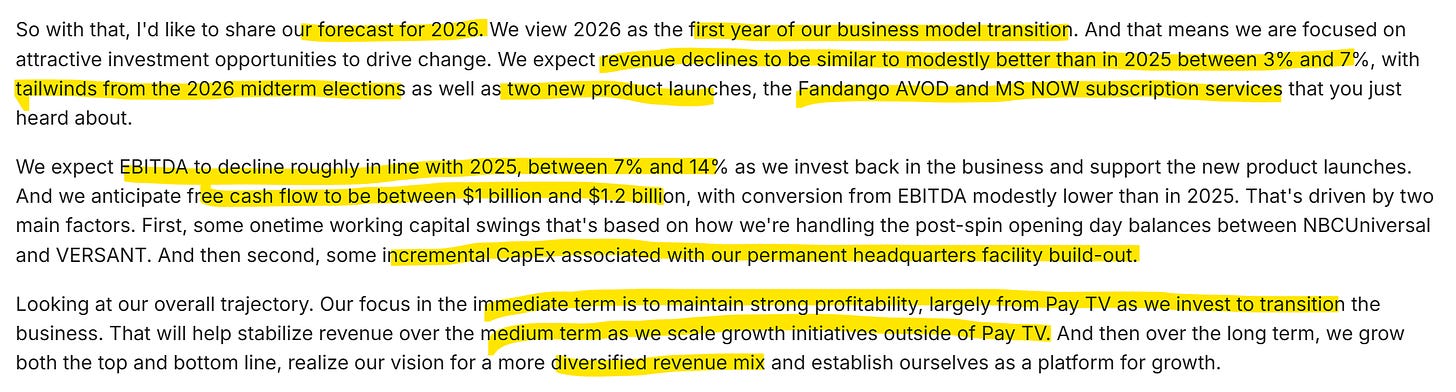

Guidance for 2026 includes investments in at least 2 product launches and capex/WC drag on cash flow:

Sales declining 3-7% = $6.15-6.4bn

EBITDA declining 7-14% = $1.85-2bn

FCF declining 13-27% = $1-1.2bn

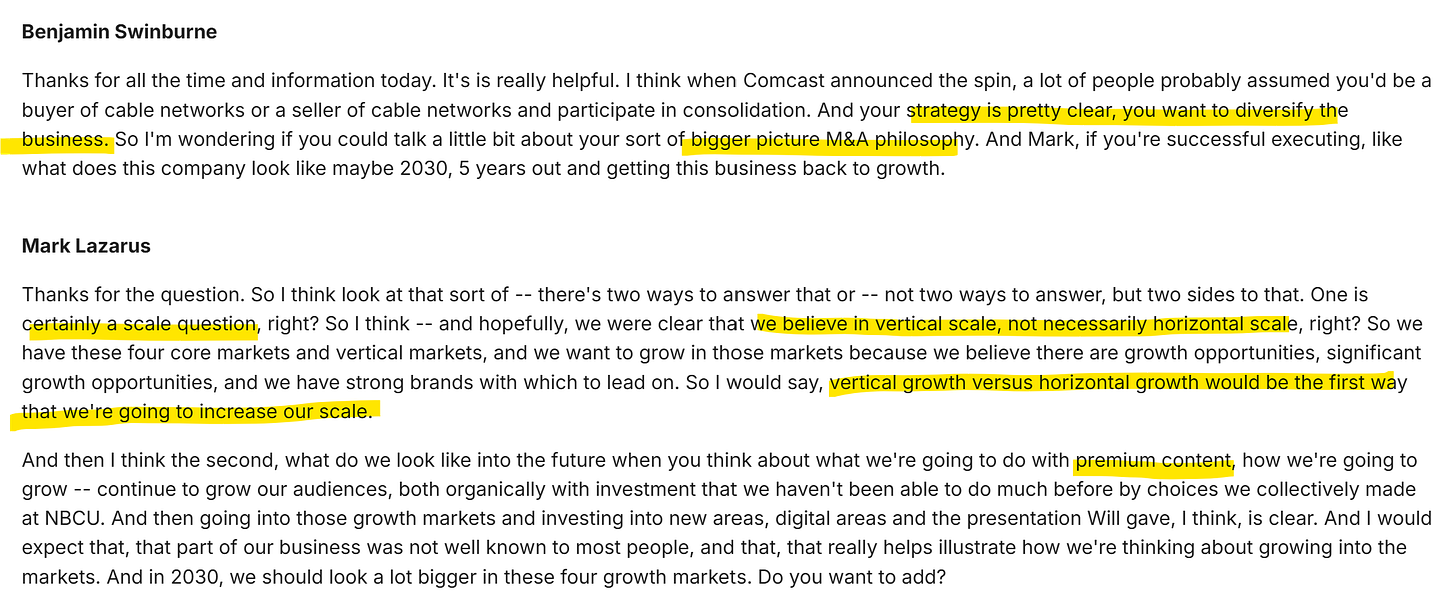

Management spoke about small scale acquisitions to diversify into non-pay-TV revenue sources (targeting 50% of revenue from non-pay-TV by 2030). They explicitly called out their lack of interest in horizontal acquisitions (i.e. buying more linear networks).

3) Valuation

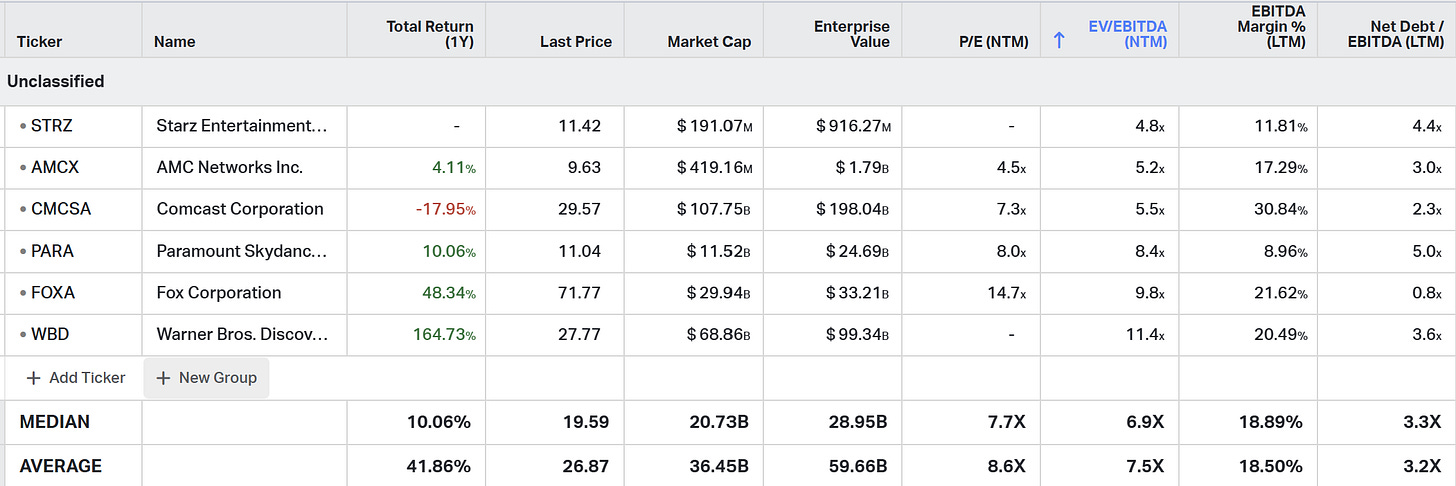

Comps have varying business models and collections of assets. Unless or until we see another pure-play cable network spin, there aren’t great direct comparisons. AMCX is likely the closest peer at this point.

STRZ, AMCX, CMCSA, and PSKY have the lowest valuations at 4-6x EBITDA. Versant currently trades at 4.7x EBITDA, but has an industry-best balance sheet (<1.25x leverage vs. peers at 3-5x).

I’m comfortable using EBITDA as a valuation metric since the add-backs are minimal (no stock-comp add-back which is impressive).

Starting with a near-term valuation using 2026 estimates… low-end guide is $1.85bn, at 4x = $7.4bn enterprise value. Assuming no change in the balance sheet ($2.25bn net debt) = $5.15bn equity value or $36 per share which is 23% downside. This seems very conservative.

On the high-end using $2bn EBITDA at 5x = $10bn EV less $1.5bn net debt (partial credit for 2026 FCF) = $8.5bn equity value or $59 per share which is 26% upside.

Roughly balanced risk/reward at ~1:1 here

What does Versant look like longer term?

This is where you have to start making some assumptions around growth rates, margins, and capital allocation. At the current $47 per share, estimates are extrapolating ~7-8% annual declines in revenue, ~14-15% annual EBITDA declines, and zero value creation from free cash flow.

That’s close to draconian in my view.

Especially with such a strong balance sheet and capacity for deploying capital.

P.S. here’s a video walkthrough of my estimates going out to 2030:

Summing it up…

I’ve been buying CMCSA in the $27-29 range lately as markets are digesting the NFLX/WBD merger, so I’ll soon have a decision to make on Versant.

Versant owns some excellent assets and I probably have a more optimistic view on pay-TV beyond 2030 than the average investor. Two things I’m waiting for here:

I’d like to get a better sense for long-term estimates to see the implied decline rates for sales/EBITDA;

The current when-issued price of $47 works out to ~$1.90 per pre-split CMCSA share (that’s 6-7% of the current $30 CMCSA price); will this thing get puked the first week of January??

With current information, I’m probably buying a full position around $40 and a seller between $60-65.

Disclosure: I own shares of CMCSA

Resources:

Nice writeup on the Versant setup. The $1bn buyback authorization at ~14% of market cap is significant, but what caught my attention is management explicitly ruling out horizontal aquisitions while targeting small M&A for diversification. Historically, declining cable networks have burned cash on bad acquisitions trying to scale legacy busines. The discipline to focus buybacks alongside targeted digital bets looks way smarter.