Quick Value #267 - Markel (MKL)

Struggling insurance operations, activist attention, strategic review, and cheap shares

Today’s post:

Specialty insurer touted as a “baby Berkshire”

Cash & investments (net of debt) at $1,025 per share

Operating income at $152 per share (shares trading at 5.1x)

Activist calling for separation of insurance and operating businesses

Welcome to a free edition of Quick Value. For new subscribers, check out the VDL “home base” for background info, links to key resources, articles, trackers, etc. As always, leave a comment with thoughts or stocks you want to see covered.

Latest posts:

04/14/25 - (AMRZ) Amrize upcoming spin off

04/07/25 - 7 small cap ideas ($)

03/31/25 - (NXST) Nexstar trading at <6x FCF

03/24/25 - (SCHL) Scholastic turnaround + SOTP ($)

03/10/25 - (NGVT) Ingevity specialty chem with activist ($)

02/24/25 - (HTLD) Heartland cheap cyclical recovery ($)

02/10/25 - (KELYA) Kelly Services recent M&A >3x market cap ($)

Quick Value

Markel (MKL)

Ticker: MKL

Price: $1,800

Shares: 12.77m

Market cap: $23bn

Valuation: 1.3x P/BWhat they do…

Markel is an insurance holding company with 3 segments:

Insurance — Specialty insurance and reinsurance focused on primarily long-tail excess & surplus (E&S) lines. Markel has a reputation for conservative underwriting and consistent profitability in this segment.

Investments — Portfolio of equity and fixed income securities (much like Berkshire).

Markel Ventures — A collection of operating businesses in a variety of industries: consumer products, transportation, equipment, construction services, consulting, etc.

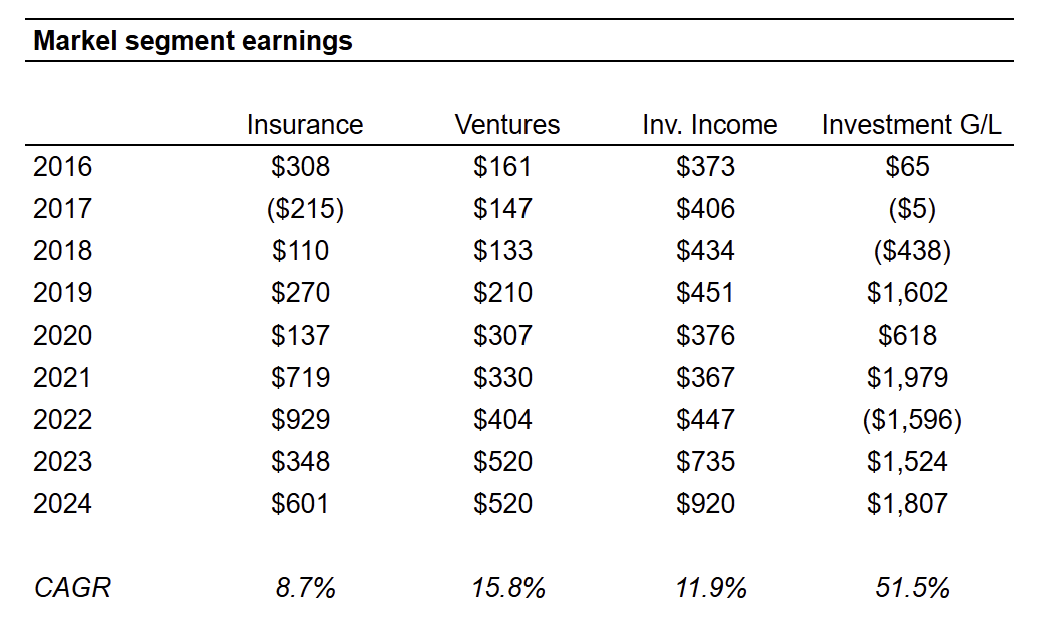

Below is a table of 5-year results on a consolidated basis and by segment:

Markel has a very different insurance business as compared to Berkshire — BRK has a large P&C business selling direct to customers and a much larger reinsurance business. Markel operates mainly in specialty lines with a smaller reinsurance segment and longer tail coverage like professional liability.

Markel Ventures is a collection of operating businesses ranging from commercial food equipment, manufactured housing, fire protection, and IT consulting. Here is the complete list with description, category, year founded, and year acquired:

Revenue is split ~50/50 between products and services with consumer and building products (31%) and construction services (41%) as the largest contributors.

To recap — Markel is a mini-Berkshire in the sense that insurance is the primary capital source used to fund: 1) acquisitions of non-related operating businesses; and 2) public equity investments.

Why it’s interesting…

A quick glimpse at the earlier chart and you’ll notice Markel significantly underperformed “insurance + OpCo” peers Berkshire and Fairfax over a 5-year period. Why is that? Therein lies my interest…

Other investors are noticing the underperformance too. In December 2024, JANA Partners called for Markel to separate the insurance and operating businesses (Ventures).

I’ll comment on a few areas of the business much like my review of Berkshire. The table below outlines operating earnings by segment from 2016-2024:

1) Markel Ventures

Earnings in the operating portfolio grew ~16% from 2016-2024 which is much faster than Berkshire’s 5-7% growth rate. Operating income was $520m and $642m EBITDA in 2024. This segment now contributes 40-50% to consolidated earnings.

Maybe the biggest negative is the limited disclosures relative to Berkshire and Fairfax. We get revenue disclosures but limited information on profitability or KPIs by channel.

With $5.1bn revenue and $642m EBITDA (12.5% margins), this collection of businesses might trade at 8-10x EBITDA as a standalone company. Some credit is warranted on their acquisition program since they’ve had ~$190m impairment charges on ~$4.4bn acquisition spend since 2015 (~4%), better than most!

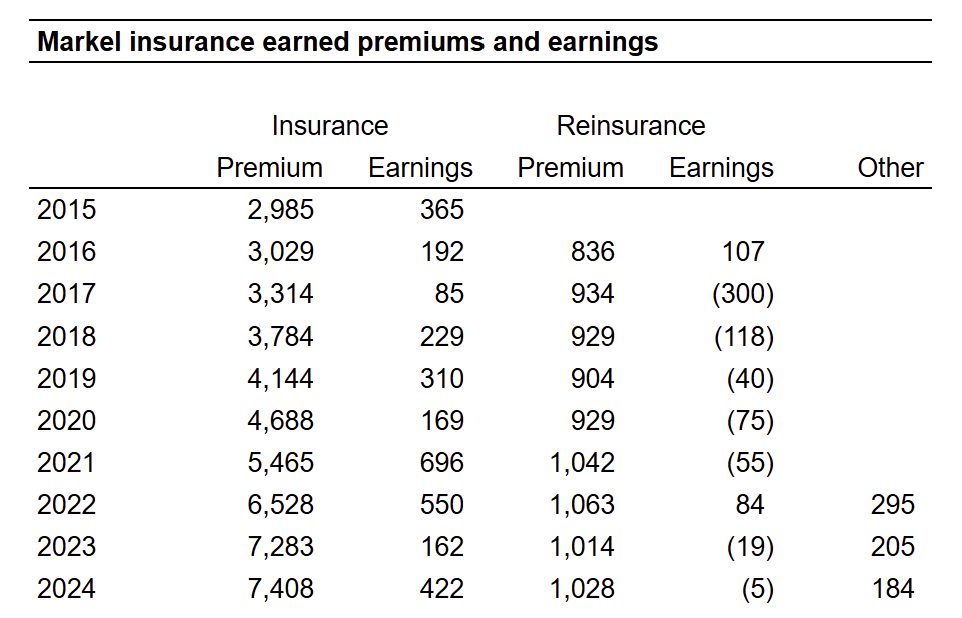

2) Insurance

While Markel consistently generates an underwriting profit (8 of last 9 years and 7 consecutive years of profit), this segment is a big underperformer when stacked against competitors.

Reinsurance operations are regularly losing money and specialty lines haven’t seen meaningful earnings growth despite higher premium volumes. Global insurance peers, especially in reinsurance, are seeing big improvements to earnings recently.

At least management acknowledges there’s work to do here… from the 4Q24 earnings call — “We must improve our insurance results to reach our full potential in the next 5 years.” If they can get this segment right-sized, future earnings growth would be significant.

3) Investments

The Equity portfolio grew from $7.6bn in 2019 to $11.8bn at 12/31/24 with a big chunk of that held in Berkshire (~13%). CEO Tom Gaynor manages the portfolio and has a “quality” investing style. “Through our public equity portfolio, we own interests in many of the best businesses in the world. We seek out profitable businesses with good returns on capital, management teams with integrity and talent and companies that have attractive reinvestment opportunities and are available at reasonable valuations.”

This portfolio is underperforming the market over a 5-10 year period by 100-150bps. Here are the return metrics outlined in their earnings release:

If we take cash and short-term investments ($6.2bn), plus equities ($11.8bn), less debt and minority interests ($4.9bn) = $13.1bn net cash & investments or $1,025 per share. Roughly 57% of the current market cap. Note: I don’t think it’s completely fair to treat this amount as “excess” capital from a valuation standpoint; if you stripped this capital out of the business, it would be very highly levered for an insurer.

4) Capital allocation

Analyzing cash flows is always interesting when it comes to insurers, they constantly need to plow funds into the investment portfolio to cover future claims.

Some notes on capital allocation:

Operating cash flow is steadily growing and hanging around $2.6-2.8bn over the past 3 years ($200-220 per share).

Acquisitions were the main focus from 2015-2021 with $4.2bn spent during that timeframe.

Since 2021, Markel has been feeding the investment portfolio (both bonds and equities) with $8.8bn from cash flow.

Buybacks are ramping from less than $70m per year during 2015-2020 up to $573m in 2024… these are still fairly pedestrian amounts compared to the $23bn market cap (i.e. 2.5% or less)

5) Valuation

Management outlines their approach to valuing the business in the Q4 earnings press release. Here’s the full excerpt with some emphasis:

We use a straightforward methodology to measure intrinsic value that can be recalculated from our financial statements, as detailed in the tables below. Our calculation of intrinsic value is performed in two steps.

First, we take the operating earnings from our three engines – insurance, Ventures, and investments and apply a multiple to arrive at an earnings valuation. We exclude certain non-cash items, such as amortization, as well as income attributed to our public equity portfolio, which is valued separately in our calculation. We apply a multiple of 12 to a three-year average of the calculated earnings. This multiple was selected as it falls within a conservative range when considering the sources of our cash flows. Using a three-year average of earnings helps normalize the impact of cyclicality and non-recurring items to provide a broad measure of earnings-based value.

Second, we add certain items from our balance sheet that are not included in the earnings valuation. The balance sheet component of the valuation consists of adding cash, short term investments and equity securities, then subtracting debt and noncontrolling interests. The sum of the earnings and balance sheet valuation divided by the number of shares outstanding represents our estimate of intrinsic value per share.

Given its simplified nature, this calculation should be viewed as a directional indicator rather than a precise valuation. As of December 31, 2024, our intrinsic value estimate was $2,610 per share, reflecting an 18% five-year CAGR, compared to a 9% CAGR in our stock price. While the five-year CAGR of intrinsic value provides an initial view of value creation, we consider additional factors in evaluating shareholder returns and making capital allocation decisions.

I’m not in love with this approach, but at least they’re consistent in sharing the calculation over time. If net cash & investments (net of debt/minority interests) are $13.1bn, then another way to look at it is you’re getting the operating earnings ($1.94bn) at an implied 5.1x multiple.

Summing it up…

I’m just scratching the surface on this one… there’s a lot more information to digest between past 10-K’s and shareholder letters.

The activist situation makes this one a bit more interesting, and the board / management are already taking corrective action:

In 2025 and beyond, we will continue to improve the foundation of our business. Yesterday, we announced a Board-led review that will include evaluating where we can continue to improve our insurance organization. As part of the review, we will consider ways to simplify our structure, find greater efficiency, optimize our approach to capital allocation and enhance our disclosures.

At today’s price, you’re getting $1,025 per share of net cash & investments and insurance + operating businesses generating operating earnings of $152 per share. If they can fix the insurance businesses, earnings growth could be significant from here. Also, similar to Berkshire, they look over indexed to equities and I’d rather see part of that capital used for buybacks or Ventures acquisitions.

Share your thoughts if you’ve gone deeper on this one!

Disclosure: I don’t own any shares of MKL.

Resources:

Hagerty probably worth $700 million in equity method investments. And maybe back out deferred taxes. Gayner obviously wants to defer taxes indefinitely which has led to some high multiples in the portfolio.

One of the brilliant parts of the portfolio is that when they buy Ventures companies they can take debt against it and treat that debt as high quality capital in the insurance operation.

Overall I do not have a ton of bones to pick with their valuation. Gayner basically wants to count $1 of float as $1 of value which Buffett has outlined many times. Although my understand what Buffet means is that it is because the float was achieved with an underwriting gain and he can invest it anywhere (hence I do not think you should also capitalize underwriting earnings). Anyways, I love this stock. They are going to buy back $2 billion this year. The insurance business should improve. And I think it gets stronger as the markets get weaker because they have a long pipeline of Ventures investments.

I also think Ventures would go off at greater than 10x EBITDA in public markets given my assessment of quality of some of the businesses and the lack of leverage.

Excellent analysis.