Quick Value #290 - ONEOK Inc (OKE)

Large cap midstream energy: shares are cheap + integrating series of acquisitions + solid nat gas outlook = ~12% IRR or better?

Today’s post:

Shares down 30% YTD vs. peers down 1-6%

Historically non-acquisitive business spent $30bn+ in 2 years

Shares trading at <9x EBITDA, 12.5x earnings, and a 6% dividend yield

Acquisition integration + rising natural gas demand = solid 3-5 year outlook

Quick reminder — For newer subscribers, my write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Check out past write-ups here and my home base page here.

Recent write-ups include:

10/20/25 — Net-net in oilfield services ($)

10/13/25 — Solstice spin off from Honeywell

10/06/25 — Divestitures and delevering at Leggett & Platt ($)

09/29/25 — A look at Portillo’s recent struggles

09/15/25 — Axalta Coatings = quality mid-cap chemical business

09/09/25 — Deleveraging catalyst at Synchronoss ($)

08/25/25 — A look at Greenlight’s stake in Fluor (negative EV?) ($)

08/18/25 — Atleos a 20% EPS grower at 10x earnings

Quick Value

ONEOK Inc (OKE)

Ticker: OKE

Shares: 630m

Market cap: $43bn

Valuation: 9x EBITDA / 12.5x P/E

Theme: CheapBackground

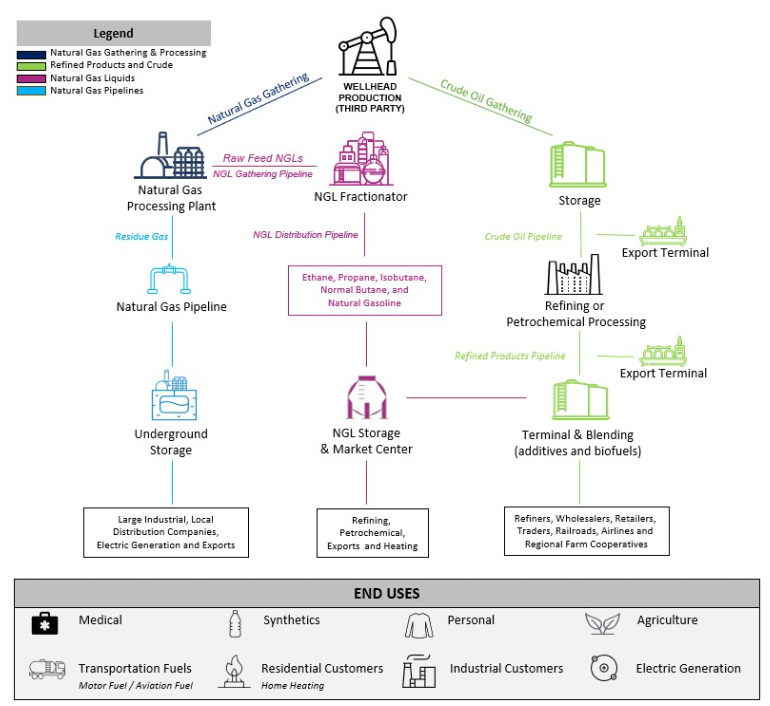

ONEOK is a large cap midstream energy company focused on 4 areas:

Natural gas liquids (37% of EBITDA) — takes NGL from gas processing plants and fractionates for use by customers (mostly petrochemical producers)

Natural gas gathering & processing (28%) — gathers raw natural gas from wellhead and processes it for delivery to pipeline, storage, or customer

Refined products and crude (27%) — storage and transport of crude oil and other products like gasoline, jet fuel, etc.

Natural gas pipelines (8%) — takes processed gas and stores/distributes for end users

This picture from the 10-K is a helpful overview of how ONEOK fits into the supply chain from a producing oil & gas well:

Each segment generates 90-95% fee-based revenue, so results aren’t entirely tied to commodity prices (though some segments range between 80-90% fee-based over the past 5 years).

So what drives revenue? More capacity (more plants or pipeline miles), higher utilization (volume), higher fees.

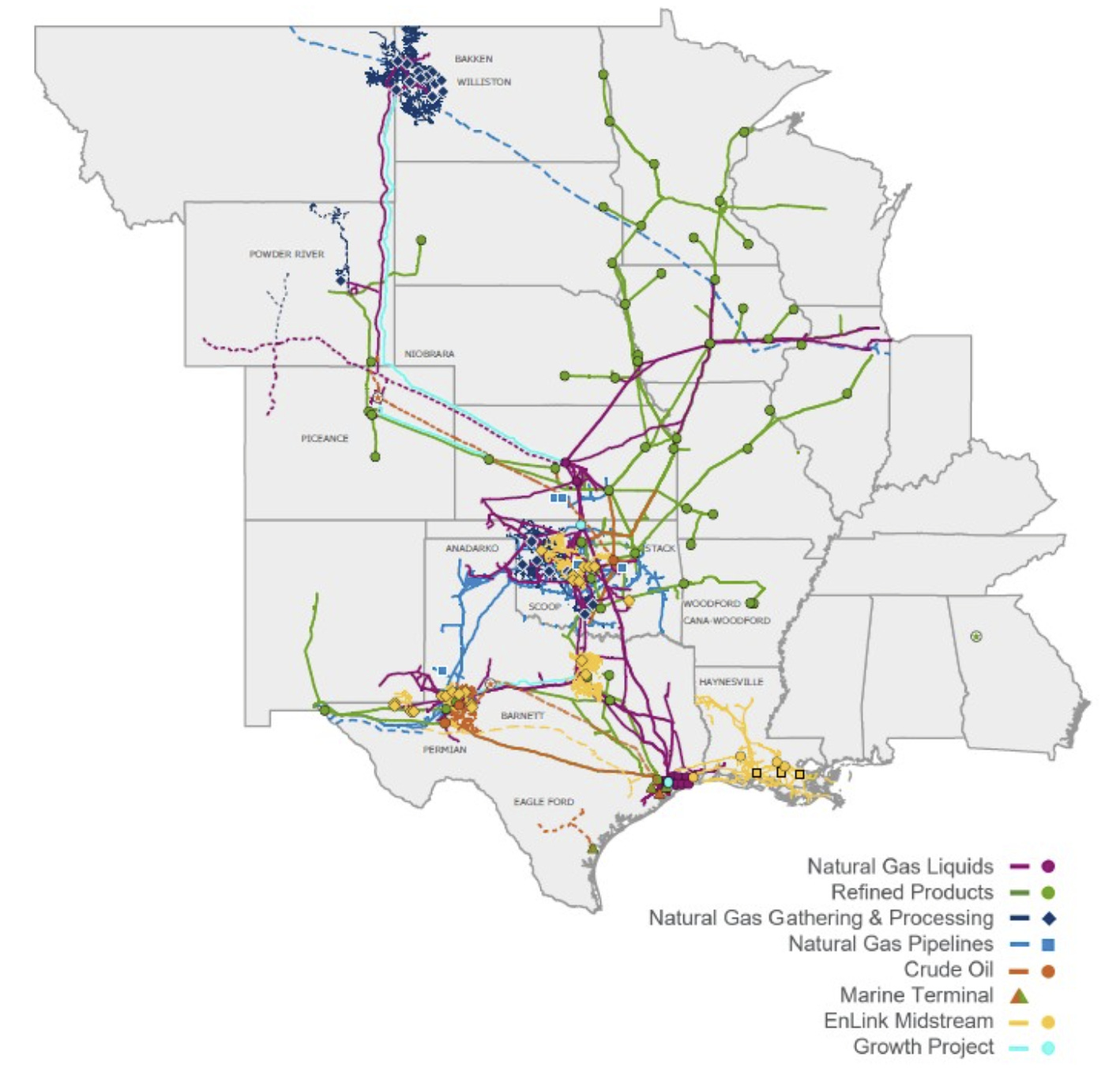

These assets serve virtually all major drilling regions in the central US:

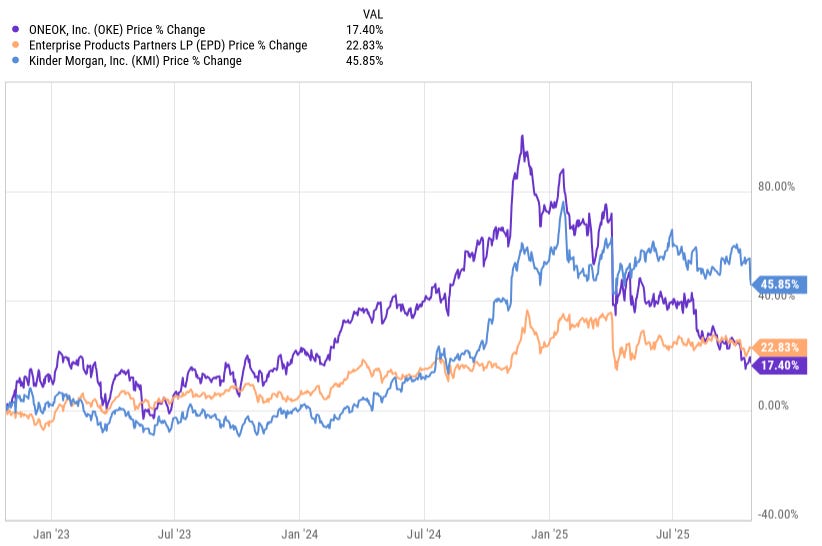

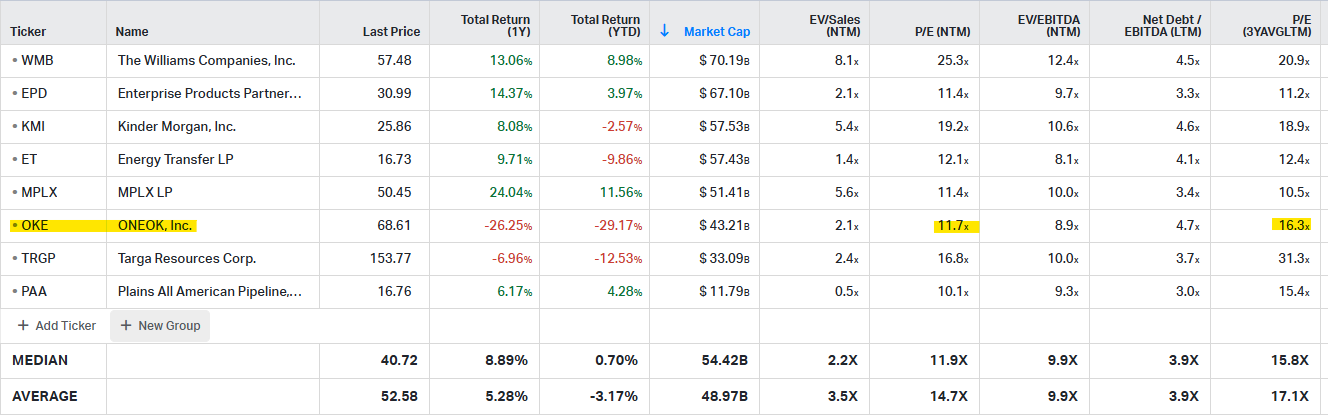

Shares of OKE are down >30% YTD vs. peers EPD and KMI down 1-6%. OKE was outperforming this group as of early 2025.

Why it’s interesting…

Completed a series of large acquisitions

It’s a fundamentally attractive business

Long-term growth should be good

1) Acquisitions

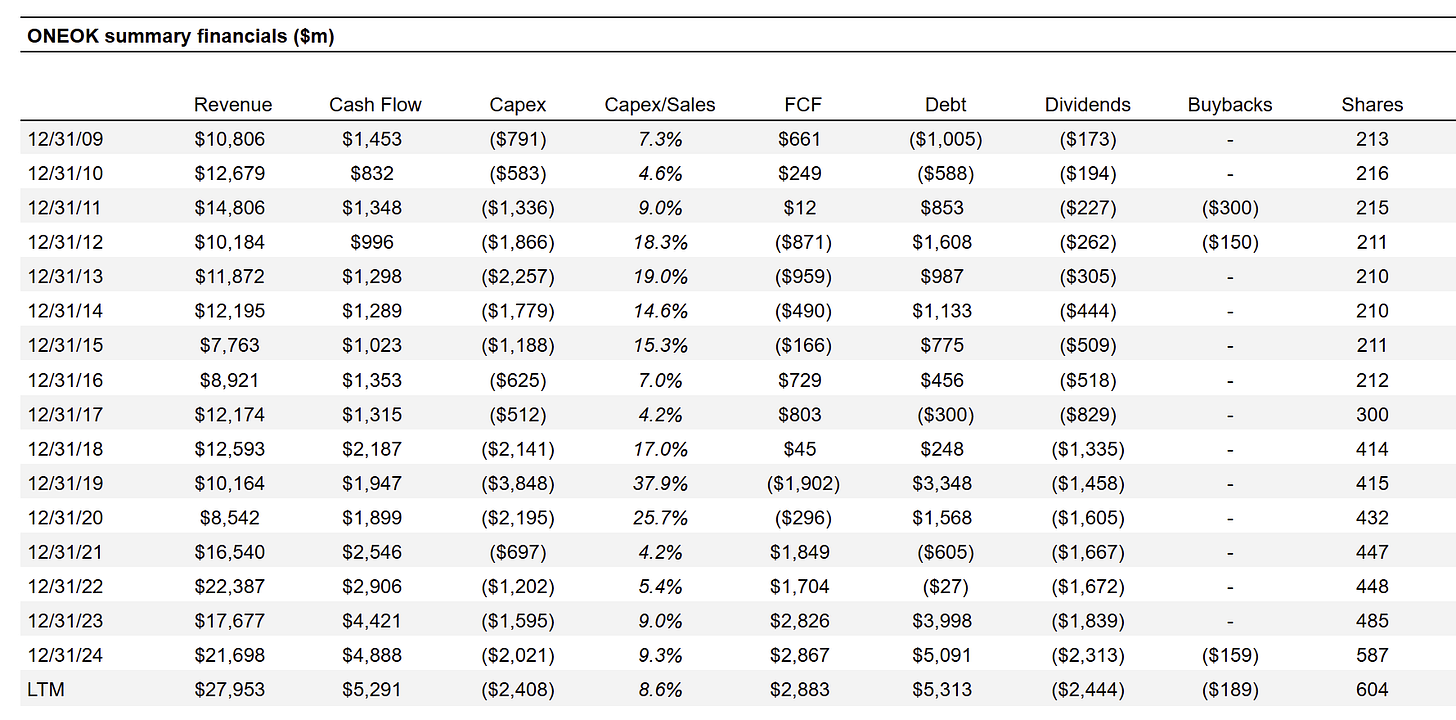

ONEOK is not a highly acquisitive company historically; spending only ~$1.2bn on acquisitions from 2009-2022 (14 years) vs. a current market cap of $43bn.

But in 2023-2024, they made 3 splashy acquisitions totaling ~$10.8bn cash, ~182m newly issued shares (+41% from yearend 2022 share count), and total debt jumping from $13bn to $32bn.

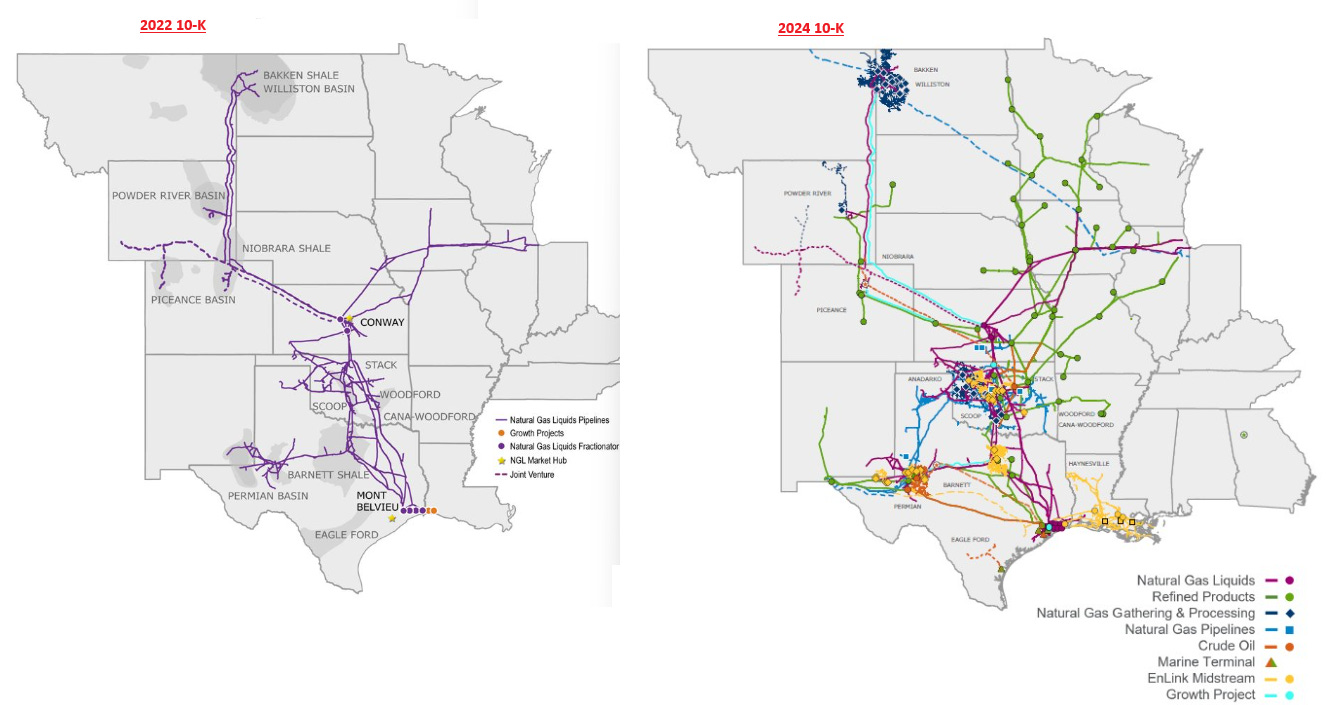

Translation? Over the past 2 years, ONEOK completed reshaped their business.

So what did they buy?

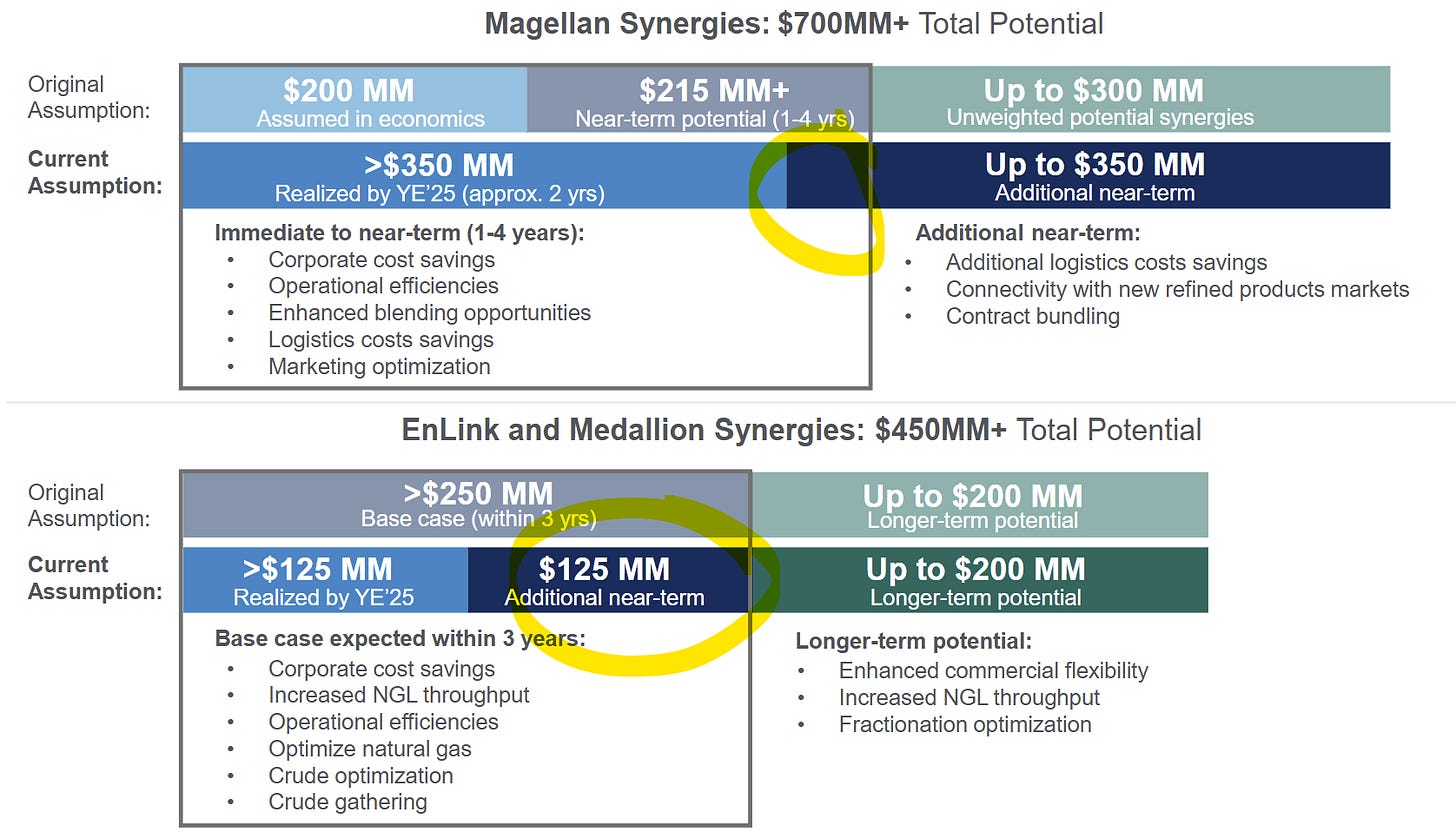

2023 — Acquired Magellan Midstream for $14.1bn (cash & stock) which added crude and refined products pipelines

2024 — Acquired Medallion for $2.6bn (cash) which added crude oil storage and pipelines.

2024 — Acquired EnLink Midstream for ~$7bn which added a mix of gas, NGL, and oil pipeline, storage, and processing plants.

Today, an OKE bet sits at the early part of the integration effort from these acquisitions. Collectively, these deals add density to the OKE geographic footprint, new revenue channels (crude & refined products), export terminals, and additional scale + capacity.

Here’s a quick look at the asset/geography makeup from the 2022 10-K (pre-acquisition) to the 2024 10-K:

Were these good acquisitions?

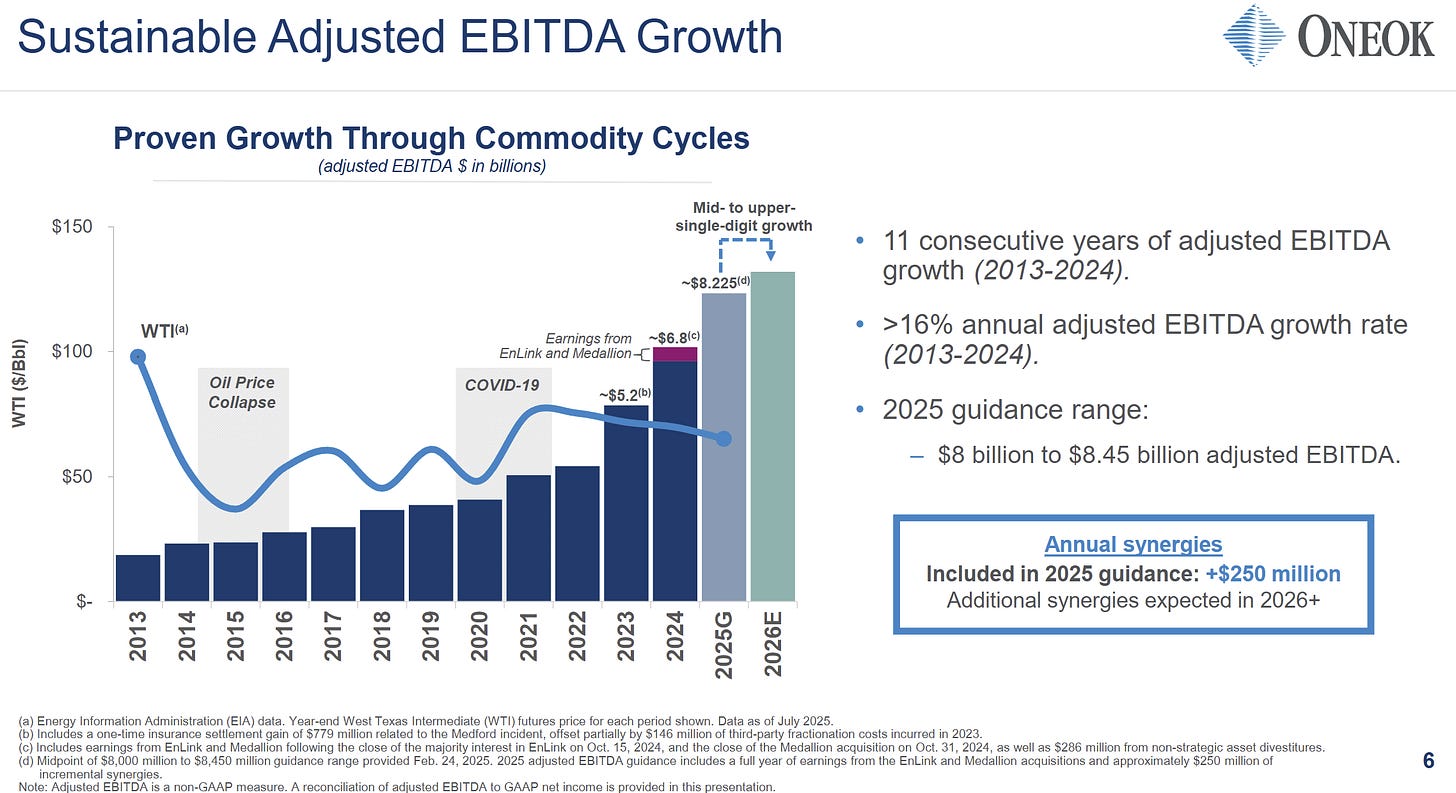

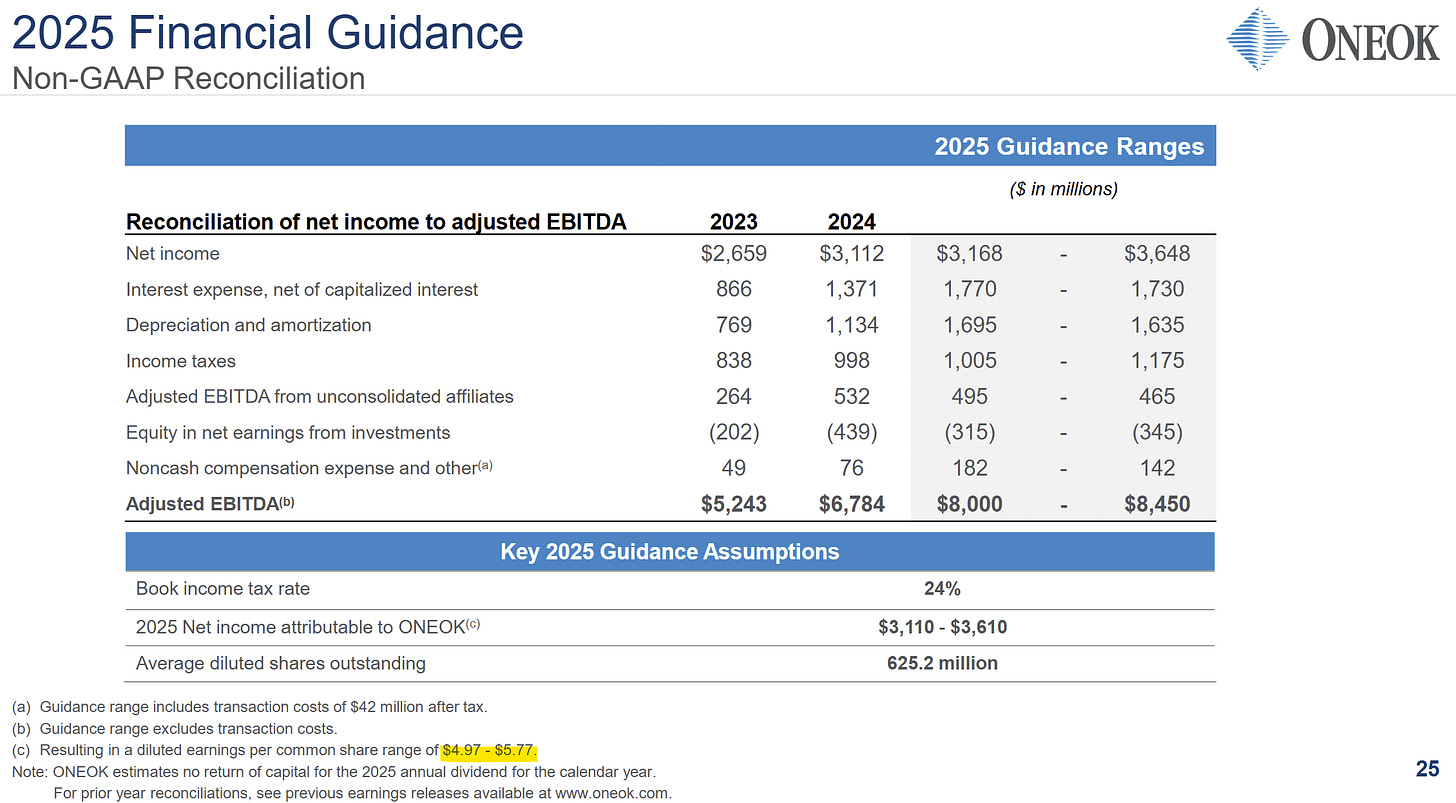

Full year 2022 EBITDA was $3.62bn while 2025 guidance is $8.2bn (+$4.6bn). Since then, they spent $10.8bn cash on acquisitions, added $19bn debt, and issued $12.4bn equity. That’s $42bn spent to buy $4.6bn; call it ~9x EBITDA in total (this ignores organic growth so it’s just a reasonableness check).

Magellan was acquired in late 2023 so most of those cost savings have been realized, but management is guiding to $250m deal-related cost savings in 2025 and another ~$150m or so in 2026.

We should have a clearer picture on whether these were “good” acquisitions with 2026 guidance. Back in Feb 2025, management signaled 15% EPS growth and close to 10% EBITDA growth in 2026 (consensus estimates are much lower than that).

2) Fundamentally attractive business

With mostly fee-based revenue, this is a stable, recurring revenue business model. Investor presentations spend a great deal of time outlining the consistent performance despite commodity price volatility.

Operating cash flow was resilient even as oil prices collapsed in 2015-2016 and again in 2020:

Virtually all FCF is used to fund the dividend (currently $4.12 per share / 6% yield). Like other midstream players, this means consistent debt & equity issuances to fund growth projects and few, if any, buybacks.

Leverage is fairly reasonable even after these acquisitions. At $32bn net debt on $8.2bn EBITDA = 3.9x leverage. Management is targeting 3.5x leverage which should be achievable with another year of earnings growth and balanced capital spending.

3) Growth outlook

For the first time in decades, utilities are becoming a “growth” industry on the back of AI and data center growth. Capex at Facebook, Google, Amazon, and Microsoft went from $70bn in 2019 to $217bn in 2024… with an outlook for even more.

This is leading to record levels of power consumption and therefore more natural gas demand (which powers 40-43% of US generation).

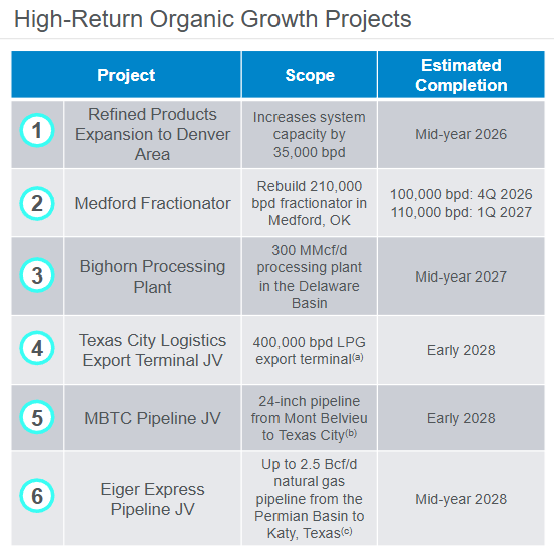

On top of rising gas demand, ONEOK has several expansion projects coming online in 2026-2028. Maybe the most notable is a pipeline and export terminal joint venture with MPLX which should open up international markets.

ONEOK’s financial “algorithm” targets 3-4% annual dividend growth with stable leverage (3.5x). At $68, you’re paying 12.5x earnings (8% earnings yield) + 3-4% dividend growth = 11-12% annual return profile.

What are shares worth?

Peers trade at 12-15x earnings (granted, they have varying business models) and a 3-year average P/E of 16-17x.

If OKE can grow EPS from $5.40 in 2025 to $6+ in 2026, then a 16x multiple (3-year average) = $96 per share (vs. $68 today). Perhaps continued realization of cost savings from deal integration is the catalyst for a re-rate? This price does not seem unreasonable for a stable business with an attractive 3-5 year outlook.

Summing it up…

I’ll need to do some work on peers EPD and KMI to better understand the full picture (I’m new to big cap midstream energy), but it’s an attractively stable business with shares down ~30% YTD and a mix of cost savings + new projects adding to earnings over the next few years.

What I haven’t unpacked yet is why shares of OKE are falling harder than peers recently. Granted, they had a strong run as acquisitions were getting announced in 2023-2024.

Adding this one to my watchlist and may get more excited about it after reviewing KMI, EPD, etc.

Leave a comment if I’m missing something critical to the situation!

Disclosure: no position

Resources:

Great write up Colin!

Few points, you probably already know but just in case

You can't compare P/E between the C-Corp's (KMI, WMB, OKE) and the MLP's, since MLP's don't pay taxes. C-Corp's also have a far wider number of investors that can invest in them, which was the rationale for converting to them for many midstreams.. so C-Corps should trade at a significant premium, but OKE is not right now.

My view on why shares are down: It's just not a clean of a story as many other midstreams with all the noise from the acquisitions, and unlike peers KMI and WMB, it's exposed itself to tax loss selling currently (almost no one holding an MLP can sell for a tax loss unless the holding period is short and the loss is large.) Further issues include disappointing ROI's from recent projects, as well as some short term concerns about missing Q3+Q4 EBITDA targets, primarily because of the commodity environment. This all said, I think a lot of this is priced in already, and if we get a dip after Q3 results, my guess is that it will mark the bottom.

Another follow up comment as I re-read this

"Virtually all FCF is used to fund the dividend (currently $4.12 per share / 6% yield). Like other midstream players, this means consistent debt & equity issuances to fund growth projects and few, if any, buybacks."

This was true about the sector 10 years ago but really isn't true anymore. The majority of the CapEx here is growth CapEx and until this year at least, most is paid for from OCF.

TTM of OKE, OCF=$5.3B, DIV=$2.4B, CapEx=$2.4B(maint. capital $400m of this.)

For ET, OCF=$11.2B, DIV=$4.6B, CapEx=$5.6B(maint. ~$1B)

Also, with OKE, their EPS understates their cash flow as they won't owe cash taxes until 2028 or so..