Quick Value #298 - Becton Dickinson (BDX)

Upcoming RMT transaction set for 1Q26 closing; a look at stub BDX

Today’s post:

Spin/merge with Waters (WAT) set to close in 1Q26

Exit multiple for SpinCo >20x in cash & stock deal

Stub BDX attractively priced today

For new subscribers — these write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Each write-up includes: 1) company background; 2) why the idea is interesting; and 3) fair value estimate.

Check out past write-ups here and my home base page here.

Recent write-ups include:

12/22/25 — Initial look at Versant spin-off

12/01/25 — Gibraltar beaten down on acquisition announcement ($)

11/27/25 — New Aptiv (RemainCo) and Cyprium (SpinCo)

11/17/25 — Turnaround + management change at SWK ($)

11/10/25 — Dole fully deleveraged, cheap, kickstarting buybacks

10/27/25 — ONEOK is a cheap midstream energy co

10/20/25 — Net-net in oilfield services ($)

10/13/25 — Solstice spin off from Honeywell

10/06/25 — Divestitures and delevering at Leggett & Platt ($)

This post is for paid subs, but as a “holiday discount,” grab 20% off for a limited time :) will be back with a free edition next Monday!

Quick Value

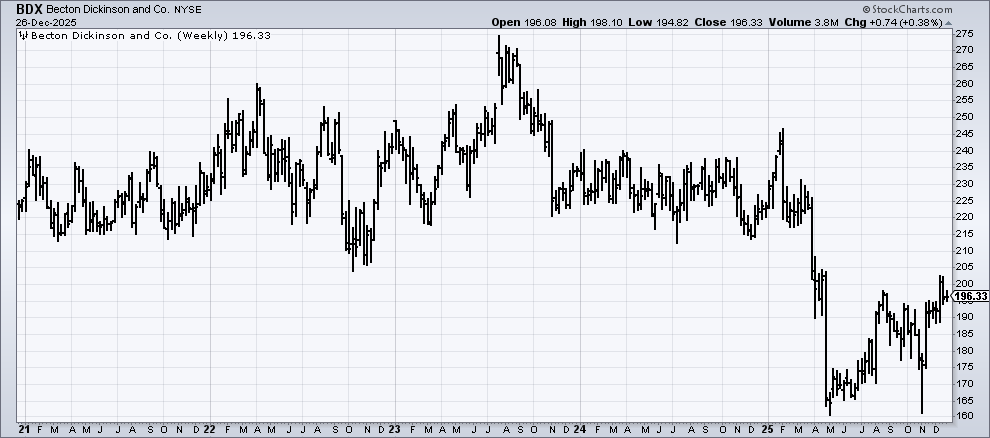

Becton Dickinson (BDX)

Ticker: BDX

Price: $196

Shares: 285.5m

Market cap: $56bn

Valuation: 11.9x P/E (stub)

Theme: spin-off / stubBackground

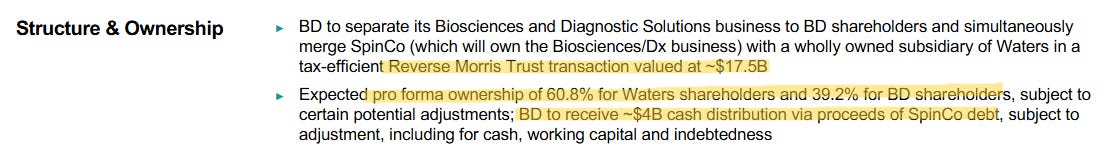

In July 2025, BDX announced it would sell its biosciences & diagnostics solutions businesses in a Reverse Morris Trust transaction to Waters (WAT) in exchange for cash plus stock in the combined company.

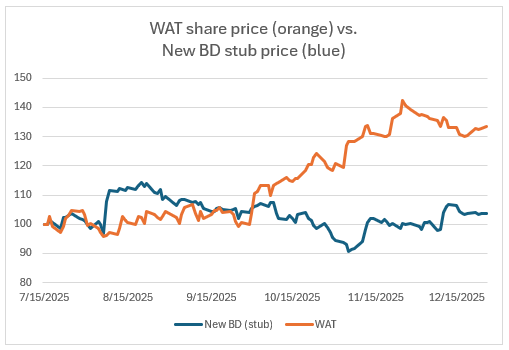

At the time of announcement, Waters was trading at $350 per share which valued the transaction at $17.5bn ($4bn cash + $13.5bn stock). Since then, WAT has appreciated while stub BDX (“New BD”) flatlined, this increases the value of the transaction to ~$18.9bn ($4bn cash + $14.9bn stock).

BDX is reaping a large sum for these businesses at >20x EBITDA and more value is accruing to the stub: