Quick Value #268 - Air Lease (AL)

Multi-year industry tailwinds trading at 9.4x earnings / 0.8x TBV

Today’s post:

Aircraft lessor with a solid growth outlook

Shares trading at 9.4x earnings and 0.8x TBV

Trading at steep discount to peer AerCap (1.3x TBV)

Welcome to a free edition of Quick Value. For new subscribers, check out the VDL “home base” for background info, links to key resources, articles, trackers, etc. As always, leave a comment with thoughts or stocks you want to see covered.

Latest posts:

04/28/25 - (MKL) Markel at a discount to BRK/FFH

04/21/25 - (TEVA) Teva growth & cash flow inflection ($)

04/14/25 - (AMRZ) Amrize upcoming spin off

04/07/25 - 7 small cap ideas ($)

03/31/25 - (NXST) Nexstar trading at <6x FCF

03/24/25 - (SCHL) Scholastic turnaround + SOTP ($)

03/10/25 - (NGVT) Ingevity specialty chem with activist ($)

Quick Value

Air Lease Corporation (AL)

Ticker: AL

Price: $54

Shares: 111.8m

Market cap: $6bn

Valuation: 0.8x P/BWhat they do…

Air Lease is an aircraft lessor founded in 2010 by Steven F. Udvar-Házy. Quick backstory, Udvar-Házy founded and ran ILFC from 1973 to 2010, even after they sold to AIG in 1990. It was eventually sold to rival AerCap (AER)

The business model is fairly simple… They purchase airplanes directly from Airbus and Boeing using mostly investment grade debt and lease them to major airlines under long-term leases (7-8 years) for commercial use . It’s a levered business with scale advantages from a lower cost of capital.

As of 1Q25, Air Lease owns 487 aircraft with $28.6bn net book value, an average age of 4.7 years, and an average lease term of 7.2 years. They manage another 57 aircraft owned by customers.

Air Lease has a large orderbook delivering over the next 5 years, totaling 269 aircraft (~50% of the current fleet).

As of December 31, 2024, we had commitments to purchase 269 aircraft from Airbus and Boeing for delivery through 2029, with an estimated aggregate commitment of $17.1 billion. We have placed 100% of our expected orderbook on long-term leases for aircraft delivering through the end of 2026 and have placed approximately 62% of our entire orderbook. We ended 2024 with $29.5 billion in committed minimum future rental payments, consisting of $18.3 billion in contracted minimum rental payments on the aircraft in our existing fleet and $11.2 billion in minimum future rental payments related to aircraft which will deliver between 2025 through 2029.

AerCap is the lessor industry leader with 1,722 aircraft owned and managed, totaling >$60bn net book value. and an average age of 7.5 years. That aircraft portfolio is >3x larger than Air Lease.

On the leasing side, Air Lease has >200 customer relationships in 70 countries. Virgin Atlantic, Air France, ITA, Vietnam Airlines, and Aeromexico are the 5 largest lessees at 27% of net book value. Lease revenue comes primarily from Asia and Europe (combined ~78%).

Why it’s interesting…

Industry/organic tailwinds

Valuation gap with peer AerCap (AER)

1) Industry tailwinds

First, global air travel is steadily increasing and the lessor business model makes a ton of sense in the context of the airline industry. Most airlines (especially smaller ones), don’t have the cost of capital and earnings stability to act both as a bank (ordering aircraft years into the future) and airline operator (fuel volatility, wage inflation, capex, etc.).

Next, airlines are increasingly moving to a “capital light” model with operating leases instead of aircraft ownership. Per AerCap, the industry went from 32% leases in 2004 to 50% leases in 2024. Both fleet size is increasing and lease mix is increasing. That’s a nice tailwind for scaled players with access to cheap capital.

Last, there are 2 sources of higher future rents for lessors. Aircraft supply (i.e. from Boeing and Airbus) are well below pre-COVID levels which will lead to a multi-year shortage.

And lessor portfolios include COVID-era leases at lower rates which are rolling off and leading to higher overall yields (Air Lease expects 150-200bps of yield improvement over the next 4 years).

2) Valuation gap with AER

Air Lease has 111.8m shares outstanding x $54 = $6bn market cap. Trailing EPS (1Q25) is $5.33 (10x earnings) and tangible book value is roughly $70/share (0.77x). These are a pretty wide gap to AerCap at 9.4x earnings and 1.3x P/TBV.

Why the difference?

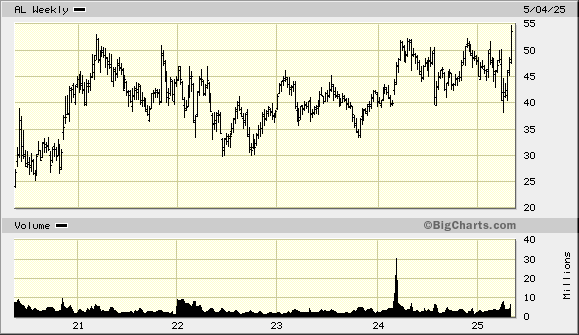

A few reasons come to mind… first, AerCap has grown book value at a significantly faster rate with 13% 5yr growth vs. 6% for AL (see chart above).

Next, AerCap is earning much higher yields on their fleet at 7.7% operating cash flow to average total assets vs. peers at 6% or lower.

Last, these companies have very different capital allocation priorities going on. Air Lease is spending all operating cash flow + borrowing to fund fleet growth via capex. While ALC is focused on organic growth, AerCap has an acquisition-driven history (first ILFC, then GECAS) with buybacks as the main capital allocation tool.

Both companies grew operating cash flow around 5% from 2016-1Q25, but buybacks helped growth in cash flow per share at AerCap (5.1% vs. AL at 4.7%).

AerCap does a nice job in their quarterly earnings presentations outlining the sources and uses of capital over the next 12 months and whether they will have any excess capital available for buybacks.

Based purely on investor relations websites, Air Lease does a much poorer job outlining the story and future path for the business (which makes it interesting).

So we have a steep valuation gap (0.77x TBV vs. 1.3x), a steadily increasing industry, higher yields incoming on the existing fleet, and a large orderbook of new aircraft at 50% of the current portfolio. Plus, Air Lease has a much younger fleet

What could this business look like in a few years?

Let’s say they deploy the entire $17bn orderbook by 2029 with minimal net reduction in fleet/portfolio size. That would bring total assets to ~$50bn from $32bn today. Air Lease is getting 5.2% operating cash flow out of their asset base today which should improve 150-200bps by 2029. Call it 5.4% on $50bn in 2029 = $2.7bn operating cash flow or $24/share. At their 10-year average 3.7x P/OCF = $89 per share for a 13% IRR from today. That has zero buybacks, multiple appreciation, or incremental improvement in yield.

Air Lease should be able to self-fund all of this asset growth and may have some amount of excess capital along the way for buybacks or M&A.

Summing it up…

This post is only scratching the surface of this industry. There are other risks and considerations I didn’t touch on like gain on sale margins and fleet residual values (that murky period in the late stages of an airplane’s life with questionable value and rental yields).

At a glance, it looks like a nice growth story at a reasonable multiple. It’s a finance vehicle so likely won’t ever command a huge multiple, but it trades at a discount both to history and peers.

I’m adding this one to my watch list and will take a closer look at AerCap in the next few weeks.

Resources: