Quick Value #270 - Monro Muffler (MNRO)

$390m auto repair turnaround with GAAP net income & low leverage

Today’s post:

Recession resistant auto repair business

Clean balance sheet ~2x, GAAP net income, and FCF

Turnaround mode with shares down ~80% since 2021

Board ousted prior CEO and hired industry turnaround vet

Welcome to a free edition of Quick Value. For new subscribers, check out the VDL “home base” for background info, links to key resources, articles, trackers, etc. As always, leave a comment with thoughts or stocks you want to see covered.

Latest posts:

05/24/25 - How to read a 10-K

05/19/25 - (ZDGE) Zedge $14m EV with $4-5m FCF ($)

05/12/25 - (AL) Air Lease vs. AerCap

04/28/25 - (MKL) Markel at a discount to BRK/FFH

04/21/25 - (TEVA) Teva growth & cash flow inflection ($)

04/14/25 - (AMRZ) Amrize upcoming spin off

04/07/25 - 7 small cap ideas ($)

Quick Value

Monro Muffler (MNRO)

What they do…

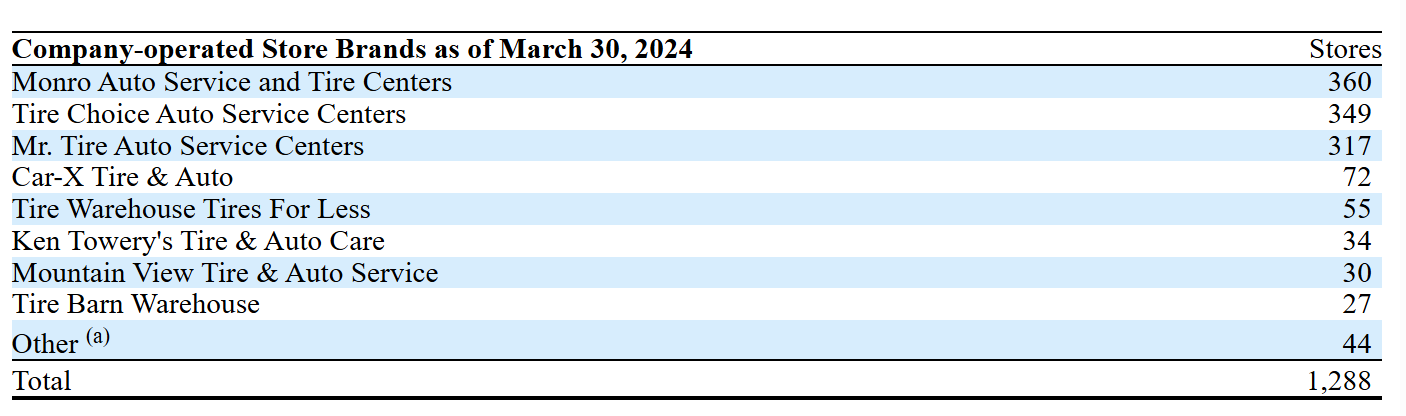

Monro operates auto repair stores in the US. They have 1,263 locations in 32 states with a small number of franchised locations. Auto repair is generally non-discretionary and benefitting from macro tailwinds like aging vehicles and miles driven. Monro is focused on serving the “low income” consumer base with its dealerships.

Overview of locations by brand:

There are ~10,000 locations owned by the top 100 tire dealers in the US. PE-backed Mavis Tire is the largest with >2,000 locations and they’ve been aggressively acquiring, including Midas which will add another >1,000 locations here soon.

The typical format for a Monro store is a free-standing building consisting of a sales area, fully equipped service bays and a parts/tires storage area. Most service bays are equipped with above-ground electric vehicle lifts. Generally, each store is located within 25 miles of a “key” store which carries approximately double the inventory of a typical store and serves as a mini-distribution point for slower moving inventory for other stores in its area.

Services include: tires (~50% of sales), general maintenance (26-27%), brakes (12-13%), steering, batteries, and exhaust work.

Note: Monro is a 3/31 yearend and expected to report 4Q25 earnings soon.

Why it’s interesting…

First, financial performance has been lackluster for years — revenue on a consistent downtrend since COVID, gross margins declining, and operating income is less than half of pre-COVID levels. It’s no surprise the stock has been a dud.

Why?

Sales are flat from 2019 to 2024 at $1.2bn, but gross margins are down 300bps and SG&A is up ~$40m since then. Despite headline revenue performance, the cost structure is killing them.

A big contributor is the competitive market in tires, where Monro gets half of sales. That market is incredibly tough, customers are delaying replacements, trading down to cheaper / lower margin products, and competitors are aggressively expanding. Comps in tires were down 4% in 2024 and another 4% YTD 2025.

The “value” consumer saw a big stimulus benefit during the pandemic and is probably feeling the biggest pinch from inflation and lower discretionary income.

Looking at things another way…

Vehicles serviced (volume) is really dragging (down from 5.8m in 2016 to 4.7m 2024) while pricing is up 6.6% annually and sales per store is fairly stable. It looks like Monro has a big traffic problem.

It’s still a profitable company. GAAP net income was ~$39m in each of 2023 and 2024 (adjusted EPS of $1.36 and $1.33). But the latest quarter is closer to $20m when annualized. D&A is running ~$70m per year and capex at $25-30m per year, so owner earnings are close to $60m ($2 per share).

What about cash flow?

Fortunately, declining businesses spit out excess cash flow as working capital unwinds (at least for a period of time); so cash flow is pretty good lately. Even as operating income fell below $100m, operating cash flow (and FCF) was consistently above $100m. Much of that from working capital inflows (see table):

A few comments on these cash flows and capital allocation:

Repaying debt was a key focus the past few years (2021-2024) and leverage is low even using a lower earnings base

Acquisitions were a core part of capital allocation from 2016-2020, then stopped in ~2022 — this actually flipped to divesting assets in the past 2 years

The dividend consumes $35-36m per year and looks vulnerable here (yield is ~9%)

Buybacks were probably an attempt to help the stock price in FY23-24, but have since stopped

This is still a good cash-flowing business with a clean balance sheet (~$60m debt + ~$270m finance leases = $330m gross debt at 12/31/24) and a somewhat recession-resistant offering.

So where do they go from here?

In March 2025, the Board ousted the prior CEO and immediately inserted Peter Fitzsimmons with previous experience running an auto collision business and auto parts distributor. What’s also interesting is Fitzsimmons is a partner at turnaround firm AlixPartners which Monro engaged to help identify the root causes of their financial problems. Hmm…

The upcoming earnings call this week will be Fitzsimmon’s first as CEO so we’ll get a sense for where he’s focused pretty soon.

Historically, EBITDA margins were >15-17% and comps like DRVN, GPC, VVV, BYD.TO are anywhere from 7% to 25%. Margin improvement and cleaning up revenue performance will be a big piece of the puzzle for Fitzsimmons.

Summing it up…

So what could shares be worth?

Monro is currently trading at $13 with 30m shares outstanding = $390m market cap. Net debt is $320m with finance leases included. That’s a $710m enterprise value.

FCF is expected to continue benefitting from working capital in FY2025 so there may be cash to deploy in fixing this thing up. Maintenance capex is below D&A here (maybe some deferred investment) even with the goofy finance lease accounting. I get owner earnings closer to $30m or $1 per share. Not a bad starting point for a turnaround.

Turnarounds are tough to handicap, but I like the industry exposure and the low(er) level of pressure. This isn’t an imminently distressed company headed for bankruptcy.

It’s premature to get involved here since we haven’t heard from the incoming CEO, but the board is clearly tired of the underperformance. I like to get up to speed and track progress, especially in a business that (in theory) should be more defensible in today’s economy.

Disclosure: no position

Resources:

Probably a buy once they cut the dividend. The 9% yield and 100% payout ratio is a bit concerning.

People need to change the tires afterall.

$290 000 per store was a little bit too cheap, perhaps below a replacement cost.