Quick Value #299 - Cinemark (CNK)

Beaten down on fears of NFLX/WBD deal; stock is cheap and capital allocation inflecting

Today’s post:

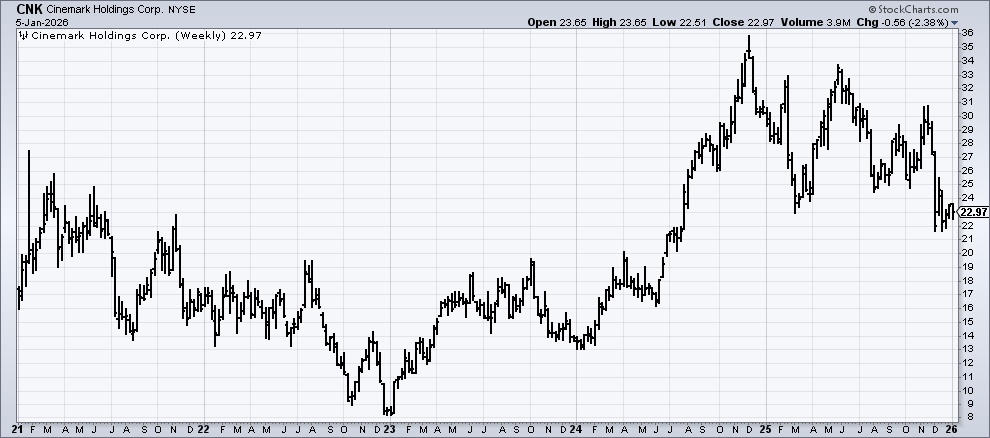

Classic beaten down stock — shares down from $36 to $23 over past year (-36%)

Capital allocation inflecting away from debt, toward capital returns

Potentially overblown fears from Netflix/Warner acquisition

Stock trades at ~10x FCF and <7x EBITDA

For new subscribers — these write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Each write-up includes: 1) company background; 2) why the idea is interesting; and 3) fair value estimate.

Check out past write-ups here and my home base page here.

Recent write-ups include:

12/29/25 — A look at stub Becton Dickinson ($)

12/22/25 — Initial look at Versant spin-off

12/01/25 — Gibraltar beaten down on acquisition announcement ($)

11/27/25 — New Aptiv (RemainCo) and Cyprium (SpinCo)

11/17/25 — Turnaround + management change at SWK ($)

11/10/25 — Dole fully deleveraged, cheap, kickstarting buybacks

10/27/25 — ONEOK is a cheap midstream energy co

10/20/25 — Net-net in oilfield services ($)

10/13/25 — Solstice spin off from Honeywell

10/06/25 — Divestitures and delevering at Leggett & Platt ($)

Quick Value

Cinemark Holdings Inc (CNK)

Ticker: CNK

Price: $23

Shares: 119m

Market cap: $2.74bn

Valuation: 11.9x P/E (stub)

Theme: beaten downShares of media companies were selling off hard leading up to the announcement of the Netflix/Warner acquisition which fits my theme of looking at beaten down stocks. Cinemark was trading at $30+ in November and now sits at $23.

Let’s see if there’s an opportunity here.

Background

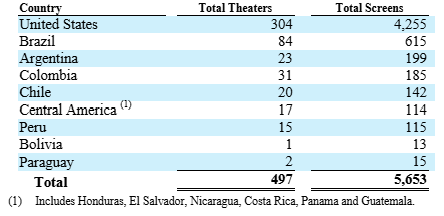

Cinemark is the #3 movie operator behind AMC and Regal with 497 theaters and 5,653 screens in the U.S. and Latin America (of which, 304 theaters & 4,255 screens in the U.S.).

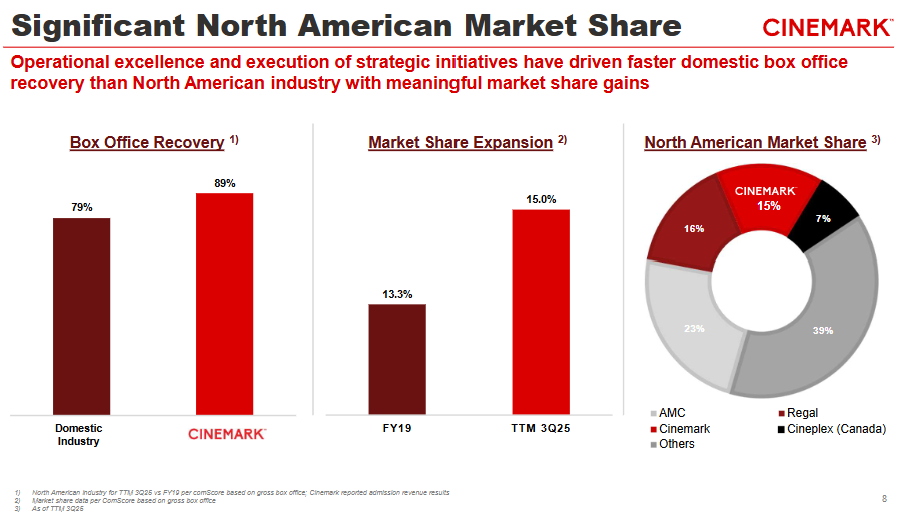

Market share, currently at 15% of North America, is growing since 2019 with smaller theaters being market share donors.

The business model essentially has 2 components to it: 1) admissions (ticket) sales; and 2) concession sales (popcorn, snacks, soda, etc.). Ticket sales operate under revenue-share agreements with movie studios and Cinemark keeps ~43-45% of each dollar sold. Sort of like a gas station, the ticket (gas) is a loss leader while concessions drive most of the profit (81% product margins).

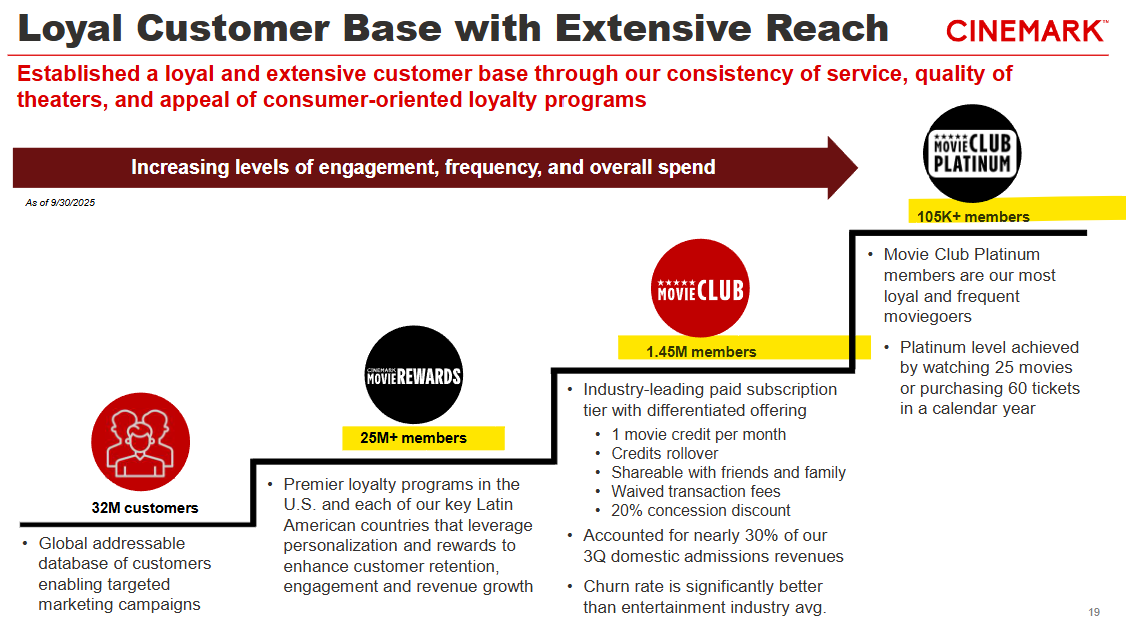

Cinemark has the industry’s largest paying loyalty member base at 1.45m Movie Club subscribers. Plans start at $10.99 per month which is cheaper than both AMC and Regal loyalty programs. It won’t ever be a Costco model since they still need to share these revenues with the movie studios; instead, the goal is to drive loyal fans into seats and pay for concessions.

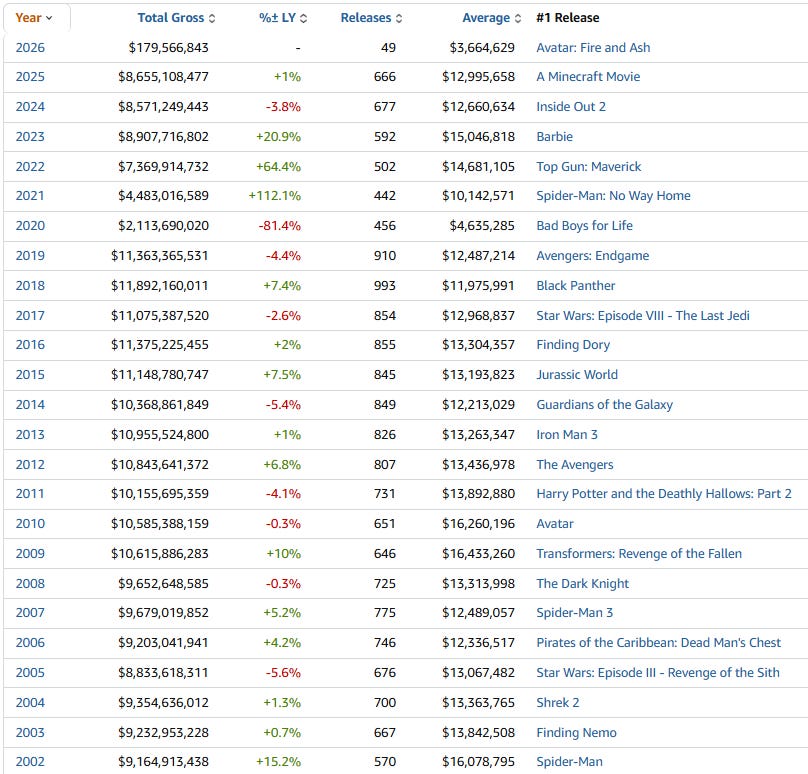

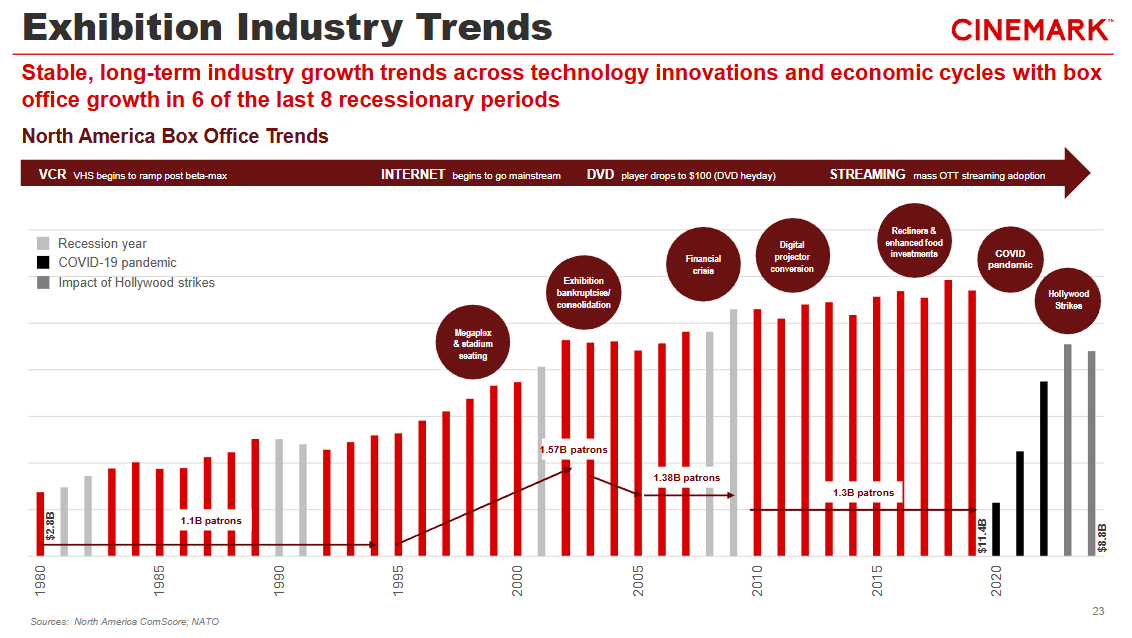

Movie theaters are driven largely by the number of film releases each year and the success of those films (box office). It’s an industry that was significantly impacted by COVID and again from 2023 Hollywood writer strikes.

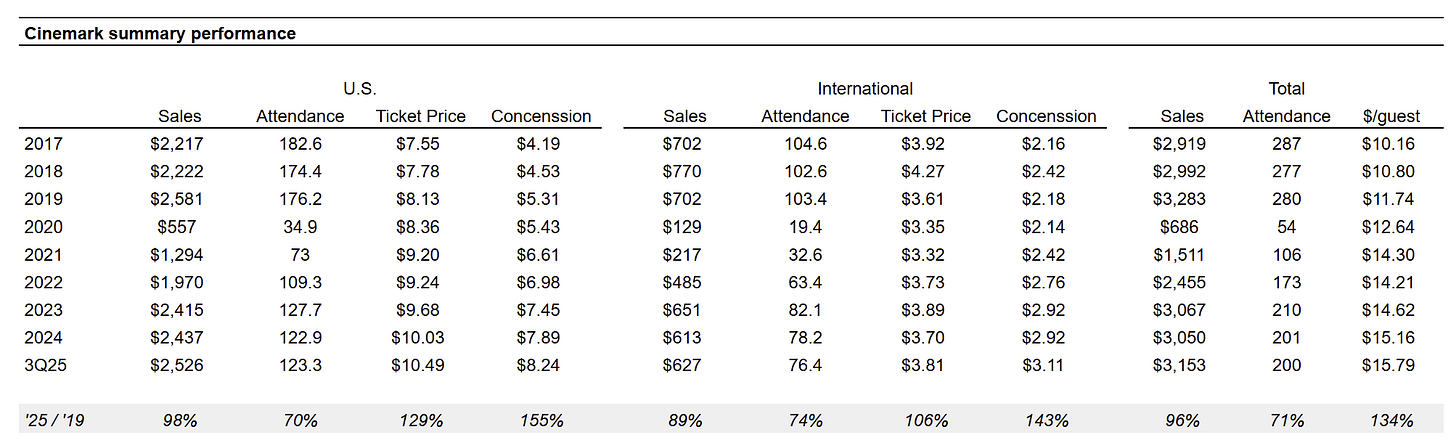

Total attendance for Cinemark theaters was 200m as of 3Q25 (TTM) compared to 280m in FY2019 (i.e. ~72% of pre-COVID levels).

Why it’s interesting…

Total box office sales are still only ~76% of pre-COVID levels ($11.4bn) and volume is similarly down.

Despite this, Cinemark is generating ~96% of 2019 sales levels from increased ticket pricing and concession spending.

Yes, this means volume is down/declining while prices are increasing substantially. It may not be sustainable at this pace, but it does make the subscription package more enticing.

Financials

Fundamentals are solid because the margins are so much higher on concession revenue. Concession sales per guest was $8.24 as of 3Q25 vs. $5.31 in 2019, a 55% increase.

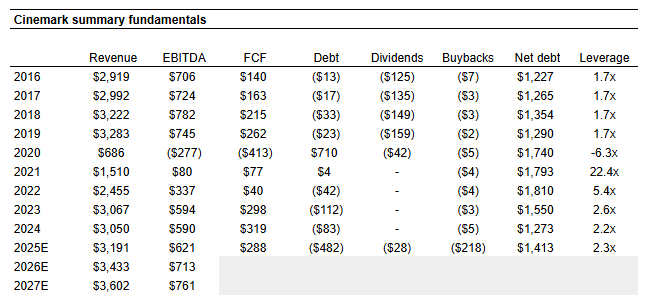

Prior to the pandemic, Cinemark (and rival theater chain AMC) were big dividend payers. Both eliminated their dividends in 2020 and borrowed heavily to survive.

Since 2021, nearly all free cash flow was used to repay debt.

That capital allocation policy is turning a corner in 2025 with $200m spent on buybacks at an average price of ~$25 and a dividend reinstated.

Outlook & valuation

Industry results were severely impacted in 2024 (and to some extent 2025) from Hollywood writers and actors strikes. This had a delayed impact on production and film releases which has analysts excited about the potential for 2026 box office performance (most estimates are +10%).

Cinemark EBITDA estimates are steadily climbing as a result:

CNK has ~119m shares outstanding (per Q3 earnings call) x $23 = $2.74bn market cap. Net debt (excluding leases) is ~$1.42bn for a $4.16bn enterprise value.

FCF was $288m as of 3Q25 (9.5x P/FCF) and EBITDA estimates are $620m for 2025 (6.7x EV/EBITDA). Shares have historically traded between 8-9x EBITDA.

At 8x 2026 EBITDA estimates of $717m = $5.74bn EV or $4.32bn equity value. That works out to $36 per share vs. $23 today (+57% upside). It’s also where the stock was trading for parts of 2024 and 2025. Last, it gives no credit to future capital allocation despite a 10%+ FCF yield.

Hmm…

If you believe in the 2026 film slate, then shares could be extremely cheap here.

Management is hinting at continued buybacks and looking at M&A to improve their footprint.

I don’t own shares of this one and I’ve glossed over some of the risks here (i.e. heavy international ops with currency risks), but I like the setup and plan to do some additional work.

Disclosure: no position

Resources:

$CGX.TO - Similar valuation, considered a takeout target, has misc businesses that can be sold to delever, CEO leaving and some small activist pressure. Also worth watching.

The elephant in the room is that domestic movie tickets sold per capita peaked in 2002 and has declined by over a third since then. So the industry was a slow, secular decline even prior to the pandemic. Matthew Ball put out some good work on this a year or two ago, but there are plenty of other places to get the same info.

Also, this industry is (obviously) capital-intensive and individual cinemas tend not to be permanent assets.