Quick Value #250 - 2024 Recap

At least 40 tickers mentioned, a recap roundup of 2024 ideas and some stuff for next year.

Will be skipping the usual format of a new idea quick review this week. Instead, I want to tackle 4 things:

Some lessons learned from 2024

Top articles from the year

Themes, charts, and macro stuff

Trading highlights, position notes, and current recs

1) Lessons learned

2024 tested our patience as value investors.

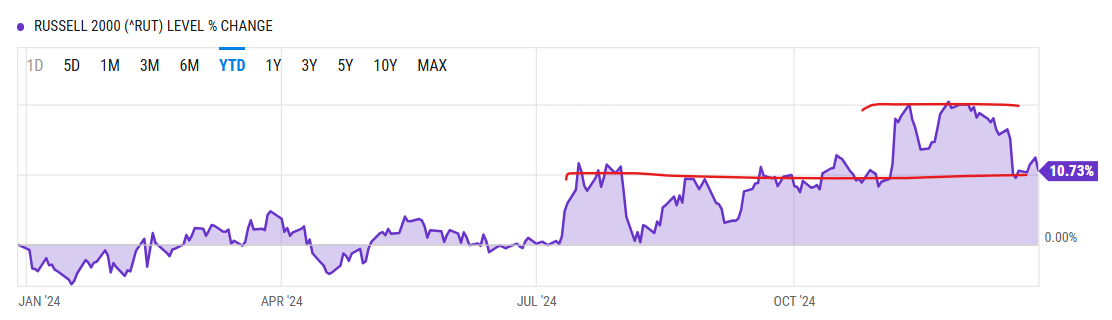

Index returns are looking great in 2024 — S&P 500 is +27% and Russell 2000 +12% YTD — but intra-year price action to get there was way more volatile than those returns indicate. R2K was +10% on the year by ~July… gave it all back, gained it all back, gave it back again, gained it back again, spiked to +20% on the year and gave that back to the current ~10% YTD gain.

Same story with the VIX… it started and finished 2024 at ~13-15… but spiked to ~40 in August and hit 20-30 another 5 times throughout the year. So it felt more like 2022 or 2018 than 2023.

Some takeaways from this year’s investments:

Mean reversion bets still work — HBB and CCSI were good performers in this camp — I’m oversimplifying a bit here, there are still tons of variables at play (business deterioration, changes in growth, industry changes, rate environment, etc.), but it pays to review current valuation against historic median + peer group + absolute return objective. I’m looking to buy a business at 7x with historic valuation at 10x, peers at 11x, and a fixable perception.

Don’t need to overanalyze obvious bets — I enjoy deep-dive research, but sometimes all it takes is an hour of focused work and a quick competitor analysis to make a well-informed decision. These situations are much easier with reliable management teams and clean (mostly unadjusted GAAP) financials. They also don’t come along that frequently… I felt I got only one true “no brainer” in 2024 (HBB) and perhaps have one in the portfolio right now. Out of the 50-60 ideas researched this year that’s a 3-4% hit rate on no brainers.

Cheap stocks can (and will) get cheaper — Don’t buy a business just “because it’s cheap.” Maybe a violation of the mean reversion comment earlier but I felt this a few times in 2023-2024 (SIRI comes to mind). Maybe this is why Burry prefers to see technical support before buying. Also why I like multi-year flattish price charts with minimal volatility.

Where are “normal” results — At this point, we’re technically a few years removed from COVID, but the demand/cost/inventory impact still lingers for many industries. Several of these have been falling knives (ATKR comes to mind as I type this). Will 2025 be closer to a “normal” year of operations from some of these industries? Are any of these businesses operating at a new baseline (I’m specifically thinking of unprofitable businesses in ~2017-2019 timeframe that have sustained profits from 2021-2024). Maybe I need steer clear of these for a bit longer.

Special situations still working — The definition of “special sit” is getting looser it seems; I define them as an upcoming hard catalyst or a very recently completed catalyst (i.e. less than 1yr post-spin or post-reorg)

Successfully navigated this year

Vista Outdoor (VSTO) spin/takeover, closed

Diebold (DBD) post-reorg, closed

National Cinemedia (NCMI) post-reorg, closed

Kellogg (KLG) spin, closed

Sandoz (SDZ) spin, still holding

Phinia (PHIN) spin, still holding

Missed these ones — Knife River (KNF), GE Vernova (GEV), and sold my Everus Construction (ECG) shares way too soon

Losers (so far) — Sirius XM (SIRI) split off

Still working — MAGN spin (sold BERY stake), AMTM spin, SOLV spin

Quick Value idea generation working — My goal with this blog is to turn over a new stone each week. Virtually every holding in my portfolio came from a Quick Value write-up. Sometimes right out of the gate and sometimes months (or years) later. I write this research for myself, in the hopes I’ll revisit my notes, check my numbers, valuation, forecast, etc. Most of the paywalled posts are active buy recommendations but the free posts are good too, just a bit larger cap and fewer special sits — I bought URBN after profiling it in August and shares are +40-50% since then (recently sold my position).

2) Top articles

On the free side, here were some popular articles from 2024:

11/18/24 - (JELD) Door/window maker, beaten up, difficult turnaround

11/04/24 - (CURB) Net cash REIT spin-off, still very early

10/10/24 - (GXO) Contract logistics formerly part of Brad Jacobs complex

07/29/24 - (J) Reviewed the AMTM spin/merge and standalone J

06/17/24 - (KMT) Drill bit maker starting to look like a coiled spring

04/08/24 - (CCSI) OldTech trading at 3.5x FCF (very lucky on this one!)

03/25/24 - (SOLV) Healthcare conglomerate spun from 3M

03/11/24 - (GEV) GE Vernova spin-off (missed out on this one)

01/22/24 - (AAP) Reviewed at $63 (now $45), still early innings turnaround

From this group — I’m getting interested in GXO again (solid multi-year growth story, not expensive); CURB is still interesting as a net cash REIT, though I’m not yet convinced; I’ll keep JELD on the list since it could be a 2-3x if they figure out the turnaround; AMTM/SOLV are current holdings.

Here were some of the top paywalled articles from 2024 (including a recommendation roundup in November 2024):

12/09/24 - ($) Nanocap turnaround story with net cash at 0.1x ev/sales

11/11/24 - ($) Overview of open recs and one-liner pitch on each name

10/14/24 - ($) Small-cap spin/merge (RMT) which closed last month

09/16/24 - ($) Consumer cyclical (not retail/restaurant) entering “share cannibal” territory

09/03/24 - ($) OldTech growing, net cash, trades <9x FCF, buying back stock

07/08/24 - ($) Dirt cheap retailer at <4x EBITDA and ~debt-free

02/12/24 - ($) Pair of energy MRO distributors (guesses welcomed)

Each of these are still open recommendations and holdings.

3) Themes I’m watching in 2025