Quick Value #286 - Portillo's (PTLO)

Clobbered since IPO, now looks like a turnaround + management change story.

Today’s post:

Shares down 83% since 2021 IPO

Trading at ~8x EBITDA with >3x leverage (on lowered guidance)

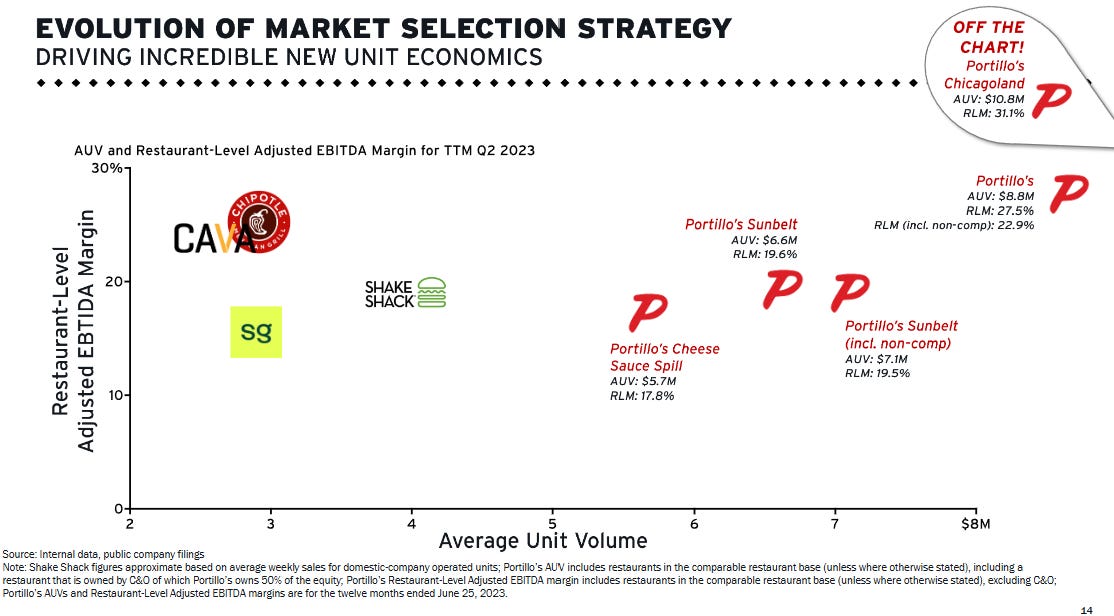

Great unit economics ($8-9m AUV) compared to fast-casual restaurants

Recently cut 2025 guidance and CEO resignation — potential for change?

Quick reminder — For newer subscribers, my write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Check out past write-ups here and my home base page here.

Recent write-ups include:

09/15/25 — Axalta Coatings = quality mid-cap chemical business

09/09/25 — Deleveraging catalyst at Synchronoss ($)

09/02/25 — Special situation in Pitney Bowes (PBI)

08/25/25 — A look at Greenlight’s stake in Fluor (negative EV?) ($)

08/18/25 — Atleos a 20% EPS grower at 10x earnings

08/11/25 — Sangoma Technologies turnaround-to-growth transition ($)

08/04/25 — My sourcing list and watchlist process

06/02/25 — Mid-year review of recommended ideas ($)

05/24/25 — Guide to reviewing a 10-K

Quick Value

Portillo’s Inc (PTLO)

Ticker: PTLO

Price: $6.30

Shares: 75.3m

Market cap: $475m

Valuation: 8x EBITDA

Theme: Beaten downI’m seeing a lot of chatter on PTLO lately and figured I’d see what all the fuss is about…

Background

Portillo’s is a “fast casual” restaurant chain with 94 locations as of 2Q25. The company was founded in 1963 with a menu of Chicago-style hot dogs, Italian beef sandwiches, burgers, fries, shakes, cake, etc.

History

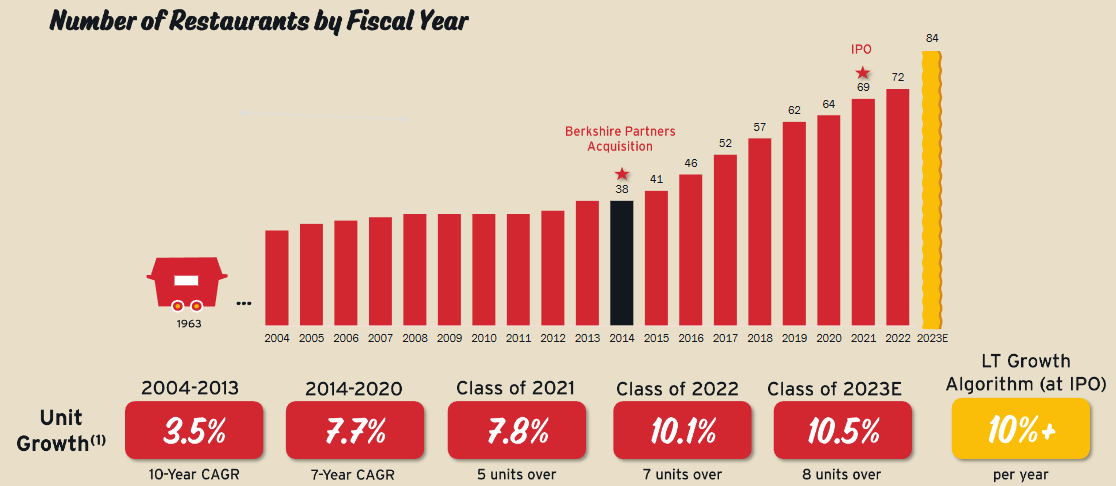

2014 — Berkshire Partners takes stake in privately held Portillo’s

2015-2020 — Unit count grows from 38-64 under Berkshire (2-6 new locations per year on average)

2021 — IPO in Oct 2021 at $20/share (67 locations at time)

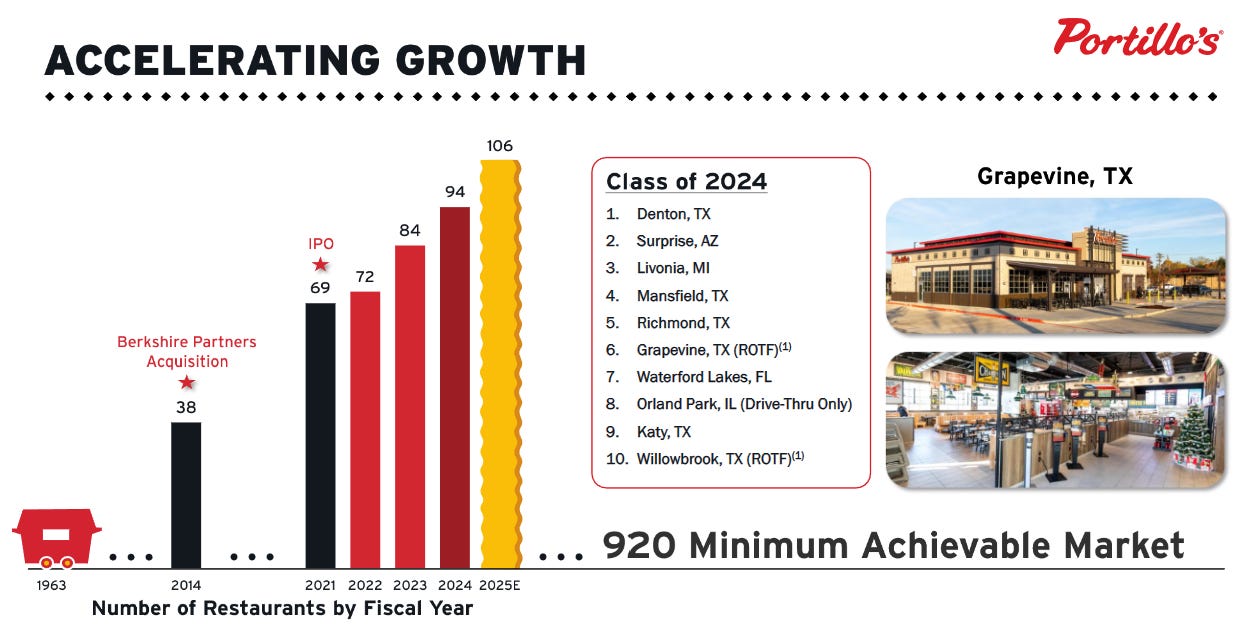

2021-2024 — Unit count grows from 64 (2020) to 102 (2025E), fundamentals weakening during this stretch.

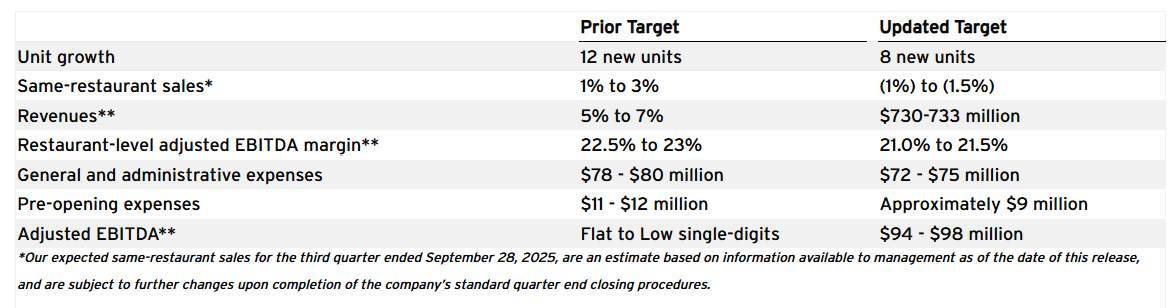

Sep 2025 — Lowers guidance for FY25 (now expecting SSS declines) and a few days later the CEO was out. Have they fully reset the bar yet?

So we have a situation of “slow and steady” unit growth leading up to and during private equity ownership (1963-2021) followed by an acceleration in unit growth with perhaps a “stalling out” of the concept as same store sales turned negative in 2024 and again in 2025.

Unit Economics

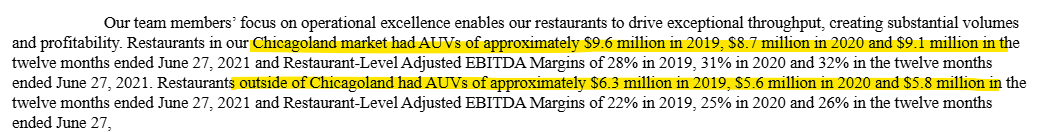

Portillo’s has very high average unit volumes for a fast-casual restaurant at $8-9m+ sales per location. So on paper, this looks more like casual dining (Texas Roadhouse, Cheesecake Factory, Darden’s, etc.) than it does fast-casual (Chipotle, Shake Shack, etc.).

Restaurant margins are comparable to fast-casual peers, but the higher AUVs make them significantly more profitable on a dollar basis (after covering fixed costs).

Average square footage for legacy locations (pre-2023) is 9,000 to 11,000 square feet (compare with Chipotle at 2,000-2,500sf and Texas Roadhouse at 8,000sf). These are big locations.

Normalizing for footprint, sales per square foot is comparable with other restaurant chains. At $9m AUV on 9,000sf = $1,000 sales per square foot. That compares with TXRH at ~$1,000 and Chipotle at ~$960.

Larger location sizes = higher fixed costs (build-out, depreciation, rent, utilities, labor required to operate, etc.), which in turn creates more operating leverage and profitability at higher sales levels. The downstroke is if sales decline, then earnings will fall harder.

We can already see this at play with falling restaurant-level margins since the IPO:

2018-2020 (pre-IPO) = 24-27%

2023-1H25 — 23-24%

2025 guide — 21-21.5%

Management is targeting smaller footprint locations starting with the class of 2023. They’ve dubbed newer openings “restaurant of the future” (ROTF). This would be an impressive shift if they can maintain AUV while lowering unit sizes.

Location Growth

There are 94 locations today and 49 are located in Illinois (52%). At the IPO in 2021, 66% of locations were in Illinois and 87% were in the Midwest.

The next largest cluster is Texas, with 10, and each of those were opened in 2023 or later. So the concept is still relatively new outside of core Midwest markets.

Unit counts went through different phases of growth.

2004-2013 — Total location count grew 3.5% annually from 27 to 38

2014-2021 — Under Berkshire Partners’ ownership, locations grew 7.7% annually from 38 to 69 at IPO (2-5 new locations per year)

2022-2025 — After going public, management increased new openings to 10% annually (69 to estimated 102 by yearend 2025)

The “core vs. non-core market” debate shows in the AUV numbers with Chicagoland locations at ~$9m AUV and non-Chicagoland at $5-6m (these figures are from the IPO).

This is important because it significantly changes the unit economic math. At $9m per store, they’re easily clearing $1,000 sales per square foot while at $6m it’s less than $800 (and that’s assuming a smaller footprint). And $800 per square foot is quite a bit lower than casual, fast casual, and some fast food concepts.

Fundamentals & Valuation

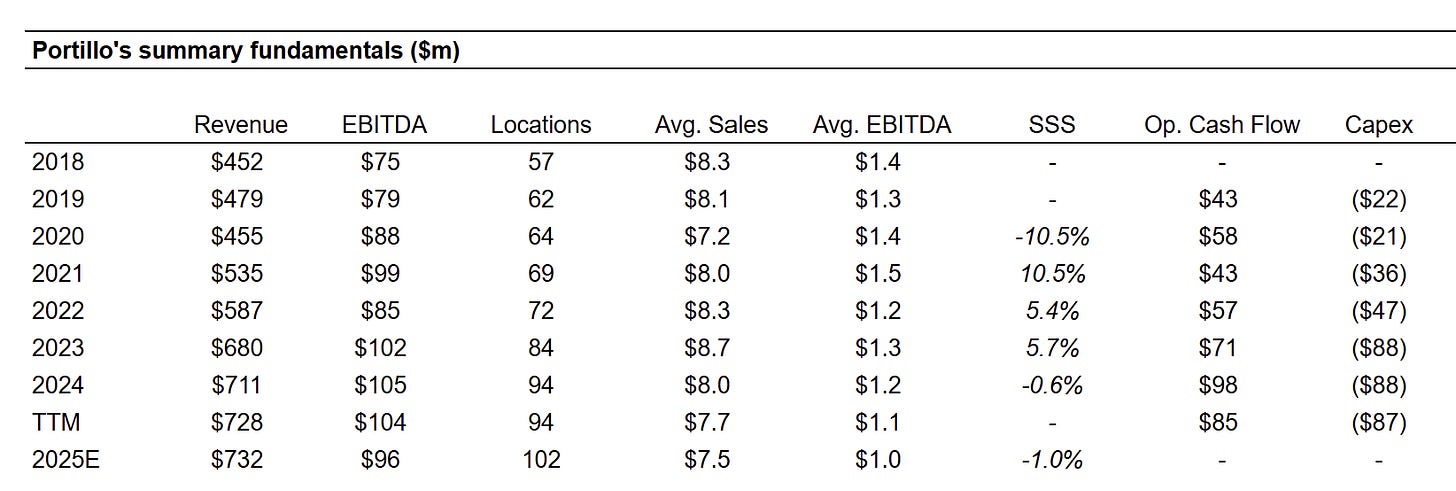

Revenue grew from $452m in 2018 to $711m in 2024 as location count expanded from 57 to 94.

(Note: these average sales & EBITDA per location use a simple average in the denominator.)

What jumps out to me is the $200m additional revenue from 2021 to 2025 with EBITDA flat during this time period. That’s a lot more revenue and SG&A without additional earnings. Pre-opening costs are ~$7m higher as of 2025 when compared with 2019-2020, but this is still a sizable gap.

A look at 2025 guidance the reset cut — comps turning negative, pulling back on store openings, reducing overhead, and 8-9% EBITDA decline in 2025 vs. 2024:

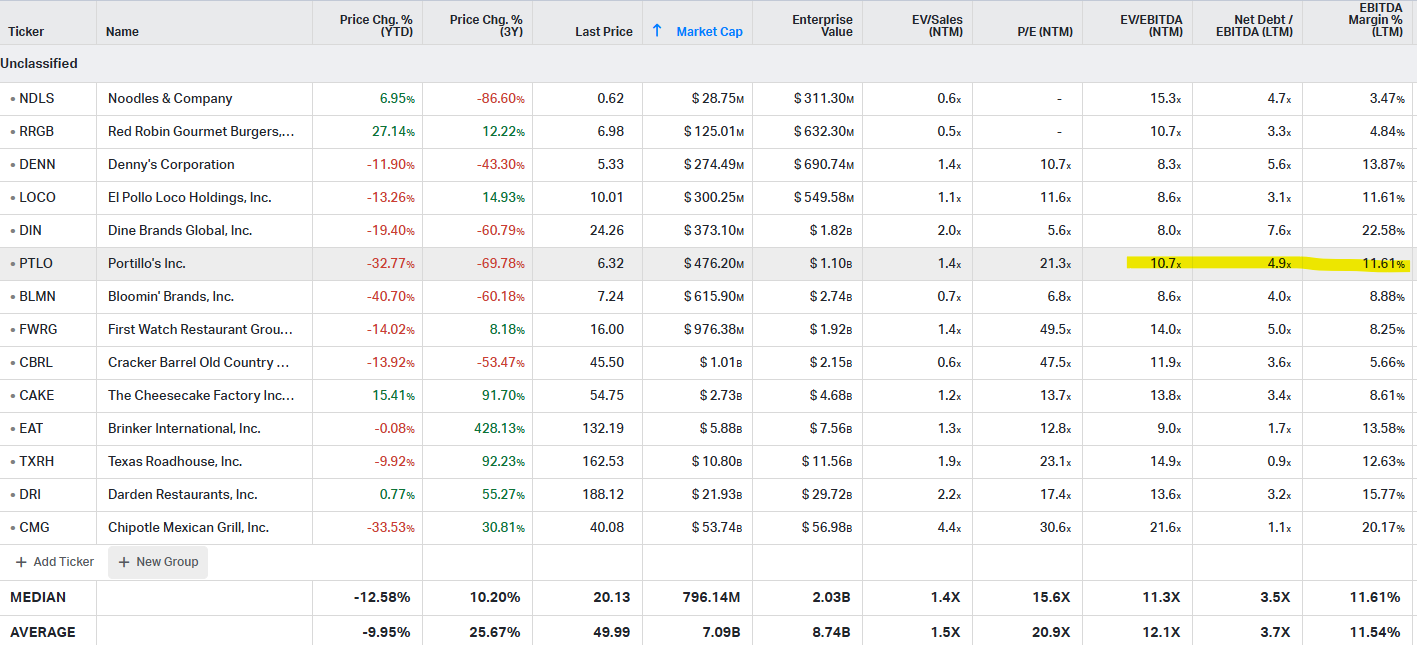

There are 75.3m shares outstanding (and another 3.2m unvested shares/options) at $6.30 per share = $475m market cap. Add $320m debt and subtract $16m cash on hand for a $780m enterprise value (excluding leases). Updated guidance of $96m EBITDA works out to 3.2x leverage and 8.1x EV/EBITDA.

The stock is trading closer to the “levered / low comps” group today:

If they can get comp sales back on track, then shares are likely worth 10x EBITDA or more… 10x $100m EBITDA = $1bn EV. Less $304m net debt = ~$700m equity value or $9.20 on a 76m share count. That’s roughly 50% upside.

But they seem to be at an inflection point.

If things worsen or continue on the same path, then either: 1) the stock could get cheaper; or 2) earnings could fall further (AND the stock gets cheaper). Consensus estimates are expecting things to “course correct” with 2026 sales & EBITDA at $817m and $108m (2027 at $884m and $118m).

Summing it up…

I’m a skeptic on this idea right now… It feels a bit too levered (both debt and leases) at a point where revenue and earnings are fragile. If I’m wrong and they get sales back on track, then earnings (and the share price) could be much higher from here. If not, then both earnings and valuation are likely coming down further.

What does interest me is the management change aspect…

Board Chair Michael Miles is stepping in as interim CEO. Is the plan to fix this up and sell it? Or will they bring in a new external hire as CEO? This is the sort of catalyst which could get me excited.

Disclosure: no position.

Resources:

I am outrageously bullish PTLO