Quick Value #301 - KBR Inc (KBR)

A "way too early" look at the upcoming KBR spin-off

Today’s post:

Shares of KBR are down 26% over the past year

Upcoming spin-off of their government contractor business in 2H26

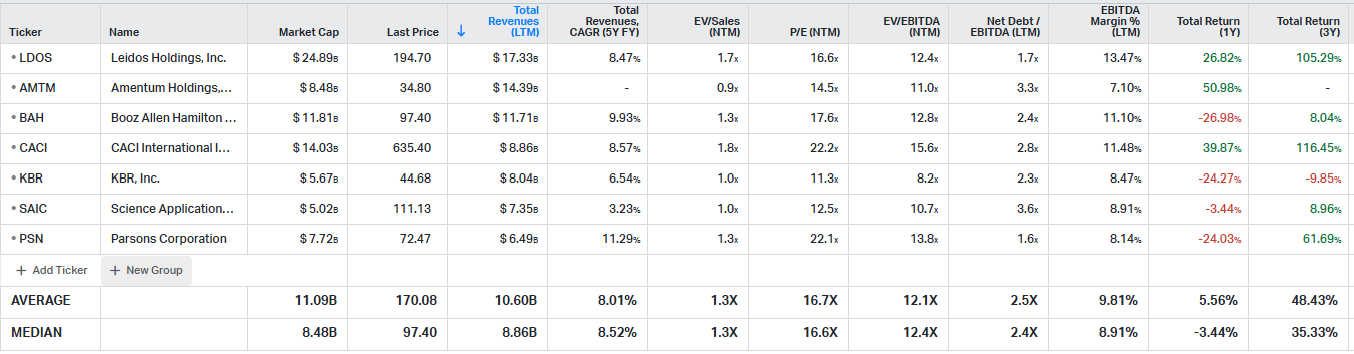

At 12x earnings and 8x EBITDA, the stock trades at a big discount to peers

For new subscribers — these write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Each write-up includes: 1) company background; 2) why the idea is interesting; and 3) fair value estimate.

Check out past write-ups here and my home base page here.

Recent write-ups include:

01/12/26 — Supremex is super cheap and inflecting ($)

01/06/26 — Shares of Cinemark look beaten down

12/29/25 — A look at stub Becton Dickinson ($)

12/22/25 — Initial look at Versant spin-off

12/01/25 — Gibraltar beaten down on acquisition announcement ($)

11/27/25 — New Aptiv (RemainCo) and Cyprium (SpinCo)

11/17/25 — Turnaround + management change at SWK ($)

11/10/25 — Dole fully deleveraged, cheap, kickstarting buybacks

Quick Value

KBR, Inc. (KBR)

Ticker: KBR

Price: $45

Shares: 127m

Market cap: $5.7bn

Valuation: 11.8x P/E

Theme: Spin-offKBR announced in September 2025 they would spin-off their government services business (Mission Technology Solutions) in mid-to-late 2026. They have yet to host a investor days for each company or set a date for the spin so this is an early look.

Background

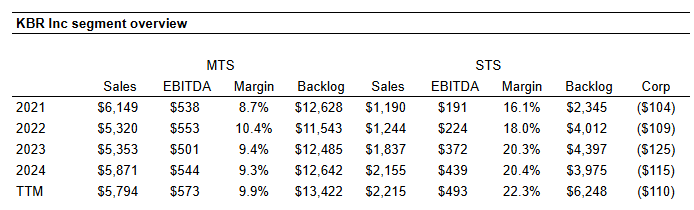

Pre-split, KBR operates under two segments:

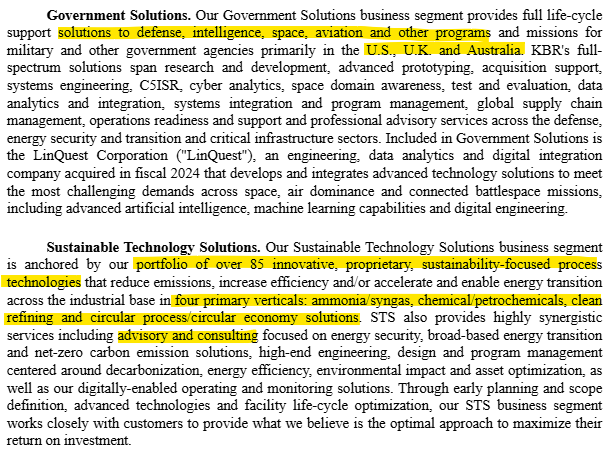

Mission Technology Solutions (MTS) — Formerly called “Government Solutions,” this segment is a traditional government contractor (BAH, LDOS, AMTM, etc.). Virtually all revenue comes from U.S., U.K., and Australian governments.

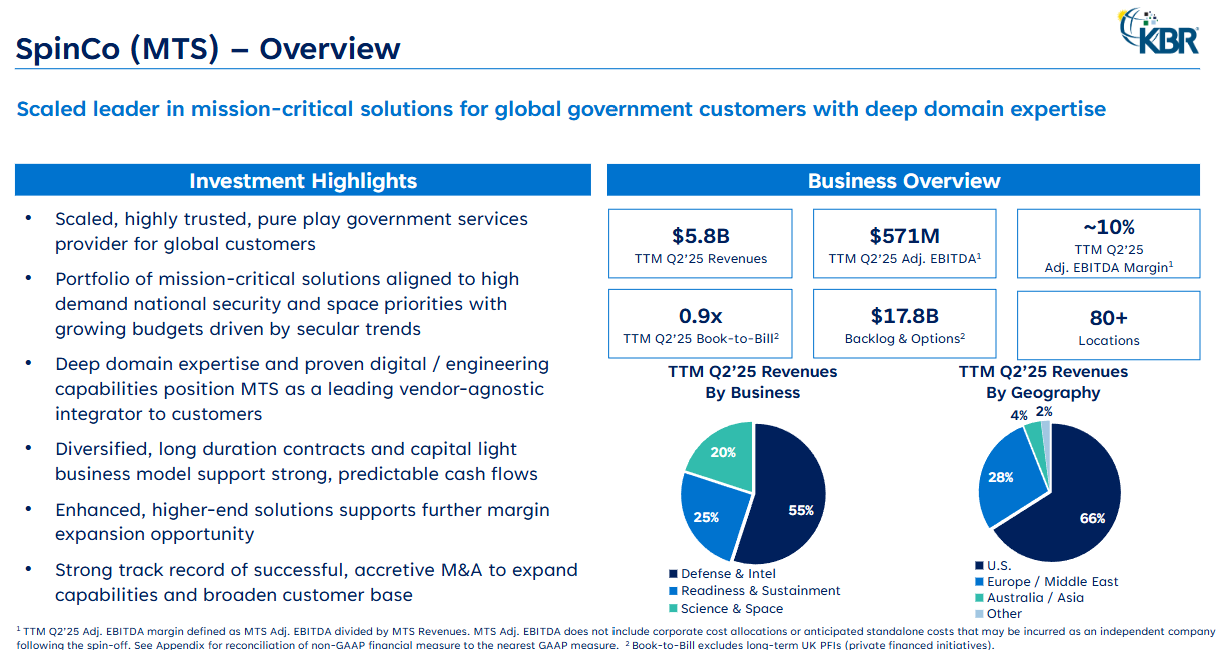

Sustainable Technology Solutions (STS) — Combination of IP licensing and consulting services mainly for “green energy” applications. Virtually all revenue comes from commercial customers.

Mission Technology Solutions (MTS) will be SpinCo. This is a traditional government contractor. Peers like Leidos and Booz Allen focus more on IT, data, cybersecurity, intelligence, etc. while the MTS business has a heavy mix of space and logistics revenue (i.e. training astronauts and managing military bases).

MTS had some false starts lately. They lost a large contract (TRANSCOM) in June 2025 for managing relocation logistics for military personnel and another contract for managing European bases as part of the Ukraine conflict.

The former contract was only a few months into launching, so it had minimal impact to earnings and cash flow. But it had $20bn revenue potential over a 9-year term which certainly dampened the multi-year revenue targets (more on that below).

Sustainable Technology Solutions (STS) will be RemainCo. There are two main revenue streams here: consulting services (design, engineering, feasibility studies, etc.) and IP licensing. Margins are 2x the MTS business and this segment is growing at a double digit pace (management guiding to 11-15% CAGR from 2023-2027).

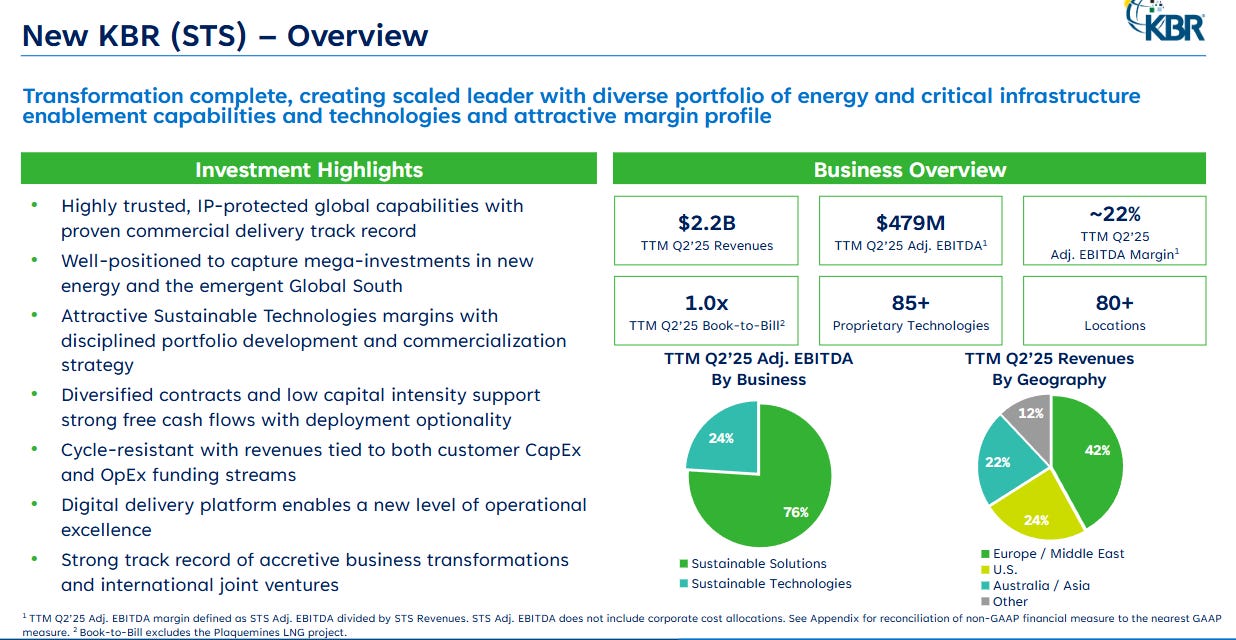

Note: there was some segment realignment in early 2025 which pushed STS closer to the $500m EBITDA level. Supporting schedules go back to 2022 so the 2021 figures below are likely less reliable:

Why it’s interesting…

First, at a surface level, KBR is trading at a significant discount to government contractor peers.

That group trades at 16-17x earnings and 12x EBITDA while KBR sits at 11x and 8x, respectively. That’s a 30%+ discount. In fact, KBR has the industry’s only negative total return over a 3-year period.

But we need more than just a cheap valuation before getting too excited.

Why are shares trading at a discount?

As mentioned earlier, KBR is in the penalty box for some operational mishaps and their “underperforming” MTS business. The TRANSCOM contract loss was a big blow to revenue growth.

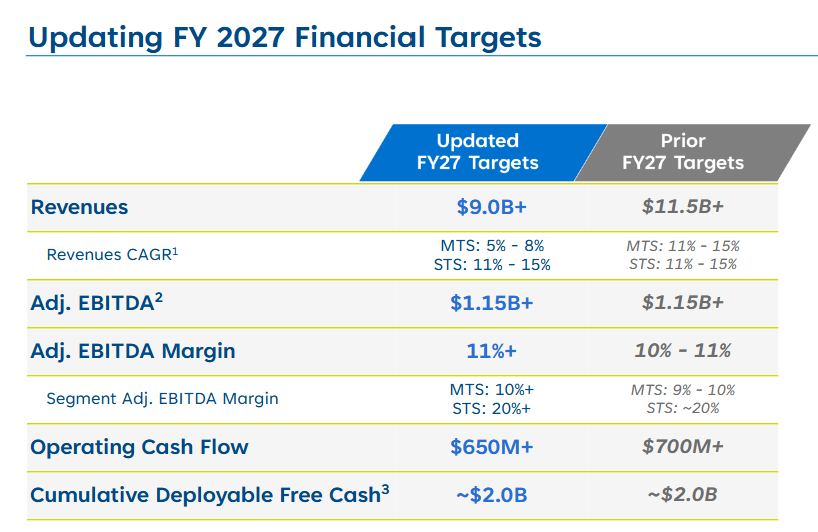

Management set 2027 financial targets during their May 2024 investor day presentation. After losing the TRANSCOM contract, those targets were revised lower in July 2025. Revenue was the major reset (from $11.5bn to $9bn) while most other targets were maintained: EBITDA target unchanged at $1.15bn and operating cash flow lowered by $50m to $650m.

MTS has lumpy revenue growth since 2022 and EBITDA is roughly flat during that timeframe. The $13.4bn MTS backlog is starting to show growth (+6% from FY24 to 3Q25 and +16% since a 2022 low), so maybe things are turning a corner here?

At this point, a discount to peers is probably warranted. Also, MTS will be the smallest industry player post-spin (<$6bn revenue compared to $7-17bn for the rest of the group).

What about the STS business?

This is perhaps the “crown jewel” of the portfolio with double digit top-line growth, 20%+ EBITDA margins, and virtually zero capital requirements (STS spent $7m on capex in FY24 vs. $1.9bn revenue = 0.4% capex/sales).

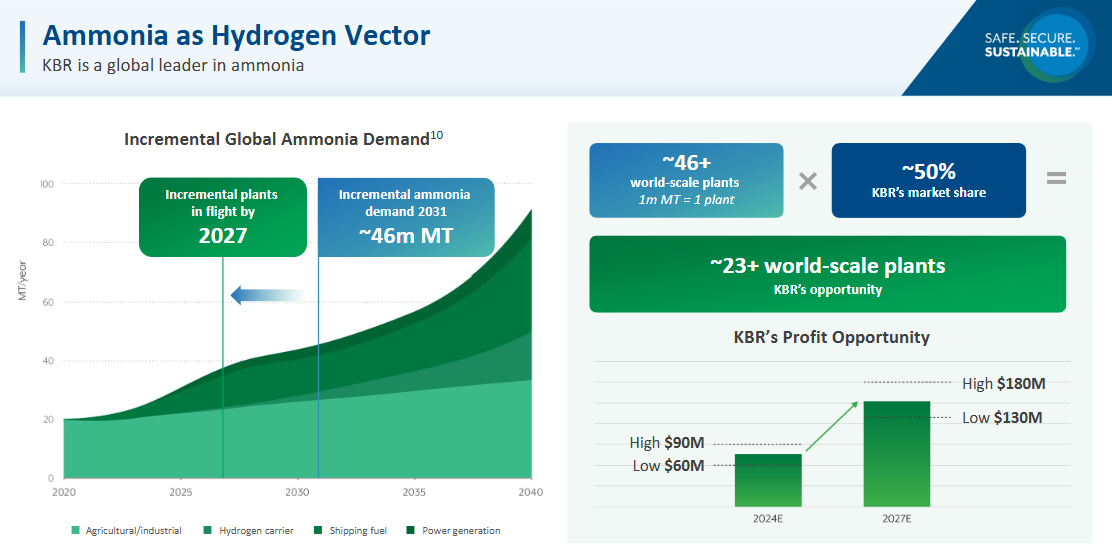

STS is a major player in the global Ammonia industry through design, engineering & technology licensing (~50% market share).

Ammonia demand is growing and at the same time a very emissions-intensive process. New plants will likely need to be built, and many of them will be the “low carbon” variety supported by STS offerings. CF Industries is estimating a 7-8 MMT capacity shortfall to meet demand by 2029.

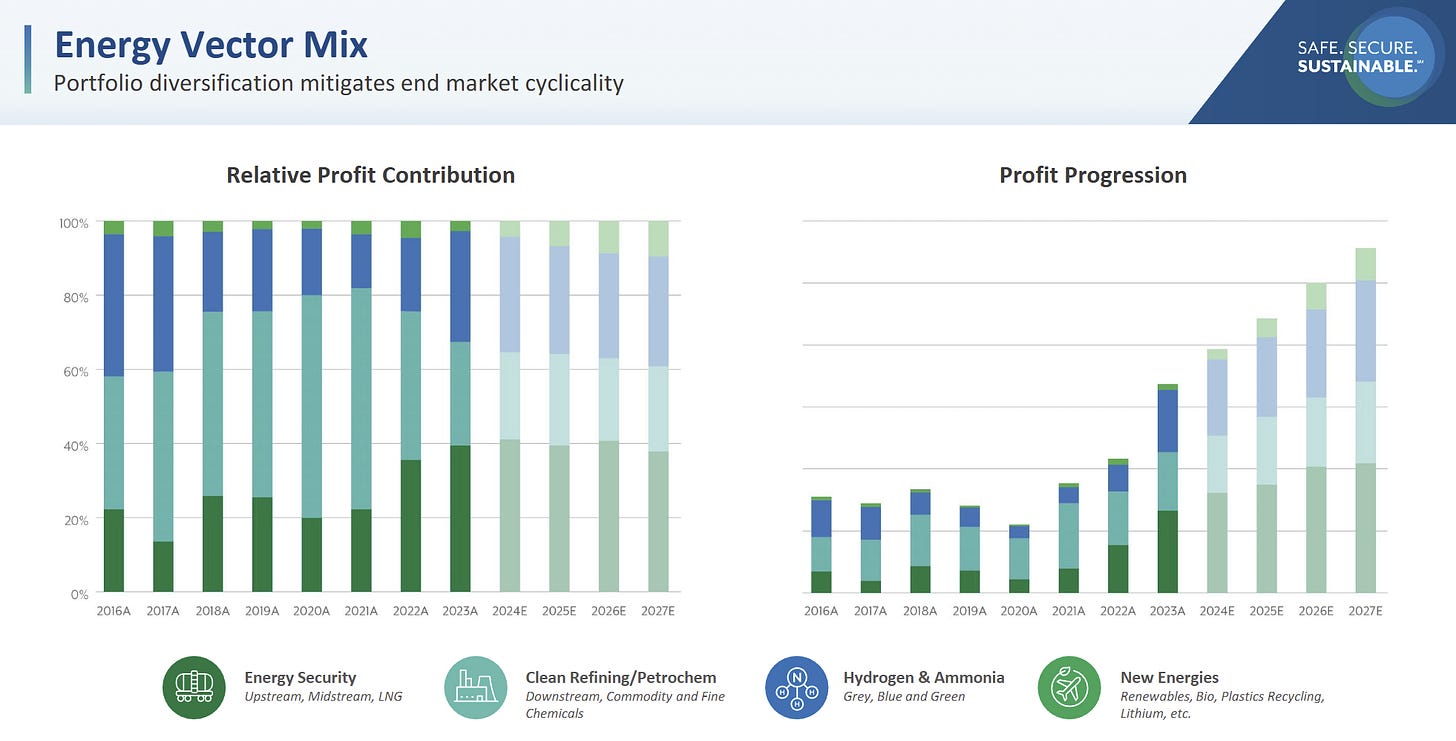

The STS business also supports energy (upstream, midstream, LNG), refining, petrochemicals, and renewables industries. You can see the ebbs and flows of revenue and profitability (from the 2024 investor day).

An early look at valuation…

For simplicity, I’ll take trailing corporate costs ($110m) and burden each company equally ($55m) plus an extra $10m each for standalone dis-synergies.

Let’s say the SpinCo government business deserves to trade at a discount to the broader contractor group (this is warranted given the mishaps and smaller scale).

MTS — $573m EBITDA less $65m corporate costs = $508m. At 9x EBITDA = $4.6bn segment value.

Fortunately, there’s a relatively recent transaction which offers a nice comparison for STS. In May 2025, Honeywell acquired the catalyst and process technologies business from Johnson Matthey for £1.8bn at an 11x EBITDA multiple.

STS — $493m EBITDA less $65m corporate costs = $428m. At 11x EBITDA = $4.7bn segment value.

That’s $4.6bn for MTS and $4.7bn for STS ($9.3bn total) less $2.05bn net debt = $7.25bn equity value or $57 per share (+30% upside) using 127m shares outstanding.

These are trailing results and apply zero credit for future growth or capital allocation.

Remember those 2027 targets?

Management set a 2027 goal of $1.15bn EBITDA before the TRANSCOM contract loss, then they reaffirmed that $1.15bn EBITDA target in July 2025 after the contract loss.

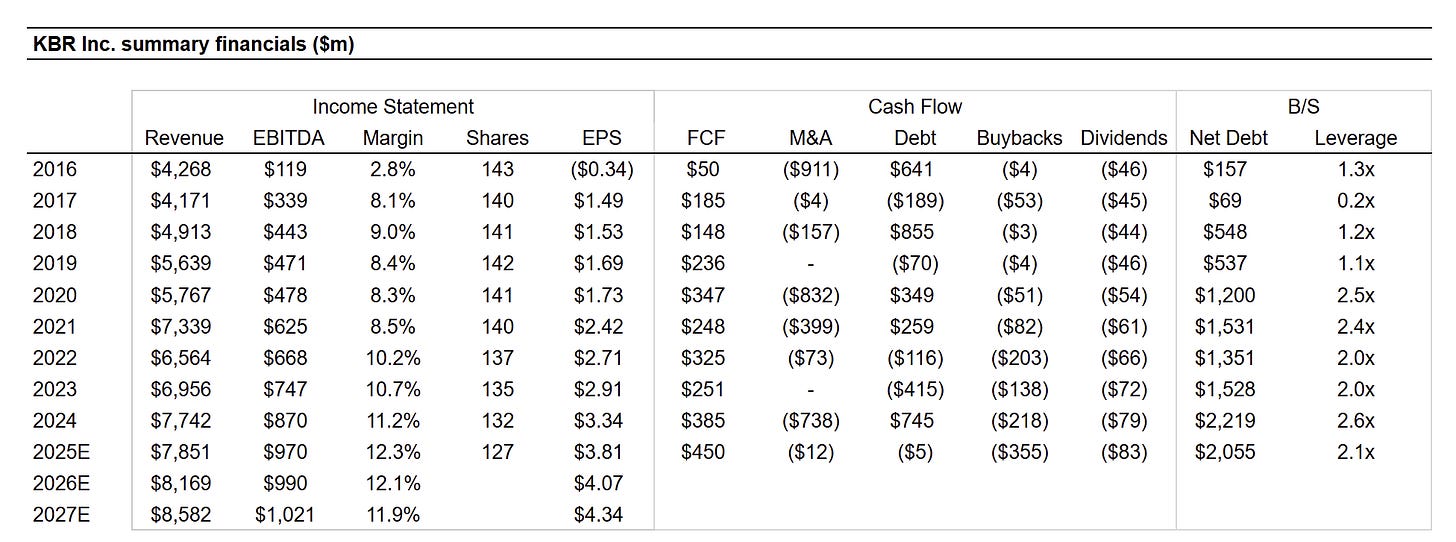

Here’s a look at summarized KBR financials since 2016 and including 2026-2027 sell-side estimates. It paints a picture of consistent growth, margin improvement, and cash generation. Leverage is steady from 2022-2025 and buybacks are increasingly favored since 2022.

You’ll notice 2027 EBITDA estimates ($1.02bn) are well below the $1.15bn EBITDA target.

Let’s say they get to $1.1bn EBITDA by 2027. The stock historically traded at 11-12x EBITDA, but let’s use 10x for an $11bn enterprise value. With no change in net debt ($2.1bn) = $8.9bn equity value or $70 per share (+55% upside).

Hmm…

Summing it up…

Both pieces of this upcoming spin have yet to host an investor day or initiate post-spin guidance, so consider this a “way too early” look at the business.

At the same time, most spins I’m looking at don’t have as clear “upside math” prior to the spin. On the other hand, I’m glossing over some of the risks and challenges here… STS has a history of lumpy revenue and earnings, but they’re seeing momentum recently. And the news around TRANSCOM indicate some serious ops challenges internally.

This one is going on my watchlist for now, but I could absolutely own this ahead of the spin and then adjust my preferences based on initial trading (i.e. if investors punt on MTS in favor of STS).

Disclosure: no position.

Resources: