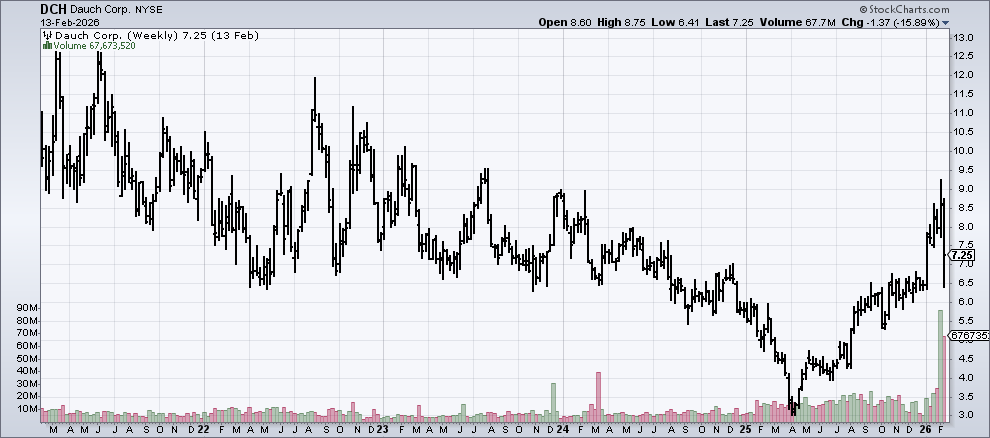

Quick Value #305 - Dauch Corp (DCH)

Recently completed "merger of equals" in the auto supplier industry

Today’s post:

Completed mega-merger in Feb 2026

Post-close, shares are trading at 4.5x EBITDA and 6-7x FCF

Deal synergies are 17% of the current market cap = solid earnings growth?

For new subscribers — these write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Each write-up includes: 1) company background; 2) why the idea is interesting; and 3) fair value estimate.

Check out past write-ups here and my home base page here.

Recent write-ups include:

02/09/26 — Wholesale changes in the VDL portfolio ($)

02/02/26 — A look at Allison Transmission’s recent acquisition

01/26/26 — Multi-pronged special sit Teleflex ($)

01/19/26 — A look at the KBR upcoming spin-off

01/12/26 — Supremex is super cheap and inflecting ($)

01/06/26 — Shares of Cinemark look beaten down

12/29/25 — A look at stub Becton Dickinson ($)

12/22/25 — Initial look at Versant spin-off

12/01/25 — Gibraltar beaten down on acquisition announcement ($)

11/27/25 — New Aptiv (RemainCo) and Cyprium (SpinCo)

Quick Value

Dauch Corporation (DCH)

Ticker: DCH

Price: $7

Shares: 243m

Market cap: $1.76bn

Valuation: 4.4x EBITDA (2026 guide)

Theme: AcquisitionIn Feb 2026, American Axle merged with Dowlais and rebranded as Dauch Corporation. To keep things simple, I’ll refer to standalone American Axle as “AAM” and the post-merger entity as “Dauch.”

Background

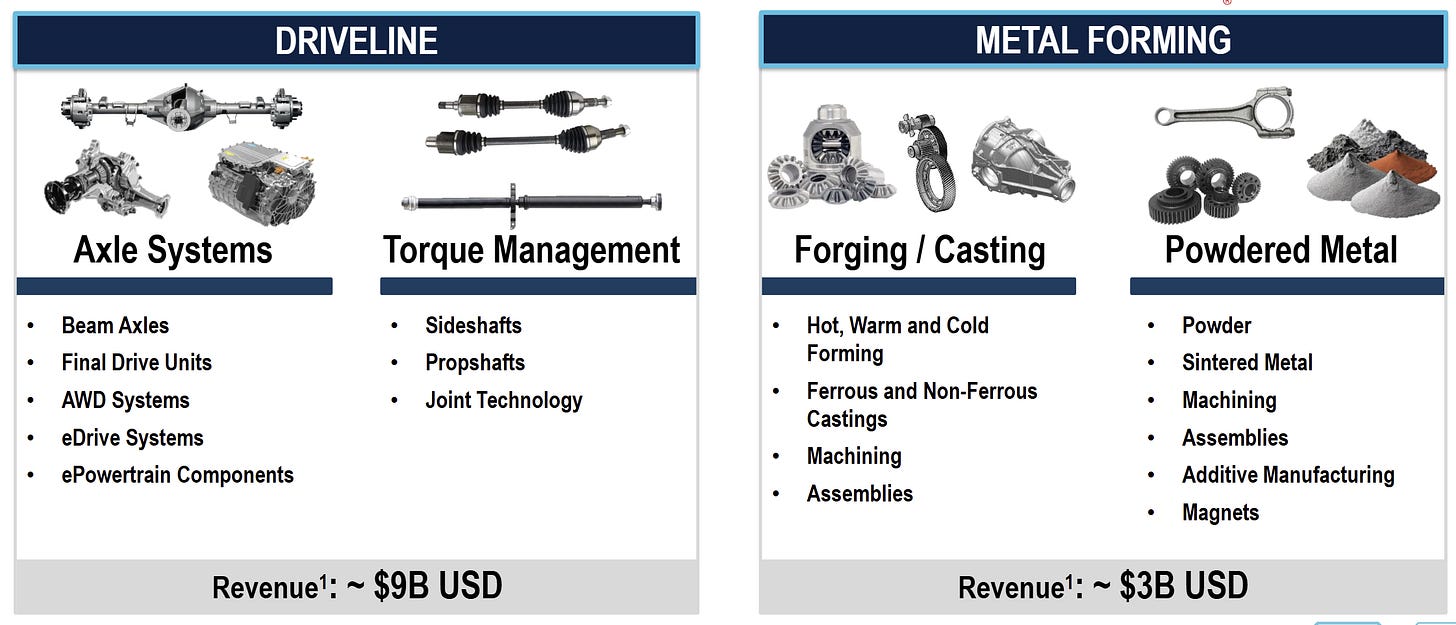

Dauch Corporation is a tier 1 auto supplier of driveline components (axles, driveshafts, differentials, etc.) and metal formed parts/products.

Some formative events in AAM’s history:

1994 — Company founded by Richard Dauch, acquired several manufacturing plants from GM.

1999 — IPO at $16-17 per share.

2017 — Acquired Metaldyne Performance Group for $3.3bn in cash, stock, and assumed debt. Sales jumped from ~$4bn to $7bn.

2026 — Completed merger with Dowlais Group for ~$3.2bn (cash, stock, and assumed debt). AAM shareholders own ~51% of the newly merged company.

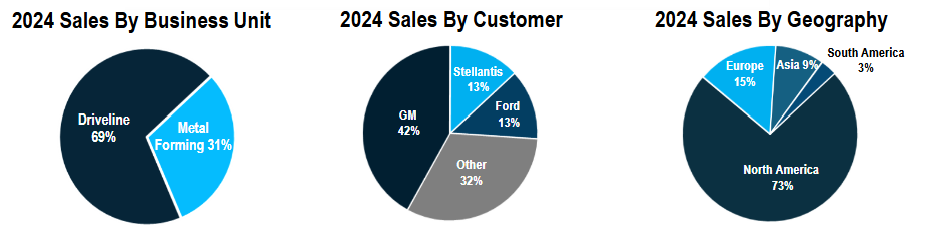

Prior to the Feb 2026 merger, standalone AAM made driveline components (~70% of sales) for tier 1 automakers (GM, Stellantis, and Ford at ~70% of sales). Though sales have recovered from COVID 2020 lows, they are still at 90% of 2019 levels.

Standalone Dowlais was spun off from Melrose Industries in early 2023. Dowlais had fiscal 2024 sales of ~£4.3bn with ~80% consisting of driveline components (sideshafts and propshafts) and the remainder from “metal powder” components.

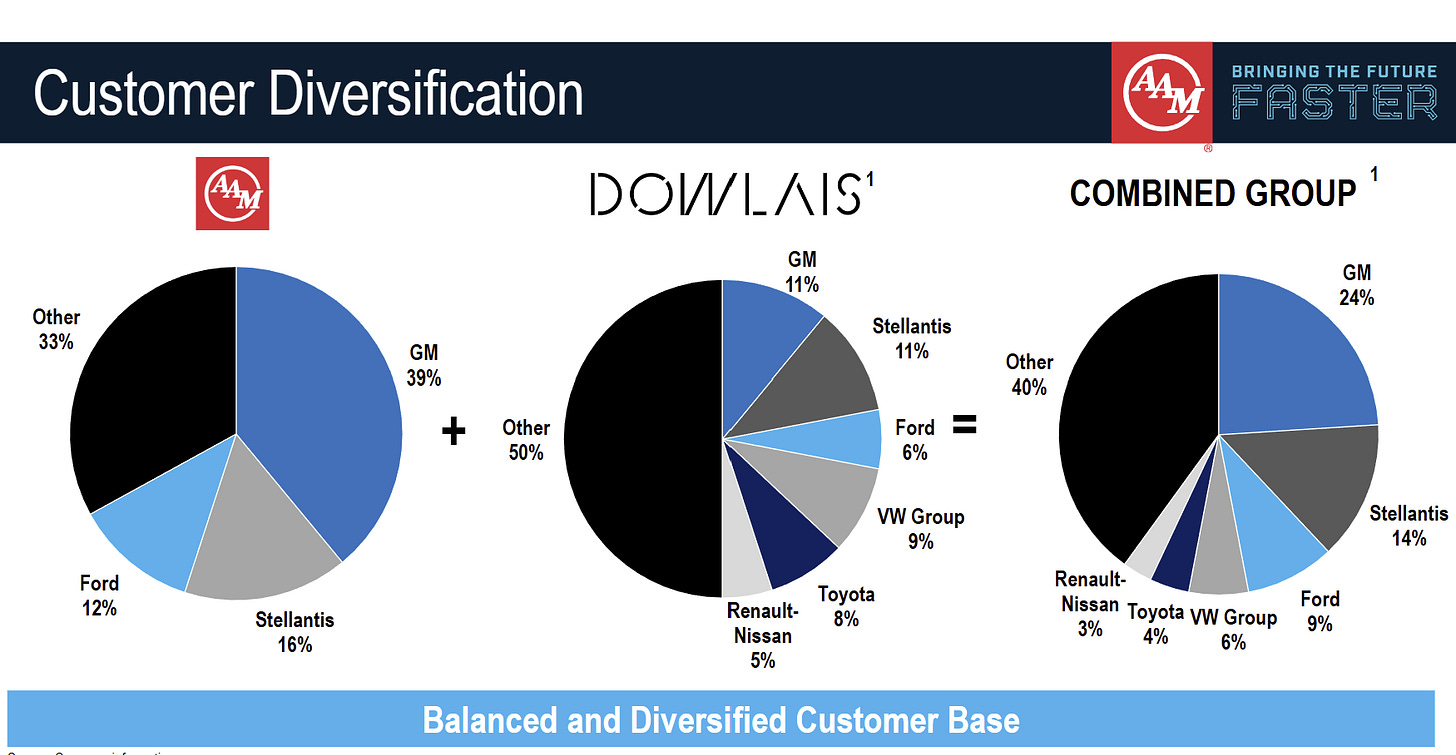

Perhaps the biggest benefit of this merger is the diversification away from GM, Stellantis, and Ford on a combined basis. Dowlais has a more diverse customer base with 72% of revenue from non-overlapping customers.

Why it’s interesting…

AAM is not a highly-acquisitive company and the Dowlais merger is only the second meaningful M&A since the company came public in 1999.

That said, AAM has a checkered past of fundamentals.

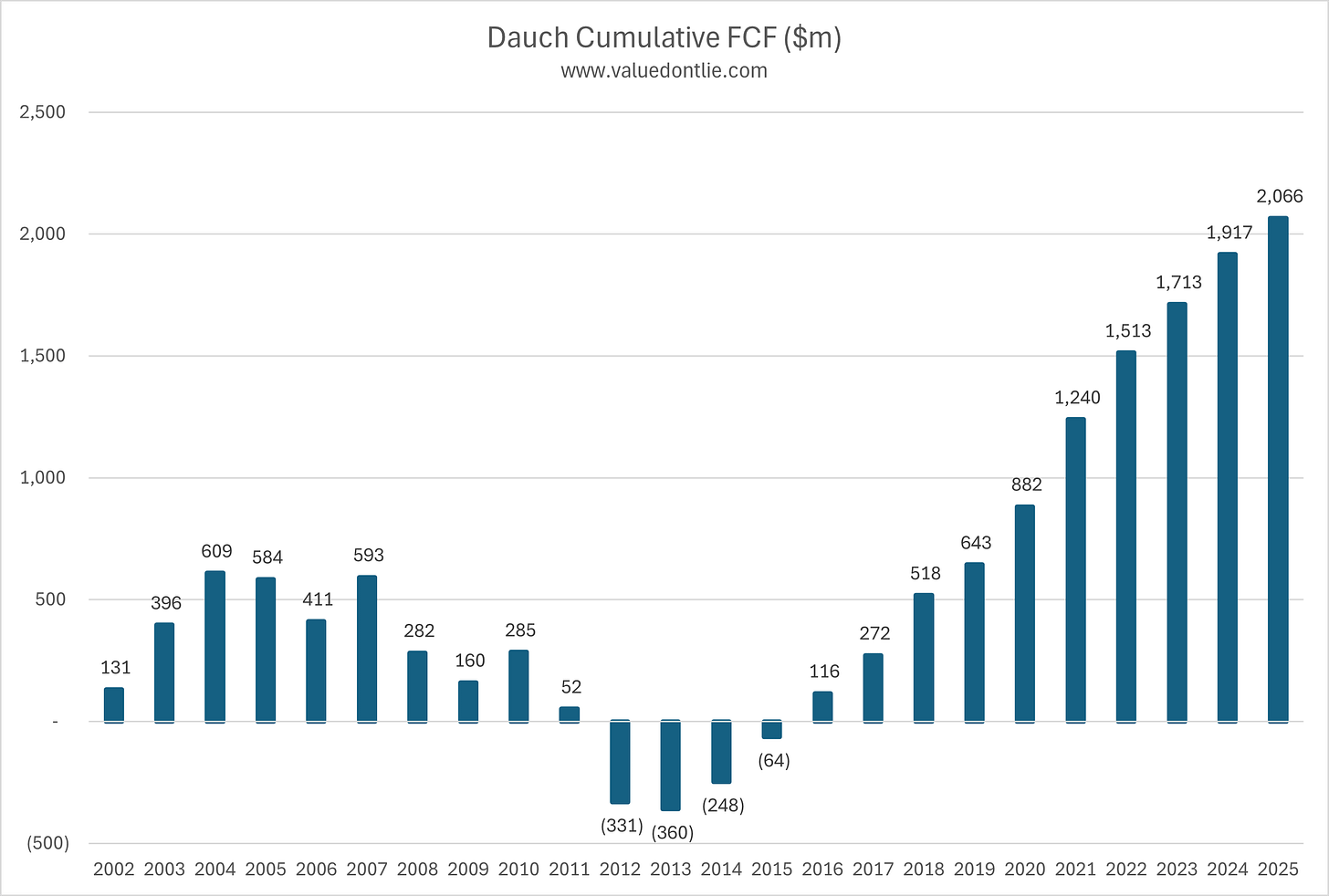

They struggled for years with generating cash and reducing leverage. For reference, cumulative free cash flow was negative from 2002-2015 (14 years!).

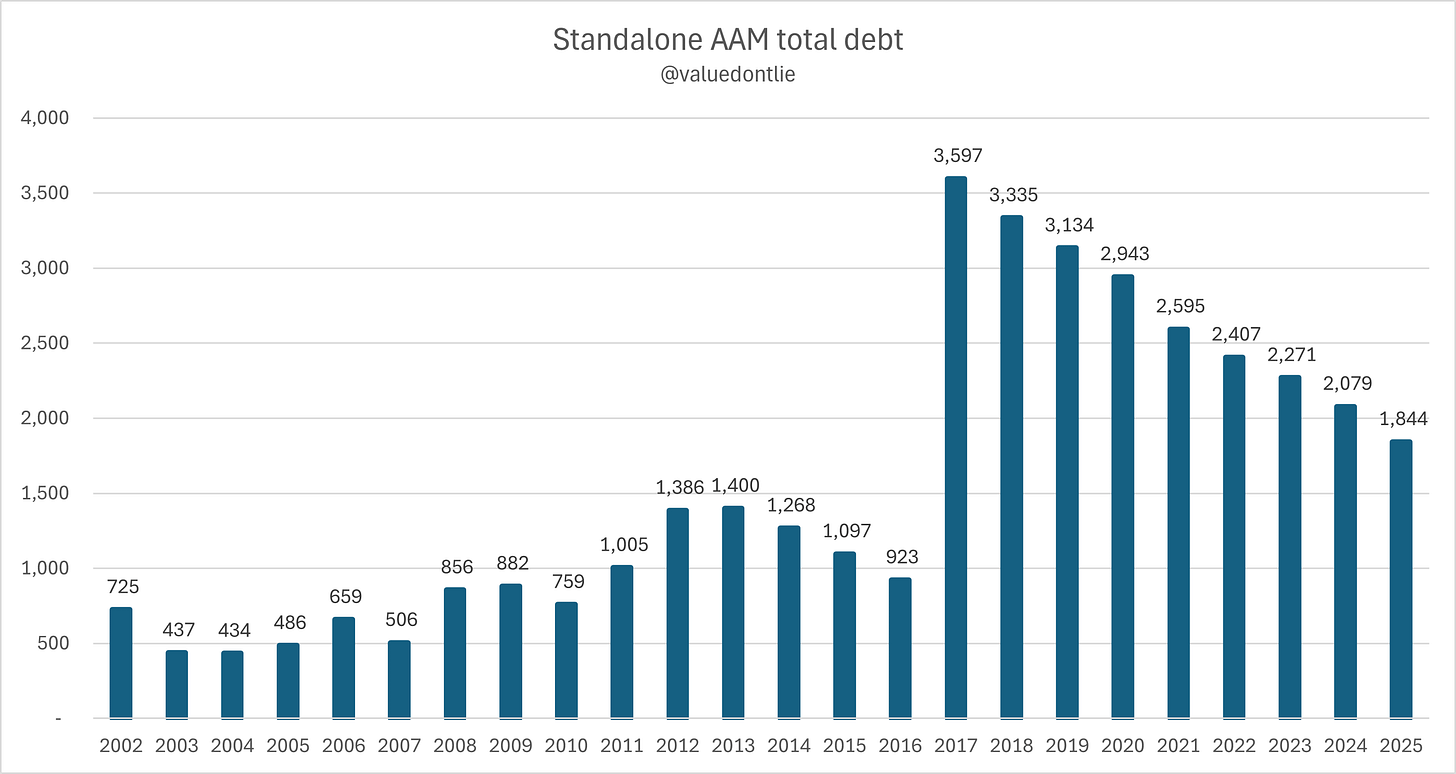

And what did they do with the $2.4bn cumulative FCF produced from 2016-2025?

Literally all of it went to acquiring and repaying debt from the previously mentioned 2017 acquisition of Metaldyne Performance Group (MPG). An acquisition which led to no/minimal increase in EBITDA or annual cash flow.

But this is a new company…

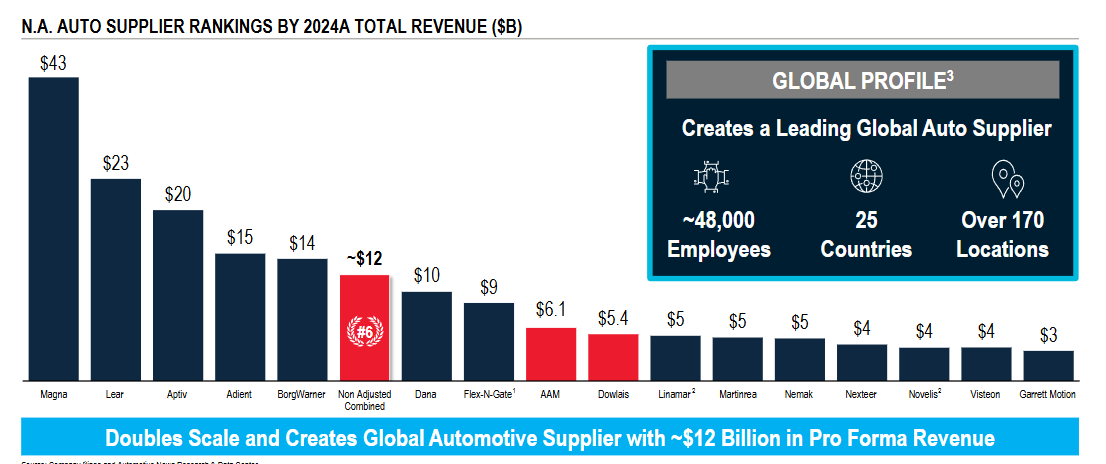

Post-merger Dauch is now a relatively large player in the auto supplier industry with combined revenue at ~$12bn and EBITDA margins close to 14%.

What does the pro-forma company look like?

At closing, the new share count is 243m.

At $7.25 per share = $1.76bn market cap.

We don’t have a post-close balance sheet yet, but management indicated $4.2bn net debt from the 4Q25 earnings call. Call it a $6bn enterprise value.

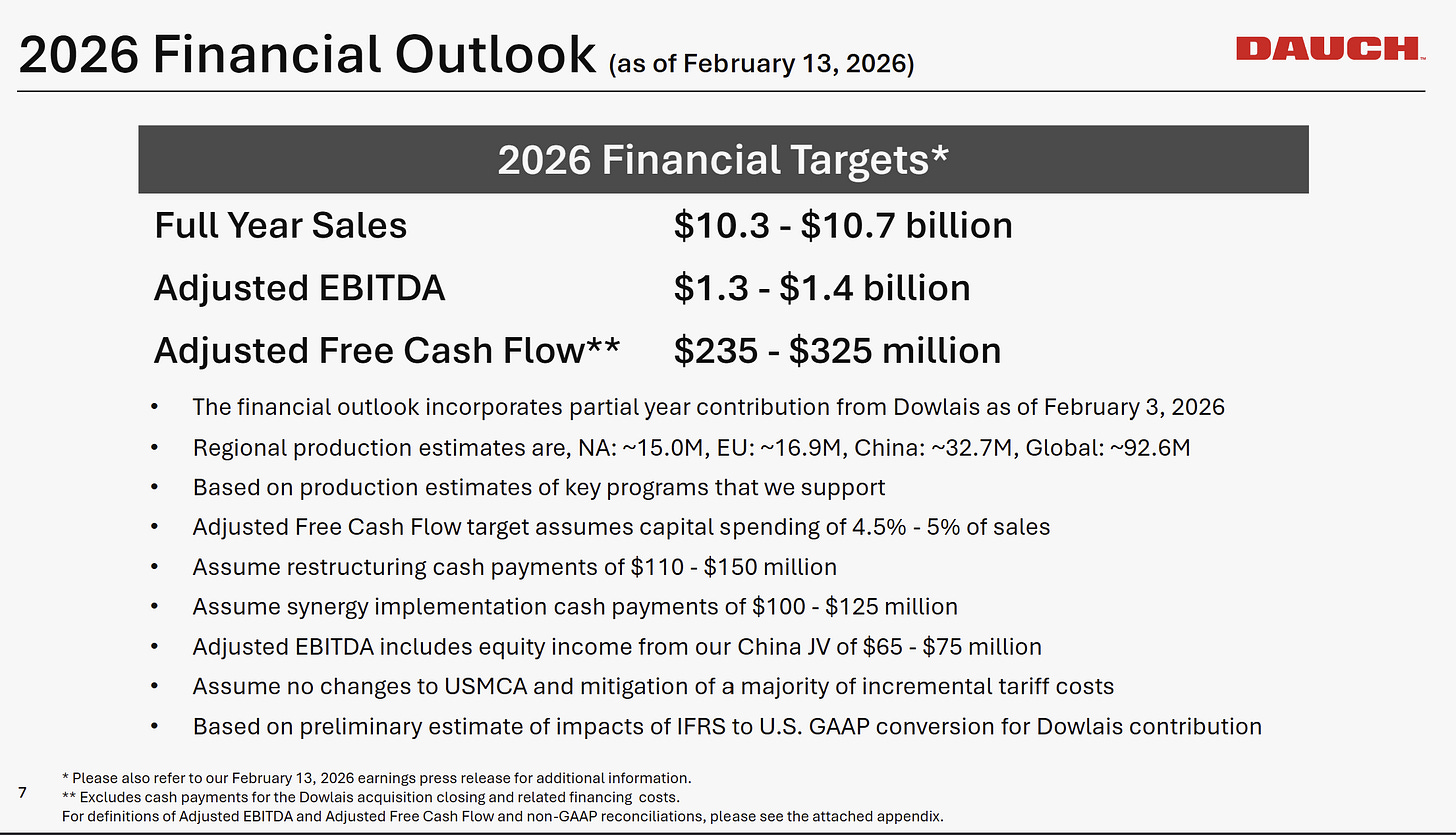

Guidance, which includes 11 months of Dowlais, calls for $1.35bn EBITDA and $280m “adjusted” free cash flow on $10.5bn sales at the midpoint.

Cost synergies are estimated at $300m which is very high at ~10% of transaction value and 20%+ combined EBITDA. They’ll see $50-75m of these benefits in 2026 and $180m (60%) by the end of 2027. This is maybe the biggest piece of upside potential and at the same time, difficult to handicap. If they hit all $300m synergies, that would be 17% of the current market cap! This could mean easy earnings growth for years, regardless of overall auto production levels.

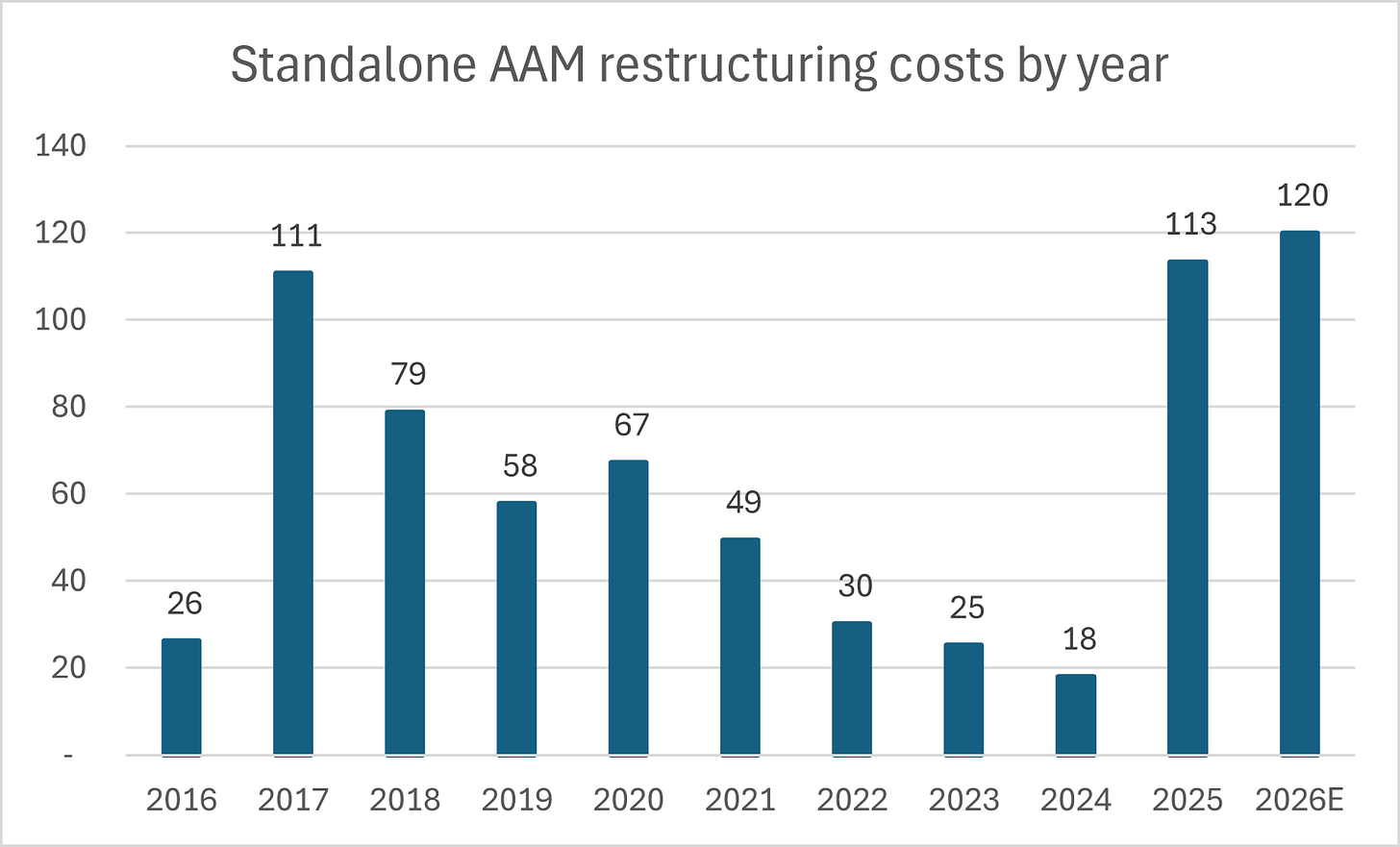

Restructuring costs and cash costs to achieve those synergies total $210-275m so true free cash flow will be close to zero in 2026. Management reports “adjusted FCF” as a key metric which excludes restructuring costs despite those costs totaling $577m from 2016-2025 (see chart below). And this is just standalone AAM, Dowlais also spent £212m over the past 2.5 years.

Defining a “normal” year of restructuring costs is key to determining future free cash flow levels. My guess is this bucket of $210-275m will come down over the next few years but not to zero.

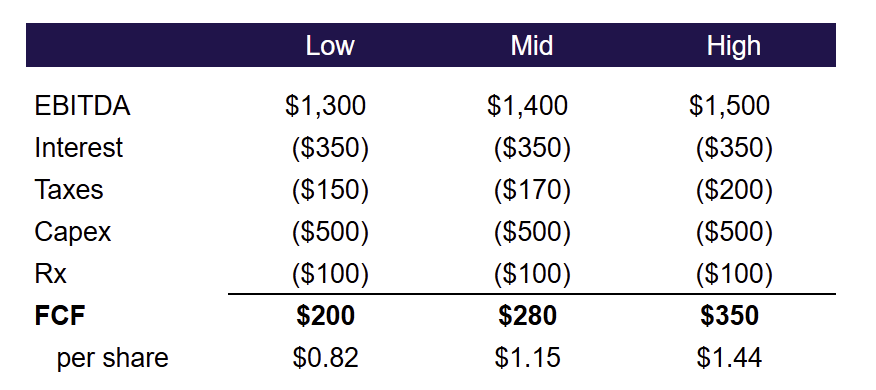

I’m estimating $200-350m (true) FCF at $1.3-1.5bn EBITDA which works out to $0.82-1.44 per share. This assumes $100m of recurring restructuring costs and $500m capex (guiding to 4.5% to 5% of sales).

My big takeaway here: it’s going to take a while to reach a 2-2.5x leverage target unless I’m miscalculating the starting debt balance and leverage profile.

What are shares worth?

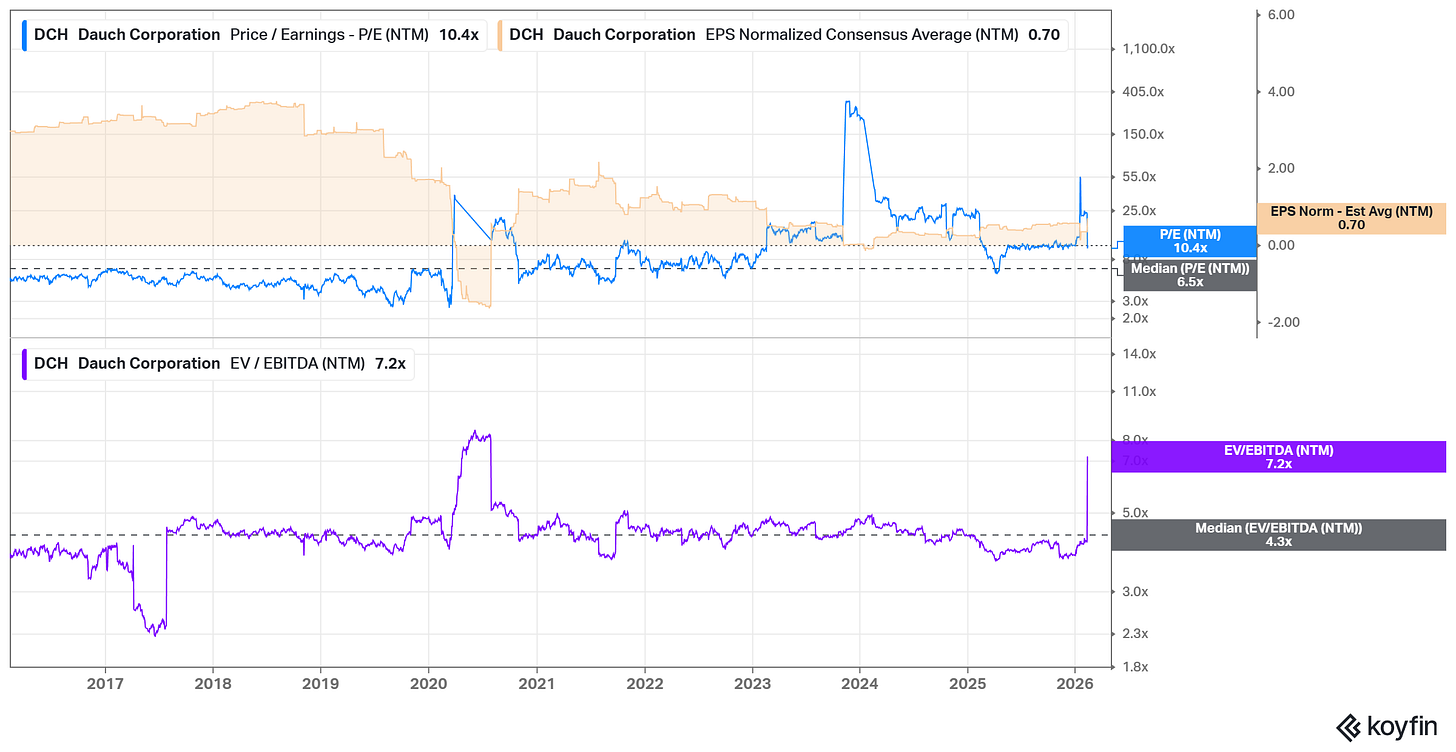

Estimates aren’t yet updated for the recently completed merger, but AAM historically traded at 4-4.5x EBITDA and 6-7x earnings. I don’t expect this valuation range will change much go-forward.

Taking my range of FCF estimates, I get:

6x low-end FCF of $0.82 = $5 per share (31% downside)

7x high-end FCF of $1.44 = $10 per share (38% upside)

That’s a pretty balanced risk/return setup at 1.2x. And it’s a levered cyclical, so when market volatility spikes, downside is likely higher than a rational estimate like this one.

Summing it up…

This is a sizable merger for a company not historically active in M&A. On the surface, the deal makes sense too, combining different products & customers in the driveline category.

There are easier bets in the auto supplier universe right now, but I’ll want to watch year one of this merger play out. I’d rather have more clarity on the FCF profile and balance sheet (management refers to this deal as “leverage neutral” but the pro-forma debt picture implies 0.5x incremental leverage?).

Resources: