Quick Value #303 - Allison Transmission (ALSN)

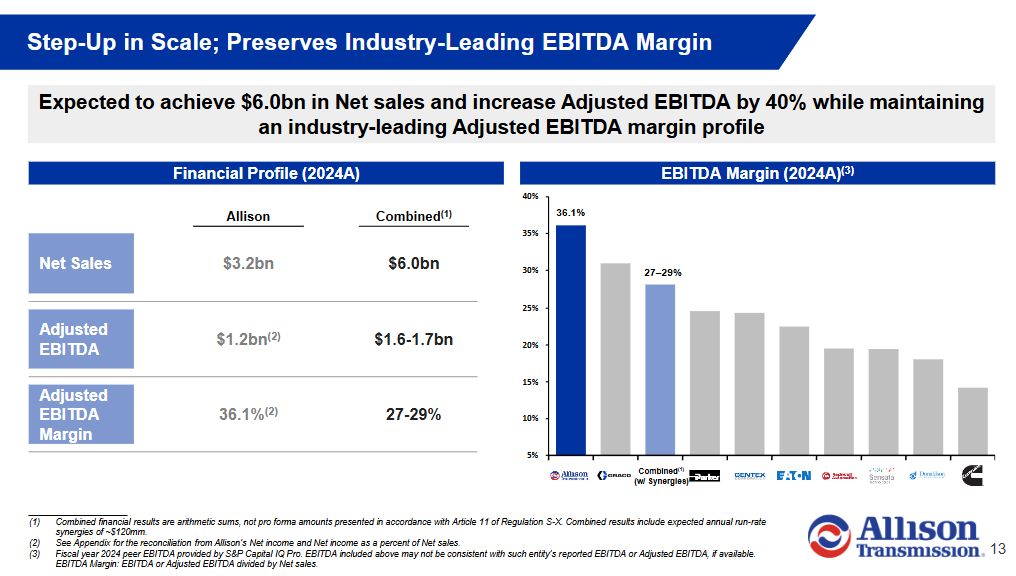

Recently acquired Dana's off-highway business; a look at the pro-forma financials

Today’s post:

Compelling acquisition thesis of Dana’s off-highway business

Stellar fundamentals: 30%+ EBITDA margins & 20%+ FCF margins

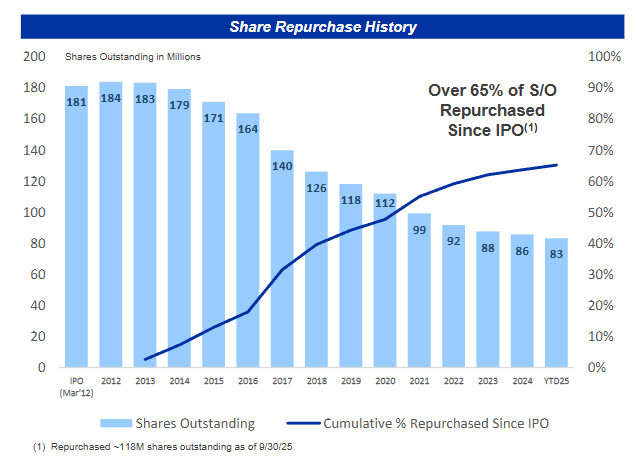

Share cannibal: repurchased >65% of outstanding shares since 2012 IPO

Shares trading at 8.5x EBITDA (after synergies) and 11.5x FCF (after synergies)

For new subscribers — these write-ups are meant to be a “jumping off point” for the idea generation process (i.e. a surface level review). Each write-up includes: 1) company background; 2) why the idea is interesting; and 3) fair value estimate.

Check out past write-ups here and my home base page here.

Recent write-ups include:

01/26/26 — Multi-pronged special sit Teleflex ($)

01/19/26 — A look at the KBR upcoming spin-off

01/12/26 — Supremex is super cheap and inflecting ($)

01/06/26 — Shares of Cinemark look beaten down

12/29/25 — A look at stub Becton Dickinson ($)

12/22/25 — Initial look at Versant spin-off

12/01/25 — Gibraltar beaten down on acquisition announcement ($)

11/27/25 — New Aptiv (RemainCo) and Cyprium (SpinCo)

11/17/25 — Turnaround + management change at SWK ($)

11/10/25 — Dole fully deleveraged, cheap, kickstarting buybacks

Quick Value

Allison Transmission (ALSN)

Ticker: ALSN

Price: $110

Shares: 84m

Market cap: $9.2bn

Valuation: 8.5x EBITDA (after synergies)

Theme: AcquisitionI caught this quick pitch on Allison Transmission from the Barron’s 2026 roundtable issue where Meryl Witmer pitched the stock at $98. It was compelling so I thought I’d take a closer look.

Here are my notes…

Background

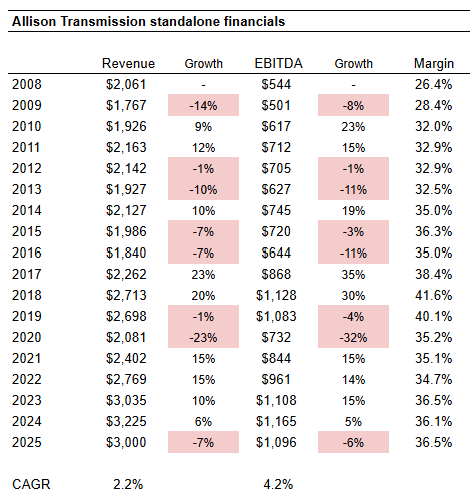

Quick history — Allison Transmission (ALSN) was a division within GM since the early 1900’s until it was sold to private equity in 2007. GM needed to raise cash as the financial crisis was gaining steam. PE owners Carlyle & Onex grew EBITDA from $544m in 2008 to $712m in 2011, then took it public in early 2012. It was a quick fix of an undermanaged business, they even published a little case study on it. From 2007-2018, ALSN was managed by CEO Lawrence Dewey. David Graziosi took the CEO job in 2018 after acting as CFO from 2007-2018.

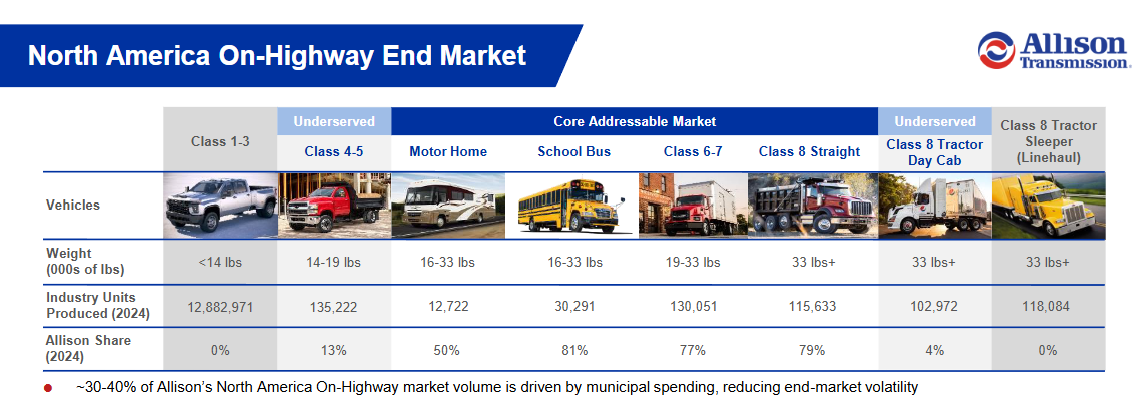

ALSN is the largest manufacturer of automatic transmissions for medium-and-heavy-duty commercial vehicles. They have a dominant market position in buses and class 6-8 trucks with ~80% market share.

A fully automatic transmission from ALSN might add $3,000 to $11,000 to the cost of a vehicle, but customers typically pay this premium for the reliability in heavy/harsh use cases (example: high start/stop frequency from a garbage truck).

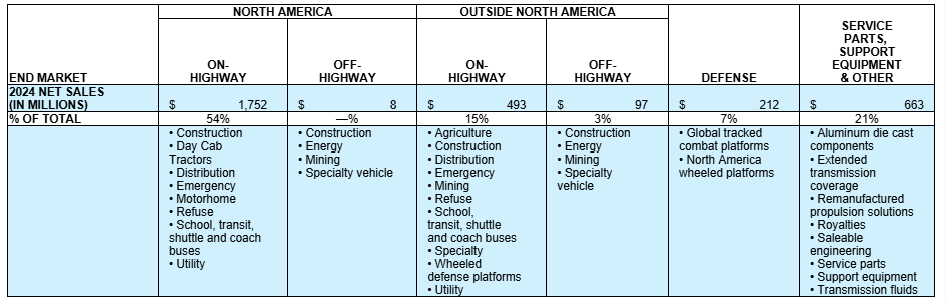

There is only one segment for financial reporting, but they give us a detailed breakdown of revenue mix:

On-highway applications = 70% of sales

Parts & service = 21%

Defense = 7%

Off-highway = 3%

Less than 25% of sales come from foreign markets where penetration rates of automatic transmissions are much lower (close to 5%). This is a growth opportunity and a driving force behind the Dana acquisition.

Like most auto suppliers, it’s a highly concentrated business. ALSN’s top five customers represent more than 50% of sales and the top three customers (Daimler, PACCAR, and Traton) were 20%, 13%, and 11% apiece (44% total).

Why it’s interesting…

The Dana acquisition closed on Jan 1, 2026 so the story is shifting to what can they do with this business in a few years.

First, a look at standalone ALSN

ALSN trades at $109 with a $9.1bn market cap (84m shares outstanding) and $4.2bn net debt makes it a $13.3bn enterprise value. This includes the recently closed $2.7bn Dana acquisition.

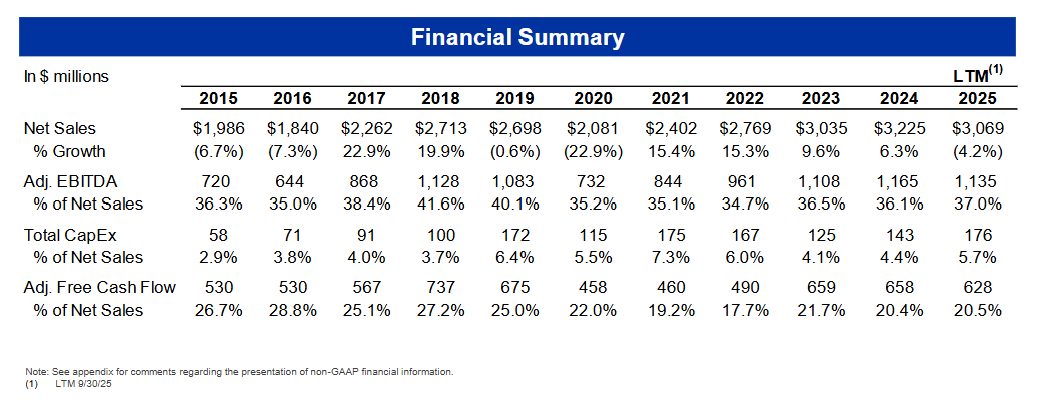

From a purely quantitative standpoint, this business is insanely profitable with mid-30% EBITDA margins and 20%+ free cash flow margins. Most auto suppliers have 5-10% margins with a few very good operators in the mid-teens.

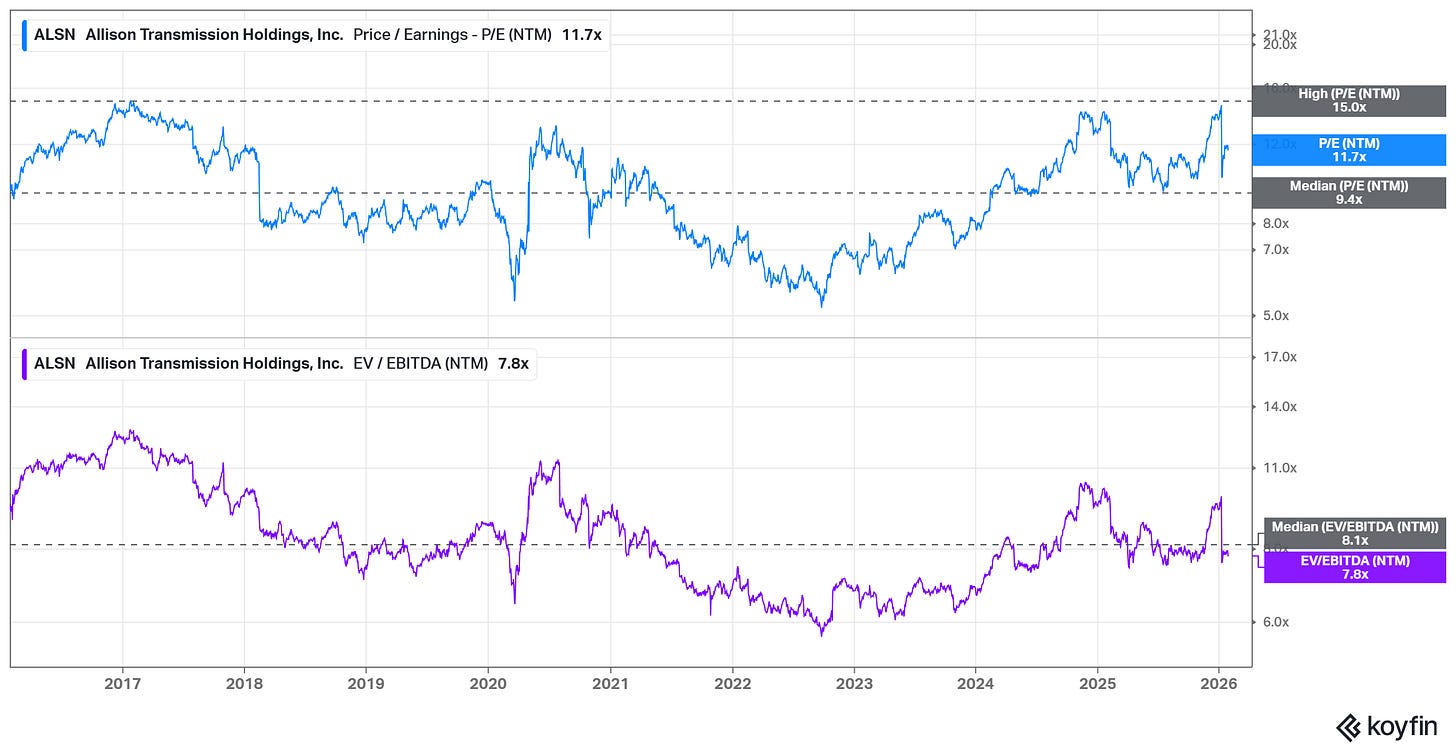

Industrial businesses with this margin profile typically trade at 20x earnings or more, but ALSN historically trades at ~9.4x earnings and 7.8x EBITDA. The most “expensive” it traded was 15x earnings in early 2017.

Even today, after a big run (shares are +30% over the past 3 months), the stock is still trading at “only” 11.7x forward earnings.

So if the fundamentals are good, why does the stock consistently trade so cheaply?

Two things stand out here…

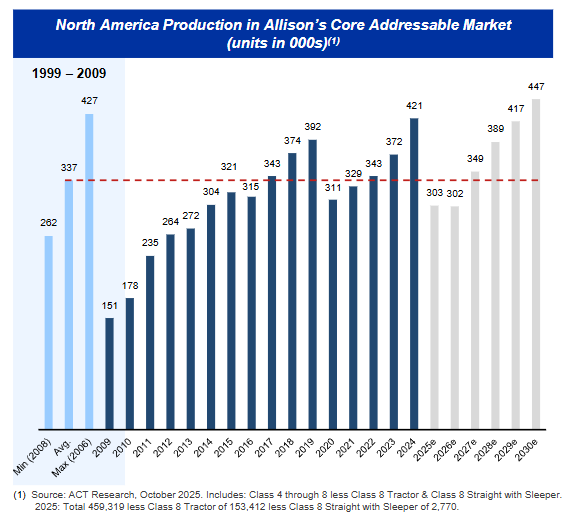

One, it’s a cyclical and slow grower. Revenue and EBITDA grew 2% and 4% annually since Carlyle & Onex bought the business from GM in 2007 through 2025 (midpoint guide). Along that 18-year journey, revenue and EBITDA fell 8 times; that’s a “cyclical decline” every 2 years or so.

Where are we in the cycle today? Management believes it’s bottoming in 2025 with production down significantly vs. 2024. Sales are expected to fall 7% vs. 2024.

Next are the EV risks.

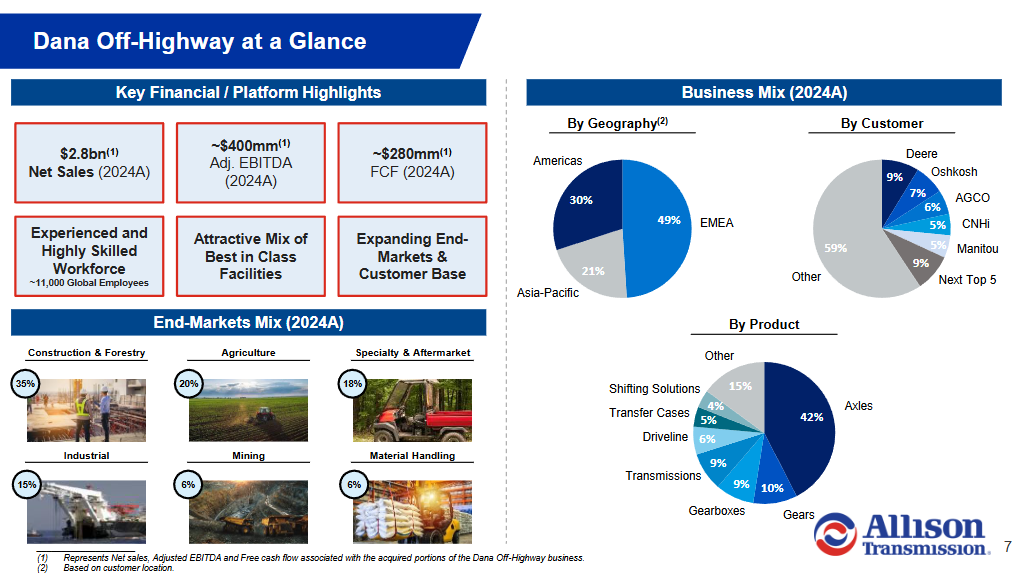

Transmissions aren’t exactly a critical component in electric vehicles, which poses some terminal risk for the core business. This is where the Dana acquisition could be a significant long-term positive. With it, the revenue mix changes across several areas:

Product mix for axles, gears, and gearboxes moves to pro-forma ~30% of sales

Geographic mix for international markets moves from 22% to 44%

End-market mix shifts from 3% off-highway to >50% off-highway

A typical powertrain consists of a motor (engine), transmission, driveshaft, differential, and axles. Electric vehicles are increasingly using “e-axles” which combine an electric motor, power, and transmission/gearbox into the axle (all as a single component). Combining Dana’s axle/gearbox expertise with Allison’s transmission expertise should allow them to develop a competitive e-axle offering long-term.

What does the Dana acquisition consist of?

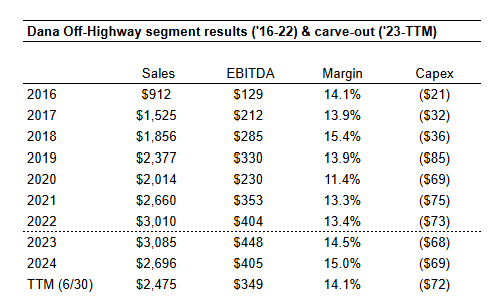

For a $2.7bn purchase price, ALSN is getting $2.8bn revenue and $400m EBITDA (based on FY24 results). Margins are lower (14-15%), but capital requirements are also lower (2-3% of sales).

This business is struggling a bit more than standalone ALSN… in 2025, sales are down to $2.48bn (-8.2% from 2024) and EBITDA is down to $349m (-14% from 2024) based on TTM 6/30 results.

The headline purchase price was 6.8x EBITDA before synergies, but it’s closer to 7.7x when using $349m TTM EBITDA. Management is guiding to $120m cost synergies by 2027.

Pro-forma financials & valuation

Based on 2024 results, this is a combined $6bn revenue and $1.6-1.7bn EBITDA business ($400m from Dana + $1.2bn from ALSN).

ALSN is guiding to ~$1.1bn EBITDA in 2025 and Dana is down to $349m as of 6/30 (it’s likely this will fall a bit further by yearend). Let’s call it $1.45bn EBITDA before synergies.

As for cash flow, 2025 guidance is $610m FCF at the mid-point ($7.25 per share). Take the $349m acquired EBITDA less $120m incremental interest, $75m capex, and $40m taxes = $115m incremental FCF before working capital ($1.35 per share). Combined pro-forma FCF = $8.60 per share (12.8x P/FCF).

What will management do with this FCF?

Historically, they’ve been a massive share repurchaser. You could categorize this one as a share cannibal. Since coming public in 2012, they’ve repurchased >65% of outstanding shares (from 181m to 83m). Management is hinting they want to continue with buybacks while integrating and delevering the acquisition.

Leverage is increasing to ~2.9-3x while target leverage is closer to 2x. My guess is they’ll hit their target through a combination of cyclical recovery, synergies, and debt paydown via FCF.

Let’s ignore any cyclical recovery and take the $1.45bn starting PF EBITDA and add $120m cost synergies = $1.57bn by 2027. At a 2x leverage target = $3.1bn net debt vs. $4.2bn today; meaning they’ll need to repay $1.1bn by 2027.

Then take the $716m pro-forma FCF and add $120m synergies (taxed at 25%) = $806m by 2027. This works out to $2.2-2.3bn total FCF from 2026-2028. Say half of that goes to debt paydown and half to buybacks. Now FCF is closer to $850m and share count down to 76m or so = $11.20 per share (9.8x P/FCF).

Auto suppliers trade between 9-14x earnings and ALSN historically trades around 10x earnings (likely too cheap for a business like this?). If we use 12-14x earnings on $11.20 per share = $134-157 fair value (i.e. 22-43% upside).

If my estimates are optimistic and ALSN returns to a normal historic multiple, maybe we could see $10/share at 8-9x = $80-90 (18-27% downside).

Summing it up…

Risk/return seems pretty balanced here and ALSN is having a big run lately. It’s going to take time for this acquisition thesis to play out, so it’s not like we’ve missed the boat on this one. I’m planning to add this name to my watchlist and keep an eye on it for a better entry price. I’d be a buyer at closer to $90.

As a reminder to myself, I should take a quick look at the other party to this transaction: Dana (DAN). That business is a ~$3.3bn market cap, just received $2.7bn sale proceeds and announced a $1bn buyback authorization. Granted, those shares are up 80%+ since this deal was announced!

Disclosure: no position, adding to watchlist.

Resources:

Fantastic breakdown of the Dana aquisition thesis. That 65% share repurchase since IPO while mantaining rock-solid margins is exactly what you want to see in capital allocation. I've followed several auto supliers that struggled with sub-10% margins, so seeing Allison hold 30%+ EBITDA while expanding into e-axles through this deal feels like a rare compination of quality and growth optionality.